Which U.S. Equity Funds Beat Their Benchmarks by the Widest Margin?

Our screens reveal a select list of equity funds that have achieved long-term excess returns.

It's been difficult for actively managed U.S. and international-equity funds to beat their benchmarks. According to Morningstar's Active/Passive Barometer, only 48% of active U.S. stock funds survived and outperformed their average passive peer over the 12-month period ended June 2019, and only 23% of all active funds beat their passive benchmark over a 10-year period. As Morningstar director of global ETF research Ben Johnson notes in the report, foreign-stock and bond funds tend to have higher long-term success rates, while U.S. large-cap funds report the lowest success rates.

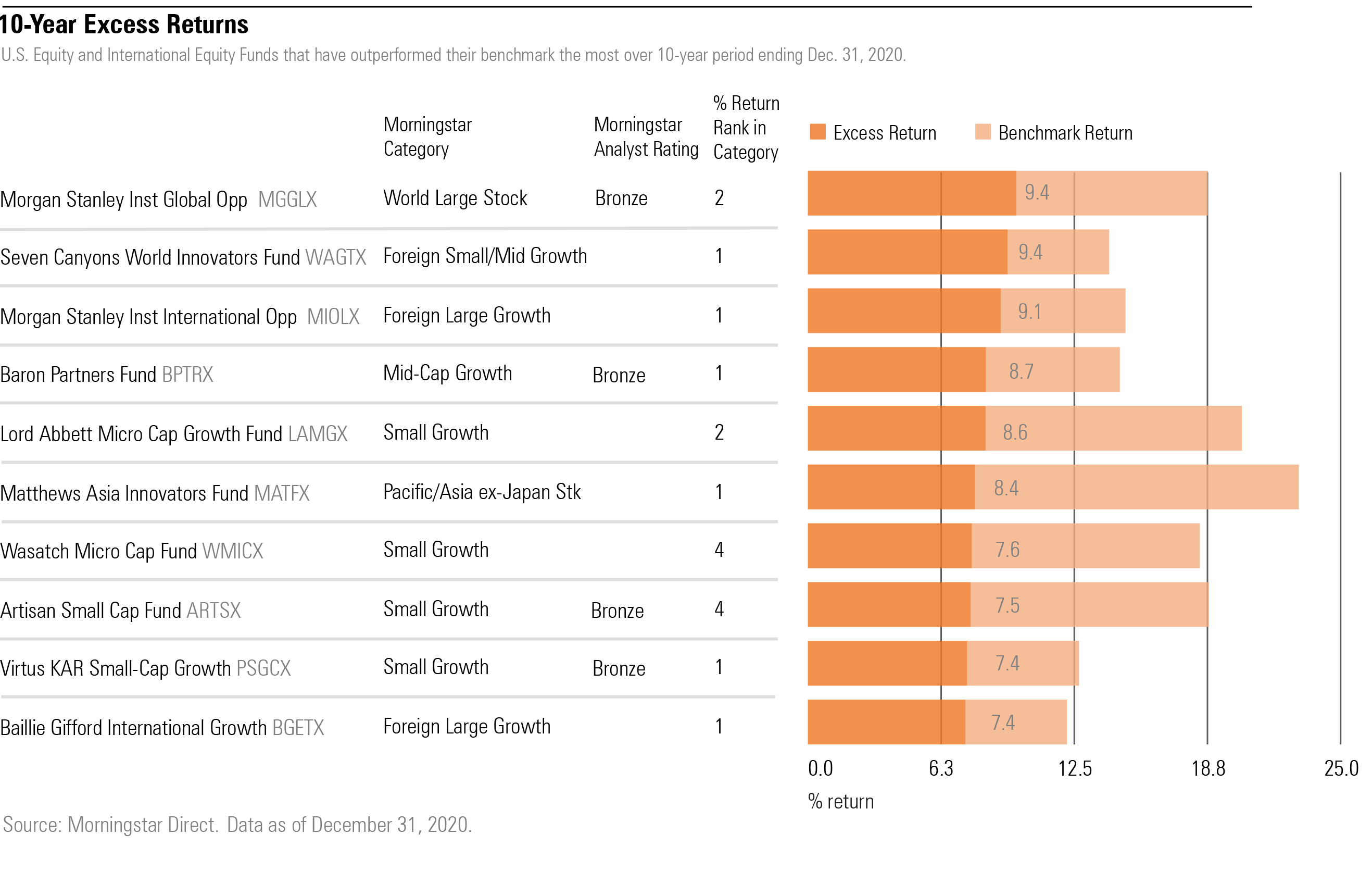

To identify funds that not only beat their benchmark but hit it out of the park, we looked for U.S. and international-equity funds that outperformed their benchmarks over the five- and 10-year periods ended in December 2020. Funds had to have a 10-year history and current assets under management of at least $100 million.

This left us with 1,755 funds for the 10-year period; of those funds, only 513 beat their benchmark. Funds that managed to beat their benchmark didn't do it by much--the average excess return was 1.75%--but 28 funds bested their benchmark by more than 5 percentage points. These are the funds that came out on top.

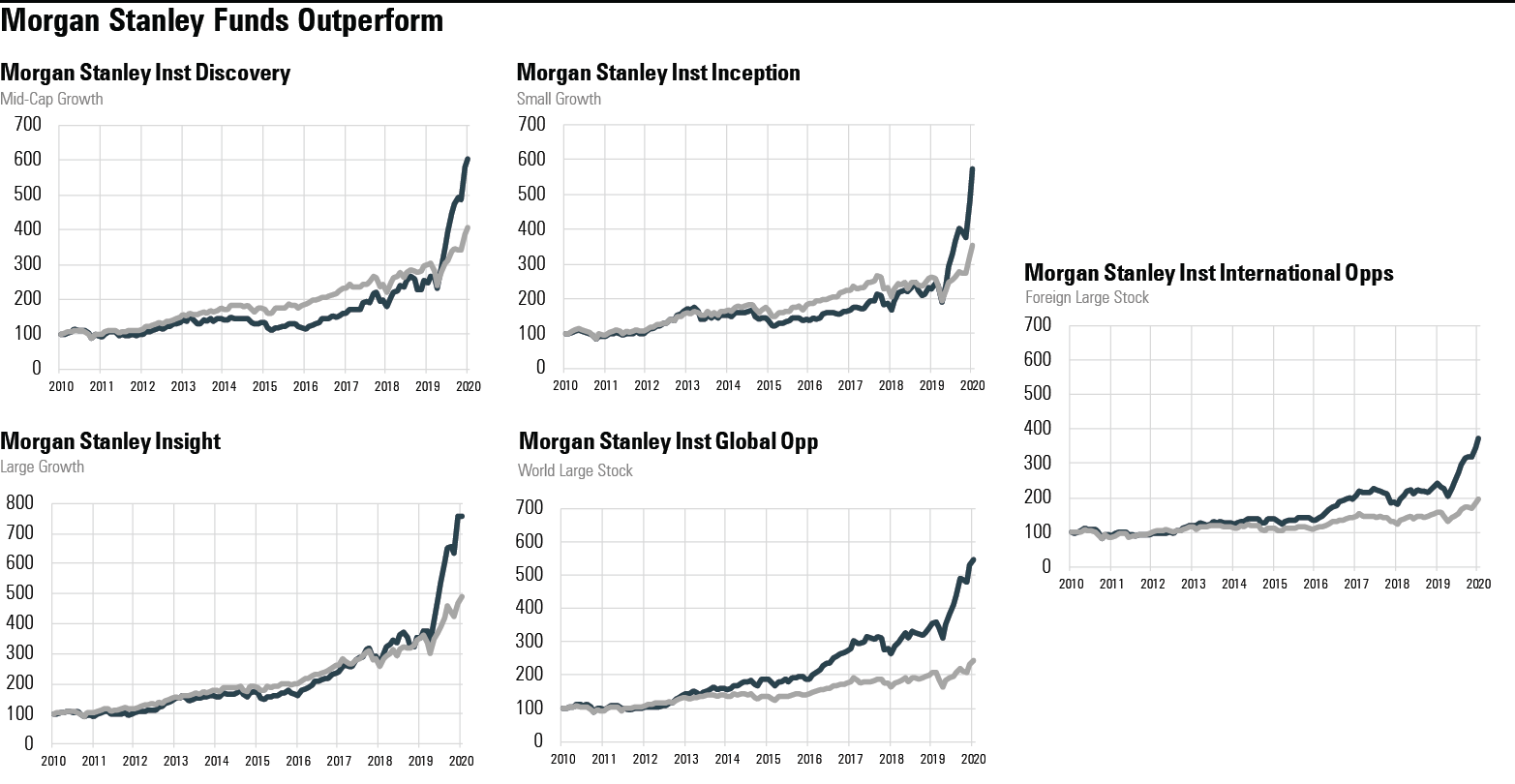

Morgan Stanley Funds Shine Whether looking over a five- or 10-year time period, Morgan Stanley funds dominated the lists. Over a 10-year period, Morgan Stanley Institutional Global Opportunity MGGLX, a world large-stock fund, and Morgan Stanley Institutional International Opportunity MIOLX, which falls in the foreign large-growth Morningstar Category, have outperformed their benchmarks more than almost any other U.S. equity or international-equity fund. Both funds are managed by Kristian Heugh. Since he took over in 2008, Morgan Stanley Institutional Global Opportunity has lost less than its benchmark in four of the five market corrections, says Morningstar analyst Tom Nations. The fund's strong performance in downturns and its aggressive growth profile have boosted its long-term returns, he adds.

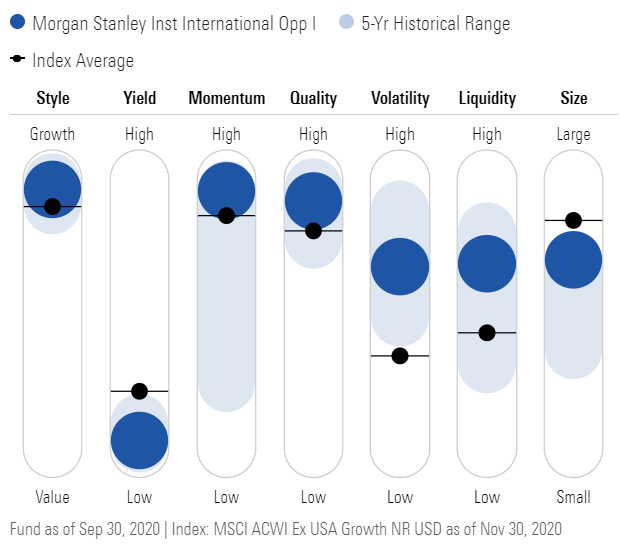

For Morgan Stanley Institutional International Opportunity (not covered by a Morningstar analyst), similarly strong performance in downturns helped long-term returns. The fund has lost less than its index in downside in down markets, and Morningstar's Factor Profile data shows that the fund is invested in more growth-oriented and smaller companies than its index. In addition, the companies it held tended to have higher volatility and more liquidity than the index, which could have contributed to its outperformance.

Source: Morningstar Direct.

Three other Morgan Stanley funds managed to beat their benchmarks (all Russell Growth indexes) more than other funds over the past five years.

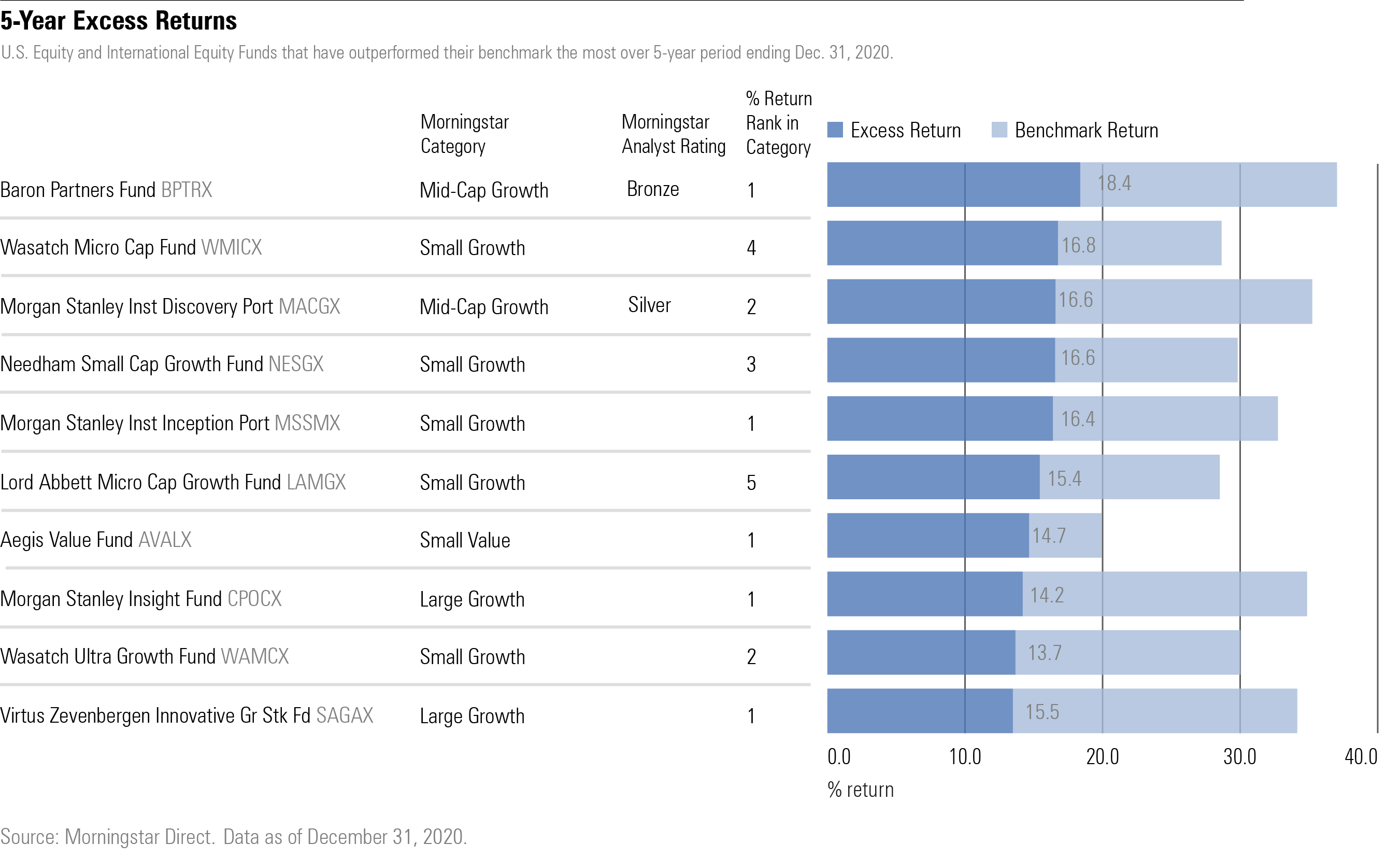

Source: Morningstar Direct.

10-Year Outperformers Baron Partners BPTRX managed to best the Russell Midcap Growth Index by 8.7 percentage points. The fund underperformed in three of the past 10 years, but a stellar 2020, mostly owing to Tesla TSLA, which was first purchased in 2014 and recently grew to 45.20% of the portfolio--affected long-term returns, says Morningstar analyst Adam Sabban. The fund also ranks as the top-performing fund over a five-year period.

In the small-growth category, Artisan Small Cap ARTSX, which has a Morningstar Analyst Rating of Bronze, has bested its benchmark by 7.5 percentage points over 10 years. Morningstar analyst Jack Shannon says the team's focus on buying low-leverage companies has helped it preserve capital on the downside; the fund's 73% downside capture ratio from October 2009 through August 2002 was significantly lower than the 91% posted by the average small-cap fund.

Recent outperformance also lifted Lord Abbett Micro Cap Growth's LAMGX 10-year return well over its benchmark. The small-cap growth fund advanced 79.42% during 2020, 58.46 percentage points above the Russell Microcap Growth Index. This put the fund 8.6 percentage points ahead of the benchmark's 10-year return, the second-best among U.S. equity funds.

Five-Year Outperformers While five international-equity funds ranked in the top 10 over a 10-year period, there were none among the highest outperformers over the five-year period. Baron Partners gained the most above its index over the past five year at 18.4%, followed by Wasatch Micro Cap WMICX.

Three Morgan Stanley U.S. equity funds also made the list, all growth funds across the market-cap spectrum and managed by Dennis Lynch. The three funds ranked in the top 2% of their respective categories for the five-year return period ended December 2020.

The three funds all have higher growth and size factor profiles than their indexes, according to Morningstar's Factor Profile (meaning they tended to invest in larger and growthier companies than their respective indexes), and both factors have outperformed over the past 10 years.

Over a five-year period, Morgan Stanley Institutional Discovery MACGX, rated Silver, gained 16.6% over its mid-cap benchmark The fund's recent performance--in 2020 it gained 123.5% over its benchmark--has put it near the top. Morningstar's director of U.S. equity strategies Katie Rushkewicz Reichart says, "A skew toward technology and healthcare companies and lack of energy and financials holdings buffered it in 2020's pandemic-induced market sell-off, and it owned some of the year's biggest winners, such as Zoom Video Communications ZM and Peloton Interactive PTON."

Similarly, Morgan Stanley's large- and small-cap funds, Morgan Stanley Insight CPOCX (closed to new investors) and Morgan Stanley Institutional Inception MSSMX, both carry higher allocations to the technology and communication-services sectors than their indexes.

For Wasatch Micro Cap, outperformance was constant. The fund beat its benchmark every year for the past four years, averaging a 25.73% gain above the Russell Microcap Growth Index. Another Wasatch fund in the small-growth category, Wasatch Ultra Growth WAMCX, ranked in the 10 best funds, recording a 13.7% excess return over the five-year period.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)