Fourth-Quarter 2020 Market Insights in 8 Charts

Morningstar’s analysis demonstrates the disproportionate economic recovery from the coronavirus pandemic.

Despite a U.S. surge in coronavirus cases and the discovery of multiple infection variants, the U.S. equity market rolled high in the fourth quarter of 2020, recovering from pandemic-related declines in the first half of the year. This resulted in double-digit, full-year returns fueled by the prospect of a less-confrontational presidency, news of multiple vaccine approvals, and stimulus expectations.

The last few days of 2020 also brought long-awaited pandemic relief. Congress agreed on a plan to extend many of the CARES Act measures, including direct payments to households and generous unemployment benefits—an important step for the U.S. to build a bridge to “normalcy.”

For bond investors, despite hopes of an economic recovery, government bond yields moved only slightly higher due to central bank intervention. Rates and yields are likely to remain at rock-bottom for much longer.

Every quarter, Morningstar's quantitative research team reviews the most recent U.S. market trends and evaluates the performance of individual asset classes. We then share our findings in the Morningstar Markets Observer, a publication that draws on careful research and market insights. (Morningstar Direct and Office clients can download the report here.)

Here are some of the market insights from our latest quarterly review.

Risk Factors Driving Fund Returns Rotated in Fourth Quarter Despite an equity rally for the third consecutive quarter, the portfolio makeup of top performers reversed in the fourth quarter. The U.S. Food and Drug Administration's emergency use authorization of the first COVID-19 vaccine, announced on Nov. 9, led to one of the largest momentum shifts in history.

Portfolio exposures that were hit hard in the first nine months of the year, such as small-cap, value, and high-yield stocks, added gains. The pandemic winners—high-momentum and quality stocks—pulled back.

- Source: Morningstar. Data as of 12/31/2020.

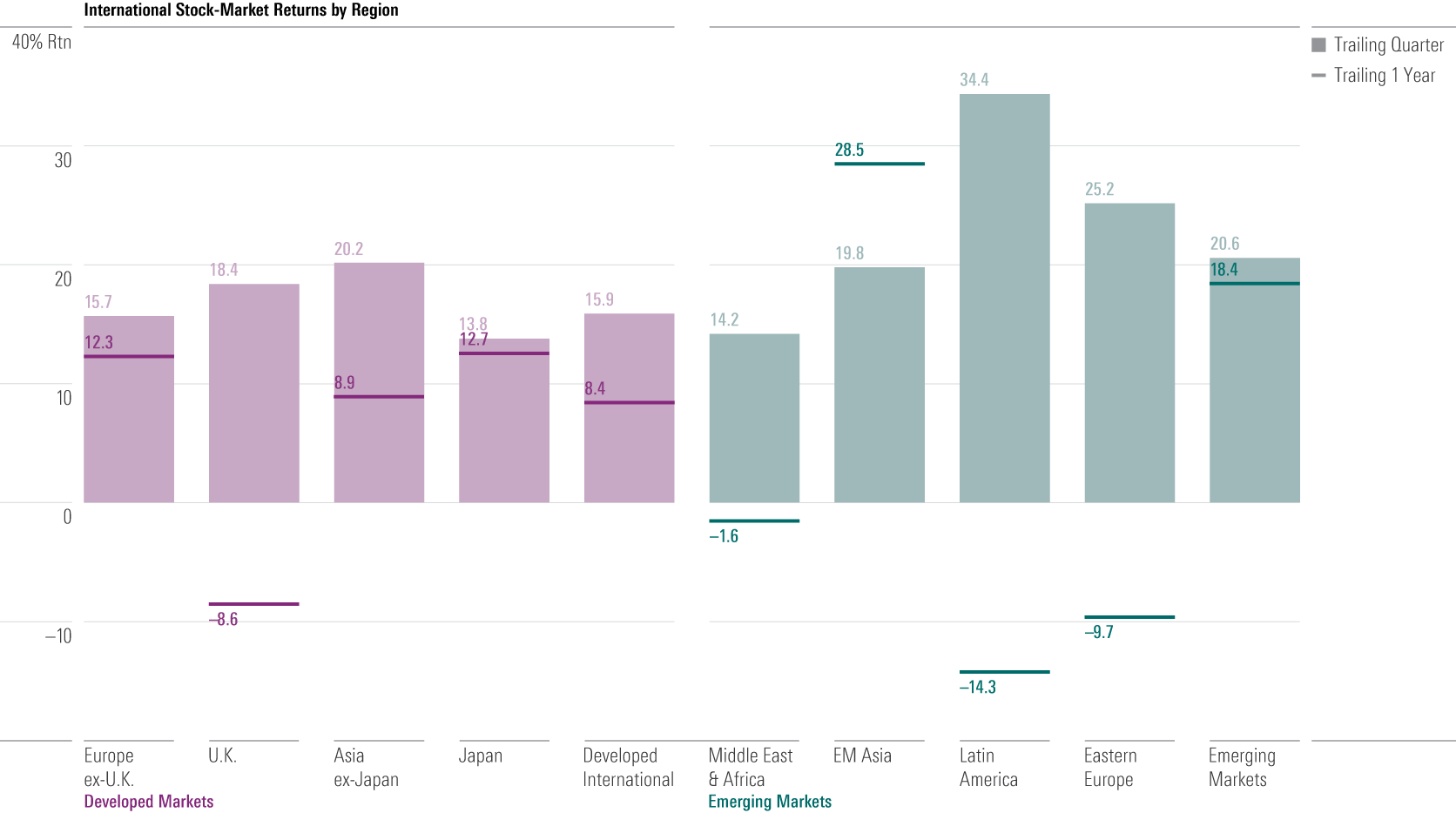

Developed Markets Bounced Back Quicker from First-Quarter Slump

This quarter’s recovery was not enough to carry all regions into positive territory for the year, as nearly all regions pushed past trailing one-year performance numbers. Latin America and Eastern Europe suffered the most, with losses of 14.3% and 9.7%, respectively, for the year.

In general, foreign developed markets were able to bounce back faster, with the notable exception of the U.K., where Brexit uncertainty may have played a role.

- Source: Morningstar. Data as of 12/31/2020.

U.S. Stock Market is Historically Overvalued The cyclically adjusted price/earnings, or CAPE, ratio of the S&P 500 rose to 33.4 in December, eclipsing 2018's 33.3 high. This comes as no surprise to Morningstar analysts: The U.S. market almost tripled in valuation over the past year.

When the ratio is high, stocks are expensive relative to their earnings. Historically, this is then followed by a period of low long-term returns. Prior to 2018, there were only two episodes where the ratio surpassed 30: the late 1920s, leading into the Great Depression, and the late 1990s, before the dot-com bubble burst.

- Source: Morningstar. Data as of 12/31/2020.

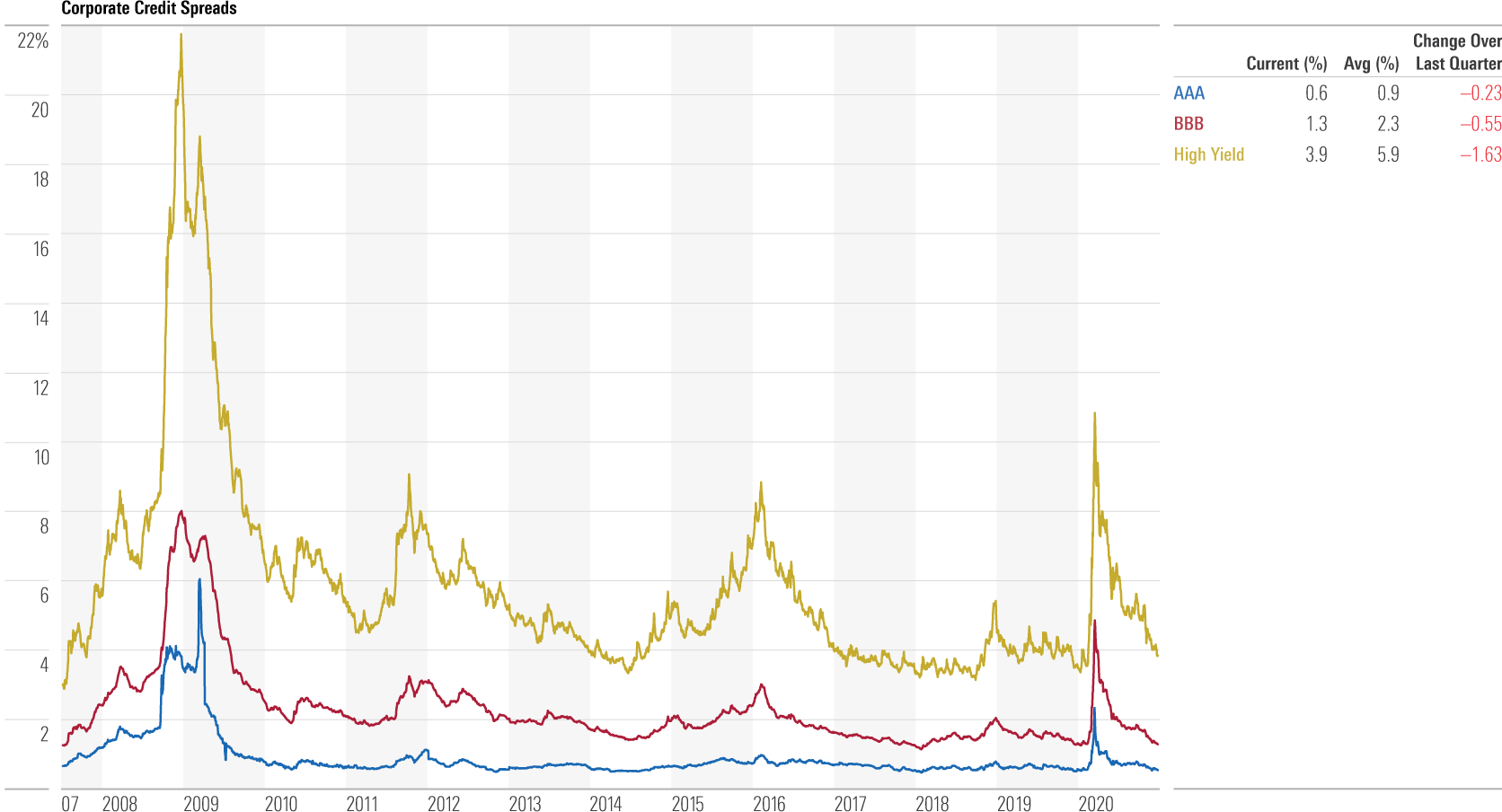

Credit Spreads Compress to Pre-Pandemic Levels The risk premium in U.S. corporate-bond markets continued to narrow as the risk of widespread defaults dissipated and investors gained more confidence in the health of corporate borrowers. This was even more impressive given the amount of gross issuance in 2020: about $2.2 trillion through November, the most since 2007.

- Source: Federal Reserve. Data as of 12/31/2020.

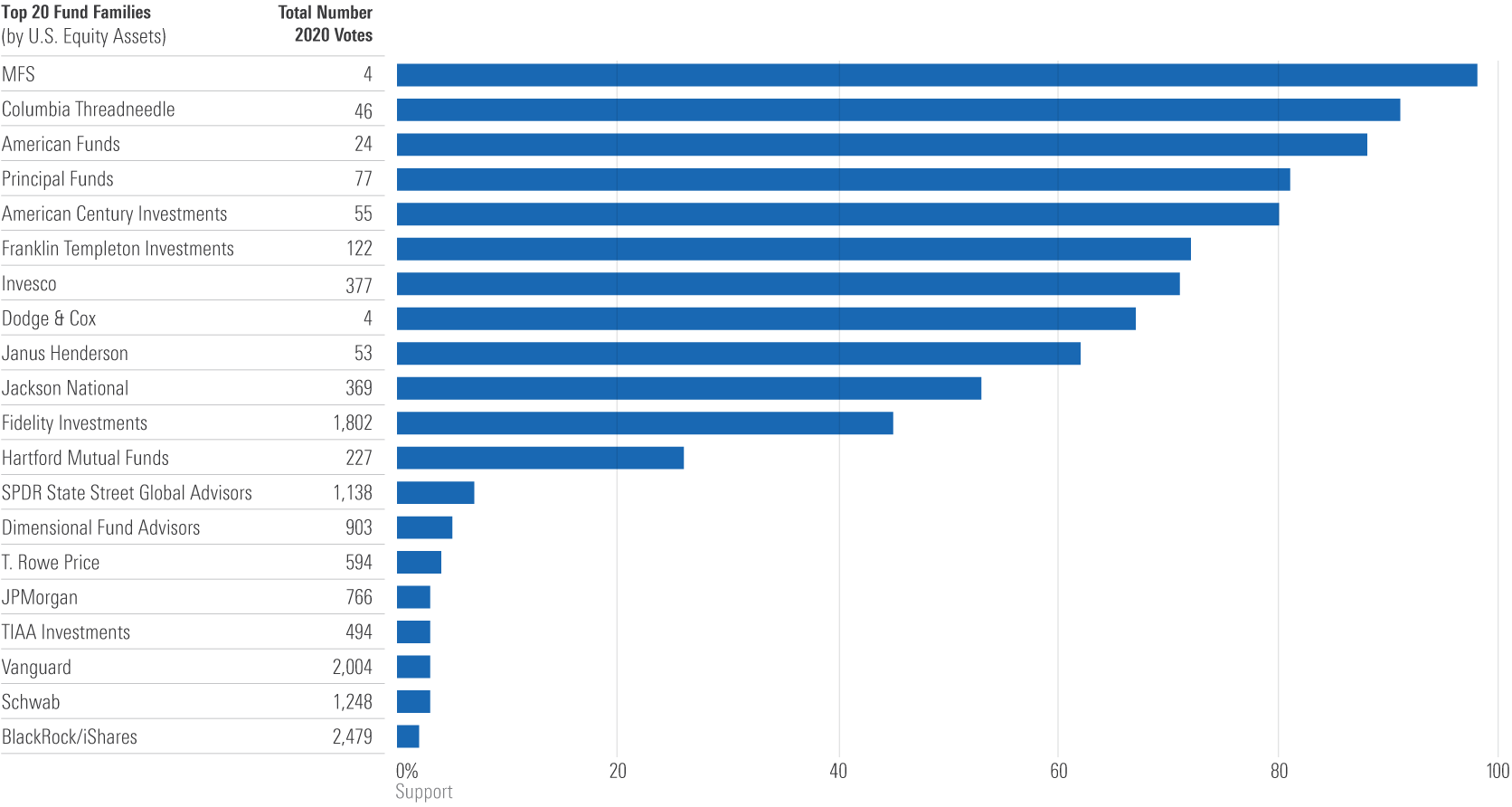

ESG Resolution Support Varies Widely Among Top Asset Managers For mutual funds, asset managers' proxy votes are cast on behalf of shareholders, giving investors a say in the governance of companies in which they invest. However, despite the growing interest in environmental, social, governance, or ESG, investing, voting records vary from Columbia Threadneedle, which supported over 90% of all ESG resolutions (across 46 votes), to larger firms like Vanguard and BlackRock/iShares, which supported less than 10% (2000-plus votes).

- Source: Morningstar. Data as of 12/31/2020.

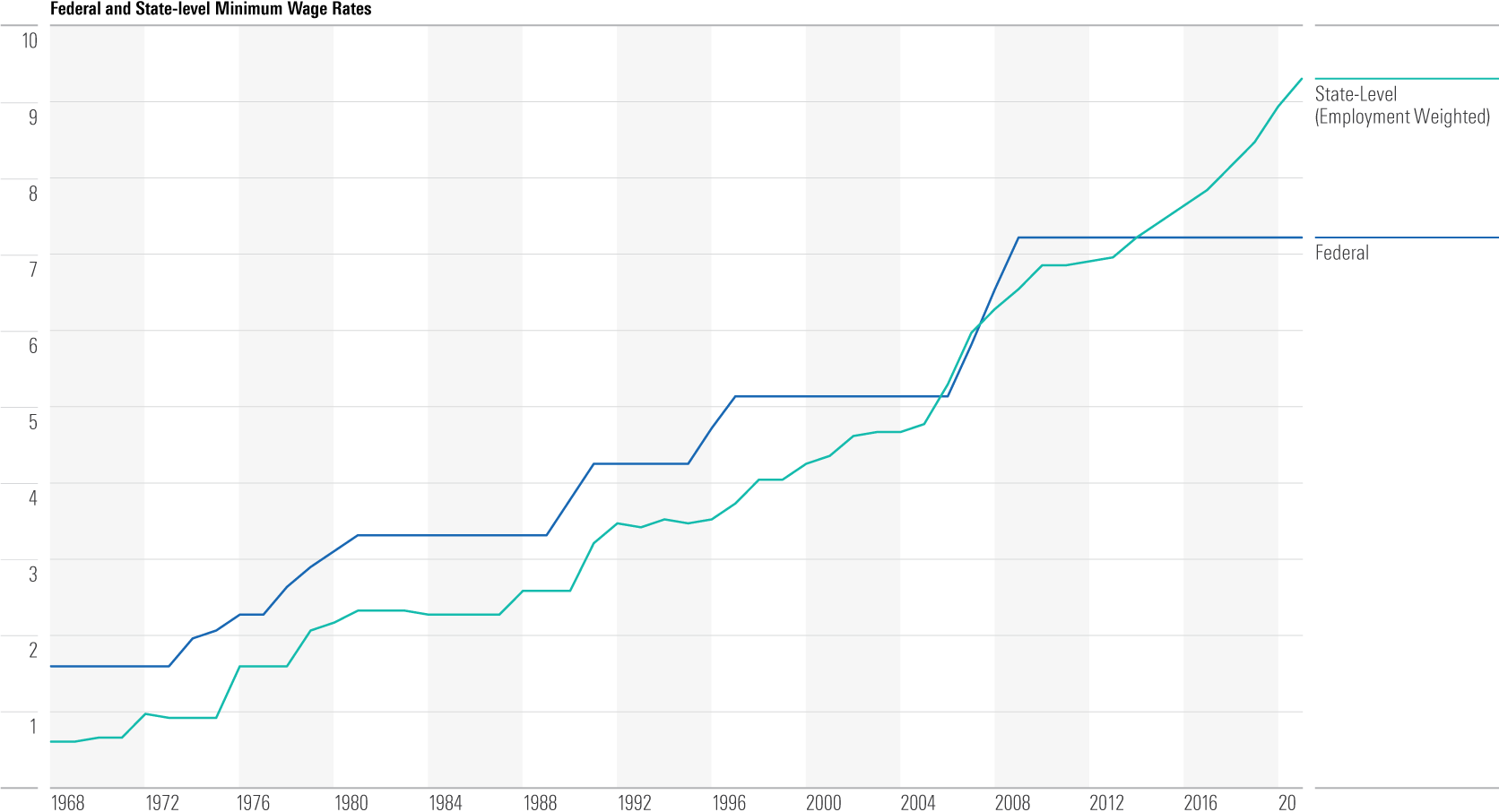

Individual States Have Driven Higher Minimum Wages The federal minimum wage was last raised in 2009. Since then, state-level minimum wages have risen dramatically, surpassing the federal minimum wage in 2015. This trend has only accelerated, with 24 states raising their minimum wages in 2021.

The Biden Administration hopes to change course, proposing a $15-an-hour federal minimum wage, more than 50% above the current state-level effective rate.

- Source: U.S. Department of Labor, U.S. Bureau of Labor Statistics. Data as of 1/1/2021.

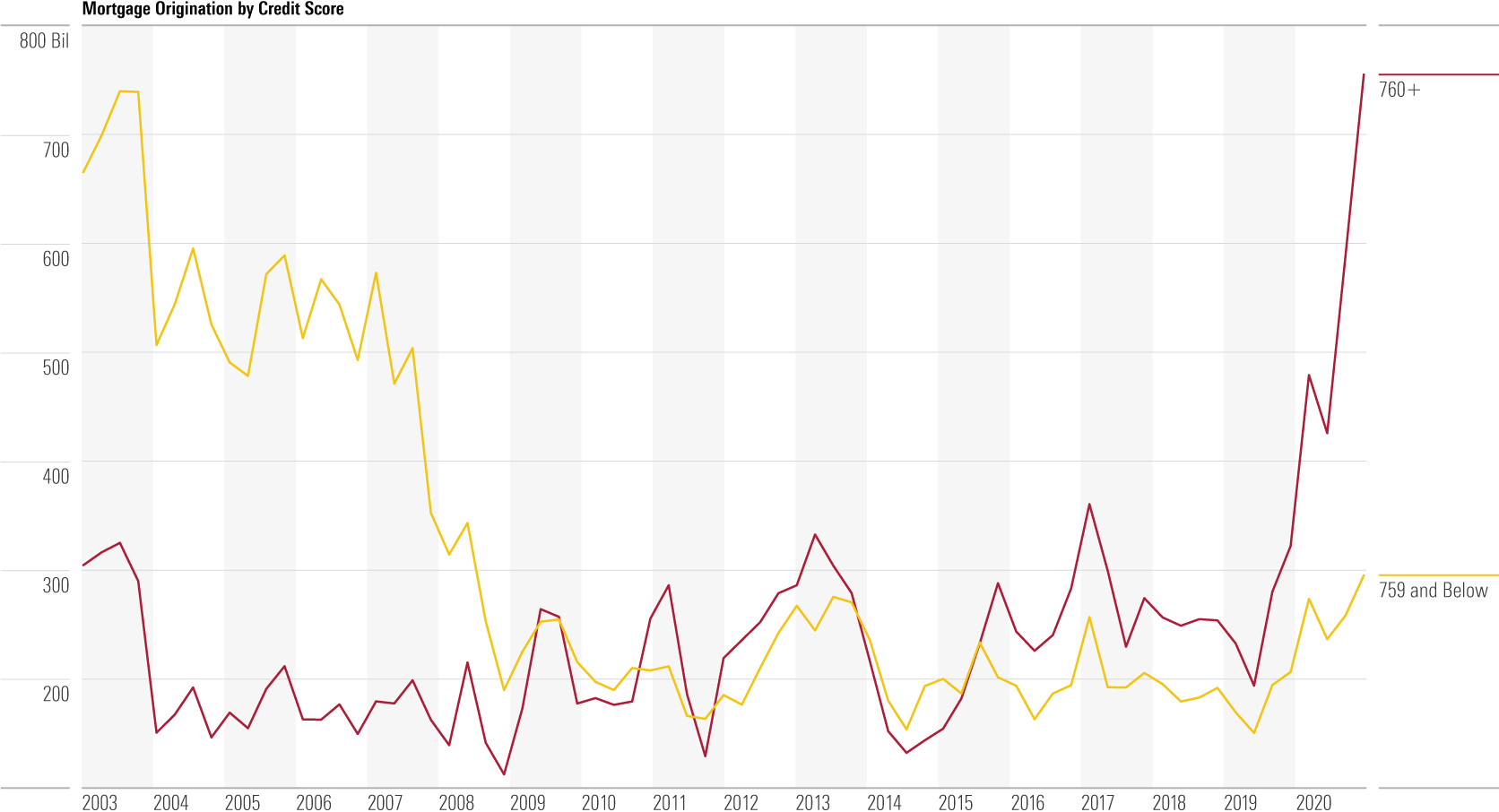

High-Credit-Worth Borrowers Dominate New Mortgage Origination An additional sign of disproportionate U.S. economic recovery can be seen in the breakdown of new mortgage origination. The vast majority of mortgages have gone to very high-credit-worth buyers (usually high-income earnings with little debt), while lower-credit-quality borrowers have seen only a modest increase in origination. By comparison, the main drivers of the housing boom in the mid-2000s were lower-credit borrowers.

- Source: Federal Reserve Bank of New York. Data as of 9/30/2020.

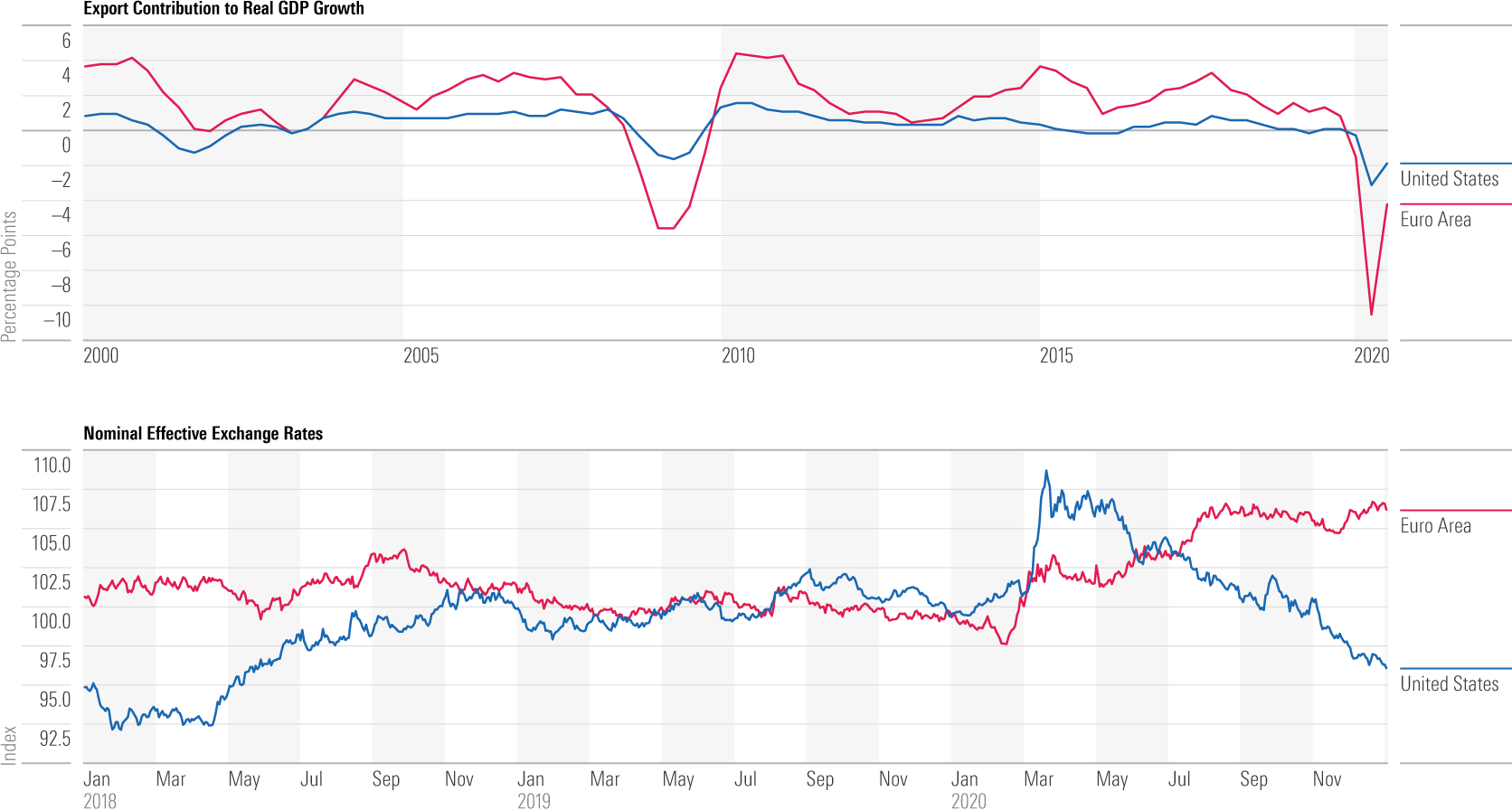

Euro Area Exporters Grapple with Weaker Global Demand, Stronger Euro The euro area economy has struggled to rebound from the pandemic shock, partly due to a severe hit to global trade. Exports from the euro area accounted for nearly 2 percentage points of real gross domestic product growth, on average, over the past 20 years, compared with only 0.5 for the U.S. (top chart). Additionally, this year's significant appreciation of the euro likely hasn't helped, only exacerbating already-existing headwinds.

- Source: National Sources, Macrobond, J.P. Morgan. Data as of 12/31/2020.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)