Student Loans: Answers and Resources for the Advisor's Tool Kit

A roadmap for conversations with clients.

I often work with couples where at least one or both partners have student debt. Many student loan borrowers are delaying life goals--including home ownership, saving for retirement, and even starting a family--to service their debt in an attempt to first build a stronger financial foundation for themselves before moving forward.

It’s important that advisors working with clients of all ages, and across income and wealth spectrums, understand loan forgiveness programs and strategies for managing student debt in light of competing priorities, overlapping life goals, and potential tax implications.

In the first installment of this two-part series, I shared the state of student loans in the United States and common student loan scenarios that I and other financial advisors have seen and how we’ve approached them. We ended with a way for advisors to gain a clear picture of their clients’ goals and student loan debt burdens before making any recommendations.

In this installment, I’ll provide recommendations for the most common student loan questions and expert resources for your advisor tool kit for clients.

Common Student Loan Questions and Recommendations

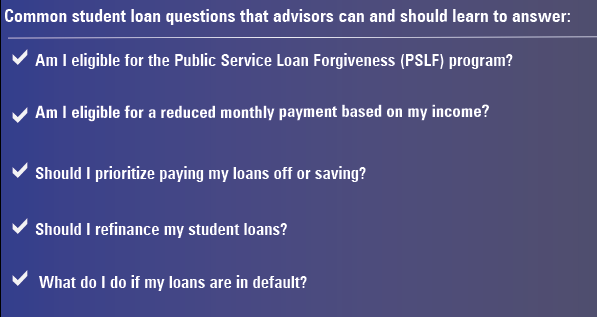

Below are some of the most common student loan questions that borrowers have, including recommendations for how to support your clients.

Am I eligible for the Public Service Loan Forgiveness program? If clients have federal student loans and are working at nonprofits or in the public sector--like public schools, hospitals, or for the government--they're often eligible for repayment plans and even student loan debt forgiveness if they work at eligible organizations. The debt forgiven under PSLF is nontaxable. Ryan Fralich, CFP, CSLP, founder and financial planner of Deliberate Finances, wrote about maximizing the value of PSLF.

Am I eligible for a reduced monthly payment based on my income? Depending on their income and family size, the client may be eligible for income-driven repayment, meaning a lower monthly payment compared with their default payment. Borrowers can contact their student loan servicers to check whether they are eligible. Here is an excellent overview for advisors on how to select an income-driven repayment plan.

Should I prioritize paying my loans off or saving? Student loan borrowers have to make the tough decision to pay down their debt or save toward their goals. Karen Wallace, CFP, Morningstar's director of investor education, shared these suggestions for how to assess a course of action when there's no clear answer.

Should I refinance my student loans? If clients have private student loans, consider refinancing to get a lower interest rate. Refinancing federal student loans is not typically recommended because federal loans have lots of borrower protections such as income-driven repayment options, disability-based cancelation, and loan discharge at death. Also, the current pause on student loan payments and 0% interest is only for federal student loans. Lauryn Williams, CFP, CSLP, founder of Worth Winning, specializes in student loan planning and is also a consultant at Student Loan Planner. According to Williams, "I would say refinancing federal loans requires close examination before doing so. Generally, if you owe as much as you make you may be a candidate for refinancing."

What do I do if my loans are in default? If clients miss enough payments, they go into default. In these cases, the options are to rehabilitate, consolidate, or pay off the loans. According to Williams, rehabilitation is ideal for borrowers in default who are trying to improve their credit profile and score. If the default status is not remedied, the borrower's wages or tax refunds can be garnished.

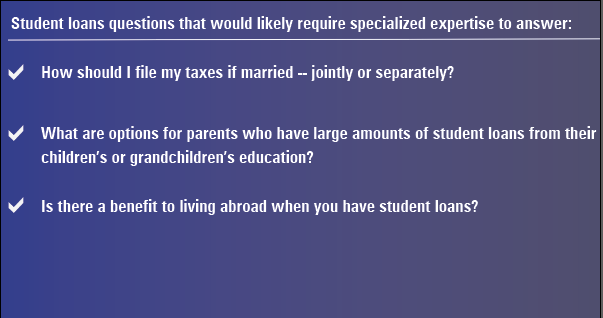

Ben Martinek, EA, CFP, CSLP, founder and financial planner at Bona Fide Finance and Student Loan Tax Experts, shared the following tax-focused and specialized questions and suggestions:

How should I file my taxes if married--jointly or separately? According to Martinek, there are several scenarios to consider for married couples aiming to reduce their income-driven student loan payments. Remember that it's important to weigh this question against the overall tax liability of the household.

- If the primary income earner in the relationship makes most of the income (75% or more) and has all the student loan debt, then filing jointly is likely the best option. "However, if the couple lives in a community property state, then filing separately is recommended to lower their overall debt payments."

- If the student loan borrower makes a small portion of the income (25% or less), filing separately will likely significantly reduce student loan payments. But it will likely come with a large increase in tax liability for the household.

- The two income earners make roughly the same amount of income. Filing separately is likely best, as the tax increase will be minor but the student loan payments savings will likely be significant.

- If both spouses earn income and have student loan debt, then whether filing separately would be advantageous depends on whether borrowers can make the "double debt loophole" strategy work to reduce payments.

- Last, filing in community property states versus separate property states makes an enormous difference on the outcome. Expert advice is highly recommended for this decision as results vary widely.

What are options for parents who have large amounts of student loans from their children's or grandchildren's education? This is a common and growing situation, often causing older generations to postpone retirement or to return to paid employment to meet student loan obligations. Reduced payment options here can be limited, too, as Parent PLUS loans have only one income-driven repayment option. Borrowers might consider a little-known strategy called "Parent PLUS double consolidation." Double consolidations can be tricky to execute, especially as the transition into retirement with student loans has its own planning implications.

Is there a benefit to living abroad when you have student loans? American student loan borrowers can work abroad to benefit from the Foreign Earned Income Exclusion, which can often bring their student loan payments to zero. However, any loans forgiven under long-term loan forgiveness (different from Public Service Loan Forgiveness), for federal student loans that have not been completely repaid after 20-25 years of repayment under a qualifying repayment plan, is currently treated as taxable income. That, paired with international tax implications, mean that professional tax filing assistance is recommended for borrowers hoping to employ this strategy.

Resources and Referrals for Your Client Tool Kit

Just as you’d refer clients with particularly complex tax or estate planning issues, you should also refer clients to student loan specialists. The wrong student loan advice can lead to a costly and irreversible error. Below are free resources or at-cost referrals to include in your tool kit of client resources:

Online Resources

- StudentAid.gov is the authority for federal student loan rules.

- VIN Foundation's student loan planning tool provides a free summary and access to a repayment simulator to explore different scenarios.

- The Student Loan Borrower Assistance website from the National Consumer Law Clinic provides plain-language support for borrowers and their families, including resources for understanding bankruptcy, collections, and private student loans.

- Consider student loan planning software for advisors as part of your suite of financial planning tools.

Advisors

- Certified Student Loan Professionals are advisors that have earned the CSLP designation to specialize advising clients on student loan issues.

- Student Loan Planner provides one-time consultations for a wide range of student loan issues for a flat fee. The website also has resources for folks before they incur student loan debt.

Tax Help

- Student Loan Tax Experts is a tax planning and preparation firm that specializes in clients with complex student loan issues.

Legal Support

- The Project On Predatory Student Lending is for borrowers who have been victims of fraud, and it shares resources and a pro bono debt clinic that is run alongside its legal advocacy work on behalf of all student loan borrowers.

Phuong Luong, CFP, is an educator, financial planner, and investment strategist focused on economic justice and closing racial wealth divides. She is currently the investment strategist for Adasina Social Capital and the founder of Just Wealth, a virtual, solo, fee-only Registered Investment Advisor. She is also the online facilitator for the Boston University Financial Planning Program and a subject matter expert in ESG and regenerative investing. The views expressed in this article do not necessarily reflect the views of Morningstar.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)