7 Surprising Stocks to Consider

These large companies lack economic moats and have negative moat trends--but we think they’re attractive nonetheless.

Some things just go together. Chocolate and peanut butter. Tom Petty and the Heartbreakers. Teens and their iPhones. Morningstar and moats.

As longtime readers know, our approach to stock investing rests heavily on the idea of economic moats. We believe companies that have carved out economic moats have unassailable competitive advantages that should allow them to thrive for a decade or more. And even better than a company with a moat? A company whose moat exhibits a positive moat trend, meaning that its competitive position isn’t just solid--it’s improving.

That being said, valuation is important. No matter how moaty a company, we won’t suggest you buy it if its stock is overpriced. Conversely, there are plenty of underpriced stocks that may not be competitive juggernauts, but they’re attractive investments at today’s prices.

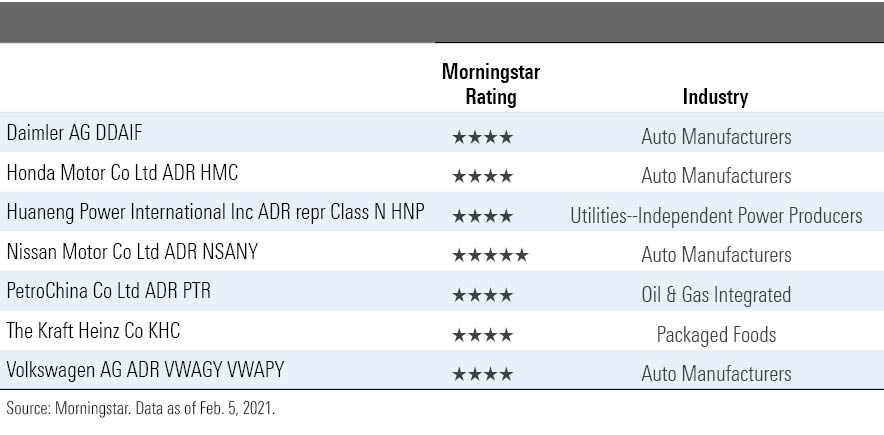

This week, we’re screening for stocks that land in the large-cap area of the Morningstar Style Box that lack economic moats and even carry negative moat trends but are underpriced according to our metrics, trading at 4- and 5-star levels. Seven stocks make the cut.

Four automakers populate the list: Daimler DDAIF, Honda HMC, Nissan NSANY, and Volkswagen VWAGY VWAPY. Why? Senior analysts Richard Hilgert and David Whiston explain in their 2020 Automotive Observer that few automakers can effectively carve out economic moats because of the ultra-competitive landscape.

“[Automakers] are capital-intensive, causing substantial swings in economic profitability on relatively moderate changes in demand, and they experience cyclicality that can destroy economic value for years at a time,” say Hilgert and Whiston. “Even though the automobile is a modern-day technological marvel that requires enormous engineering talent, complex software coding, considerable regulatory compliance, and immense organizational skill to design, develop, and bring to market, substantial global industry overcapacity would seem to indicate limited barriers to entry despite substantial capital requirements as well as complex regulatory safety and emissions compliance.”

Nevertheless, all of those automakers are trading well below what we think they’re worth and therefore present opportunity.

Here’s what our analysts think of the other businesses on the list.

Huaneng Power International Inc ADR HNP "Huaneng Power International is a leader among Chinese coal-fired independent power producers, or IPPs, in terms of installed capacity, production, and revenue. At the end of 2019, the company owned and operated power plants with total attributable capacity of 94 gigawatts, making it one of China's largest independent power producers. Coal-fired generation accounted for more than 95% of total power output. This means, Huaneng's profitability is subject to underlying coal-price swings, and there is considerable volatility in margins.

"Huaneng’s power plants are mostly located in eastern and southern China, which are China’s most economically developed regions, with sustainable and robust power demand. These favorable locations help Huaneng to maximize the utilization of its plants, which have consistently outperformed the broader Chinese average historically. The company continues to promote energy saving and emission reduction. In 2019, the average coal consumption rate per unit of power sold was 307 grams per kilowatt-hour, well below the Chinese average.

"Despite fluctuations in the Chinese economy, Huaneng has consistently delivered strong top-line growth, averaging 22% annually between 2002 and 2012. However, during that same period, net income hardly budged, increasing just 0.2% per year on average. This was the accidental byproduct of the combination of a coal price rally and China’s flawed coal power pricing mechanism: The government-controlled on-grid tariffs are usually slow to respond to coal price movements, which has historically caused coal-fired generators to earn below their cost of capital. Nevertheless, the 15% year-over-year decline of the QHD 5,500 Kcal spot coal price in the first half of 2020 reaffirms our view that coal prices should have peaked."

Jennifer Song, analyst

PetroChina Co Ltd ADR PTR "PetroChina is the listed arm of one of China's two integrated oil majors and the largest oil producer. With revenue and assets more heavily weighted toward the upstream activities, PetroChina is more sensitive to swings in the oil price than its peer, Sinopec. In addition, the firm's downstream operations lag Sinopec, which has better scale and efficiency in the sector. However, PetroChina will benefit more in a rising oil price environment.

"While we believe government restrictions on domestic exploration by foreign firms have given PetroChina a clear advantage when securing oil and gas reserves in China, the lack of large discoveries and the structural decline in legacy oilfields have led to a decline in total reserve life to less than 13 years in 2019 from about 17 years in 2012. As a result, the company is forced to secure resources overseas. It is common practice for China National Petroleum Corporation, or CNPC, PetroChina’s parent, to acquire, develop, and inject high-quality projects into PetroChina at below-market prices. As CNPC buys up assets in South America, Central Asia, and Africa, we expect it to drop down some of these projects when they mature.

"PetroChina owns 70% of China's oil and gas pipeline network and is looking to spin off these midstream assets. The sales should enable the company to reduce its capital expenditure commitment and recognize a higher valuation for the assets. The additional cash flow will also help the company offset lower contribution from its upstream operations in a low-oil-price environment.

"Being a state-owned monopoly has hurt the firm financially, as it is obligated to import natural gas at a higher cost than it can sell it for. Consequently, margins at PetroChina’s natural gas pipeline segment suffer when prices rise. As China shifts its focus away from subsidizing the industrial sectors toward encouraging private consumption and reducing pollution, reforms should allow prices to move more closely with international benchmarks. We expect the continued roll out of natural gas pricing reform to help PetroChina stage a gradual margin recovery."

Chokwai Lee, senior analyst

The Kraft Heinz KHC "Like its packaged-food peers, Kraft Heinz has benefited from consumers' newfound penchant for eating at home, with 85% of its sales driven through the retail channel. In addition, we surmise that its performance has been aided as consumers and retailers opt for leading branded fare (like that in Kraft Heinz's portfolio), in line with the gains in household penetration and repeat purchase rates to which Kraft Heinz alluded.

"However, we had believed the firm was charting a new course even before the onset of the pandemic, following the appointment of CEO Miguel Patricio in 2019. More specifically, we posit the firm's revised strategic playbook--pursuing sustainable efficiencies, elevating brand spend (marketing and product innovation), enhancing capabilities (category management and e-commerce), and leveraging its scale to more nimbly respond to changing market conditions--is prudent. As a part of this, we think Kraft Heinz has abandoned its profitability-at-all cost mantra in favor of driving sustained and profitable growth. And while the firm intends to realize $2 billion in efficiency savings through 2024, it appears to be doing so as an opportunity to free up resources to reinvest in its product mix rather than inflating profits.

"As such, we think the firm’s focus on fueling marketing spending and aims to get more mileage out of these investments are judicious--aided by its decision to narrow its stock-keeping unit count (down 20% in North America this year). In this vein, management targets a 30% increase in marketing investments over the next five years, which we think stands to support its brand mix and its retail relationships. This aligns with our forecast for marketing, research, and development to expand to more than 5% of sales in the aggregate over our 10-year forecast versus less than 5% the past few years.

But even with this shift, we don't envision the blistering pace prompted by COVID-19 will extend longer term (with our forecast calling for organic sales to moderate from the midsingle digits to low single digits) as consumers work through their pantries and resort to away-from-home food consumption as social distancing mandates are eased.”

Erin Lash, sector director

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)