When Diversification Backfires

Your investment plan lineup is not a buffet table--the dangers of naïve diversification.

Diversification is the key to any successful portfolio, and for good reason--a well-diversified portfolio can help an investor weather through the most turbulent markets. However, there are times when the general principle of diversification can work against investors. For example, the prevalence of mixed target-fund investors is a continuing concern for financial professionals. Despite the fact that target-date funds were designed to offer a pre-made, diversified solution for investors, some investors continue to spread out their assets to avoid “putting all their eggs in one basket.”

How can a well-meaning financial mantra--don't put all your eggs in one basket--lead to such misguided decisions? Well, because we are human. When we are overwhelmed by a decision and aren't quite sure what to do, our minds may start taking shortcuts. One of these shortcuts is naïve diversification, where we choose a little bit of each option to spread out our risk. When we're facing an overloaded buffet table, this can be a great strategy. Serving ourselves a bit of each food option will ensure that we don't miss out on anything. However, in investing, this shortcut can get us into trouble. Our research finds that a remarkable 86% of investors do what seems like diversification--but actually causes them to incur fees that directly undercut their returns.

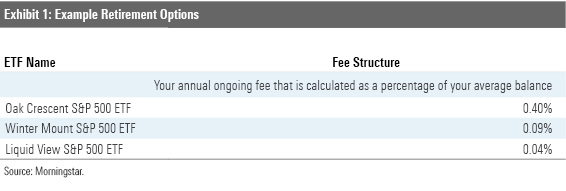

It May Look Like a Buffet Table Imagine you're updating your retirement account allocations and you're presented with the following options:

What would you invest in? For some of us, there’s a clear winner. All three investments are just exchange-traded funds that follow the S&P 500, but Liquid View S&P 500 ETF is much less expensive. However, this stark winner isn’t clear to everyone.

When we asked a nationally represented sample of individuals what they would choose, 86% put some assets into each of the options. Participants who chose to diversify in this scenario ended up paying, on average, four times more in fees.

But It's Not! Due to naïve diversification, our minds might automatically tell us to invest some assets into all the options, even those with similar holdings, but very different fees. Unfortunately, quite a few retirement plans offer two or more indistinguishable S&P 500 index funds with disparate costs--a choice environment that is identical to our experiment.

Or, this shortcut can prompt us to take on too much risk. Previous research found that a person's retirement allocation is strongly influenced by the array of funds offered by their plan because of our tendency toward naïve diversification. In other words, a person is more likely to have a higher equity allocation if their plan offers more equity funds.

What This Means for Everyday Investors Unfortunately, there's no quick way to completely avoid naïve diversification when making your own investing decisions, especially because some level of diversification is still an essential part of any investor portfolio. That being said, there are a few things you can do to avoid falling into this trap when investing.

1. Look to existing solutions: Target-date funds already offer diversified solutions based on your age, allowing you to side-step the process of finding a suitable asset allocation. Some plans also offer solutions similar to robo-advisors, where a mathematical algorithm will make allocation decisions for you based on a few personal characteristics.

2. Prepare before jumping in: Before looking into your retirement options, there are a few things you can do to prepare for the tough decisions ahead.

a. Define your desired asset allocation: Do some research so you can have a general idea of what allocation best fits your personal needs. One way to get started is by planning based on your age or life stage, whether you are an early career accumulator, a mid-career accumulator, or a pre-retiree. b. Identify a set number of metrics to prioritize: There are plenty of financial data points available nowadays. But, given that we are only human, selecting a few data points to focus on can make it easier for you to make a decision.

3. Be aware: The next step is to be aware of our own biases. When opening your retirement plan lineup, prepare to be overwhelmed by the onslaught of information and the mind's natural tendency to take shortcuts. Make sure to be prepared with a write-up of your desired allocation and metrics to focus on.

4. Ask for help if you need it: Given your circumstances, seeking professional advice might be a good option. I know this may seem like yet another decision you have to struggle through, but there are online resources that can make this one easier.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)