The Best-Performing ESG International-Equity Funds

These funds also stood out relative to their non-ESG peers in 2020.

Investors looking for a sustainable foreign-stock fund don't have many options to choose from. Morningstar counts fewer than three dozen environmental, social, and governance funds landing in the international-equity Morningstar Categories.

But among that group are funds that have put up solid returns for their respective categories. For this article, we screened for top-performing foreign-stock ESG funds in 2020 and looked under the hood for clues that explained their strong showings.

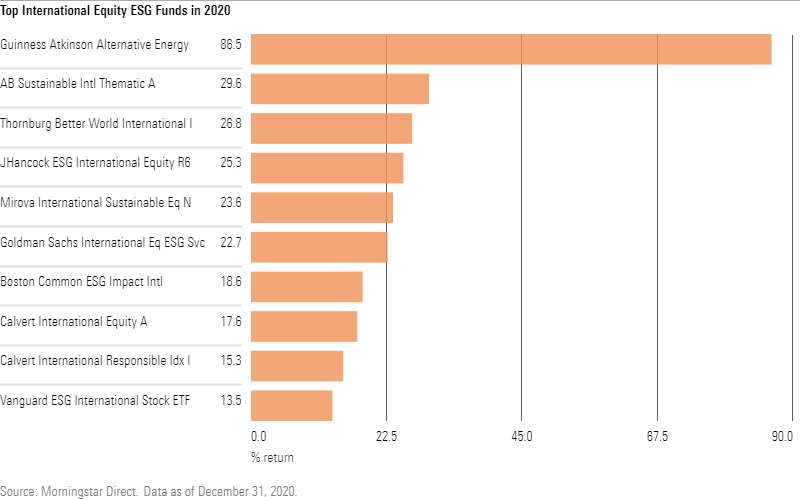

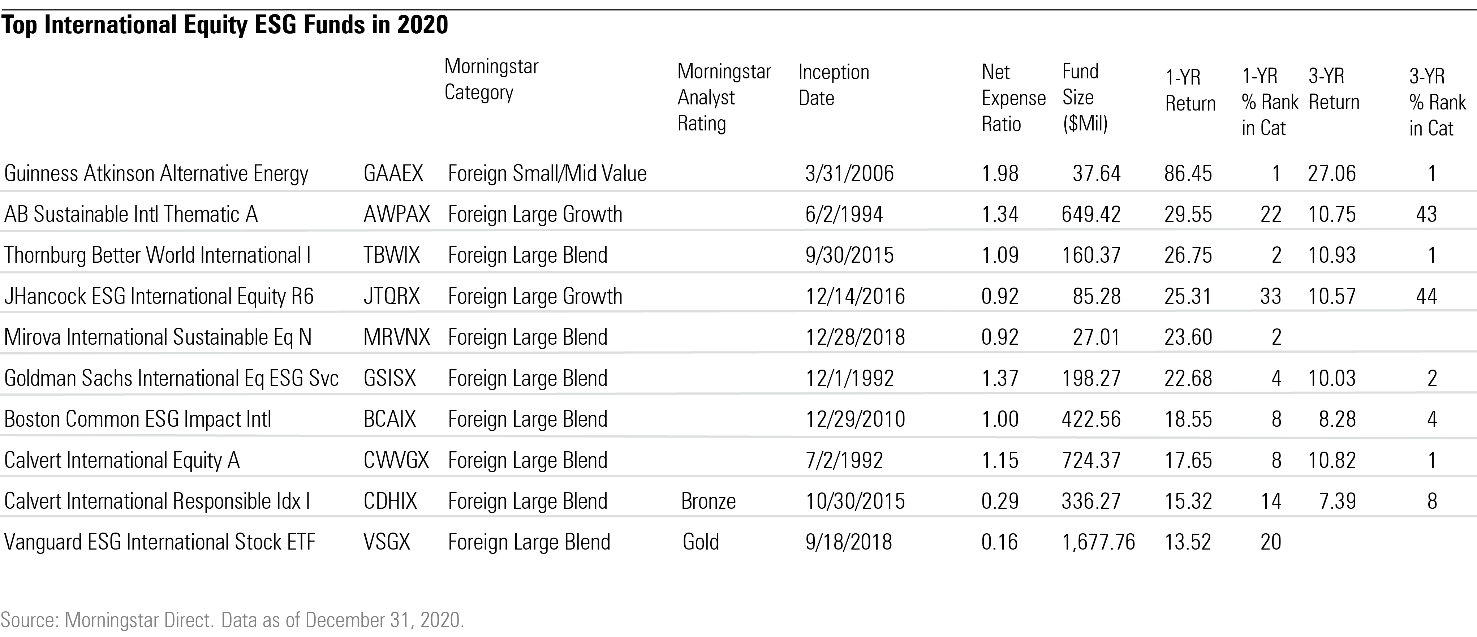

The 10 best ESG international-equity funds all gained over 13.0% in 2020, beating the 11.2% return of the Morningstar Global Markets ex US Index. These 10 funds also outperformed relative to their non-ESG peers--all ranked in the top halves of their categories for 2020 returns (one foreign-stock fund ranked in the top 10 among its ESG peers but landed in the bottom half of its category and was excluded from our list). These top 10 funds from 2020 also ranked in the top half of their categories for the three-year time period ended December 2020.

The list of foreign-equity ESG funds is composed mostly of large-blend funds (Morningstar Direct and Office clients can find the full list of ESG funds here), but out of the 34 funds, Guinness Atkinson Alternative Energy GAAEX, a foreign small/mid-value fund, and AB Sustainable International Thematic AWPAX, a foreign large-growth fund, rose to the top.

Underweighting energy and overweighting technology led to a strong year for most of the funds. Country weights also made a big difference; the Morningstar Japan Index gained 7.6%, while the Morningstar UK Index lost 11.5% in 2020. Managers that ventured further into emerging markets were rewarded; the Morningstar China Index gained 25.6%, and the Morningstar India Index gained 20.0%.

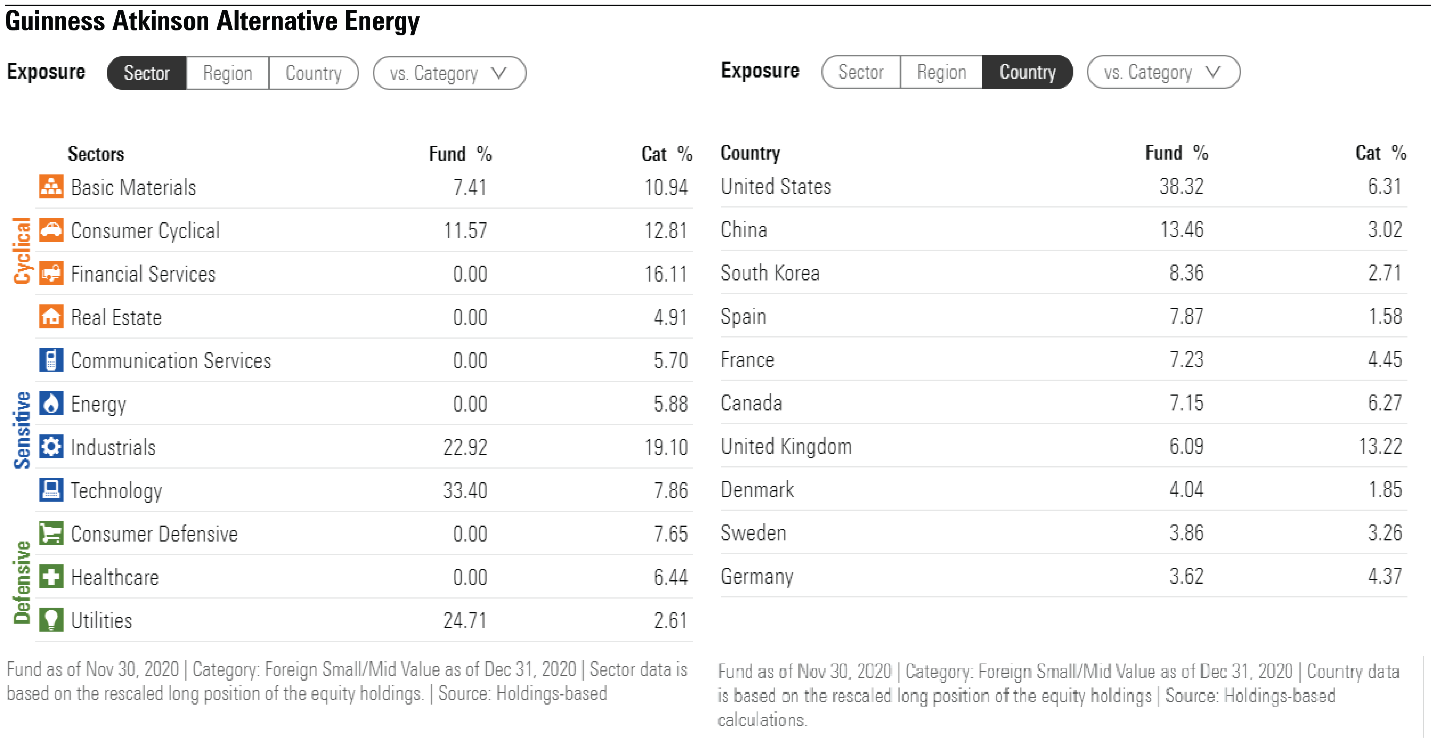

Guinness Atkinson Alternative Energy performed the best not just of all ESG international-equity funds, but of all foreign small/mid-value funds in 2020 and over the past three years.

The fund allocated a much larger portion of its portfolio to U.S. and Chinese stocks compared with the category average, and it was underweight U.K. stocks. Sector weights also appeared to work in its favor. The portfolio counted 33.0% of its assets in technology stocks at the end of the year compared with the 7.9% held by the average fund in the category.

The fund's five biggest holdings each returned over 100% during the year, including South Korean chemicals company LG Chem LGCLF and First Solar FSLR.

Guinness Atkinson recently launched an exchange-traded fund, SmartETFs Sustainable Energy II ETF SULR, managed by the same team.

Guinness Atkinson Alternative Energy also has done extremely well over longer periods, ranking in the top 1% of all foreign small/mid-value funds over the trailing one-, three-, and five-year time frames.

AB Sustainable International Thematic ranked second among ESG foreign-stock funds in 2020 with a 29.6% return, which landed in the top quartile of the foreign large-growth category for the year.

Manager Dan Roarty attributes the fund's performance in 2020 to resilience during the first-quarter downdraft, thanks to "high-quality attributes--such as strong environmental, social, and governance characteristics, clean balance sheets, and higher-than-normal cash levels." And, he added, "when stocks rebounded sharply over the next two quarters, the fund's relative outperformance was driven by broad-based positive stock selection in stronger and more resilient industries."

Of the 16 ESG foreign large-blend funds on the list, Thornburg Better World International TBWIX fared the best in 2020. The fund beat not just its ESG counterparts, but almost all foreign large-blend funds, ranking in the top 2% in the category over the past three- and five-year periods.

According to manager Lei Wang, while the fund's "underweight in financials, zero weight in energy, and 6.1% average allocation to cash" hurt in the fourth quarter, those three factors were "positive contributors over the first three quarters and for the year as a whole."

Two Calvert funds also ranked among the best foreign large-blend funds. Calvert International Equity CWVGX gained 17.6% during the year, just beating passively managed Calvert International Responsible Index CDHIX, which gained 15.3%. The index fund, which has a Morningstar Analyst Rating of Bronze, outperformed its MSCI ACWI ex USA benchmark and the average category peer by 29 basis points and 1.8 percentage points per year, respectively, over the five years through November 2020.

Morningstar analyst Daniel Sotiroff writes that "overweighting the information technology sector and underweighting energy stocks provided most of its index-relative advantage over that period and helped it beat the category average. Poor stock selection on the part of a typical actively managed competitor also aided the portfolio's category-relative performance." The fund's low allocation to energy companies further helped it in the March 2020 sell-off, Sotiroff points out.

One other index fund made the top-performers list: Gold-rated Vanguard ESG International Stock ETF VSGX. This fund is a relative newcomer, and its expense ratio of 0.16% is the cheapest of the group. Sotiroff says that "during its short life, its lower allocation to energy stocks helped it outperform many of its competitors. It beat a typical peer in the foreign large-blend category by 1.7 percentage points annually from its launch in September 2018 through March 2020, and the fund's low expense ratio should provide a long-term edge."

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)