What Are SPACs and Should I Care?

What to know about this roundabout route to taking a company public.

SPAC to investor: "Hi, I am raising money to buy equity in a private company."

Investor: "I'm interested. What are you buying? And how much are you paying for it?"

SPAC: "I don't know."

Investor: "OK, here's $200 million."

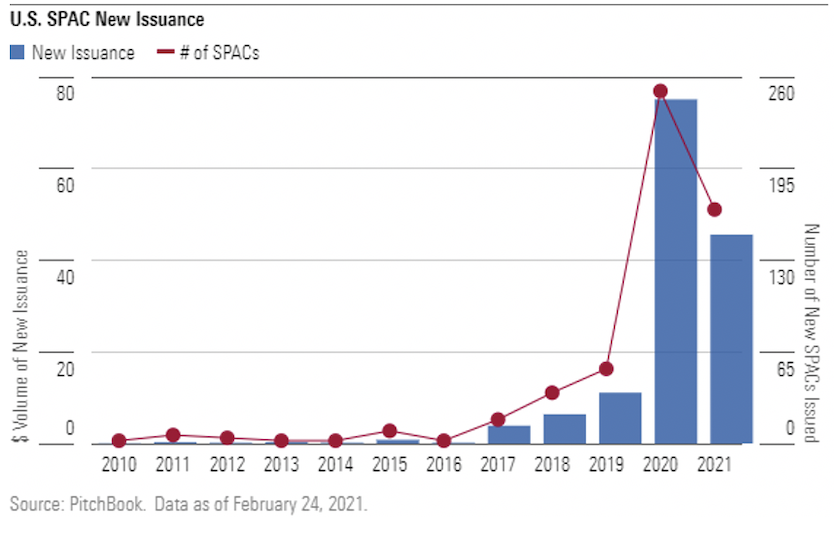

This approach to investing may sound suspect, but it's gaining in popularity. With names like Colin Kaepernick and Jay-Z getting in on the game, special purpose acquisition companies, or SPACs, are reaching record levels of exposure. New issuance of SPACs has skyrocketed over the past year: Over $75 billion was issued in 2020, almost 7 times more than in 2019.

The last time SPACs proliferated was in 2007, just before the market imploded from the global credit crisis. So are SPACs just a bubble market phenomenon, or is it different this time?

SPAC 101: What Are SPACs?

A special purpose acquisition company, or SPAC, is formed and taken public in an initial public offering with the sole intention of merging with a private company, thereby taking the private company public.

The SPAC does not have any business operations to start, but its purpose is to create the shell of a public company and raise a blind pool of capital. The SPAC's sponsor will then search for a private company looking for capital that also has an interest in going public. The sponsor will negotiate to make an equity investment in the target company and use that equity investment to essentially conduct a reverse merger, thereby taking the target private company public. Usually, the investors in the private company will end up being the majority shareholders in the merged entity. In this roundabout way, the private company is able to raise capital and go public without going through the typical SEC regulatory process.

There are three main benefits for a private company to go public through this process as opposed to the traditional IPO route.

- The certainty of a private company knowing its valuation prior to selling equity.

- This process is often faster than the typical IPO.

- Most importantly, a private company is able to provide investors with more information such as projections and forward-looking statements, which are not allowed during the traditional IPO process.

Many people equate investing in SPACs with investing in private equity funds; however, there are a couple of significant differences:

- Investing in a SPAC does not provide diversification. It is an investment in a single company as opposed to investing in a private equity fund that invests in a portfolio of companies. Investing in a single company while it is still in its early stages of revenue generation and product monetization has a very high degree of risk.

- Private equity sponsors only earn their 20% fee if they generate gains on the capital they have invested, whereas SPAC founders have an incentive to put capital to work--even if they don't necessarily think the merger is a great investment at an attractive valuation.

Let's take a closer look at what happens at each phase of the SPAC process.

Phase 1: Initial Public Offering A typical SPAC goes about its IPO as follows:

- The SPAC sells its shares as a unit offering consisting of one share and a warrant. The shares are typically priced at $10 and the warrant is usually convertible between one half to one share at $11.50. In consideration for setting up the SPAC and conducting the due diligence to find a private company to merge with, the sponsor of the transaction purchases 20% of the total equity of the SPAC for a de minimis amount. This is the first instance in which shareholders are diluted by additional equity. Effectively, this dilution in the IPO acts as a 20% up-front fee payable to the sponsors. In addition, the underwriters charge a 5.5% fee to sell the stock (often splitting the fee into 2.0% payable upon issuance and 3.5% deferred until a merger is completed). The net cash proceeds of the offering are placed in a trust and invested in short-duration fixed-income assets.

- The sponsor then has two years to identify and negotiate a merger with a private company. If at the end of the two years the sponsor has not announced a merger, the SPAC will be unwound. The IPO shareholders will receive a cash payment from the trust that is intended to be equal to the $10 purchase price plus accrued interest. However, investors should be cognizant that the interests of the equity sponsors may not always align with those of the shareholders. As the sponsors only paid a small amount for their shares, they will lose the economic value they would have realized from those shares being used to conduct the merger. As such, the sponsors have incentive to find a merger candidate before the two-year clock runs out.

- Shortly after the IPO, the units can be divided, and the stock and warrants then trade separately. During the period before the merger, the original buyer can sell the stock, which typically sells in the secondary market at a slight premium to the IPO price, and effectively retain the warrant for free.

The intent of this structure is to provide the IPO shareholders with the option to hold their shares and invest in the merger target if they think the business and valuation is attractive. Plus, the warrants act as an additional kicker if the stock price trades up.

If IPO shareholders do not want to invest in the merger candidate or think the valuation or potential equity dilution is too great, they then have the option to put their shares back to the SPAC. Yet, they retain their warrants as payment for the opportunity cost of being invested in the SPAC instead of a different investment.

Phase 2: Before the Merger Once the sponsors have identified a merger target and agreed to a non-binding purchase agreement, they then make a public announcement. As part of the merger, if the cash consideration paid to the target is greater than the amount of cash raised by the IPO, the sponsor will raise additional capital through a private investment in public equity, or PIPE. A PIPE transaction provides the benefit of a third party affirming the valuation of the merger target with further investment, but, depending on the structure of the PIPE, this may further dilute the IPO shareholders.

At this point, the shareholders will conduct their own due diligence and valuation analysis to determine if they want to continue to hold their shares or require that the SPAC repurchase those shares. A significant part of this analysis is estimating the total number of shares that will be put back to the SPAC and the total amount of dilution the remaining shareholders will suffer.

Historically, a large number of shareholders have elected to put their shares back to the SPAC based on the amount of equity dilution that would reduce the value of their equity ownership.

Phase 3: After the Merger Once the merger has closed, the SPAC will change its name and ticker symbol to reflect the name of the operating company. The shares will then trade based on the market valuation as applied to the now-public operating company.

Are SPACs a Bubble Market Phenomenon?

Though SPACs may be appropriate for certain investors and in specific situations, the geometric proliferation of newly formed SPACs in such a relatively short time certainly has the look and feel of a financial product that has entered a bubble. As all of these SPACs are searching for merger targets in a relatively limited pool, they may end up in bidding wars by placing higher valuations on private companies to win deals.

The SPACs that have surged appear to be more of an arbitrage between private market and public market valuations than any added value that was created by the transaction. This may also be an indication that valuations in the public markets may be getting ahead of themselves. If investors think that valuations are too high on existing public companies, they may be willing to pay higher valuations on these late-stage private companies that have high growth potential.

SPACs have been around for about 20 years and were last this active in 2007, just before the global financial crisis. In 2019, SPAC issuance slightly surpassed the prior record in 2007, but issuance skyrocketed in 2020 and has continued at an exponential rate thus far in 2021. Year to date through Feb. 24, $45.6 billion has already been priced for new SPACs, representing 60% of the record amount in 2020. At this pace, we will see another record-breaking year in 2021.

Should I Care About SPACs?

For most individual investors, no. SPAC IPOs are typically allocated to a select group of hedge funds that specialize in these transactions. While the vast proliferation of new-issue SPACs has increased the distribution to a wider audience, the IPO allocations will likely remain limited to institutional investors. Although many mutual fund portfolio managers have begun to invest in SPACs, those investments are usually a small part of a larger diversified portfolio. Individual investors may purchase SPACs in the secondary market, but investing in SPACs has a much higher degree of risk than investing in traditional public equities.

SPACs include many additional risks that are not typically found within more traditional equity analysis. These risks include the need to:

- conduct an extra layer of due diligence on the terms and structure;

- evaluate sponsors' track records of investing in private companies as you are relying on their business acumen to invest your money;

- closely monitor for when sponsors announce merger transactions;

- properly value merger candidates, which is especially tricky as they are in their early stages and do not have track records to help investors evaluate their growth potential;

- evaluate the amount of potential equity dilution that may occur when a merger closes and how that may impact the value of the premerger shares;

- understand that while shareholders have the right to exercise their redemption rights when a merger is announced, any premium paid over the IPO price would be lost.

In our view, investing in SPACs should be limited to those investors who have the financial wherewithal to take on greater risk and who are willing to put in the extra time and effort to properly evaluate the risks and rewards.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PPB6K765QVEN5C6ZRHVEXM3CIQ.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4TYZEEXD3RGWNKTVNUJBWDUFAM.jpg)