4 Ways Today's Stock Market Resembles That of the Late 1990s

And two ways that it does not.

The Similarities

For those of us who followed the U.S. stock market closely during the 1990s, it’s hard to avoid comparing it with the 2021 market. Many of today’s investment stories read as if they were ripped from last generation’s headlines.

Let’s view the parallels.

1. Stock Valuations

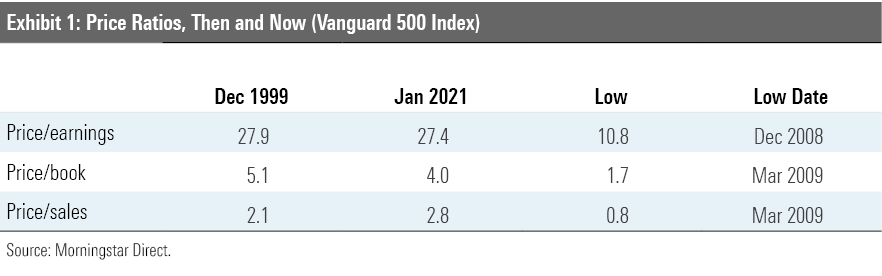

Equity prices peaked at the start of the New Millennium, dropped for a decade, and have since risen so that they now match their previous highs. That statement, of course, paves over many bumps that occurred along the way, but it is broadly correct. Below are various price ratios for Vanguard 500 Index VFINX from three dates: December 1999, January 2021, and their interim lows.

We are where we started. The price/book ratio is lower today, the price/sales ratio higher, and the price/earnings ratio an almost exact match. Overall, the U.S. stock market is valued very much as it was when it entered this century.

2. Technology’s Triumph

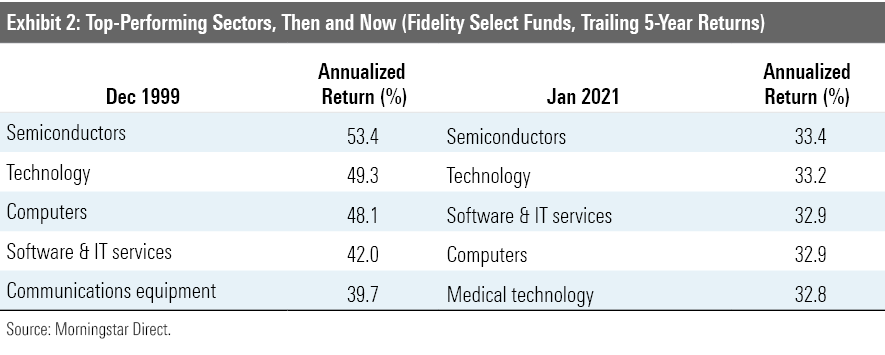

In both eras, growth stocks outperformed value securities. Above all were technology stocks. Exhibit 2 shows the top-performing Fidelity Select funds for the trailing five-year periods ending in December 1999 and then again in January 2021.

Deja, meet vu. Admittedly, recent gains haven’t matched the late-1990s levels, but the winners’ list is virtually identical. Unfortunately, few shareholders enjoyed the entire ride. The top four funds possessed an aggregate $20 billion in 1999, but only $4 billion a decade later. Today, they possess $33 billion. Such are specialty funds. Typically, their paper gains far surpass shareholders’ profits.

3. Increasing Optimism

In the late 1990s, many investors believed that the old rules had changed. Rapid productivity gains, fueled by increases in computer processing power, telecommunications improvements, and, above all, the rise of the Internet, explained why the long bull market just kept getting longer. Also changing was the Federal Reserve's role. When either the overall economy or stock prices showed significant weakness, Federal Reserve Chairman Alan Greenspan would provide assistance by issuing "Greenspan puts"--federal policies intended to arrest the decline. They had reliably worked.

Today’s atmosphere is similar. The transition from bricks-and-mortar businesses to electronically based companies that appear to be able to grow during every economic condition suggests that stock-market downturns are temporary blips. Old-line industries suffer through boom-and-bust cycles, but it seems that e-companies do not. Nor has the Greenspan put been repealed. If anything, Greenspan’s approach has been extended under current Chairman Jerome Powell, whose spring 2020 actions exceeded any of Greenspan’s efforts.

4. Retail Participation

Since stock commissions were deregulated in 1975, discount brokerages had gradually chipped away at trading costs, but it wasn't until online platforms were launched in the late 1990s that commissions truly became cheap. By 1998, Ameritrade (now a subsidiary of Charles Schwab SCHW) charged just $8 per online trade. For comparison's sake, Schwab began the decade with an $80 trading fee.

This cost revolution, along with the raging bull market, led to the birth of day traders--everyday investors who took the whole endeavor so seriously that some made it their full-time occupation. For example, a March 1999 Chicago Tribune article profiled a gentleman named Scott Weiner, who "took down his lawyer's shingle a year ago to trade from home full-time." (Weiner's advice: "Don't quit your day job." Ironic.)

I don't know how many day traders exist today--or even back then, because such figures have never been available--but retail interest has returned in a big way. Even the most casual of stock-market observers understands that Robinhood has become the 21st-century equivalent of that first wave of discount brokerages and that, as reflected in social-media conversations, everyday investors are buying stocks more enthusiastically than at any time since, well, the late 1990s.

The Differences

Although the likenesses are striking, such that every week I find myself recalling an episode from the 1990s--for example, the December 1999 announcement that Michael Jordan, John Elway, and Wayne Gretsky had sold their names to an e-commerce site called MVP.com, which folded 13 months later--there are two key differences.

1. The Economic Cycle

By December 1999, the economy was enjoying its 105th consecutive month of expansion. Even those who believed that boom-and-bust cycles had been moderated did not claim that downturns would not occur. It was reasonable to expect the economy to take a step backward, perhaps sooner rather than later. That is indeed what happened, with the stock market peaking in March 2000, which presaged a recession that arrived 12 months later.

In contrast, the U.S. is only now climbing out of its 2020 hole, such that economists are currently debating whether the country still remains in recession. The slump caused by the coronavirus pandemic was selective, striking some industries very hard while barely touching others. One cannot therefore claim that the recent downturn purged all excesses, as is customary for severe recessions. Nonetheless, the possibility exists that the economy will now expand for several more years.

2. Interest Rates

In 1999, 10-year Treasuries yielded 5.3%. Today, they pay 1.5%. Equities aren’t priced in isolation: Their worth is established while considering the investment alternatives. Viewed from that perspective, the fact that stocks cost as much today as they did in 1999, shortly before a bear market arrived, isn’t terribly worrisome. Stocks are as expensive as they once were, but their fixed-income rivals have become pricier yet.

Of course, relative arguments aren’t as comforting as absolute justifications. Better that stocks were cheap by any measure, so that even if the investment competition strengthened, they would remain attractive. Today’s equity valuations depend upon the assumption that inflation will remain dormant. It would be better if they rested on firmer ground.

Wrapping Up

The parallels with the 1990s are sufficiently strong to cause concern. Indeed, not just the 1990s--the 1920s and then the 1960 were also marked by rising stock prices, excitement over technological advancements, optimism that business cycles would become less severe, and enthusiasm among retail investors. As with the 1990s, each of those parties ended badly.

Increasingly, I feel as if I have watched this film before. However, as I wrote in “My 2020 Lesson: The Peril of Overconfidence,” history is an imperfect guide. I also recognize that today’s economic underpinnings--interest rates in particular--differ from those of the late 1990s. Thus, my pessimism is tempered with the hope that this time, too, my fears will not materialize.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)