The Case for Indexing in the Corporate Bond Market

Low fees and market-representative portfolios make corporate bond ETFs a compelling option.

Exchange-traded funds tracking indexes that are representative of the broad investment-grade corporate bond market are a solid option for exposure to this asset class. Portfolios that mimic the contours of this opportunity set and boast low fees have been difficult for active managers to beat. Over the 10 years through June 2020, just 40% of actively managed funds in the corporate bond Morningstar Category managed to survive and outperform the average of their passive peers.

This article explores the contours of the investment-grade corporate bond market, how it has evolved over time, and the case for indexing in this asset class.

The Wisdom of the Bond Crowd

Leveraging the wisdom of the crowd through indexing is a sensible approach to gain exposure to large and liquid markets that enjoy active price discovery. The process of buyers and sellers actively negotiating fair prices for assets allows markets to incorporate new information in real time.

Market-cap weighting defers to the market’s assessment of the relative value of a pool of stocks or bonds to size portfolio holdings. The relative performance of market-cap-weighted benchmarks depends on the breadth, depth, and liquidity of the relevant market.

At the beginning of 2021, the U.S. investment-grade corporate bond market (proxied by the ICE Bank of America U.S. Corporate Bond Index) had a total market value of $8.5 trillion. There were more than 1,200 issuers and 8,800 bonds within what is the third-largest segment of the U.S. taxable investment-grade bond market. This is a broad, deep market.

But liquidity is not a hallmark of the corporate bond market. Less than one fifth of all corporate bonds trade in a given day.[1] This speaks to the nature of bond markets and the objectives of bond investors. At the beginning of 2021, issuers had an average of 10 distinct bonds outstanding (proxied by the ICE Bank of America U.S. Corporate Bond Index). These issues vary along the dimensions of maturity, coupon, and more. Bond investors’ objectives are distinct, too. Many buy bonds to offset matching future liabilities. Liability-matching buy-and-hold investing affects bond market liquidity, sitting many bonds on the edge of the pool of liquidity in the secondary market.

An illiquid market can be fertile ground for mispricing. A market populated by mispriced securities can be target-rich for active managers. Why, then, have actively managed strategies struggled in the investment-grade corporate bond market?

While there are many factors at play, one of them pertains to the technological advances that have made the bond market more fluid.

More Transparency, More Liquidity

The advent of electronic trading platforms has been a major structural change in the corporate bond market. Adoption of these platforms has made the market more fluid and better equipped to quickly incorporate the views of market participants.

A FINRA study of the corporate bond market, spanning January 2003 through September 2015,[2] found that liquidity has been improving. The report noted that, on average, trading volumes have increased and bid-ask spreads narrowed. Among the most actively traded bonds, the number of trades increased approximately 20% and average bid-ask spreads declined by about 60%.

The FINRA study also found that 14% of trading occurred electronically in 2015. But the amount of secondary trading volume on these platforms increased 100% between 2005 and 2015. More recently, The Wall Street Journal[3] reported that 34% of all corporate bond transactions were electronic.

A plethora of platforms providing a range of services exist, but, in general, electronic trading platforms enable market participants to view quotes, submit electronic requests for quotation, view historical prices, and execute trades. These services enable greater price discovery and better liquidity as they allow investors to express their views with greater ease.

These developments have increased the efficiency of the corporate bond market and further bolstered the case for indexing in this sector.

Credit Crunch

While liquidity has improved in credit markets, investing in corporate bonds is still risky. The coronavirus-driven sell-off between Feb. 19 and March 23, 2020, is the most recent example of this inherent risk. During this episode, credit spreads widened (the ICE Bank of America BBB option-adjusted spread increased to 4.88% from 1.31%, for instance) and bond prices dropped. The category average return during this downdraft was negative 12.72%.

Active managers will often claim that their ability to manage this sort of downside risk is one of their strong suits and justifies the premium that investors pay for active management. It intuits that a flexible alpha-seeking process, plied by experienced managers and supported by a bevy of talented analysts, should be able to navigate turbulent market conditions better than an index fund. But passive corporate bond ETFs actually held up better during the pandemic sell-off than their active peers, falling by 1 percentage point less on average.

Moreover, the peak-to-trough performance spread between the best- and worst- performing actively managed strategies was considerably wider than the spread between the best- and worst-performing ETFs (18.88% versus 5.96%). While many actively managed strategies did well for their investors, holding up better than the average ETF, more of them did worse.

To be fair, the best-performing strategies during this specific sell-off were actively managed, as were the best-performing strategies during the prior sell-off; but they were not the same set of strategies. And while ETFs beat their average actively managed category peers, their performance was still middling. The average return for an ETF ranked in the category’s 40th percentile. That was the case during the prior sell-off and will likely be the case during the next one.

Ultimately, corporate bond ETFs proved their worth during 2020. Not only did they hold up reasonably well during the pandemic sell-off, they were also able to keep pace during second half of 2020 when credit spreads returned to their precrisis levels. Consequently, the average corporate bond ETF provided superior risk-adjusted performance (as measured by Sharpe ratio) over the trailing three years ended December 2020, relative to the average of their actively managed category peers.

Wrapping It Up

Leveraging the wisdom of the crowd through an indexed approach is a sensible way to gain exposure to large and liquid markets that enjoy active price discovery. As the corporate bond market has expanded and liquidity has improved, the case for investing in a broadly diversified, low-cost ETF for long-term exposure to the investment-grade corporate bond market has grown stronger.

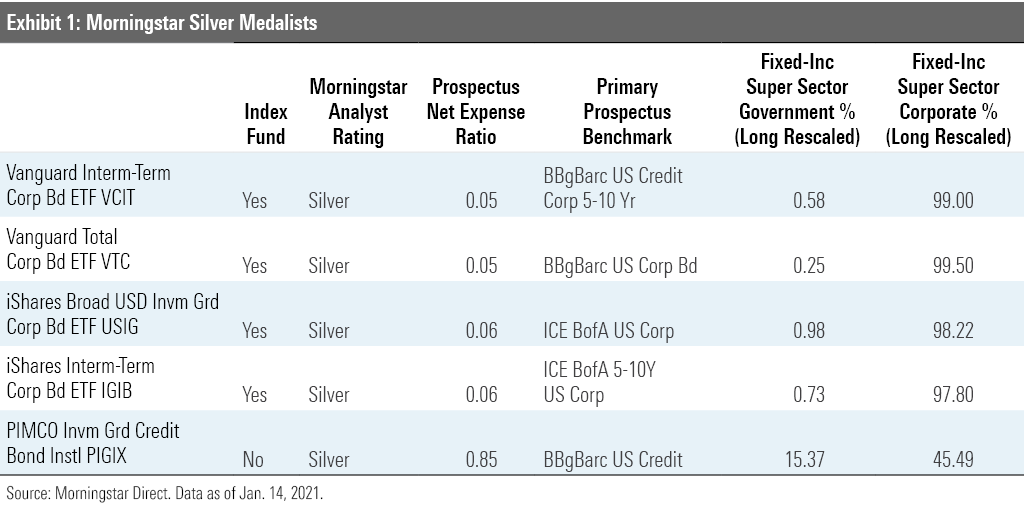

While leveraging the market’s wisdom is not a guarantee for success, diversifying broadly and keeping costs down is almost always a solid bet. Exhibit 1 features Morningstar Medalists from the corporate bond category. Four of the five top-rated strategies in this category are index-tracking ETFs.

[1] McCrum, D. 2018. "Most Bonds Don't Trade." Financial Times. https://www.ft.com/content/3175772a-7ea0-3b61-ae53-063459e78c42.

[2] Mizrach, B. 2015. "Analysis of Corporate Bond Liquidity." FINRA Office of the Chief Economist. https://www.finra.org/sites/default/files/OCE_researchnote_liquidity_2015_12.pdf.

[3] Wirz, M. 2020. "Electronic Trading Surges to 34% of Corporate Bond Market." The Wall Street Journal. https://www.wsj.com/articles/electronic-trading-surges-to-34-of-corporate-bond-market-11579010400.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)