Baron Partners' Huge Tesla Stake Leads to Downgrade

Having 47% of net assets in this holding highlights the fund's lax risk controls.

While Baron Partners BPTRX has always been an aggressive fund, it has moved into unprecedented territory.

All share classes of Baron Partners have been downgraded to a Morningstar Analyst Rating of Neutral from Bronze, as the continued growth of its top position highlights lax risk controls.

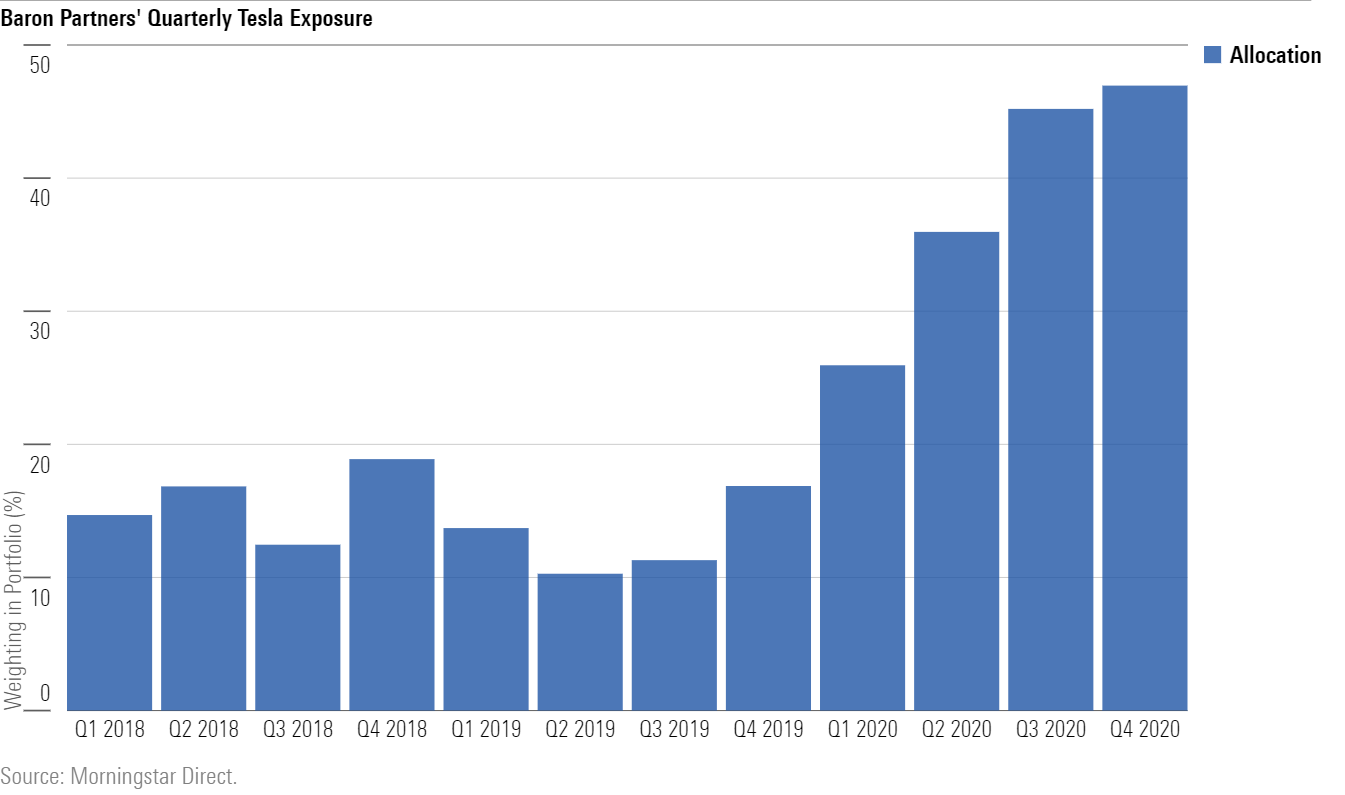

Originally run in a hedge fund format, Baron Partners makes big bets with the help of leverage, but none of these bets has reached the extreme level of electric auto manufacturer Tesla TSLA. Shares of the stock saw a meteoric rise over the past few years, gaining 743% during 2020 alone. While lead manager Ron Baron initially bought a stake worth 5% of the fund's net assets in 2014, it grew into 47% of net assets as of December 2020 after its massive rise. Baron sold 17% of the stake over the course of the third and fourth quarters of 2020, but the stock's continued appreciation more than offset those trades. At such a level, the stock effectively controls the fund's fate.

The rise of Tesla's weighting has circumvented the fund's risk controls, which seek to balance the weightings of steadier businesses and more-volatile fare, like Tesla. Ron Baron divides the portfolio into four different groupings: core growth, financials, real assets, and disruptive growth. Tesla's 47% weighting alone was greater than that of any bucket. Other holdings have consumed as much as 10% or even 20% of assets as recently as 2019, but they were steadier business, such as real estate data provider CoStar Group CSGP and animal health company Idexx Labs IDXX. Their influence on the fund is now dwarfed by Tesla.

Ron Baron has taken steps to reduce risk in some areas, but not where it really counts. He cut the fund's leverage from about 22% in June 2020 to 5% as of December but still allowed Tesla's share of total assets to increase materially.

None of this is to say Baron's decisions haven't helped investors so far--look no further than the retail shares' 148.5% return in 2020. However, such volatility often applies on both the upside and downside, and while the fund has been wildly successful, the risks are too large to ignore.

Among Ron Baron's other funds, Baron Focused Growth BFGFX also has a very large Tesla weighting. Its hefty 39.0% position is up from 14.4% at the end of 2019. The $663 million fund, which does not carry an Analyst Rating, returned 122.2% in 2020.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)