Should I Buy Apple Stock Now?

What you have to believe to justify the high valuation that the market is placing on Apple's stock.

Ranked by its $2.2 trillion equity market capitalization, Apple AAPL is the single-largest constituent of the Morningstar US Market Index. Its weight in the index is 5.6%, almost a full percentage point greater than the second-largest, Microsoft MSFT, and 2 percentage points greater than the third-largest, Amazon.com AMZN. In fact, following the combined market cap of Alphabet’s two share classes, GOOGL and GOOG, Apple’s market cap is equivalent to the combined total of the next four-largest companies: Tesla TSLA, Facebook FB, Berkshire Hathaway BRK.A, and Johnson & Johnson JNJ.

As such, Apple’s stock price has an outsize impact on overall market valuation. And the gap between its market value and other giants has widened, with Apple’s share price outpacing Amazon.com, Microsoft, and Google over the past year. This impressive run has left many investors wondering if more gains still lie ahead, asking: Should I buy Apple stock?

We think the current market price for Apple’s stock is well in excess of its fundamental value. Based on our fair value estimate of $98 per share, Apple’s price/fair value is 1.34 times. As a comparison, in a ranking of the 12 most-overvalued mega-cap stocks (equity market cap > $200 billion), Apple places fifth behind Tesla, PayPal PYPL, Netflix NFLX, and Nvida NVDA.

While we agree that Apple has good growth prospects and we have assigned the company a narrow Morningstar economic moat, reflecting its long-term sustainable competitive advantages, we think the market has gotten too far ahead of itself. We believe the market is pricing in too high of a growth rate for the next five years and has over-extrapolated Apple’s growth prospects too far into the future.

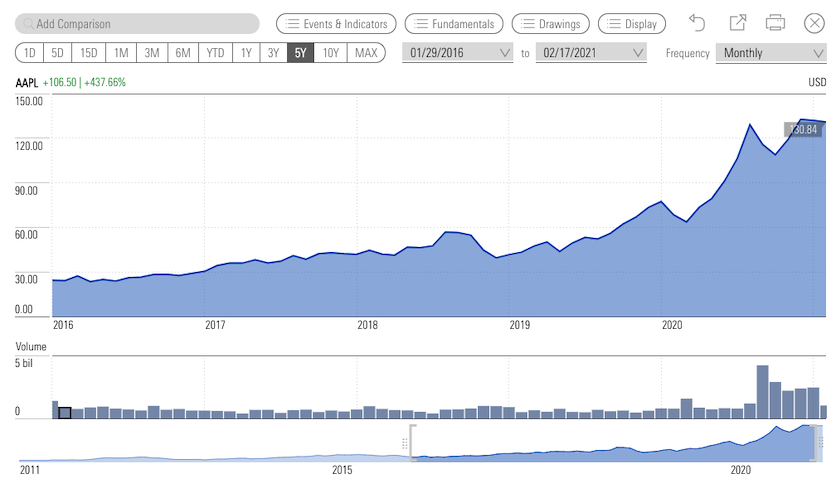

Exhibit 1: Apple Stock Prices, 2016-21

Source: Morningstar. Data as of Feb. 17, 2021.

Multiple Expansion Overwhelms Fundamentals Over the past year, multiple expansion has had a greater impact on Apple's stock price appreciation than rising earnings estimates.

In February 2020, prior to the pandemic-driven market rout, Apple’s stock traded at $82 and the earnings estimate for 2020 was $3.46, resulting in a forward P/E ratio of 23.7 times. Since then, Apple’s stock has risen 60% to $131 and the current consensus estimate for 2021 earnings is $4.42, resulting in a forward P/E multiple of almost 30 times.

If Apple’s forward P/E remained at 23.7 times, the current price would be $105, not that much higher than our current fair value estimate of $98. In fact, looking back even further, at the beginning of 2019 when we rated the stock as 4-star, Apple’s forward P/E multiple was only 14.5 times.

While our base-case forecasts are slightly lower than consensus, it appears a significant amount of the difference between our fair value estimate ($98) and consensus valuations ($150) has more to do with a difference in valuation methodologies. We consistently rely on our discounted cash flow model, as compared with many street analysts who slap on ever-higher multiples in order to justify chasing the stock higher.

The application of a higher forward multiple overstates the value of the long-term underlying business growth prospects. According to our forecast, we expect Apple's earnings will grow by 25% to $4.10 in 2021; meanwhile, consensus earnings grow by 35% to $4.42. Yet, where we agree with the consensus is that Apple's earnings growth will slow rapidly for the next two years thereafter. For example, our forecast for earnings in 2023 is $4.34, resulting in a 3% compound growth rate between 2021 and 2023. The consensus forecast for 2023 is $4.89, only a 5% compound growth rate. Even using the 2023 EPS consensus estimate, the forward P/E multiple two years from now would still be an eye-popping 27 times!

Apple Earnings Will Surge in 2021, but Don't Expect It to Last In our base-case scenario, we project that revenue will leap by 16% in 2021. Apple's main revenue driver is the iPhone, which constitutes more than half of the company's sales. We're forecasting iPhone revenue will increase by 19%, consisting of a 15% increase in unit sales and nearly 4% increase in the average selling price.

We see a couple of factors driving the number of units sold in 2021:

- The recent launch of the iPhone 12 with its 5G capability. As often seen, consumers will delay upgrading their phone until the new versions are released and the pent-up demand will drive sales higher in those years.

- We think the coronavirus pandemic has shifted consumer spending toward purchasing more goods as spending on consumer services has dwindled.

Following iPhones, the Services segment (including subscriptions such as Apple Music, TV+, and other apps and software) is the second-largest segment, accounting for 20% of total revenue. We forecast Services will increase by 17.9% this year.

However, we don’t expect this sales growth rate to last. Typically, unit sales surge in the year when new iPhone handsets are released and are slower in the off-cycle years when “S” versions are launched. The versions between the main unit upgrade cycles, typically denoted with the letter “S,” have modest changes as compared with the main handset upgrades, which are denoted by numbers (for example, the iPhone 12).

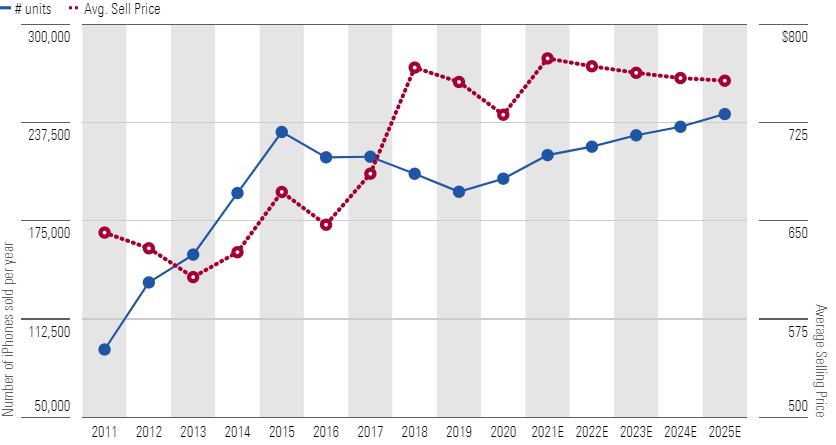

The chart below shows the unit sales surge in mid-2014 and 2015 as a result of the iPhone 6 release. Sales then slowed when the 6S was the latest release. They picked back up starting in September 2019, when the launch of the iPhone 11 led to increased sales.

Exhibit 2: IPhone Unit Sales and Average Selling Price, 2011-25E

Source: Morningstar and Apple. Data as of Feb. 10, 2021.

Following strong revenue growth in 2021, we expect that the sales growth rate will slow in 2022 to 3.5%, and we expect an average growth rate of 3.9% over the next three years.

In addition to revenue growth, we forecast that margins will remain high for the company. In our base case, we project that the gross margin will average 39.2% over the next five years, higher than both the three-year and five-year historical averages for the company of 38.1% and 38.4%, respectively. The increase in our gross margin assumption is driven by a combination of mix-shift to higher-end iPhones as well as an increase in the proportion of overall sales of Services, both of which have higher margins. In addition, Apple has brought in-house the design capabilities to develop its own semiconductor chips, which should lower costs.

We project that the operating margin will average 25.5% over the next five years, higher than the 25.1% average over the past three years, but slightly lower than the five-year average of 26.0%. Our assumption underlying the operating margin is that Apple will need to increase spending on research and development in order to maintain its leading position as well as develop new applications in artificial intelligence and virtual reality, and expand into new areas such as automotive vehicles.

The net result is that we forecast Apple’s earnings per share for the next three years to grow to $4.10, $4.16, and $4.34. Using our fair value estimate of $98, that would result in forward P/E ratios of 23.9 times, 23.6 times, and 22.6 times, as opposed to the current market price which results in forward P/E ratios of 32.0 times, 31.5 times, and 30.2 times, respectively.

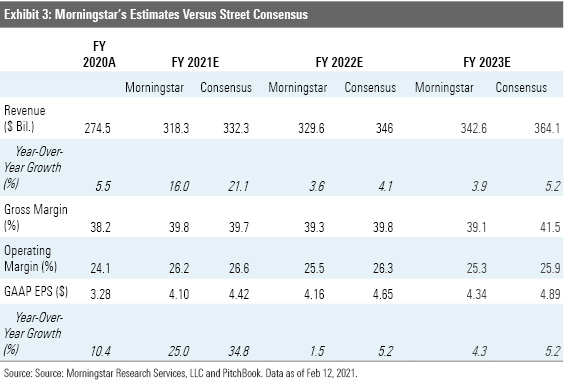

Street Consensus Expectations for Apple Earnings Likely Exceed Reality The biggest difference between our base case and the consensus is in the amount of revenue growth in 2021. As compared with our forecast for a 16% increase in revenue, the consensus is calling for a 21% increase. Between the two forecasts, the number of iPhones sold is similar, but the consensus is projecting an average sales price increase that is 5% greater than our expectation.

The remaining difference is owing to a greater sales increase in the Services segment. We think the rate of growth in the Services segment will be constrained as the existing customer base has already subscribed to many services offered.

Interestingly, following 2021, our base-case scenario for revenue growth is not that far off of what the consensus expects over the longer term. Consensus expectations for revenue growth in 2022 and 2023 are only 0.5% to 1% more than our projections.

In reviewing the margin forecasts, the consensus expectation is for a much higher operating margin averaging 26.3%, some 60 basis points above ours. By way of comparison, Apple’s operating margin has not reached that level since 2018. As a result, consensus EPS for the next three years is $4.42, $4.65, and $4.89, which based on the current price results in forward P/E ratios of 29.6 times, 28.2 times, and 26.8 times.

So What Do You Have to Believe to Buy the Stock Today? We have modeled an upside case scenario which approximates fair value at today's market price. However, we think this scenario is unlikely and have only assigned a 25% probability of it occurring.

In order to justify the current market price, revenue would need to grow at an 11.5% compound annual growth rate over the next five years and the operating margin would need to average 28.0%. Yet, without a paradigm shift in the company’s business profile, these assumptions appear unlikely.

Embedded in our assumptions as compared with the consensus, we forecast that replacement cycles will continue to elongate as differentiation between upgrades becomes more difficult. Apple’s revenue has not grown at an 11.5% CAGR since 2015 when consumers were purchasing the eagerly awaited iPhone 6 with its larger screen size and there was significantly less competition in the smartphone market. That was also the year that Apple’s iPhone sales peaked (which we don’t expect to be reached again until 2024). The high volume in 2015 provided for strong operating leverage (30.5% operating margin); however, the operating margin has since steadily declined.

What's Still Undervalued in Tech Today We estimate the fair value for Apple's stock is $98 per share. At its current market price, we think the market is far overestimating the value of the company for long-term investors. While sentiment could certainly push the price to being even further overvalued in the short term, for long-term investors we think future returns will lag the broader equity market.

According to our calculations, the broad equity market is generally overvalued, and the technology sector in particular is even more overvalued; however, in any market there are always pockets of undervaluation. We do not currently rate any technology companies as 5-stars, but there are several 4-star rated. We recommend looking at 4-star-rated Microsoft, VMWare VMW, Splunk SPLK, and Citrix CTXS.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)