Our Favorite Model Portfolios for Advisors

We've doubled our coverage of model portfolios. These are our top picks.

Third-party model portfolios have become increasingly popular among financial advisors in recent years. Model portfolios are designed for advisors, allowing them to outsource investment management so they can focus on strengthening client relationships through other financial planning services, such as developing estate and tax strategies. Investment management firms and strategists have responded to that demand, launching more than 500 model portfolios over the past three years, according to our data.

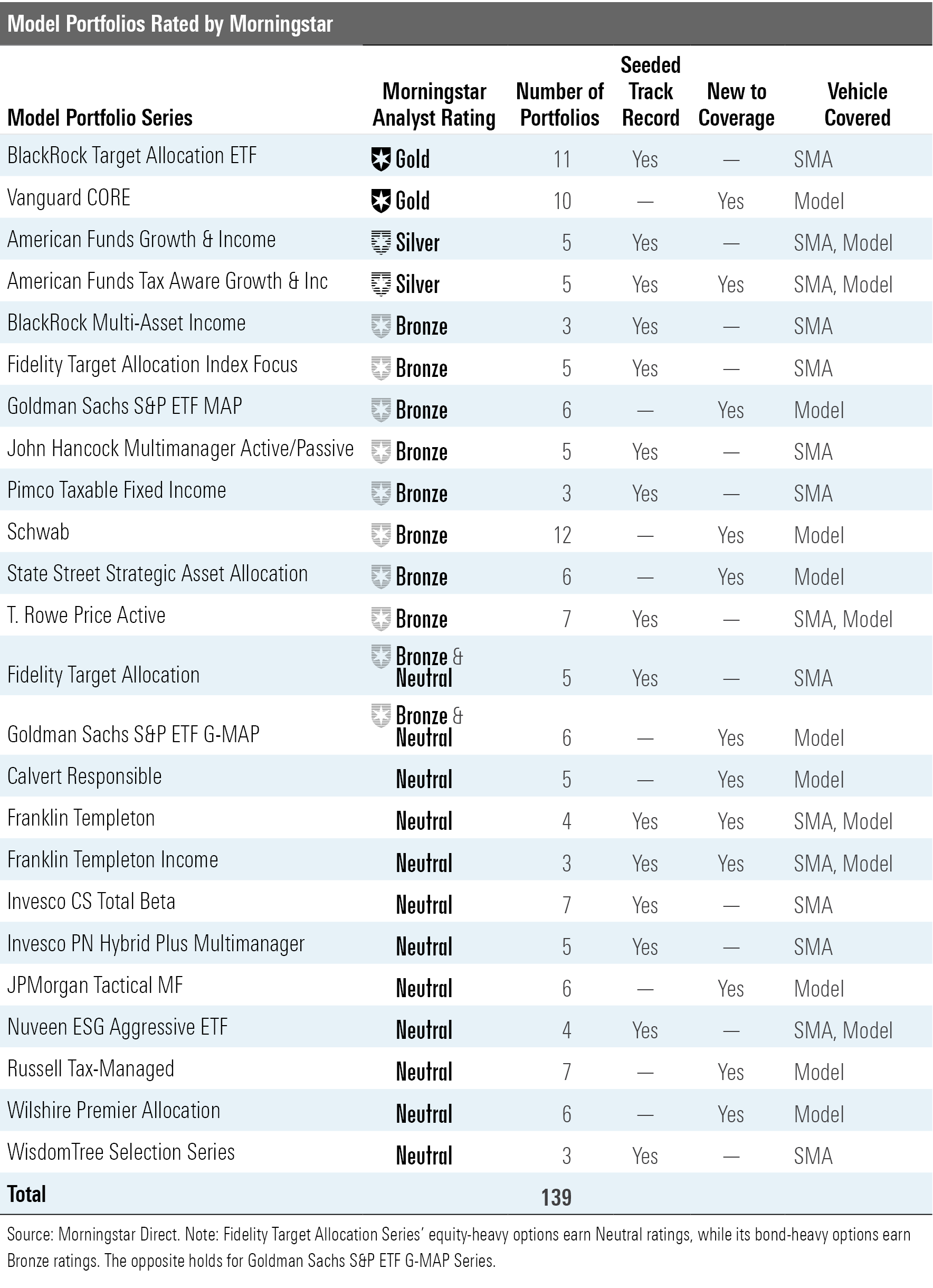

To help advisors navigate the vast, nascent landscape, Morningstar began assigning qualitative, forward-looking Morningstar Analyst Ratings on model portfolios in March 2019. We recently doubled our model portfolio coverage, launching ratings on 12 new model portfolio series spanning 76 unique portfolios. That brings our total coverage to 24 series and 139 portfolios. (Model portfolio ratings are available in Morningstar Direct and Office, along with our 2020 model portfolio landscape report)

Our model portfolio coverage is shown below.

Models are not directly investable and therefore lack reporting standards. So, we initially only covered models that had clones in vehicles with live assets, such as separate accounts. The separate accounts represent the "golden copy" of the model portfolios; the asset manager retains discretion over the separate account, so it illustrates the performance an advisor could expect by following the model as recommended. However, to expand our reach and help advisors make more informed decisions, as of today we've expanded our capabilities and now cover models that lack clones in regulated vehicles. Still, we consider it a best practice when firms seed separate accounts of their model portfolios, which helps legitimize the track record.

As shown above, nine of the 24 model portfolio series we rate do not have live track records in other vehicles. Only having a model portfolio requires increased scrutiny. Because model portfolios aren't regulated and are only reported voluntarily, they often have gaps in historical portfolio holdings, missing or inaccurate management team histories, or reported returns that may include back-tested results. Still, our diligent research process and lengthy management team interviews give us high confidence in our conclusions.

Model Portfolio Ratings Overview

The BlackRock Target Allocation ETF and Vanguard Core model portfolio series earn Gold ratings. BlackRock's series benefits from a dedicated model portfolio team, strong exchange-traded fund building blocks, a thoughtful and relatively active asset-allocation approach, and rock-bottom fees. Vanguard also offers an extremely appealing price tag along with topnotch, highly diversified underlying index funds. Unlike BlackRock, Vanguard rarely makes portfolio changes and avoids tactical tilts, a laudable approach that we believe will serve investors well over time.

American Funds' Growth & Income and Tax Aware Growth & Income series represent our next top picks, earning Silver ratings. Both series benefit from highly skilled underlying active managers and relatively low costs, especially versus peers that favor active underlying funds. The American Funds Tax Aware Growth & Income series leans toward tax-efficient underlying funds--for instance, its bond sleeve consists of municipal-bond instead of taxable-bond strategies--which increases its appeal for taxable accounts.

The remaining series earn Bronze or Neutral ratings. Notably, several model portfolio series earn lower ratings than their similarly managed mutual fund siblings. For instance, the cheapest share class of BlackRock Multi-Asset Income BIICX is rated Silver, whereas the BlackRock Multi-Asset Income models all earn Bronze ratings. The T. Rowe Price Spectrum series of allocation mutual funds receive Silver ratings on their cheapest share classes, but the model portfolios, which resemble the mutual funds, garner Bronze ratings. We think highly of J.P. Morgan and State Street's asset-allocation teams--the cheapest share class of each firm's target-date series we cover receives a Silver rating--yet their model portfolios receive Neutral and Bronze ratings, respectively. The reasons for the disparities vary. Some firms are struggling to find their footing in the rapidly growing and evolving model portfolio space. There has certainly been a proliferation of model portfolios in general, which might make it tough to keep track of all the strategies on offer. And in some cases, firms can't implement their best thinking--such as tactical shifts via derivatives--in model portfolios, or they opt for less-granular portfolio construction to reduce complexity for advisors. Those aren't unreasonable decisions, but it explains the general trend of model portfolios earning lower ratings than similarly managed mutual funds.

Overall, we hope our research and ratings of model portfolios will help advisors identify strong options for their clients in this relatively opaque space. We believe model portfolios will continue to grow in popularity among advisors, and we plan to continue increasing our coverage in this area.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)