How ESG Benefited My Clients in 2020

These selected sustainable funds held their own during a choppy year for the markets.

There aren't a lot of good things to say about 2020, except that the stock market ended up doing well. Plus, many investments with environmental, social, and governance tilts did even better. That was particularly good news for my firm's clients.

Just under a year ago, I wrote about how Rowling & Associates had integrated ESG-focused mutual funds into all our client portfolios. I explained our rationale--that companies adequately considering ESG factors should be subject to less business risk and thus would produce better risk-adjusted returns over time--and how we approached portfolio construction.

From a practical standpoint, it was not possible to fill every subclass slot with an officially mandated ESG fund. When ESG mandated funds met Rowling's standards, we used them. When we couldn't find acceptable ESG mandated funds, we looked at the Morningstar Sustainability Ratings to choose high-quality funds with better-than-average globe ratings. In the case of American Century funds, we considered the structure of the company as favorable from an ESG standpoint. American Century founders James and Virginia Stowers donated almost $2 billion, including a controlling interest in American Century Investments, to the Stowers Institute for Medical Research. This means that over half of American Century's profits go to a nonprofit institution performing cancer research.

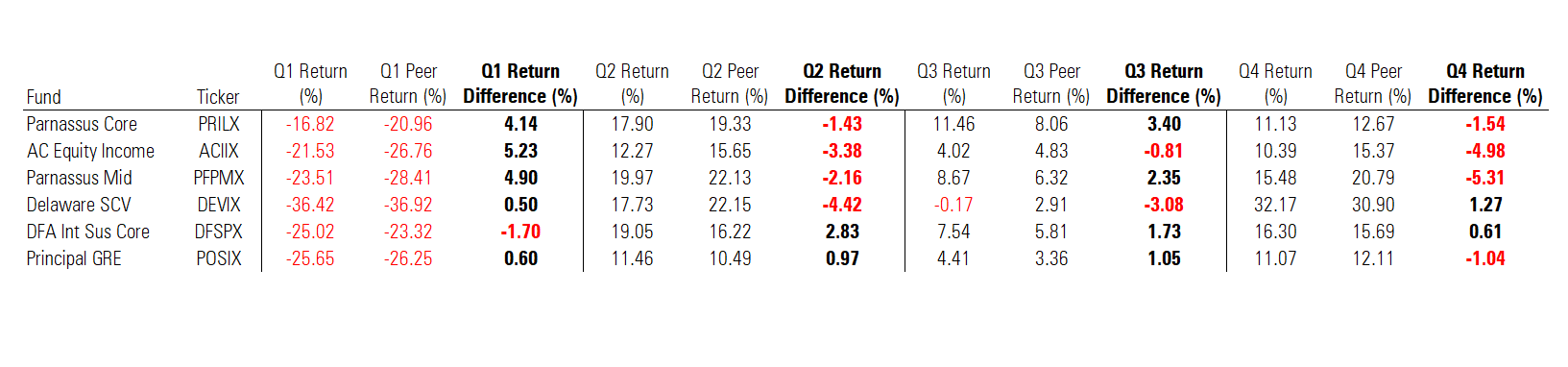

The research we did at Rowling & Associates had shown that ESG funds would capture the long-term returns of their respective indexes while reducing volatility. 2020 turned out to be a year that tested our conclusions. Although the year ended on the positive side, there were interim periods of market drops. The following table shows our primary fund holdings and year-to-date performance by quarter for our funds versus associated peer groups.

The first quarter of 2020 was a disaster for the markets (and of course, more broadly). However, with one exception, our selected ESG funds lost significantly less than peer funds. In the following three quarters, most of the ESG funds tended to slightly lag the non-ESG funds. This makes sense when considering the lower volatility of ESG funds. Clients were pleased during the downturn and were satisfied with their share of the recovery.

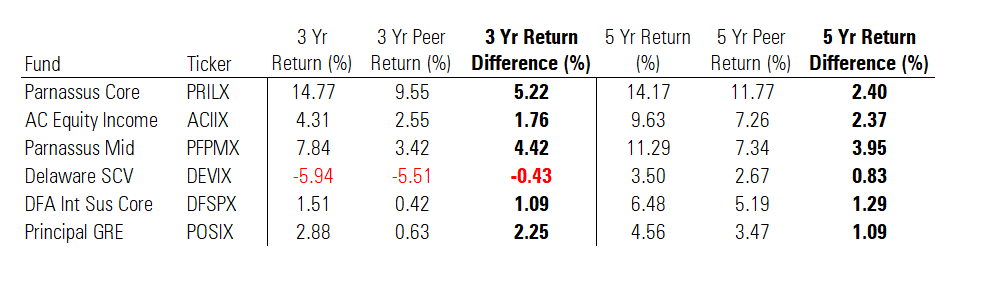

So how do these funds look on a long-term basis?

Here we can see, with one slight exception, that our ESG funds outperformed peers during the prior three years and, without exception, outperformed peers during the prior five-year period.

I will admit that this is not a scientific "double-blind" study. It is merely a summary of results for our implementation of an ESG strategy. What is important to note is that the ESG tilt did not negatively affect clients' portfolios and, in fact, benefited them.

Our clients are happy. Granted, our firm is located in Southern California, so clients like the "do-good" feeling of ESG investing. However, they also notice that the strategy has been working. One client emailed us following a downturn, stating that he was, "very pleasantly surprised at how small the total drop was last month" and he was prepared for "a whole lot worse." That same client wrote to us in December saying that his November statements exceeded his expectations. His conclusion on ESG investing? "I'm a believer!"

Sheryl Rowling, CPA, is head of rebalancing solutions for Morningstar and principal of Rowling & Associates, an investment advisory firm. She is a part-time columnist and consultant on advisor-focused products for Morningstar, and she continues to actively run her advisory business, from which Morningstar acquired the Total Rebalance Expert software platform in 2015. The opinions expressed in her work are her own and do not necessarily reflect the views of Morningstar.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)