How Fares the World's Largest 401(k) Plan?

Quite well, thanks for asking.

A Giant Among Us Technically, the Federal Thrift Savings Plan, or TSP, isn't a 401(k) plan, as it is not organized under Section 401(k) of the IRS tax code. Effectively, though, TSP walks like a 401(k), talks like a 401(k), and quacks like a 401(k), which makes it in my book the world's largest such plan, at $800 billion. (In comparison, the biggest actual 401(k) plan, Boeing's, possessed but $50 billion at last report.)

One would expect such a gargantuan plan, containing the retirement assets for 6 million federal employees, to be run cautiously. Let smaller organizations attempt to lead the charts. The important thing for TSP is to avoid conspicuous failure. No matter how the markets behave, TSP should always perform at least respectably. The 800-pound gorilla cannot be a turkey.

The Claim I was surprised, then, to receive a detailed email this week alleging that TSP has failed at its mission. The note begins, "Uniformed Service and Civil Servants deserve better performance, oversight, and service from the private sector than the Federal Retirement Thrift Investment Board provides." It continues:

- The Board mismanages the plan because of its "lower capabilities and lack of financial literacy," qualities that may be found in abundance in the "private sector fund management industry."

- "Participants could do much better on their own investing with a curated menu of readily available private sector funds or ETFs, with some online financial/coaching advice."

- Poor supervision has led to "lackluster performance of the funds and inferior service to participants, with lagging capabilities in recordkeeping, data security, and brokerage/mutual fund windows."

Then come several pages of analysis supporting the claims of weak returns, followed by a recommendation that the board replace the current investment lineup with a “curated set of private-investment choices,” as Australia does with its national Superannuation retirement program.

On the surface, the note convinces. Run it by somebody without investment experience, and they will likely believe the charges. However, for those who have previously encountered investment arguments, the allegation sets off a loud alarm, because its analysis is conducted haphazardly. This fund is criticized for one reason, that fund for another. Nowhere does the author evaluate the performance of every TSP fund while using the same, consistent measurement.

The Investigation Let's do that now--it won't take long. TSP has a limited investment menu, consisting of five stand-alone funds--large U.S. stock, small U.S. stock, international stock, intermediate-term bond, and short government--plus a target-date series called Lifecycle. Vanilla does not get much plainer than this.

These are custom offerings rather than registered mutual funds. Annual expense ratios for TSP’s options range from 0.04% to 0.07%, meaning that participants pay $40-$70 in fund management fees for every $100,000 invested. The short-government fund is managed in-house, while the other stand-alone funds are BlackRock-run index funds. (So much for the claim that TSP’s board bypasses the private sector.) The Lifecycle funds combine each of those five funds, with the board setting the asset allocation.

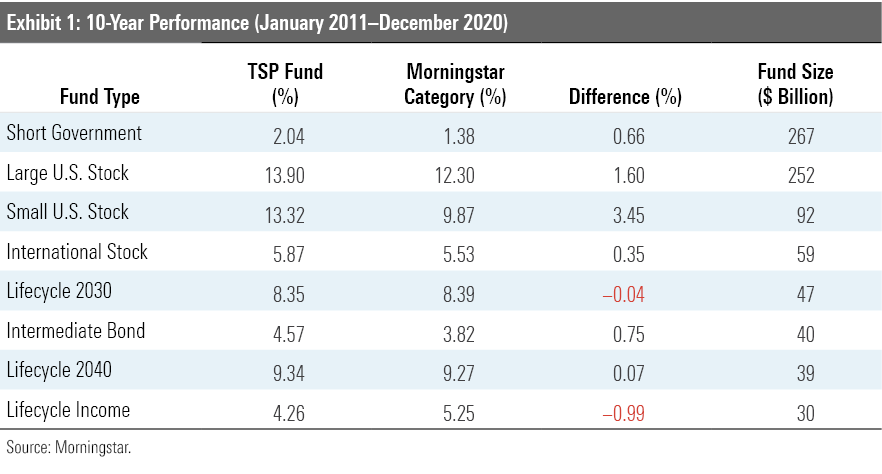

Exhibit 1 shows the trailing 10-year returns for each TSP fund through Dec. 31, 2020, along with the Morningstar Category average for its mutual fund competitors. The funds are listed in order of size, because the plan’s two largest funds account for two thirds of its assets. When evaluating the results TSP has delivered to its participants, their performances matter most.

No complaints atop the chart, and few down the list, for that matter. The plan’s U.S. stock funds excelled, its international-stock and fixed-income funds beat their average rivals by the amount of their cost differences, its longer-dated Lifecycle funds matched the competition, and its Lifecycle Income fund--owned by those who had previously held the 2010 or 2020 funds--lagged by a percentage point. In no way, shape, or form could this showing be deemed a failure.

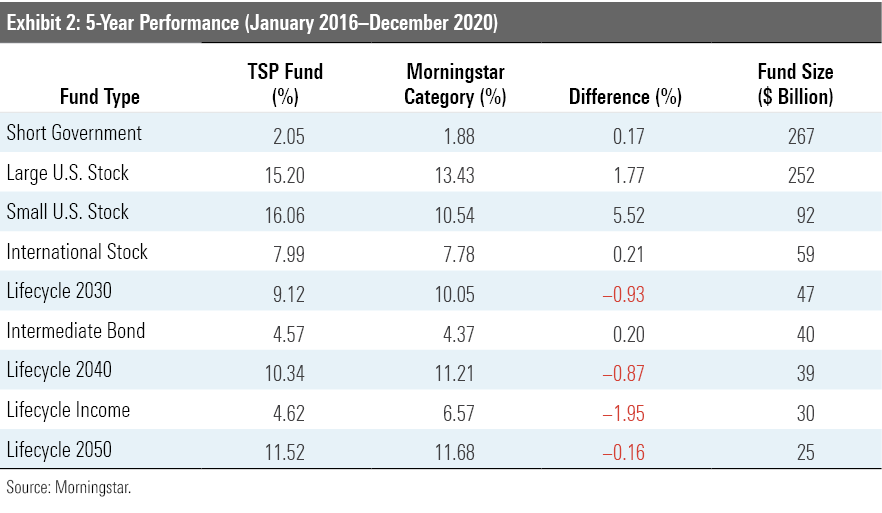

The email’s complaints focused on five-year performance numbers, which aren’t terribly germane for evaluating retirement plans, but it’s worth seeing whether there’s anything to the objections. Exhibit 2 repeats the exercise for the trailing five years through year-end. (It contains an additional fund, Lifecycle 2050, which had a five-year history on that date but not a 10-year history.)

These results are indeed worse. The two U.S. stock offerings remained stellar--the small-company fund mimics the uncommon benchmark of the Dow Jones U.S. Completion Total Stock Market Index, which has performed spectacularly--but the other funds slipped. Still, with five of the nine funds, including the four largest, outgaining the competition, one can scarcely claim, as the letter did, that investors could do “much better” by choosing among other funds.

Also, criticizing the Lifecycle funds for lagging the averages during a strong bull market is hindsight analysis. The board manages its Lifecycle funds conservatively. Lifecycle Income currently has 22% of its assets in equities, as opposed to 28% for its typical rival. The 2030 and 2040 funds also hold fewer stocks than do their average competitors. Should equity fortunes reverse, their relative performances will be strong.

Conclusion But those are excuses for a track record that needs no defending. During TSP's history (the plan was founded in 1986), the investment markets have been extraordinarily generous. Both stocks and bonds have enjoyed almost continuous bull markets, returning far above the inflation rate. To succeed, all that 401(k) plan sponsors needed to do was provide their plan participants with open, low-cost access to the markets and then get out of the way. TSP's board did just that.

If the board is to be criticized for anything, it is that one third of TSP assets rest in the short-government fund, its equivalent of a cash account. That is far above the industry norm (which consists roughly of 10% in cash and 10% in bond funds). The board has addressed this problem by launching its Lifecycle series, which attracts monies that would otherwise be invested in the short government fund. Regrettably, that change is occurring very slowly.

In summary, denouncing TSP for its participants’ investment selections would be reasonable, if somewhat harsh, as TSP is far from the only major 401(k) plan to have an imperfect allocation. Still, that claim would merit discussion--not so the letter’s allegation. There’s no indication that TSP would improve by expanding its investment lineup, and by having all its funds managed by the private sector.

Editor's Note: This article has been updated to correct the asset allocation of Lifecyle Income.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)