What Happened to All of the Self-Driving Cars?

Last year was meant to be the dawn of autonomous vehicles, so where are they?

Tech-savvy consumers spent much of the last decade thinking they could get behind the wheel of self-driving cars by 2020. But a series of legal and technological roadblocks have left us still waiting.

Despite not meeting those early expectations in 2020, we still think that now is a good time to invest in autonomous vehicle suppliers as the industry addresses various obstacles and timelines.

Here’s a look at the state of the autonomous vehicle industry, along with when you might be able to drive to work with the simple push of a few buttons.

What exactly does “autonomous” mean?

Before we forecast the next 10 years of the automated vehicle industry, we should define what qualifies as an autonomous vehicle and explain the different categories.

Technically speaking, thousands of automated vehicles are already on the road today. They may not be capable of driving you to the grocery store while you casually scroll through social media, but they do have a variety of features that operate independent of the driver.

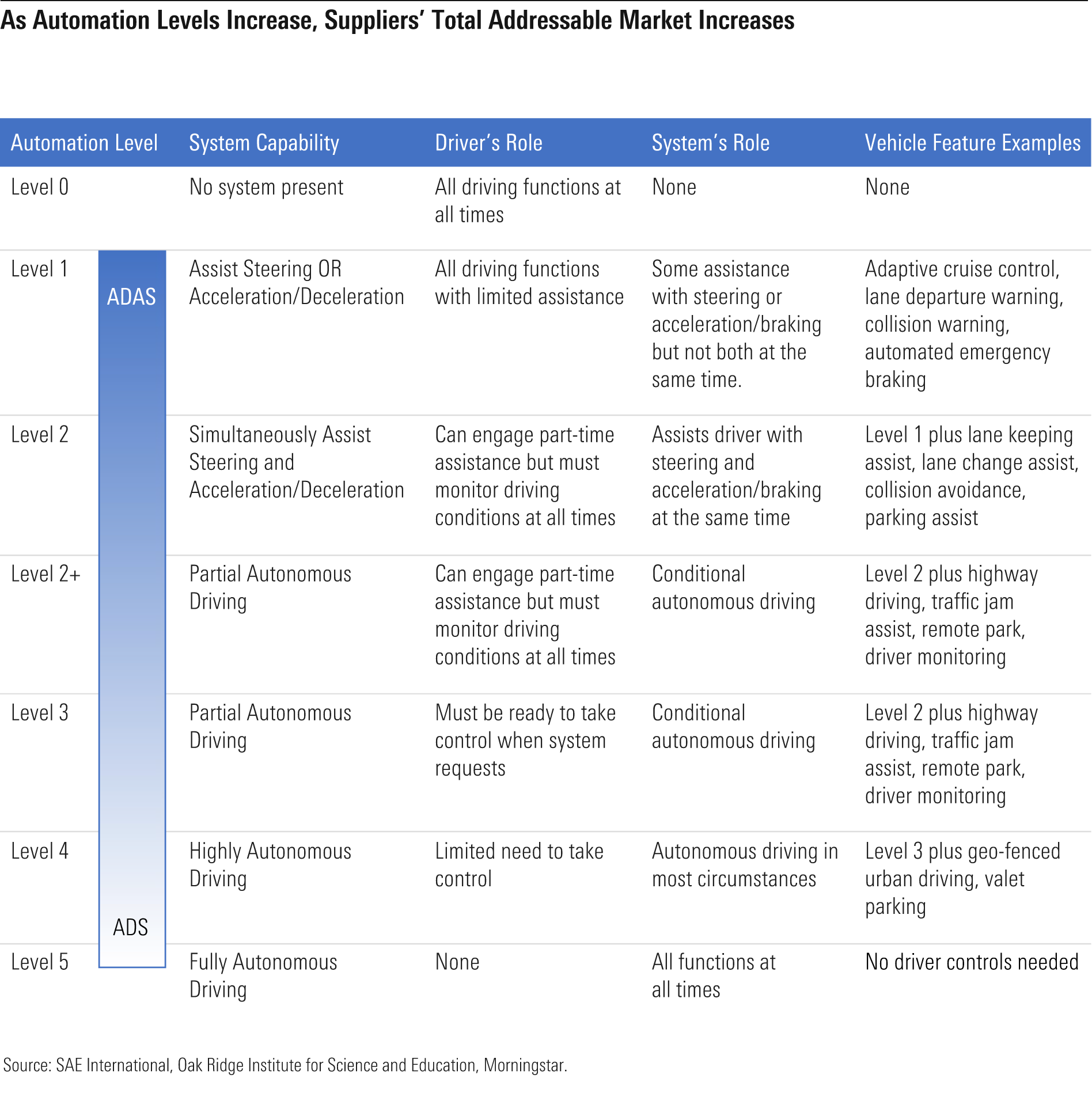

Exhibit 1

As shown above, automated vehicles include a wide variety of options. These vehicles have a range of features that include automated emergency braking, collision warnings, and adaptive cruise control (Level 1) to those that require absolutely no driver interaction at all (Level 5).

These vehicles rely on one of two types of systems to operate: advanced driver assistance systems (or ADAS), and automated driving systems (or ADS).

Today, the most technologically advanced vehicles you’ll find on the road will fall under the Level 2+ category and still use ADAS. The presence of ADS becomes more necessary at Level 4 and later.

According to a recently published Automotive Observer written by Morningstar's Richard Hilgert, Senior Equity Analyst, Automotive, Level 2+ only exists as a middle ground between Levels 2 and 3 because of the legal environment surrounding automated vehicles. Level 2+--with features like remote parking and traffic jam assistance--is essentially a threshold just before liability passes from the driver to the driving system itself.

What’s the holdup?

In 2013, Nissan NSANY announced that 2020 would see the debut of self-driving cars. Many other vehicle suppliers made similar claims in the years that followed.

However, it didn’t take long before developers came to realize that their estimates were aggressive, if not overly ambitious. Not only did they need more time to develop the technology to create fully automated vehicles, but there have been several legal hurdles throughout the development and testing process.

Three reported accidents involving Tesla vehicles TSLA between 2016 and 2019 surely added more complications to the release of self-driving cars. But a fatal 2018 accident involving an autonomous Uber UBER vehicle and a pedestrian was a true turning point, as the company suspended all of its pilot programs across the country. This tragic event led to many other automated vehicle suppliers to suspend or completely abandon their own development plans.

Outside of safety concerns, there’s a lack of a consistent legal framework across various states and countries. As of early 2021, the 50 states have vastly different laws in place--or none at all--when it comes to allowing automated vehicles on the road and whether the driver should be licensed and have liability insurance. The situation is similar across Europe and China.

Automakers will start to slowly introduce more advanced automated vehicles to the market, but only after the legal landscape for producing them safely and reliably is clearer.

The Road Ahead for Autonomous Vehicles

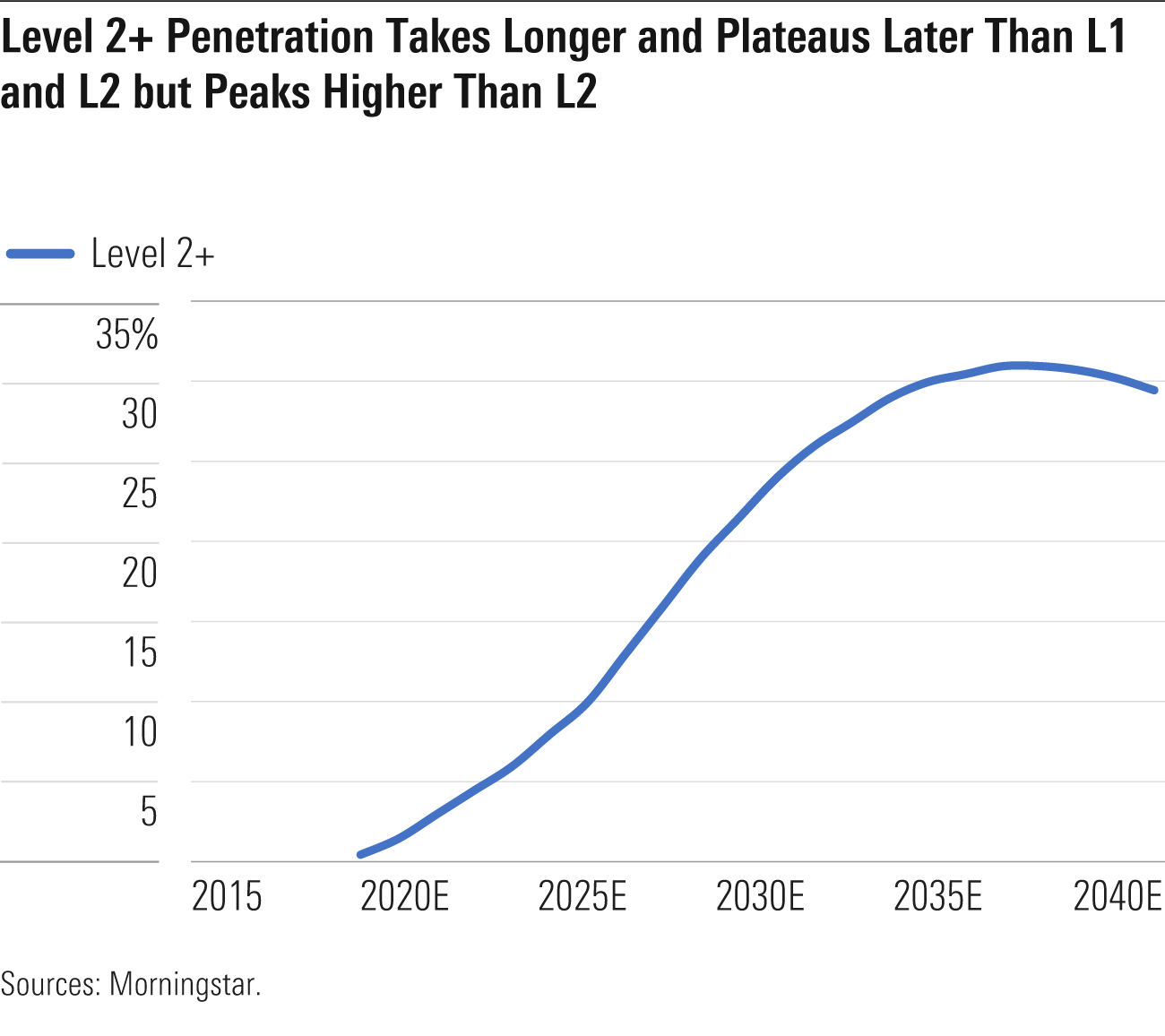

Our estimates show that Level 2 and Level 2+ vehicles will continue to penetrate the luxury markets, with mass-market adoption taking place between 2021 and 2030.

Exhibit 2

Level 2+ Penetration

The introduction of Level 3 technology was originally expected to take place in 2018 with the Audi AUDVF A8, but that was canceled due to unclear regulations. Mercedes and BMW BMW each say they intend to launch a model with Level 3 capability sometime in 2021.

We anticipate that these vehicles will mostly be restricted to the luxury market at first, owing to the liability concerns that automakers have expressed over the technology’s implementation. Their primary concern is that Level 3 vehicles will require drivers to be prepared to take control of a vehicle at a moment’s notice, which involves a heightened level of risk.

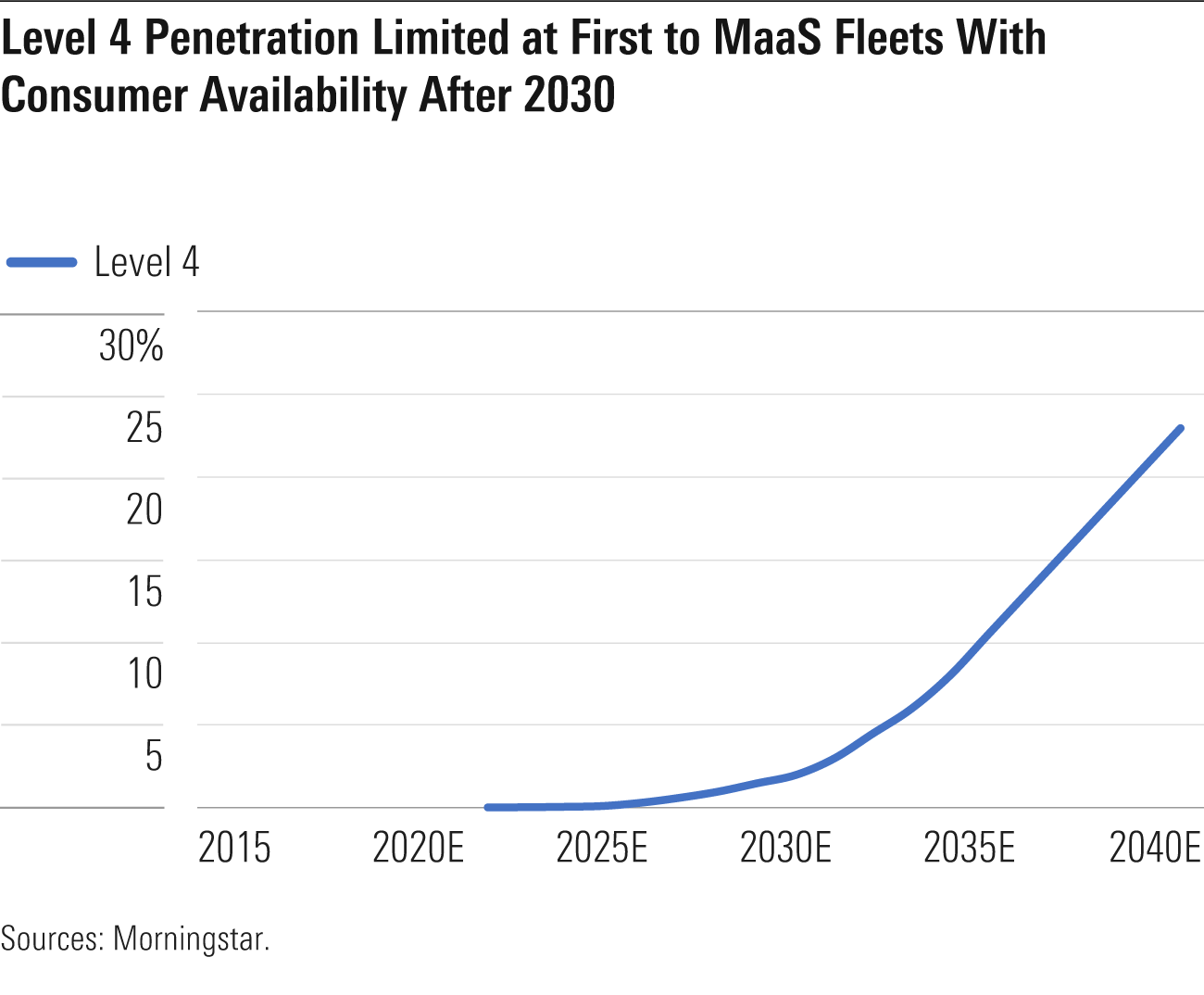

Level 4 vehicles could see limited production in as soon as two years, but largely in the mobility as a service (or MaaS) space.

Exhibit 3

Level 4 penetration

Lastly, once legal liability is better defined, Level 5 vehicles could hit the market in 2030 and continue into mass distribution later in the next decade, leaning on the successful launch and adoption of earlier models as a roadmap.

Investing in the Future of Automated Vehicles

Morningstar researchers forecast which autonomous technology suppliers are in the best position to perform well as self-driving cars are widely adopted over the next 10 years.

For example, Aptiv APTV is in a unique growth position, as we think the vendor’s product portfolio, which includes ADAS and ADS technologies, but also components and systems that could be considered the “brains and nervous system” of a vehicle, should enable annualized revenue growth.

Continental CTTAF, another supplier, produces active safety technologies, various types of automotive electronics, passive safety sensors, brake systems, powertrain systems, and tires for several types of ground vehicles.

Veoneer VNE, which spun off from Aptiv in 2018, supplies passive active safety systems and passive safety electronics. While we expect losses until 2023, we estimate 12% average annual revenue growth during our Stage I forecast due to high growth expected in active safety technologies.

Lastly, Magna MGA is diversified across several automotive supply areas, including body, chassis, exterior, seating, powertrain, active driver assistance, electronics, mechatronics, mirrors, lighting, and roof systems, as well as complete vehicle engineering and contract manufacturing.

With so many developments in the autonomous vehicle space on the horizon, the adoption of self-driving cars is more a matter of “when” than “if.” Meaning that now is a good time to invest in the industry to see the greatest return over the next 10-plus years.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b836606c-749b-456d-b245-00acf9292cb9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b836606c-749b-456d-b245-00acf9292cb9.jpg)