How to Add Impact Investing to Client Portfolios Through CDFI Loans

These loans can steer money to communities and causes that clients care about.

Morningstar Office clients can find more practice management articles like this one, here.

There are many more ways to incorporate environmental, social, and governance investing into client portfolios than just mutual funds, and one of them has been around for decades: Community Development Financial Institution loans. Through putting their money to work backing CDFI loans, clients can steer money toward the communities, businesses, and causes they care about.

I first learned about CDFIs early in my career in financial services while leading workshops for financial counselors who were working with low-income clients for the first time. Some workshop participants worked for local CDFIs, and their clients had goals such as buying their first homes or starting and growing small businesses.

While CDFIs have a long history, most advisors do not know how they might fit into a client's financial plan. Here's an overview of what CDFIs are, how they make an impact on the communities they serve, and how to incorporate them into a client's portfolio.

What Are CDFIs? CDFIs are financial institutions certified by the U.S. Treasury Department to foster economic opportunity in low-income and low-wealth communities. Once certified, CDFIs become eligible to receive federal funding for investment alongside private capital.

CDFIs & Impact Investing: An Industry Review, a report by Elise Balboni and Christina Travers, provides an in-depth introduction and overview of CDFIs. CDFIs take a variety of forms, including community development credit unions and banks that provide retail banking services and investments, loan funds that provide financing and technical assistance to borrowers, and venture funds that provide equity and equitylike debt to small and medium-size businesses.

The Opportunity Finance Network, a national network and industry leader of over 300 CDFIs, provides a comprehensive timeline of the history of CDFIs. A full list of over 1,100 certified CDFIs in the United States can be found on the CDFI Fund website.

CDFIs are incredibly diverse in terms of the geographies, communities, and entities served. CDFIs may focus on a specific region, representing urban and rural areas. Some may focus on individual borrowers, small businesses, or institutions like nonprofit organizations and schools. CDFIs may focus on providing financial services to a specific type of business or community, such as Native tribal entities, women of color business owners, or worker-owned cooperatives.

How Do CDFIs Make an Impact and How Is This Measured? In order to become a CDFI, "an entity must be a private, nongovernmental entity with community development as its primary mission and financing as its primary business line, serve and be accountable to an eligible target market, and provide technical assistance, known as development services."

I saw these requirements in action during my time training financial coaches: CDFIs aren't just lenders. They must have a clear mission and may provide a whole suite of tailored services such as financial counseling, credit management, first-time home-buying counseling, and small-business consulting.

Closely tracking the impact of CDFI loans is possible thanks to the deep, nonextractive partnerships and relationships that CDFIs build with the communities they serve. CDFIs are able to share metrics as well as individual stories of borrowers who have benefited from loans and services.

The Opportunity Finance Network tracks the impact of its membership coalition of 300 CDFIs annually. Members' cumulative impact through 2018 included:

- $74 billion in financing

- 1.56 million jobs created or maintained

- 419,177 businesses and microenterprises financed

- 2.1 million housing units developed

- 11,583 community facilities financed

Where Might CDFIs Fit Into an Investment Portfolio? CDFI investments provide both financial and social return, and the diversity of CDFI models results in varied return profiles. Investment fees vary, but generally there are no fees to investors.

CDFIs make low-interest loans, to their target communities, that may be unsecured or secured. For investors looking to CDFIs as a way of supporting small businesses, Marnie Thompson, systems strategist and investment committee member at Seed Commons, a national CDFI focused on serving small businesses and specifically worker-owned cooperatives, recommends focusing on smaller CDFIs because they "have significant focus on business lending, not just lending to housing and commercial real estate projects which many [larger] CDFIs stick to because they can be collateralized with property." Investors can request information from CDFIs or CDFI loan funds to learn more about who and what makes up their lending portfolio(s).

Depending on an investor's goals, CDFIs generally fit into the cash or fixed-income allocations of an investment portfolio. Andrea Longton, senior vice president of financial services at the Opportunity Finance Network, shared examples for how advisors can allocate client investments to CDFIs:

- Cash or cash equivalents: "Investors may consider deposits in FDIC-insured CDFI banks or NCUA-insured CDFI credit unions. For instance, a transformational deposit in Hope Credit Union offers financial returns coupled with a social justice return that addresses the wealth gap in America's Deep South communities." At Hope CU, investors can expect returns such as 0.10%, comparable to the interest rate one would expect within checking and savings accounts at conventional banks.

- Fixed income: "Capital Impact Partners issues S&P-rated, fixed-income securities whose financial returns are related to current market conditions and can be benchmarked against similarly rated corporate notes and bonds." The longer the term of the underlying investment, the greater the fixed return. Typically, investors can expect fixed returns ranging from 0.5% to 3.5%.

CDFIs may even have a place within the equity position of a portfolio. Two national CDFIs that are publicly traded on Nasdaq include Oportun OPRT and Amalgamated Bank AMAL.

How Do CDFIs Manage Risk? Strict lending standards, close relationships with communities, and wraparound services for borrowers have led to impressively low loan-loss rates for CDFIs.

During the Great Recession from 2008 to 2012, conventional bank lending declined by about 16%, while Opportunity Finance Network member CDFIs increased their lending during the same period. (Source: CDFIs & Impact Investing: An Industry Review, Page 10.)

The key to how CDFIs preserve investor capital is in their relationships with the communities they serve. Grace Chionuma, an executive director at Morgan Stanley, is a proponent of CDFIs and believes that their underlying mission to build wealth in partnership with underserved communities is the foundation for their success and disciplined lending practices. Chionuma says, "These organizations are incredibly disciplined. The underwriting standards, the processes, the technical aspects of the underwriting are first-class. They've had to be first-class because these are mission-driven nonprofits that have appropriate margins but are not gaming and trying to extract wealth from the communities. They're trying to help communities build wealth."

What Are Criticisms of CDFIs? An important consideration for investors is liquidity. Some CDFI loan funds allow for quarterly liquidity, and most require a minimum term of one year. According to Longton, "Liquidity is the biggest critique from the perspective of most investors. Until regulatory changes are considered, the fixed-income securities issued by CDFIs may only be traded in primary markets, reducing liquidity. Many investors hedge against this risk either by purchasing securities of smaller durations or committing to a 'buy-and-hold' strategy."

There have been criticisms of CDFIs being too cautious in their lending practices, and as a result not lending to the most vulnerable borrowers and communities who are unable to access conventional financing. Longton explains, "In order to lend long-term, low-cost debt out the front door, CDFIs must attract long-term, low-cost debt to their balance sheets from market investors. Historically, approximately half of all CDFI capital is driven by mainstream banks governed by their federal requirements under the Community Reinvestment Act." Fortunately, this is rapidly changing. Beyond more restrictive mainstream banking sources, the past five years have seen an accelerated flow of capital to CDFIs from retail and institutional investors, including donor-advised funds, family foundations, and corporations.

There also has been some criticism that for as much as CDFIs do to help underserved communities, more still needs to be done to address racial disparities.

Where Can Advisors Learn More About CDFIs? Institutional and individual investors, both accredited and nonaccredited, can invest in CDFIs.

Alternatively, investing in a pooled community development loan fund allows for more diversification across geographies, types of borrowers, and missions.

CNote's "Making an Impact: How to Invest in Community Development Financial Institutions (CDFIs)," provides a primer on the CDFI note programs that are available to nonaccredited, accredited, and institutional investors. Below is an expanded list of funds open for investment:

- The Impact Note, Enterprise Community Loan Fund

- RSF Social Investment Fund Note, RSF Social Finance

- Community Investment Note, Calvert Impact Capital

- Low Income Investment Fund (LIIF) bonds

- Flagship Fund (and other offerings), CNote

- Capital Impact Investment Notes, Capital Impact Partners

Smaller, more localized or targeted, CDFIs and CDFI loan funds include:

- Hope Credit Union

- Shared Capital

- Cooperative Fund of New England

- New Hampshire Community Loan Fund

- Local Enterprise Assistance Fund (LEAF)

- Seed Commons

- Oweesta (Native American communities)

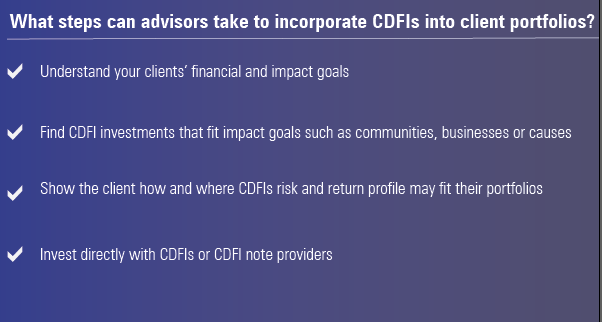

What Steps Can Advisors Take to Incorporate CDFIs Into Client Portfolios? Research shows that the majority of investors are interested in sustainable, ESG, and impact investing, but it's usually up to advisors to start that conversation.

When introducing CDFIs, advisors should talk to their clients about their desired impact and return. Questions to consider are:

- Is the client interested in supporting a particular community or mission?

- Is the client interested in supporting a specific region?

- How much is the client able or willing to invest?

- What range of return does the client expect or require?

- What type of liquidity does the client need for the invested funds?

Note whether the CDFI investments you're considering have minimums before recommending them to clients. Some loan funds may also be customized depending on the goals of the investor.

Using the information available from your clients to the questions above, find CDFIs or investment notes that fit their goals and investor profile. Or, search within the CDFI Fund's list of certified CDFIs. Reach out to CDFIs or investment providers to learn more about their work and ask for marketing materials, such as fact sheets, that you can have readily available for your next client meeting.

Then, show the client how and where CDFIs may fit within their portfolios. Most importantly, help the client determine if CDFIs would complement the cash and/or fixed-income portion(s) of their portfolio and if CDFIs could replace any positions they're currently holding.

Once clients are ready to move their money, investments can be made directly with the CDFIs or note providers and may require some paperwork. Some CDFI notes are available on investment platforms and can be purchased within brokerage accounts.

For clients who want to steer their savings or investments away from large traditional banks or companies whose practices they do not agree with, CDFIs can be an impactful alternative.

Phuong Luong, CFP, is an educator, financial planner, and investment strategist focused on economic justice and closing racial wealth divides. She is currently the investment strategist for Adasina Social Capital and the founder of Just Wealth, a virtual, solo, fee-only Registered Investment Advisor. She is also the online facilitator for the Boston University Financial Planning Program and a subject matter expert in ESG and regenerative investing. The views expressed in this article do not necessarily reflect the views of Morningstar.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)