Have Large-Growth Stocks Peaked?

The surge that confounded the experts.

History's Verdict Ten years ago, investment researchers knew two things about large-growth stocks.

First, they were the stock market's laggards. When Eugene Fama and Ken French studied the long-term performance of U.S. equities in the early 1990s, they found that returns had decreased with size and cost. In aggregate, the smallest, cheapest companies had significantly outgained the biggest, costliest firms.

This made sense. Large-growth stocks were the safest economic choices, as they operated reliable businesses that were well positioned to survive recessions. Consequently, they were handsomely valued, at prices that limited their potential for future appreciation. Properly speaking, less risk should lead to less reward. The market’s behavior appeared to be logical.

Nothing that occurred over the next two decades altered that conclusion. Although large-growth stocks enjoyed a splendid five-year run during the late 1990s, they promptly conceded their advantage once the New Millennium began. And then some. From 1990 through 2009, Wilshire’s Large Growth Index gained 7.7% annually, while its Small Value Index rose by 10.7%. Such behavior matched researchers’ expectations.

Second, the effect of investment style was fading. Although large-growth stocks continued to trail their rivals during the second half of the 2000s, and early into the next decade, their margin of underperformance was modest. Word about the Fama/French findings had spread, meaning that style differences were eroding. One of the paradoxes of investing is that the more fervently an opportunity is believed to exist, the less that it does. If the broad public had come to believe that style mattered, it probably did not.

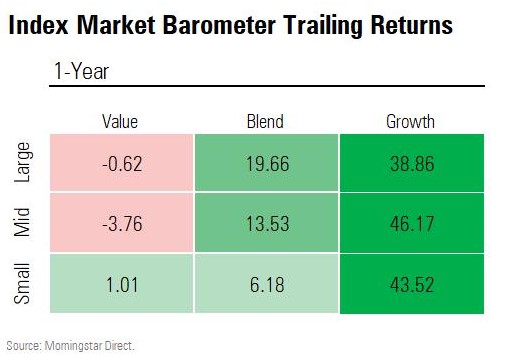

The Big Change Then came the new regime. Since 2014, investment-style results have diverged dramatically. After beating small-value issues by 16 percentage points in 2015, then losing by even more the following year, large-growth stocks have since crushed their Morningstar Style Box rivals for four consecutive years. As discussed by Morningstar's Katherine Lynch, they recorded their greatest victory yet in 2020, with the Morningstar Large Growth Index recording a 39% gain, as opposed to 1% for the Small Value Index.

That 38-point difference dwarfed the gap between U.S. stocks, as measured by the S&P 500, and those of the rest of the word, captured by the MSCI ACWI ex-USA Index (sorry for all those capital letters). In 2020, those two indexes diverged by a modest 8 percentage points. Over the past 20 calendar years, the S&P 500 and MSCI indexes have never been more than 17.1 points apart--a figure that has been exceeded during 10 of those 20 years by the investment-style diagonal.

In short, investment style has mattered far more than has international diversification. This is surprising, given that most international firms primarily generate their revenues outside the U.S., and list their stocks on exchanges that are denominated by non-dollar currencies. However, as global developed economies tend to move in unison, and both the S&P 500 and MSCI indexes are dominated by multinationals, the similarities have outweighed the differences.

Possible Explanations Why stock performance within the U.S. has varied so dramatically has four possible answers. Large-growth stocks could have beaten their small-value rivals because: 1) their recent business results have been stronger; 2) their future outlooks have become that much brighter; 3) they benefited more from declining interest rates; or 4) they have become investor darlings. The first three reasons are sound, while the fourth is not.

Unfortunately, we cannot measure each effect separately, as only the business results can be directly addressed. We will now conduct that exercise. Entering 2015, the companies in the Morningstar Large Growth Index traded at an average price of 24.2 times their trailing earnings. They now carry a price/earnings multiple of 45.2, meaning that for the same amount of earnings, today’s large-growth investors are willing to pay 87% more than were their 2015 compatriots.

Over that same time period, the Large Growth Index appreciated in price by 161%. (Its total return was slightly higher, but for purposes of this calculation, stock dividends should be set aside.) Backing out the numbers leads to the conclusion that the companies held by the Large Growth Index grew their earnings by 40% from 2015 through 2020. (That is, 1.87*1.40 = 2.61.)

The math is similar when using price/book ratios rather than trailing price/earnings ratios. In either case, about one third of the 2015-20 gain in the Large Growth Index owes to improved earnings, with two thirds deriving from steeper price multiples. The latter could signal speculation--but it also might indicate that forecasts for large-growth companies have justifiably risen, even as the competition from bonds, in the form of interest rates, has sharply declined.

Let's repeat the process for the Morningstar Small Value Index. In contrast with how large-growth stocks have performed, the price/earnings multiple on the Small Value Index has decreased over the past six years, falling from 15.6 at the start of 2015 to 14.6 today. As the price of the index itself has risen by 23%, this implies that small-value companies have managed a 31% aggregate earnings gain. (Once again, the outcome is virtually identical when using price/book ratios.)

Looking Forward Large-growth companies have indeed posted higher recent earnings gains than have small-value firms. However, that edge has been modest. So, too, has been the relative advantage that growth stocks have accrued from lower interest rates. While growth companies are helped more than value stocks by declining rates, because their cash flows tend to occur further in the future, that effect is modest.

Thus, the real explanation behind the Great Large-Growth Bull Market lies neither with reported earnings, or with changes in interest rates, but instead with investor expectations. Over the past several years, stock buyers have become far more optimistic about large-growth fortunes, even as they have soured on those of small-value stocks.

Such beliefs are not unreasonable, given that the corporate pyramid appears to be narrowing, with fewer companies atop the heap and more forming the base. (This year’s COVID-19 shutdowns have contributed to the effect.) However, it’s difficult to escape the conclusion that this trend has, at least temporarily, run its course. I will be surprised indeed if large-growth stocks once again outperform in 2021.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)