9 Wide-Moat Stocks of Tomorrow

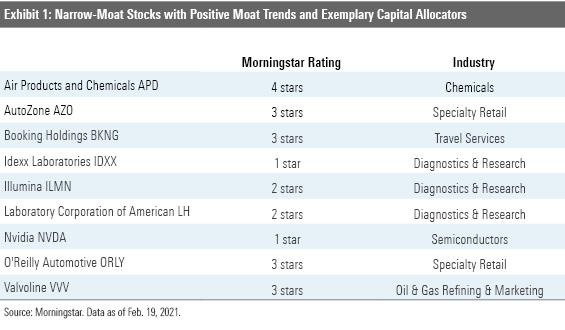

These narrow-moat firms have positive moat trends and are run by exemplary stewards of capital.

Many families have their go-to recipes for pound cake. Some call for almond extract or lemon juice--or rum--to provide extra flavor. Others say to top the cake with a glaze or powdered sugar. Still others (like our family's recipe) keep it simple, with no topping and just a hint of vanilla.

No matter the extras, all pound cake recipes share four key ingredients: butter, eggs, flour, and sugar.

Similarly, companies poised to become industry leaders--in our parlance, those seeking to carve out wide Morningstar economic moats--share some of the same ingredients. For instance, they have a competitive advantage (or two)--maybe that's high switching costs, powerful brands, or a significant cost advantage. In other words, they've begun to carve out an economic moat. But they aren't resting on those competitive advantages. Instead, these companies continue to dig a moat by exploiting trends in their industries. And they're run by smart capital allocators who make shrewd investment decisions to keep the company competitive.

Today's screen isolates companies with those qualities. We're looking at narrow-moat companies with positive moat trends whose managers earn Exemplary marks for capital allocation. While there's no guarantee that these companies will eventually establish wide moats, they certainly have the right ingredients to do so. They're strong stocks to buy at the right prices.

Perhaps not surprisingly, most of these well-run companies are fairly or overvalued according to our measures. But they’re all topnotch watchlist candidates.

Here’s a closer look at three of the names on the list.

Booking Holdings BKNG "While COVID-19 stands to materially impact near-term travel demand, we see Booking exhibiting solid financial health. Further, we expect Booking's global online travel agency leadership position to expand over the next decade, driven by a healthy position in Asia-Pacific (around high teens of total bookings), continued leadership in Europe (near 50% of total bookings), and an expanding presence in vacation rentals, restaurant bookings, and experiences, all of which are backed by leading marketing and technology scale.

Booking has built a leading network (source of its narrow moat) of hotel properties and other services, which drives an increasing user base. We see this network effect continuing to expand in both developed and emerging markets, as well as vertical markets such as rentals and attractions, resulting in a full connected trip offering. In developed markets, replicating Booking’s leading network in Europe is proving costly and time consuming for key competitors, given around 65% of all hotels in the region are small boutique establishments. In emerging markets, the firm is expanding its presence in China with its Ctrip and Meituan-Dianping partnerships, and in its own Booking.com and Agoda.com platforms, which is crucial, as we see the Asia-Pacific region representing around one third of total industry online booking growth over the next five years. This expanding network positions Booking well for the increasing global shift to booking via mobile applications. Booking.com is a top-10 travel application in 128 markets versus 11 for Expedia EXPE, according to App Annie on Jan. 26, 2021.

Focused entry from Google GOOG, Facebook FB, Alibaba BABA, Amazon.com AMZN, and others could double the current handful of players that have dominant scale, leading to a meaningful impact on profitability. That said, replicating Booking's network would require significant time and expense, and we expect most of the aforementioned operators to deploy a metasearch model (don't control hotel relationships) versus directly competing against Booking's OTA model (control hotel relationships)." Dan Wasiolek, senior analyst

LabCorp LH "As a leading independent diagnostic laboratory, LabCorp participates in a highly attractive duopoly that offers bright prospects as healthcare moves toward reformed payment models, despite current Medicare headwinds.

Even though hospitals still dominate the $72 billion diagnostic market, LabCorp has carved out a significant slice of the pie through serial acquisitions. The firm then added Covance's drug-development expertise, which also offers LabCorp an avenue to monetize its large patient database.

Just as importantly, LabCorp has single-mindedly pursued greater efficiency, which translates to an ability to reduce costs more quickly than reimbursement cuts coming down the pike. The firm has invested in greater automation and systems that can decrease the number of employees involved in sorting and running the tests. LabCorp has also put significant resources behind beefing up its information technology capabilities. As a result, physicians can more easily access test information in a timely manner, and patients can schedule blood draws with increased convenience. We admire how the management team has consistently focused on these strategies over the long term, and we expect LabCorp's investments today will reap rewards in future years.

LabCorp should take advantage of the long-term secular trends that bode well for the diagnostics industry, as the proliferation of new tests grows and new disease markers and genetic mutations with pharmacogenomic implications are discovered. New reimbursement models inspired by healthcare reform should lead more doctors and hospitals to send tests to lower-cost producers like LabCorp.

PAMA reimbursement pressure from Medicare remains the strongest near-term headwind, though the price cuts have stabilized and are unlikely to get significantly worse in 2021. Further, we think reimbursement pressure could ease in 2022 once hospital-based labs (which are reimbursed at higher levels) are included in the recalculation of Medicare's clinical lab fee schedule. The question remains whether the hospital-based labs will be able to comply with the PAMA collection and reporting requirements in 2022." Debbie Wang, senior analyst

AutoZone AZO "Narrow-moat AutoZone benefits from strong brand intangible assets borne of its nationwide presence, effective customer engagement driven by its high standard of service, and the success of its proprietary-label products. Coupled with a cost advantage generated by its scope of distribution and leading DIY market share, the firm stands to benefit from consolidation behind national chains that can efficiently provide reliable part availability. While AutoZone has been slow to fully embrace the dual-market approach that is increasingly a hallmark of the national retailers, we believe its management team's measured approach and consistent focus on returns should leave the firm in a strong position to weather change.

AutoZone is expanding its commercial sales effort, building on its leading do-it-yourself aftermarket automotive parts franchise. The initiative should build on the firm’s recent operational success, with adjusted returns on invested capital averaging 28% over the past five years and high-teens operating margins. As AutoZone’s commercial revenue rises, it should reap the benefits of a strong dual-market approach, balancing the faster-growing professional segment with more lucrative DIY sales. AutoZone benefits from a customer base that values service more than price-based appeals, which insulates the firm’s returns and acts as a bulwark against competition. We expect profitability to hold steady long term as the company scales and takes share from independent and regional competitors, with adjusted operating margins remaining near fiscal 2020's 19% mark despite rising wages. While its domestic operations still have room to grow, AutoZone has an expanding presence in Mexico and Brazil. We believe its measured approach to international expansion should lead to further long-term growth, even after its core market consolidates and stabilizes.

The pandemic had led to a spike in DIY sales, a segment which is AutoZone's forte. The surge should be fleeting, but we believe AutoZone should also benefit from recovering commercial sales as conditions stabilize, and that both markets should buoyed long-term by rising vehicle age and normalizing miles driven growth." Zain Akbari, analyst

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)