Broadening the Reach of Financial Advice

The cultural competency of the financial planning industry is still in its infancy.

As a child, I had no idea that financial planning was a career option. At first, I thought I might be a doctor, having watched my nana go to work as a nurse every day. It wasn't until I took a college elective course called Personal Finance 101--where I learned about credit scores, disability insurance, Social Security, 401(k)s, saving, and so on--that I felt I had found my passion.

I wanted to "share the wealth" and help people understand the way their student loans worked, and I found myself becoming an evangelist of personal finance. My college friends would come to me with questions, and I loved walking them through everything from their loans to credit card usage to how to build savings before we graduated. I was sure a career in financial planning was the best fit for me.

Then the unthinkable happened.

My nana became ill while I was still in college. She and I were incredibly close, and I had to watch her continue to go to work through her sickness because she wasn't financially stable enough to retire. It broke my heart to watch how hard she worked as a nurse, even though she herself was sick and needed to be cared for.

Then, when she passed away, her home of over 30 years, which was meant to stay in the family because it meant so much to all of us, was lost to foreclosure.

It was clear to me that had my grandmother spoken to a financial planner who had her best interest at heart, the outcome could have been different. This only spurred my interest in becoming a fee-only financial planner.

In 2009, as the economy was being hit by the global financial crisis, I landed an internship as a summer associate in the financial planning profession. I had a front-row seat to advisors who were reassuring clients and helping them confirm that their retirement plans were still secure. There was something so powerful about watching these advisors help their clients.

After graduating from Virginia Tech, I spent time at two different wealth management firms where I primarily worked with clients who had a high net worth. As much as I loved my work, I ran into a handful of gut checks. One was this feeling that the financial knowledge I had should not be held hostage to those who have $1 million or more of investable assets.

At the same time, there were numerous episodes of microaggressions that first felt like paper cuts and soon became unbearable, leading me to question my career path. Early in my career, I wore my hair straight or in a slick back bun because I was afraid of standing out more than I already did. I thought I needed to assimilate to be accepted and welcomed.

One day, I decided to wear my hair naturally curly because straightening it or wearing it in a bun every day was damaging it. We had a meeting that day, and I thought I had formed a good relationship with these clients after three years of working with them.

When the senior financial advisor and I entered a conference room to greet our clients, the wife embraced me. When the husband reached for me, he didn't let go. He held me by my shoulders and said, "There's something different about you ... ah, it's your hair. It's a bit more casual today."

Microaggression shows up in many forms. I was told I was a "know-it-all." Another time I was told by a manager that colleagues were frustrated by my willingness to voice my opinions and ideas.

I started to doubt myself and feel less confident, but I had to learn to not allow someone else's insecurity break down my confidence or self-worth. And, it made me think. If this is the person that is in charge of my ascension, I have already hit a glass ceiling. It was time for me to break away for my mental health. The more I thought about it, the more I realized that I wanted to truly provide assistance to people like my nana. I wanted to serve people who haven't necessarily earned the high-net-worth status--yet.

Unfortunately, there aren't many fee-only financial planning practices that prioritize diversity, equity, and inclusion. Discrimination and oppression still happen in financial planning--just as they do in every profession.

Over the past 15 years, the number of women certified financial planners has remained at just 23%. Black and Latino CFPs account for less than 4% of the profession. These numbers are hardly representative of the American population.

My goal became to start my own firm to create more accessible financial planning services. Working with my partner Lazetta Rainey Braxton at 2050 Wealth Partners, we serve diverse groups of people. Many of my clients are first-generation wealth-builders. When they come to me, they don't have a road map for what's next. They're not sure how to break the generational cycle of living paycheck to paycheck. They may also be struggling with cultural financial roadblocks that are standing between them and their goals. It's our job to help them navigate the intersection of money and culture, work toward their goals, and build a life they're proud of.

As a woman and person of color in the profession, I've made it one of my goals to continue increasing awareness and integration of the diversity, equity, and inclusion movement in the financial planning profession. I've seen a lot of growth and improvement over the years, but I know we still have so far to go.

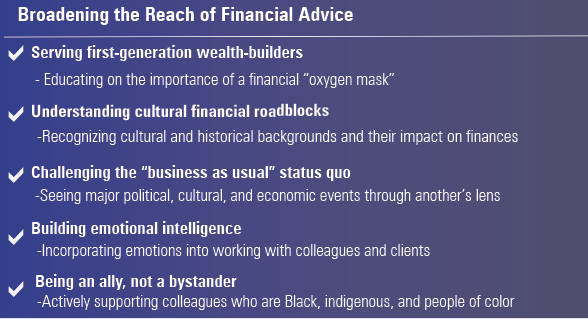

I'm excited to dig deep into the education needed to support the next generation of financial clients. In future columns, I'll be exploring these and other themes:

How Advisors Can--and Should--Broaden Their Reach

- Educating and serving first-generation wealth-builders is a very different process than working with your traditional client base. Many first-generation wealth-builders fall into a trap of where they rush to financially "save" others in their family before helping themselves. This group needs to be educated on the importance of first putting on what I call their financial "oxygen mask" before helping others--just as we've been told time and again on airplanes.

- Understanding the cultural financial roadblocks among clients with different backgrounds than yours is critical. For example, among Afro-Caribbean clients, understanding the history of savings clubs or systems of multigenerational living arrangements that put additional strain on the main breadwinners have implications for client saving and financial plan profiles.

- Challenging the "business as usual" status quo requires seeing how major political, cultural, and economic touchpoints are often viewed through the lens of white America. Your clients--and colleagues--from diverse backgrounds will often have a very different view of events in society and what they mean for their financial and emotional security

- Building emotional intelligence across leadership and within organizations. This means incorporating emotions in a productive way into working with colleagues and clients. This brings benefits personal and professional levels, often optimizing performance and minimizing disruptive events like losing key talent.

- Determining your role in the DEI movement, and ensuring you are an ally, not a bystander. Although a new administration is in place in Washington, we cannot afford to be lulled again into complacency on this very important front. We need our white colleagues' support to break the stalemate.

The cultural competency of our industry is still in its infancy and has major implications for both financial professionals and their clients. We can do better.

But change is afoot. We can feel it, some are speaking to it, and now it's time to act on it. The opportunities are tremendous for those who are willing to do the work.

Rianka R. Dorsainvil, CFP is the co-founder and co-CEO of 2050 Wealth Partners, a virtual, fee-only comprehensive financial planning firm dedicated to serving first-generation wealth-builders, entrepreneurs, and thriving professionals. Rianka also hosts 2050 TrailBlazers, a podcast aimed to address the lack of diversity in the financial planning profession by engaging industry experts and leaders in conversation. The views expressed in this article do not necessarily reflect the views of Morningstar.

/s3.amazonaws.com/arc-authors/morningstar/abeb441c-3862-4c66-82c2-c10ada2d0582.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FIN36RNGOFABFDS2NCP2RCCG3I.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UWZH3VLHBVCIDP2ANJ73YKE4QA.png)