Rocketing Stocks Short-Sheet Long-Short Equity Funds

An epic rally in the underdogs of Wall Street illustrates the challenges of short-selling.

Long-short equity funds offer an appealing pitch. If you think a manager can pick good businesses to invest in, why wouldn’t they be able to pick bad ones to bet against?

So far 2021 has demonstrated that reality is more complex. Many stocks that a lot of managers have been shorting, or betting they would crater, have blasted off instead, exposing short-sellers, including many active long-short strategies, to mounting losses. It’s been a hard-knocks refresher course on the perils of short-selling and long-short approaches in general. Such strategies should be able to keep up in strong equity environments and theoretically can act a hedge for investors worried about frothy markets.

Fundamentals often prevail in the long run. In the short term, technical factors can overwhelm a fundamental thesis. This is fine for unleveraged buy-and hold investors, who can ride out drawdowns. In a worst-case scenario, they may lose 100%, but they can limit the damage by controlling the size of the position in their portfolios. A short position, however, can lose much more than 100%, and quickly. Here’s a primer on these and other quirks investors considering long-short funds should keep in mind.

It's Harder Than Just Picking Losers First, let's review of how shorting works. Short-sellers borrow shares they want to bet against from brokerage firms, then immediately sell them to the market. At a set date in the future, the sellers return the shares to the brokers by buying them back in the open market. If the stock prices are more than what they initially paid, they lose the difference. If it's gone down, they can book the difference as profit.

These dynamics create challenges that long-only managers don’t face. These stocks are often from challenged companies trading at low prices, which can make them acquisition targets for opportunistic buyers that often offer a significant premium. Stocks can double, triple, even quadruple on short-sellers, leaving them on the hook for any gains above their initial short-sale prices. Compounding losses may force long-short managers to use idle cash or sell other positions to pay back their brokers. If managers don’t trim short positions, their portfolio positions and influence on performance grow larger and larger.

When this happens, the lending brokers rightfully begin to worry about the short-sellers’ ability to pay them back. The higher the leverage, the more of a concern it becomes. Brokers issue a margin call, or force short-sellers to post more collateral. This, if managers don’t have the necessary cash on hand, can force them sell some long positions to raise cash, which can drive down the long holdings’ prices and beget further losses. Leverage, which managers often use on these trades, can multiply these problems and lead to even more frenetic trading.

When It All Goes Wrong The confluence of the above-mentioned factors can lead to chaos in a heavily shorted stock. If the stock price begins to rally, short-sellers may rush to purchase the stock in the open market to return to their broker. This increased demand for the stock drives its price higher, creating a feedback loop called a short squeeze.

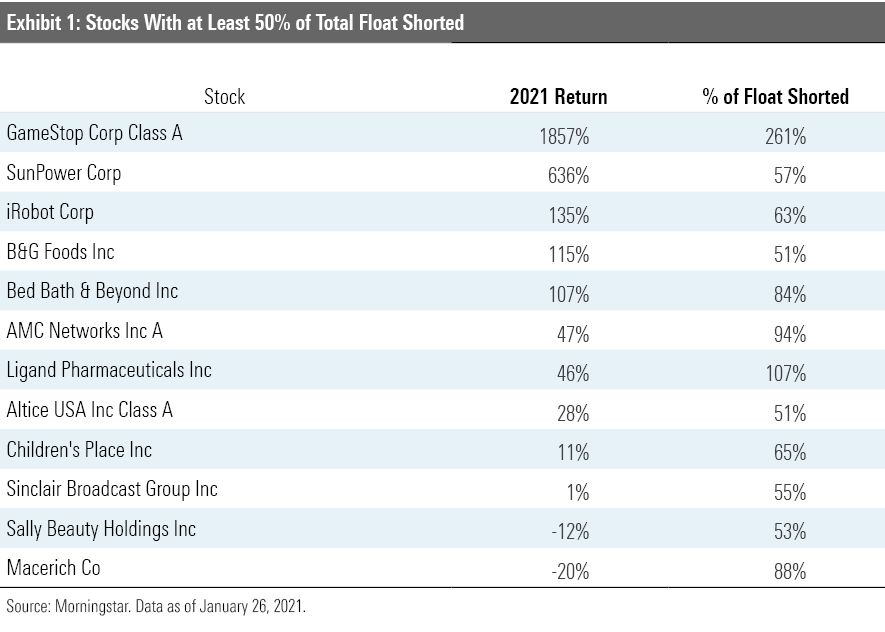

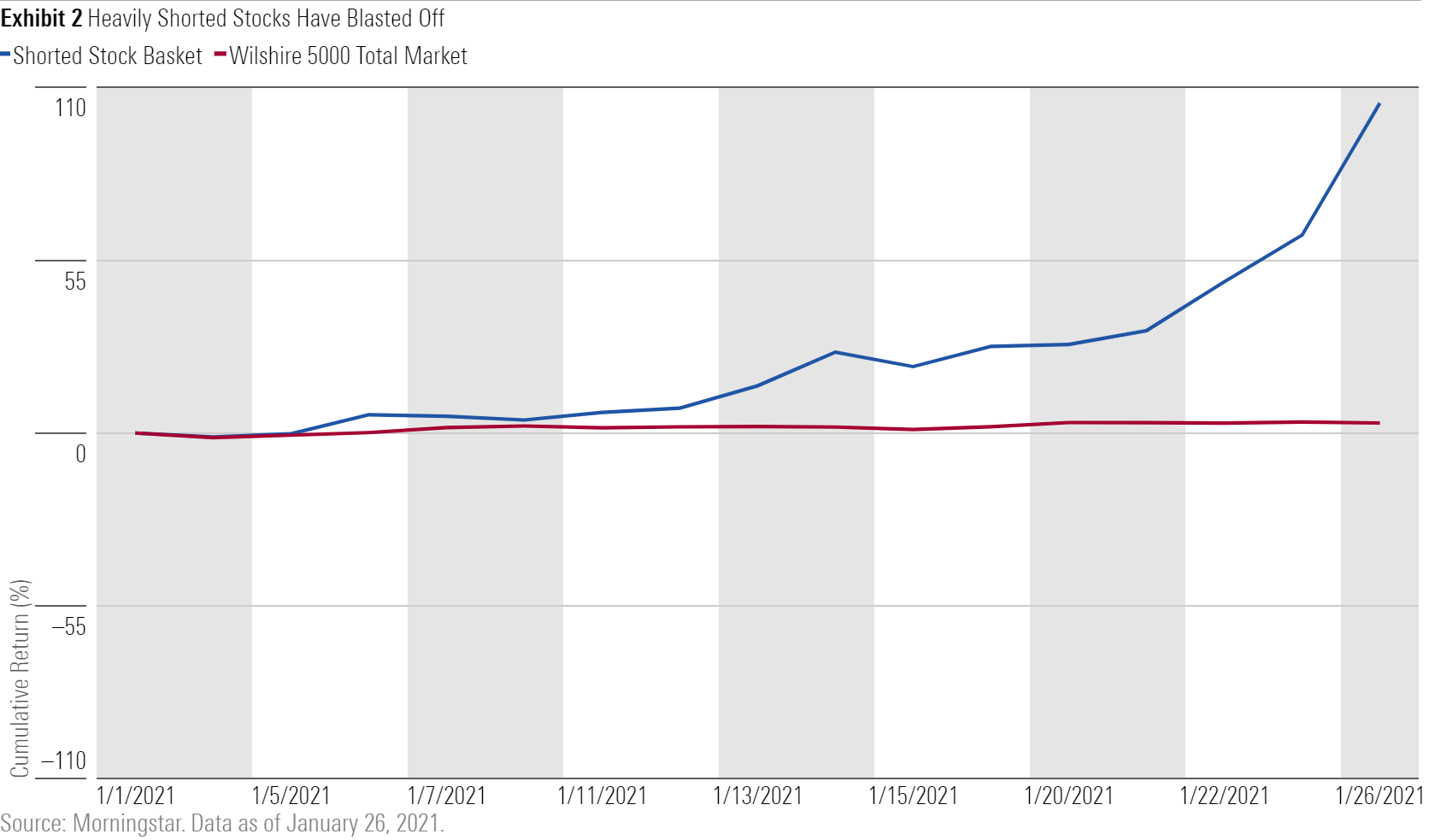

The start of 2021 has been full of land mines for short-sellers. Exhibit 1 shows an equal weight basket of the 12 stocks in the Wilshire 5000 Total Market Index with total short interest (the percent of total shares outstanding that short-sellers have bet against) greater than 50%. It’s risen more than 100% in just 16 trading days through Jan. 26, highlighting the extreme pressure that short-sellers are under right now.

Stocks like GameStop GME, Bed Bath and Beyond BBY, and AMC Entertainment AMC have all been rocket ships in January. Options market dynamics, increased interest from retail investors (including active Internet forums like the r/wallstreetbets hivemind), and increased chatter from financial news media have all contributed to excess volatility in these names. This in turn has forced short-sellers to either exit at a massive loss or post more collateral to maintain positions, which requires them to sell some of their long positions--potentially creating a run on those names as well.

Perhaps short-sellers are right about these businesses’ fundamentals, and they’re destined to fail. Morningstar Analysts rate five of the 12 heavily shorted stocks, with all but one trading above its fair value estimate. But as economist John Maynard Keynes once said, “the market can sometimes remain irrational longer than you can remain solvent," which is why risk management is a key consideration when selecting a long-short manager. Here are some important, but not all-encompassing, factors to consider when evaluating a manager’s shorting ability.

- Short-sellers should avoid concentration. Given the outsize losses that can occur from shorting, managers must be careful with the size of their shorts. Neutral-rated Boston Partners Long/Short Research BPIRX, for example, often shorts around 150 stocks, with an average position size under 50 basis points. That might be overkill, but the idea is that diversification is important.

- Managers should actively resize their positions. When a short loses money, it grows as a percent of total assets. Good managers should frequently manage its position size to ensure it's an appropriate size for the risk they're seeking.

- Managers should recognize if they're in a crowded trade. The more popular a short position is, the more intense the rush to the exits can be.

- Managers should use leverage carefully. A high gross exposure can boost returns in good times but can force managers to sell when they don't want to if their trades begin to turn against them.

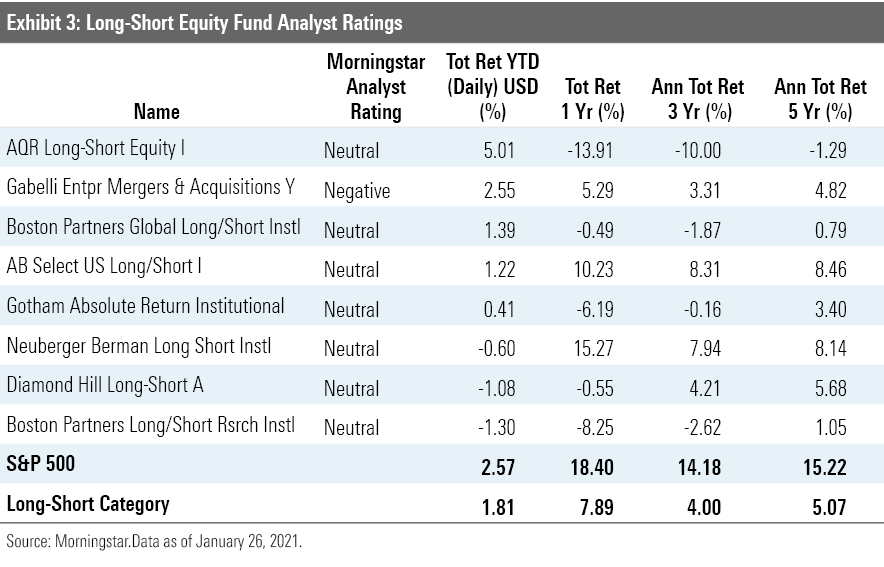

None of the 99 distinct funds in the long-short equity Morningstar Category earn a Positive Morningstar Analyst Rating; seven get Neutrals and one Negative. This is often because shorting is challenging, not because the team’s stock-picking abilities are flawed. Indeed, several of the teams with Neutral ratings also run long-only funds that are Morningstar Medalists, like Diamond Hill and Boston Partners. For the most part, they’ve avoided the worst of the short squeeze thanks to their diversified short books, but their mediocre trailing five-year returns show they’ve still been challenged.

Just 20% of funds in the long-short category have been able to deliver positive alpha, a risk-adjusted return measure often used as a proxy for manager skill, versus the S&P 500 over the trailing five years, showing how scarce winners are in this space. While it’s undoubtedly a difficult environment for these managers, short-selling remains challenging in good times and bad.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)