What Top Fund Managers Bought and Sold

As 2020 screeched to a close, financials stocks were popular.

Top-rated fund managers pushed into beaten-down sectors and pared their stakes in high-flying stocks as 2020’s roller-coaster ride came to an end. The fourth quarter of 2020 featured a contentious election cycle in the United States and the release of initial coronavirus vaccine trial results, both of which further roiled markets and prevented an otherwise merciful, smooth ending to the year. To get a sense of how active stock managers responded to the quarter’s challenges, we looked at the buys and sells of the aggregated portfolios of all U.S. equity funds with Morningstar Analyst Ratings of Gold, Silver, or Bronze.

Here is a look at some of the Morningstar Medalists’ most popular trades, broken out by market capitalization. The following data represents funds with at least one medalist-rated share class and a reported fourth-quarter portfolio as of Feb. 16, 2021. It includes: 141 large-cap strategies, 52 mid-cap strategies, and 49 small-cap strategies covering over $3 trillion in combined assets. The data is adjusted for fund-level cash inflows and outflows in an effort to distinguish changes that managers chose to make from those they had to make to meet redemptions or put new money to work.

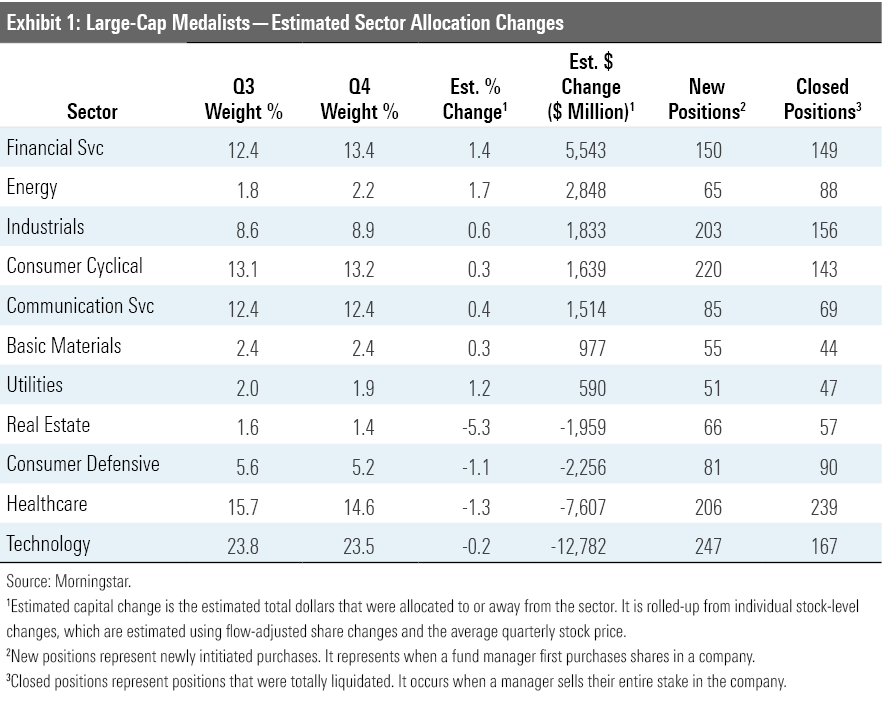

Large Cap

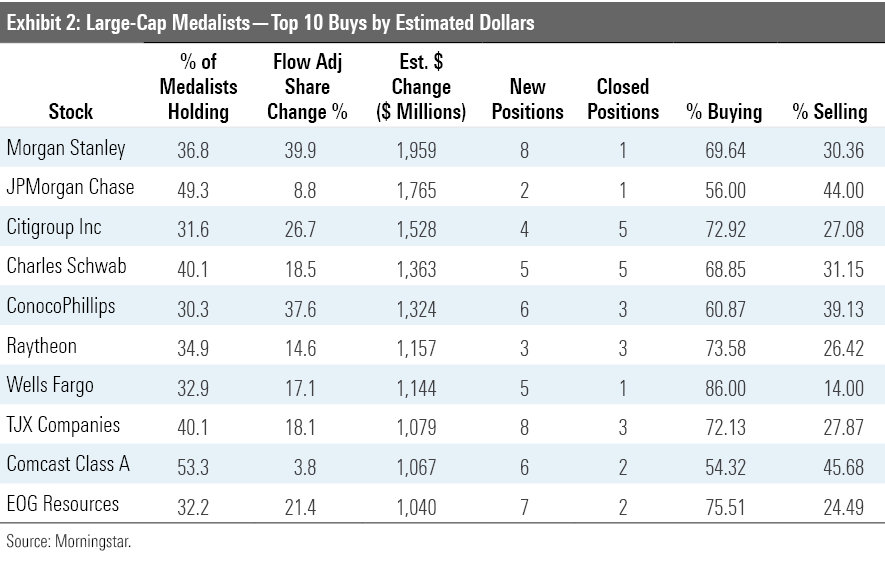

Large-cap managers poured into financials stocks as banks began releasing reserves they had stockpiled in anticipation of severe COVID-19-related loan defaults. Banks are putting that cash back to work after their worst case scenarios never materialized, and analysts expect more releases in 2021. Perhaps inspired by the improving credit outlook, medalist managers upped their stakes by at least 9% in each of JPMorgan Chase JPM, Citigroup C, and Wells Fargo WFC. Downtrodden energy companies also attracted a lot of capital as oil prices continued to rebound off their first-quarter lows and positive vaccine news stirred hopes for demand recovery. Exploration and production companies like ConocoPhillips COP and EOG Resources EOG received the most attention, as medalist managers upped their stakes in each by 38% and 21%, respectively.

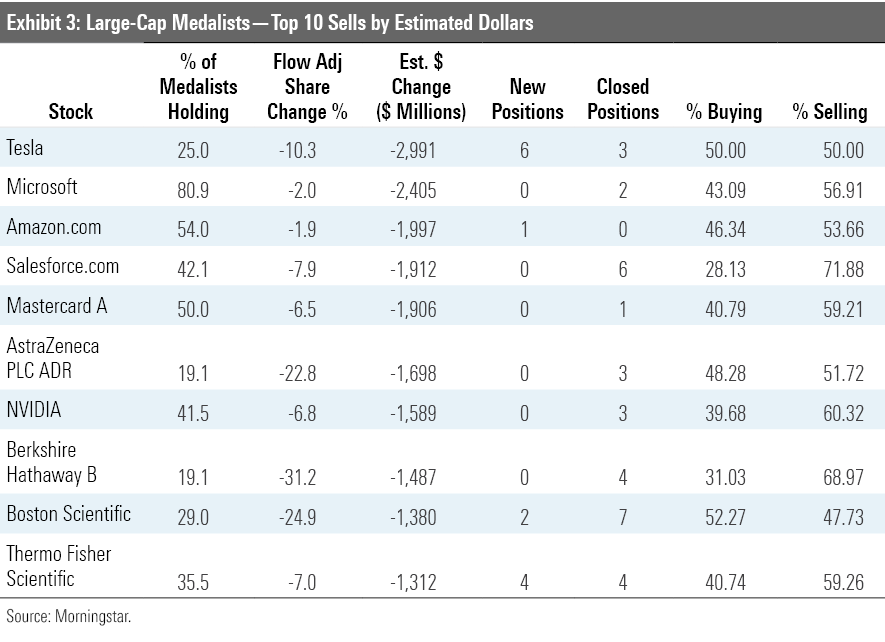

On an absolute dollar basis, managers sold technology more than any other sector. However, the relative change was minimal. Medalist funds cut their positions in the sector by an estimated $12.8 billion, which was only 0.2% of its existing stake, as managers trimmed their collectively massive interests in both Microsoft MSFT and Amazon.com AMZN. Only one medalist fund liquidated a position in either company, though more managers cut their stakes than added to them. There were, however, significant sales of semiconductor company shares. Medalist managers shed an estimated $4.9 billion of their industry holdings, particularly in Intel INTC and Nvidia NVDA. Nine managers closed positions in Intel, led by MFS Research Fund MRFIX, which sold its $92 million stake; the overall medalist stake in the company decreased by over 13%.

The most sold-off stock, at least in terms of estimated total dollars sold, was Tesla TSLA. While the number of managers adding or trimming their stakes in the electric-car maker was exactly even, the selling managers made larger moves and the collective medalist stake fell by over 10%. Tesla shares, which joined the S&P 500 index in December, jumped another 57% in the fourth quarter. Its ever-climbing valuation didn’t bother some managers. Six funds, including three Columbia Threadneedle funds, opened new positions in the stock. Airbnb ABNB, which went public in early December, was the most popular new holding. It appeared as a public company for the first time in 31 medalist portfolios, some of which--like T. Rowe Price Growth Stock PRUFX--had owned it already as a private company.

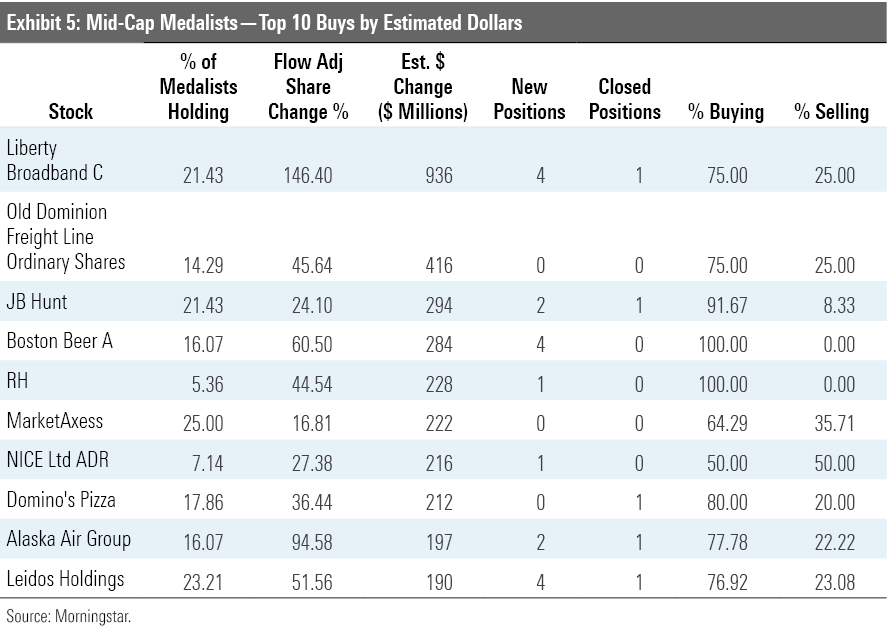

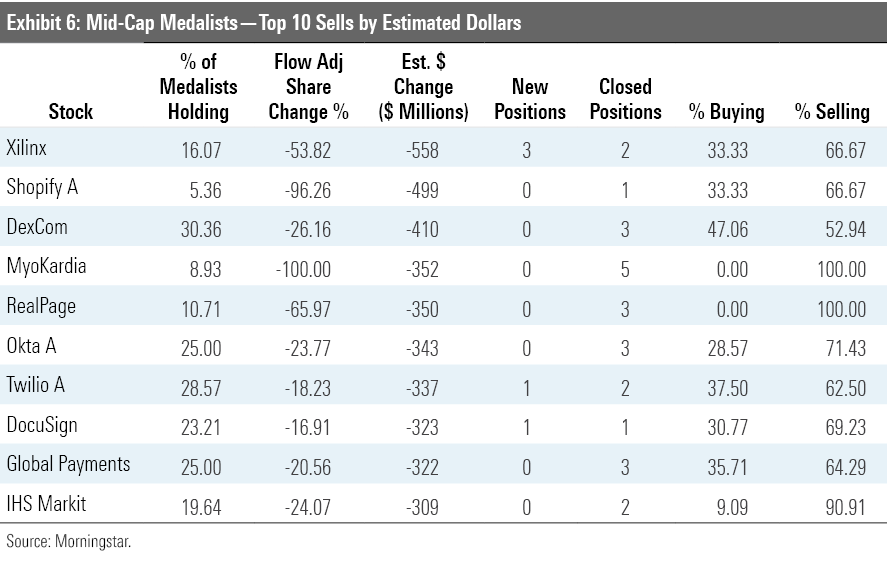

Mid-Cap

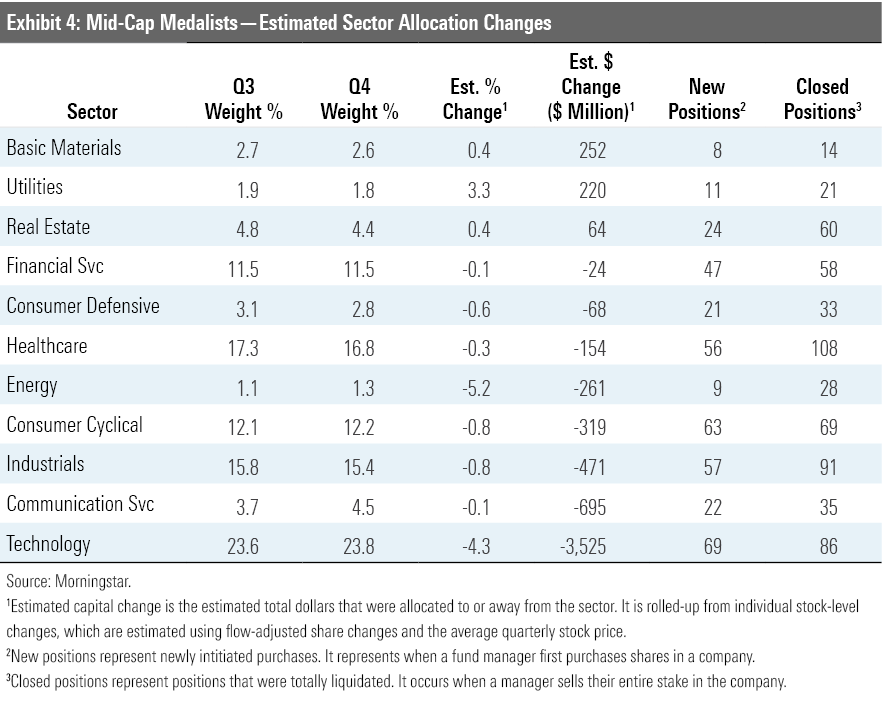

Mid-cap medalists also pared their technology stakes. They shaved an estimated 4.3% off their sector holdings, trading semiconductor and software companies the most. Shares of two of the most-sold positions, Shopify SHOP and DocuSign DOCU, continued to rise in the fourth quarter, and funds likely sold them as their valuations grew into large-cap territory and beyond their mandates’ limits. Managers collected profits on another widely sold company, RealPage RP, which went private at a more than 30% premium.

Mid-cap medalists spread their purchases around. Stakes in basic materials and utility companies increased the most, but the dollar amounts were not huge. Mid-cap medalists’ overall helping of gold miners increased by nearly 10% even as gold prices stayed flat in the quarter, as existing shareholders, rather than new buyers, added to positions. Medalists also increased their bank stakes, with positions in regional players like M&T Bank MTB, SVB Financial SIVB, and PNC Financial Services PNC each increasing by over 10%. Finally, the medalists’ thirst for beer showed no signs of slaking. Three more managers in the fourth quarter added Boston Beer Company SAM, which had a sharp increase in ownership in the third quarter; mid-cap medalists’ overall stake in the brewer increased another 60%. Their aggregate interest in MolsonCoors also increased by over 40%.

IPOs Airbnb and DoorDash DASH also were popular new appearances among mid-cap medalists. Who knows how long they’ll stay in these portfolios, though. Each already has a market capitalization over $60 billion, near the top of the Russell Mid Cap index.

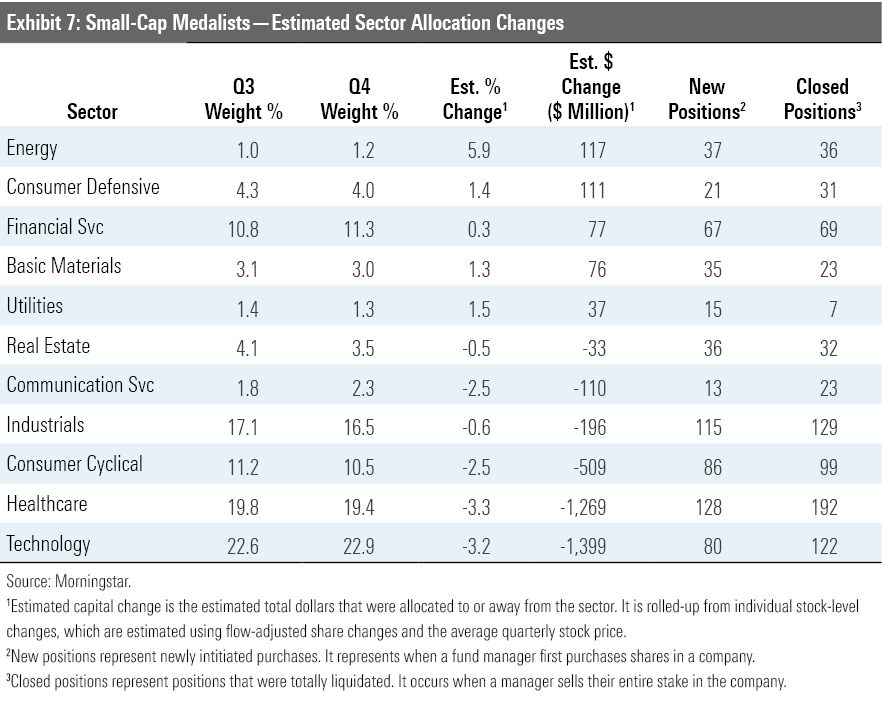

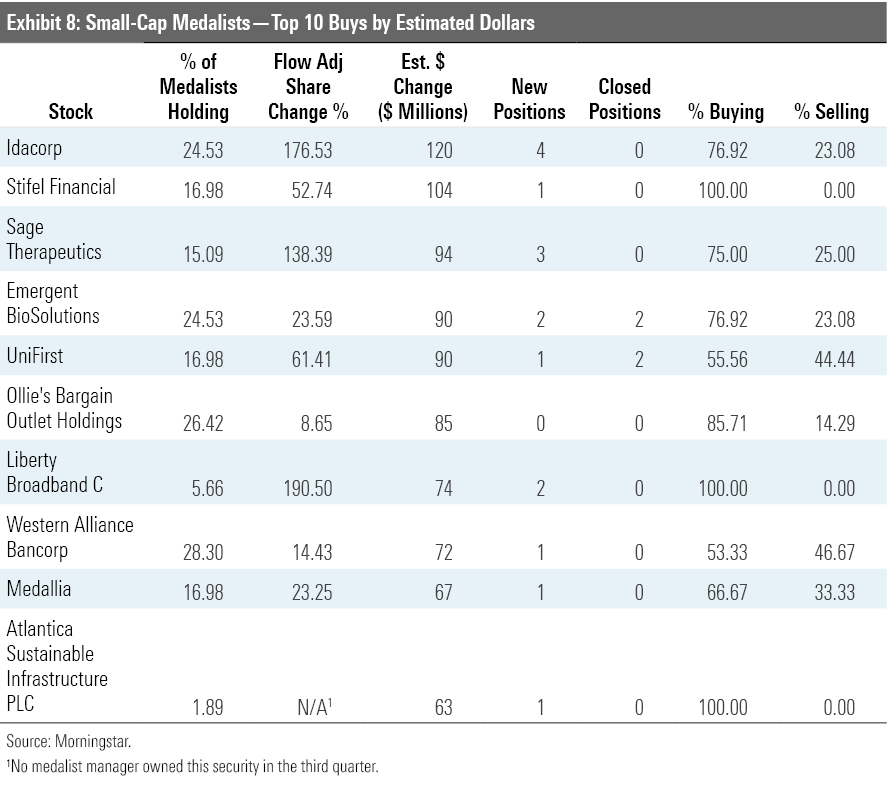

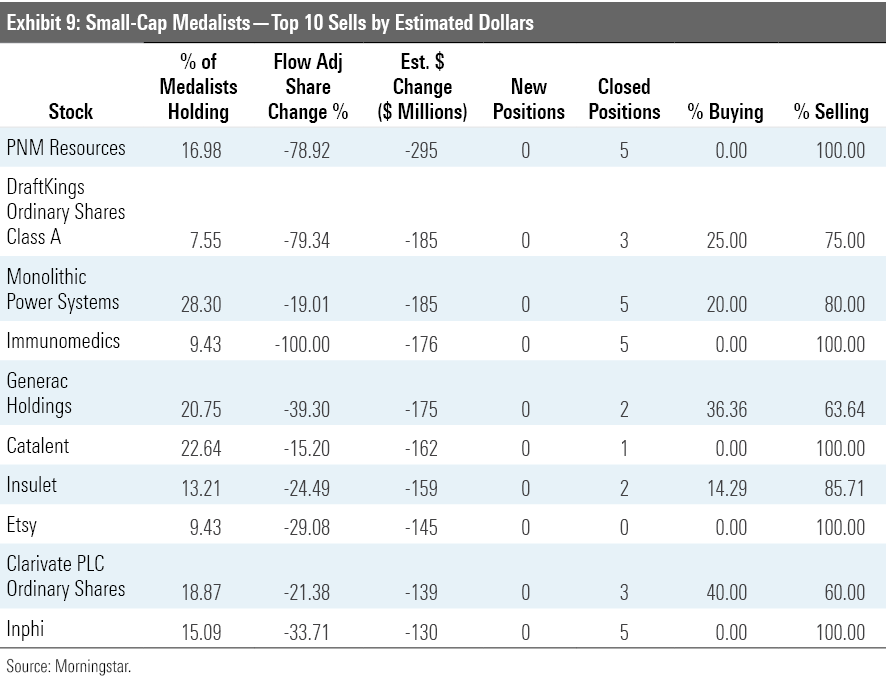

Small Cap

Small-cap medalists joined in the bank-buying binge. Regional banks attracted the most capital and new positions, with stakes in Western Alliance Bancorp WAL, Bank OZK OZK, and Prosperity Bancshares PB increasing by over 14% each. Small-cap regional banks often derive significant revenue from mortgage-related business, and an improved macroeconomic outlook and the potential for higher loan-refinancing volumes caused by low interest rates likely drove managers into the sector. Security system and smart-home device manufacturers also saw a bump. Three medalists bought Resideo Technologies REZI, while funds from T. Rowe Price and Janus Henderson combined to increase the overall medalist stake in Brady BRC by over 20%.

Small-cap medalist managers also cut technology exposure, although the biggest moves were likely market-cap-driven. As with the larger-cap strategies, semiconductors, including Inphi IPHI, Cree CREE, or Monolithic Power Systems MPWR, were prime selling targets. Small-cap medalists' aggregate stake in each decreased by at least 20%. All three stocks, however, rose at least 30% in the quarter, and their valuations reached the higher end of the Russell 2000 Index, so market-cap limits probably triggered many of the sales. Medalists sold nearly 80% of their shares in fantasy sports and gambling company DraftKings DKNG, as three of the four funds that held it completely liquidated their positions.

/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)