Some Recent Fund Style Box Moves Explained

Recent Morningstar Style Box enhancements cause some fund migration.

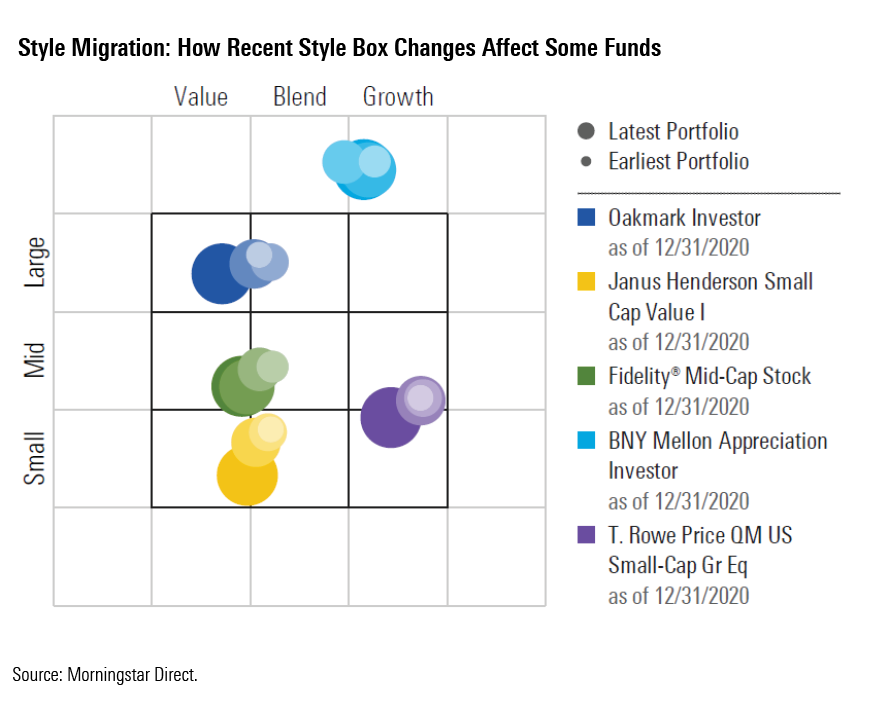

The Morningstar Style Box recently got an upgrade that could affect where your funds land in it. Last fall, Morningstar updated its style box methodology to improve the quality and timeliness of data inputs, address a pattern of core indexes and funds drifting from the blend box into growth, and make market-cap adjustments. Most funds have now reported at least one portfolio under the new methodology. There haven't been many dramatic moves yet or changes to Morningstar Category placements as those are based on three years of style box data, but some portfolios have begun to migrate. Below are some affected Morningstar Medalist funds.

The recent methodology changes reverse a 2018 decision to take a global approach to market-cap breakpoints. That inched many U.S.-domiciled funds, especially small-cap strategies, upward in the style box. The methodology returned to using local breakpoints, moving some affected portfolios back down. Prominent funds such as Wasatch Core Growth WGROX, T. Rowe Price QM U.S. Small-Cap Growth PRDSX, and Neuberger Berman Genesis NBGNX, for example, shifted from the mid-growth box to their current category of small growth.

The changes also help correct the style box’s skew toward growth in recent years, which was particularly noticeable among small-cap funds. As a result of the changes, some funds have moved leftward. Janus Henderson Small Cap Value JSIVX shifted from small blend to small value, for instance, better reflecting its value leanings and appetite for financials. Royce Pennsylvania Mutual PENNX, which mixes competitively advantaged businesses with out-of-favor value plays, moved from small growth to small blend.

Up the market-cap spectrum, Hartford MidCap HMDYX shifted from mid-growth to mid-blend. The fund looks cheaper than mid-growth peers on traditional value metrics such as price/earnings and price/free cash flow, and it has less exposure to some of the high-flying growth companies many category rivals favor. Janus Henderson Enterprise JANEX has made a similar move leftward, which also makes sense because Morningstar’s Risk Model indicates it tilts more toward value than the category benchmark, the Russell Midcap Growth Index.

Fidelity Mid-Cap Stock FMCSX traveled from mid-blend to mid-value, an unsurprising change given lead manager John Roth’s contrarian bent. Roth blends secular growers with cyclical plays. His wariness of heightened valuations within traditional growth havens has moved the fund into value territory, a more appropriate fit. Eaton Vance Atlanta Capital SMID-Cap EISMX, meanwhile, jumped from mid-growth to mid-blend. It has long favored modest growers within industrials and financials over high-flying growth companies, so the shift to the blend bucket is plausible.

Oakmark OAKMX and Oakmark Select OAKLX moved from large blend to large value. These are not deep-value funds that rely on traditional price measures. The team uses a variety of valuation techniques to find mispriced businesses that can still grow. The portfolios include not only "growthy" picks such as Netflix NFLX , but also turnarounds like General Electric GE and a slug of value-leaning financials. That eclectic mix makes large value a logical landing spot.

Some funds have moved toward the growth side of the style box. BNY Mellon Appreciation DGAGX, run by subadvisor Fayez Sarofim, shifted from large blend to large growth, reflecting the team’s conservative-growth approach. Neuberger Berman Equity Income NBHIX inched into large blend from large value, somewhat surprising given its mandate. This risk-conscious income offering blends REITs, utilities, convertible bonds, and other dividend-paying stocks. In 2020, it bought more companies classified in the blend and growth style boxes than value, such as VF Corp VFC and MGM Growth Properties MGP, which may have pulled it to growth.

The Morningstar Style Box has been part of investors’ tool kits since 1992. It’s not meant to be an investor’s only investment tool, but it provides a useful snapshot of a portfolio’s tendencies. The recent changes keep it relevant and useful, but style boxes can and do change as portfolios do. A fund’s Morningstar Category, which takes at least three years of portfolio data into account, remains a better indicator of its long-term investing style.

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)