Inside ARK Innovation's Big Stakes in Small Companies

This popular ETF stands apart from its peers with unusually large ownership of many stocks in its compact portfolio.

Investors flooding ARK Innovation ETF ARKK with new money in recent months are holding an exchange-traded fund with an unusually large number of outsize ownership stakes in small and midsize companies.

When combined with positions held in some of ARK Investment Management's other fast-growing ETFs, the result is a lineup with a significant single-company portfolio exposures.

ARK Innovation has grabbed the attention of many investors thanks to triple-digit returns in 2020. The result is that ARKK has become one of the fastest-growing funds of its size in history. (Morningstar Direct and Office clients can find our article on ARKK fund flows here.)

There's also a lot going on under the hood when it comes to ARKK's portfolio.

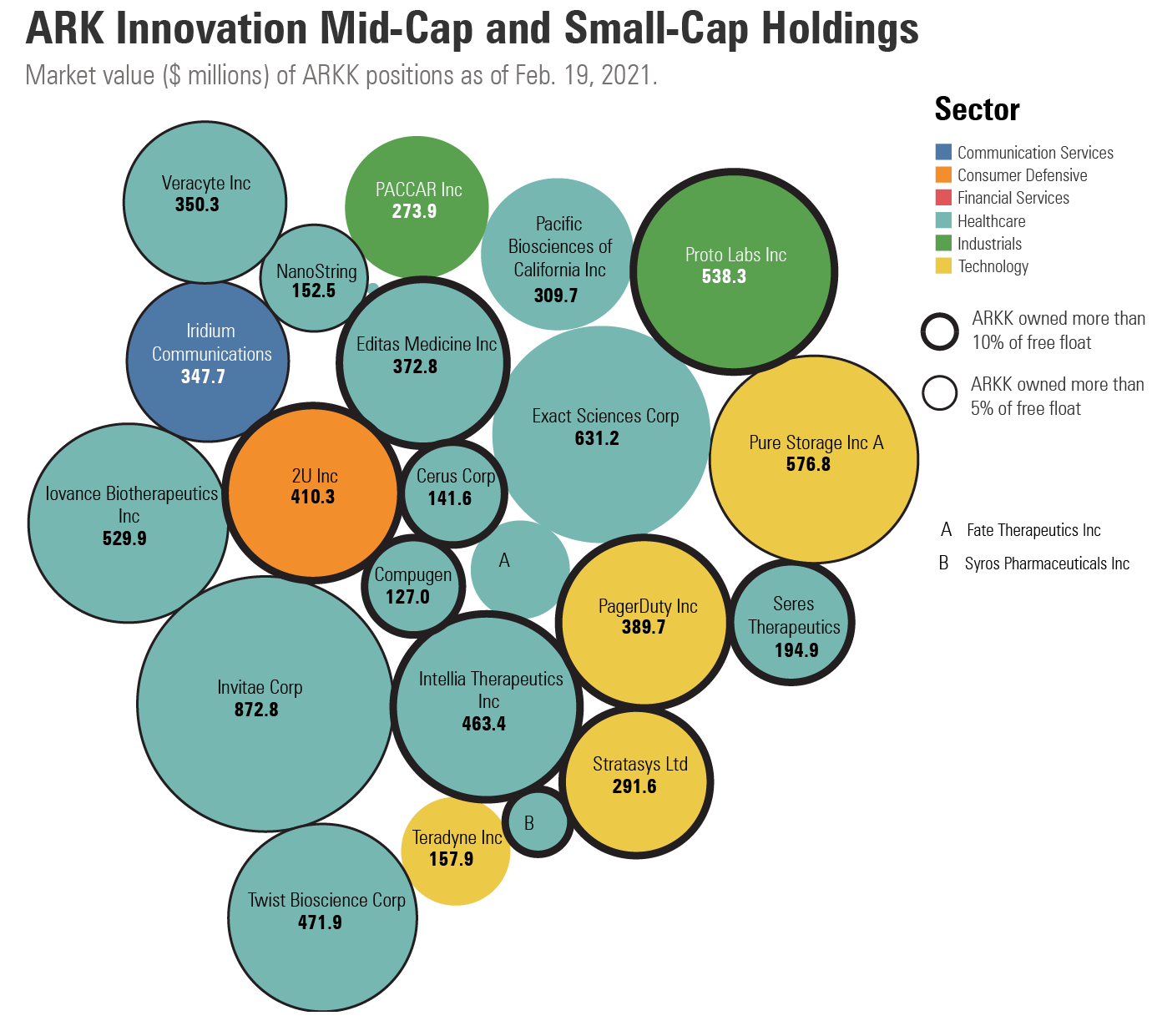

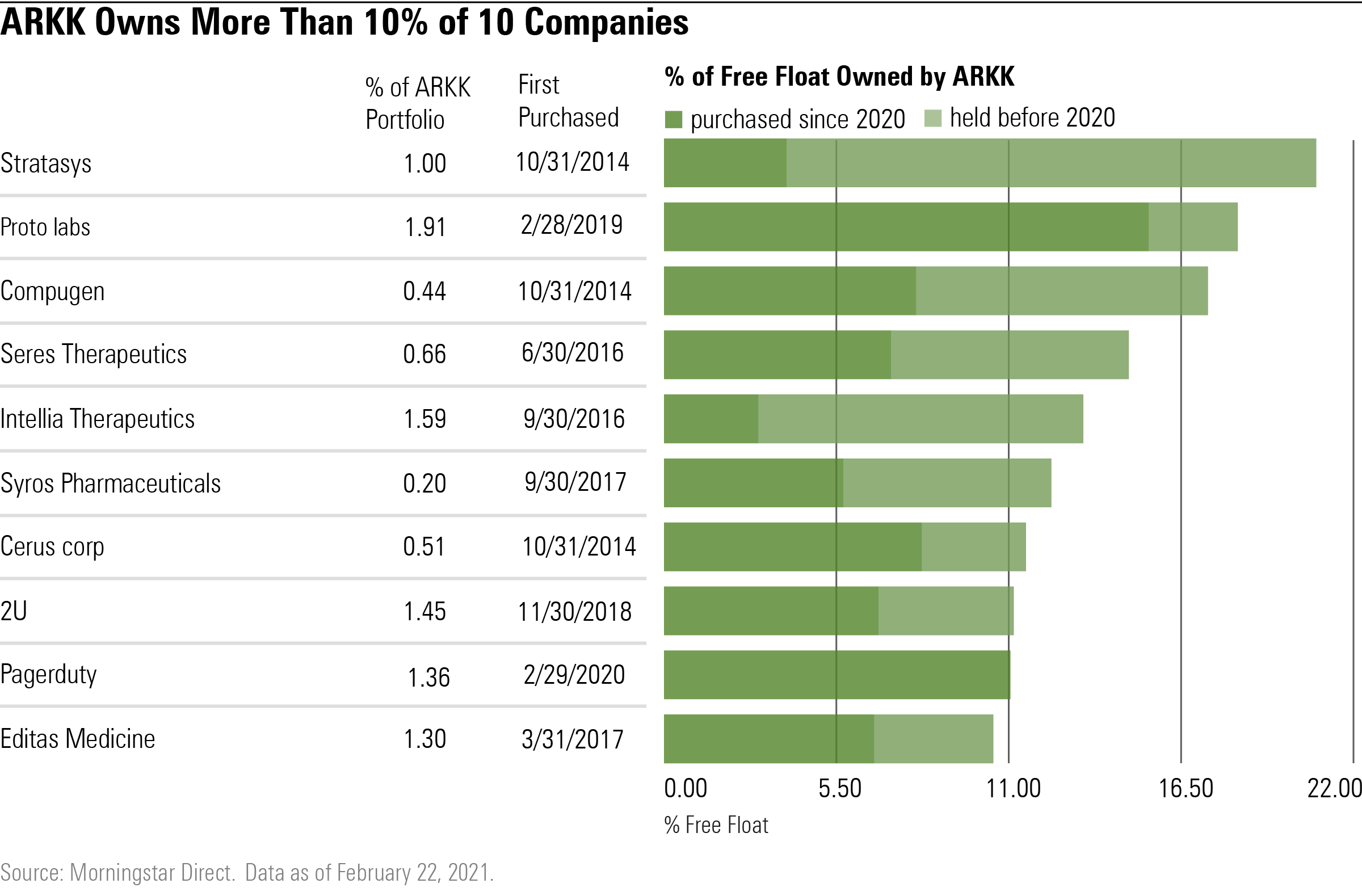

As of Feb. 22, 2021, ARKK owned at least 5% of a company's public shares in more than one third its holdings and at least 10% of free float in 10 out of the 55 companies in its portfolio. A company's free float, or public float, is the number of shares available for the public to invest in.

Source: Morningstar Direct.

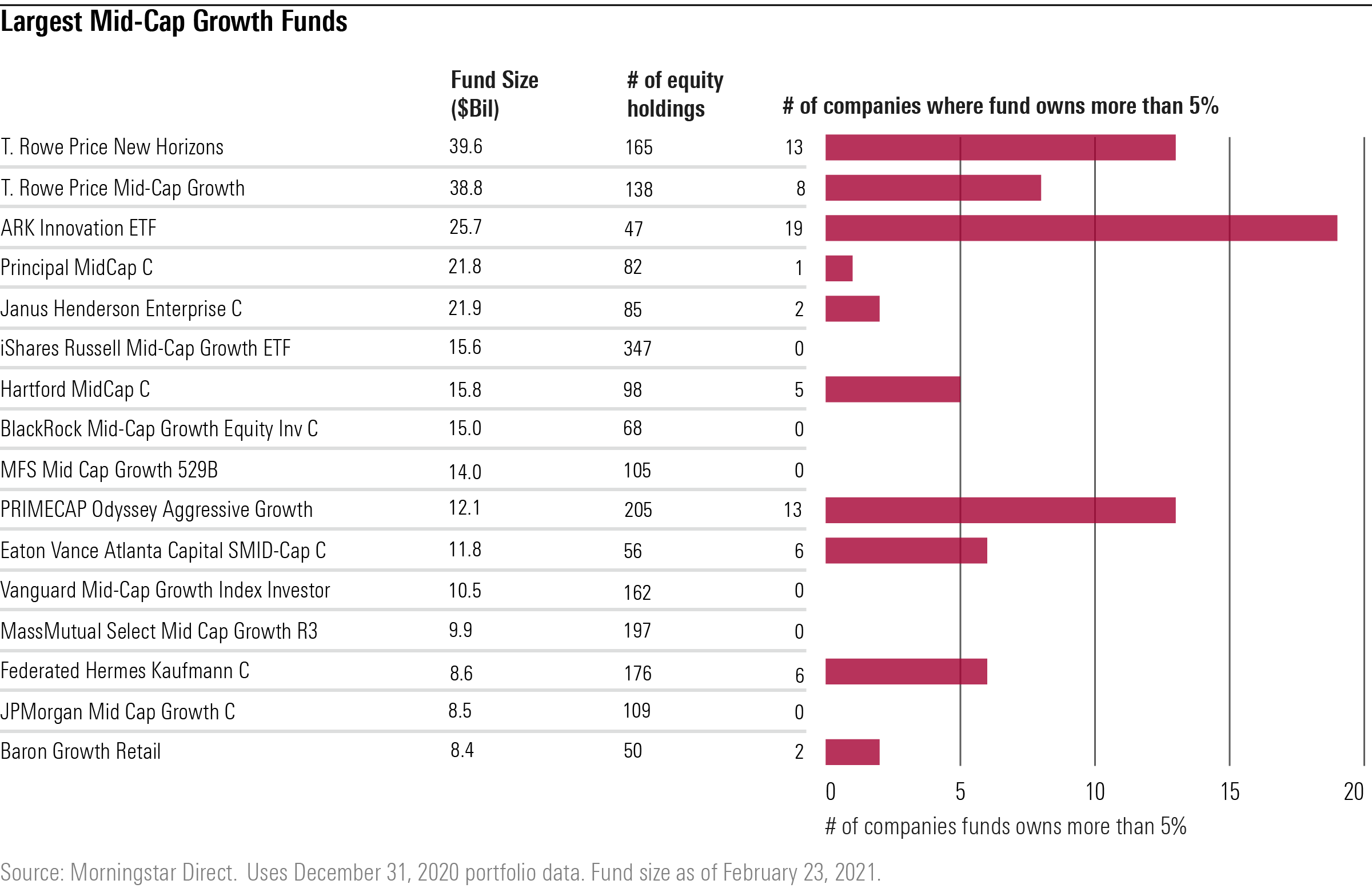

With this kind of stock ownership, ARKK stands apart from other mid-cap growth funds of its size. Among the 15 biggest mid-cap growth funds other than ARKK, nine had stakes of 5% or more of a company as of Dec. 31, 2020, but only two owned more than a 10% stake. Excluding ARKK, the 15 largest funds have an average ownership of less than 2% of the companies in their portfolios. ARKK averages a 4% stake in its portfolio holdings.

Take T. Rowe Price New Horizons PRNHX. The $49.6 billion fund owns 12% of only one company, Armstrong World Industries AWI, out of the 165 companies in its portfolio.

When compared with the broader universe of mid-cap growth funds, which are mainly passive strategies, the level of company ownership for actively managed ARKK is especially high.

ARKK had 46% of its 55-stock portfolio in its top 10 holdings as of Feb. 22. That contrasts with 23% for the average mid-cap growth ETF, where portfolios average 197 holdings. For example, the second-largest mid-cap growth ETF, iShares Russell Mid-Cap Growth IWP, spreads its assets across 351 individual companies and has 13% in its top 10.

ARKK's Biggest Corporate Stakes

ARKK's portfolio is focused on the technology and healthcare sectors. The ETF had $25.7 billion in assets as of Feb. 23, but the massive acceleration of inflows has seen lead manager Cathie Wood increase her positions in both existing and newer holdings.

In the healthcare sector, ARKK has owned Compugen CGEN, a therapeutic discovery company, since its inception, but the fund doubled its stake in 2020 and now owns 21% of the $1 billion company. ARKK also owns more than 10% in Editas Medicine EDIT, which it has held since 2017. The fund doubled its stake in the U.S.-based genome editing firm in 2020, and the stock returned more than 100% over the three months through Feb. 22.

In December, when it took in $3.1 billion of new money, the fund added $36 million to its position in Proto Labs PRLB (it already held $457 million), leading ARKK to hold 18% of the industrials company's shares available to the public.

ARK Investment Management's influence isn't limited to small-cap companies. ARKK's additional purchasing of shares of Stratasys SSYS, a manufacturer of 3D printers, in 2020 pushed its ownership up to 21% of the firm's free float.

ARKK added to an existing position of another mid-cap growth company in December, Twist Bioscience TWST, leaving the fund with a 7% stake in the $7.3 billion company. Throughout 2020 ARKK also invested in genetic information firm Invitae NVTA, which is now the fund's ninth-biggest holding, a stake that accounts for 9% of the company's float.

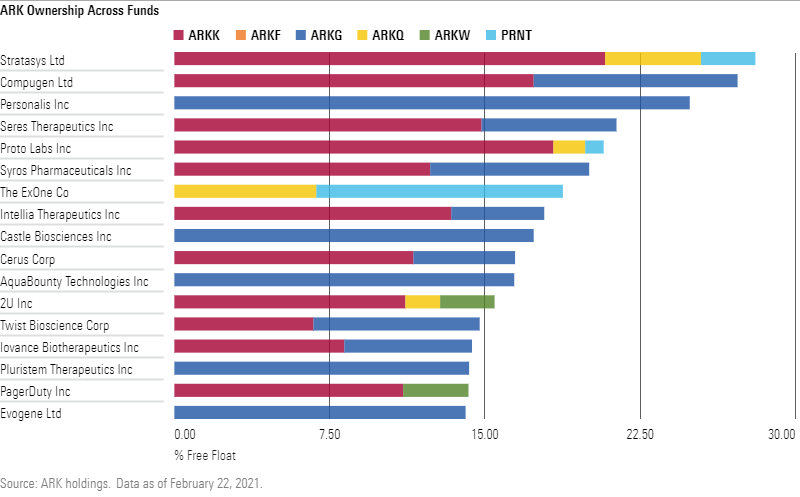

While ARKK is the firm's largest fund by a wide margin--ARK Genomic Revolution ETF ARKG is half its size--there is a large crossover in holdings.

Not only does ARK Investment Management own 21% of Stratasys' free float in its ARKK fund, it owns 5% and 3% of the company's free float in ARK Autonomous Technology & Robotics ETF ARKQ and The 3D Printing ETF PRNT, respectively.

ARK Genomic Revolution ETF shares a large number of holdings with ARK Innovation. The two funds combined own more than 20% in three healthcare companies--Compugen, Seres Therapeutics MCRB, and Syros Pharmaceuticals SYRS.

ARK Genomic Revolution alone owns large stakes in Personalis PSNL and Castle Biosciences CSTL, and on the 3D printing theme, ARK Autonomous Technology & Robotics ETF and The 3D Printing ETF together own 19% of ExOne's XONE free float.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)