Which U.S. Bond Funds Beat Their Benchmarks by the Widest Margin?

Our screens reveal a select list of taxable-bond funds that have achieved long-term excess returns.

The ranks of bond funds that have been able to beat the market over the long term are small.

Take the data from the most recent Morningstar Active/Passive Barometer, which compares actively managed funds against comparable index-tracking funds. Among intermediate core bond funds--a basic building block for most portfolios--barely half of the funds in the Morningstar Category have made it to their fifth birthday, and only one third that were around 10 years ago are still in existence. And of that group, fewer than one fourth of intermediate core bond funds have beaten their average passive counterpart.

But there are some long-term outperformers out there. For this article, we created a screen to identify taxable-bond funds that have a track record of delivering consistent outperformance against their benchmarks over the past five- and 10-year periods. (Morningstar Direct and Office clients can find an expanded version of this article here.)

To run the screen, we started with a universe of U.S. taxable-bond funds with at least a 10-year history and current assets under management of at least $100 million. We included all taxable-bond categories except one: nontraditional bond, which was excluded because, in the view of Morningstar analysts, the indexes that these funds use to measure performance often do not make for a good comparison for investors looking to evaluate returns.

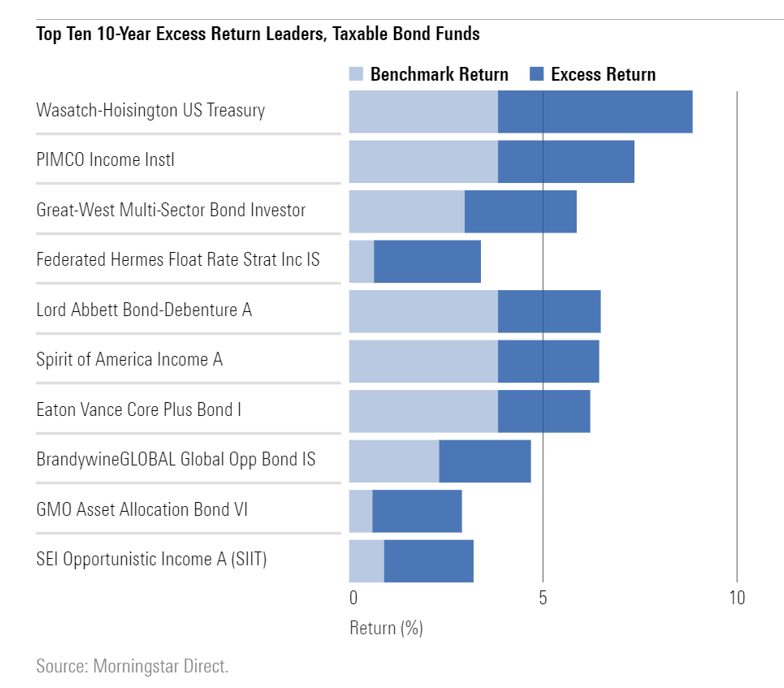

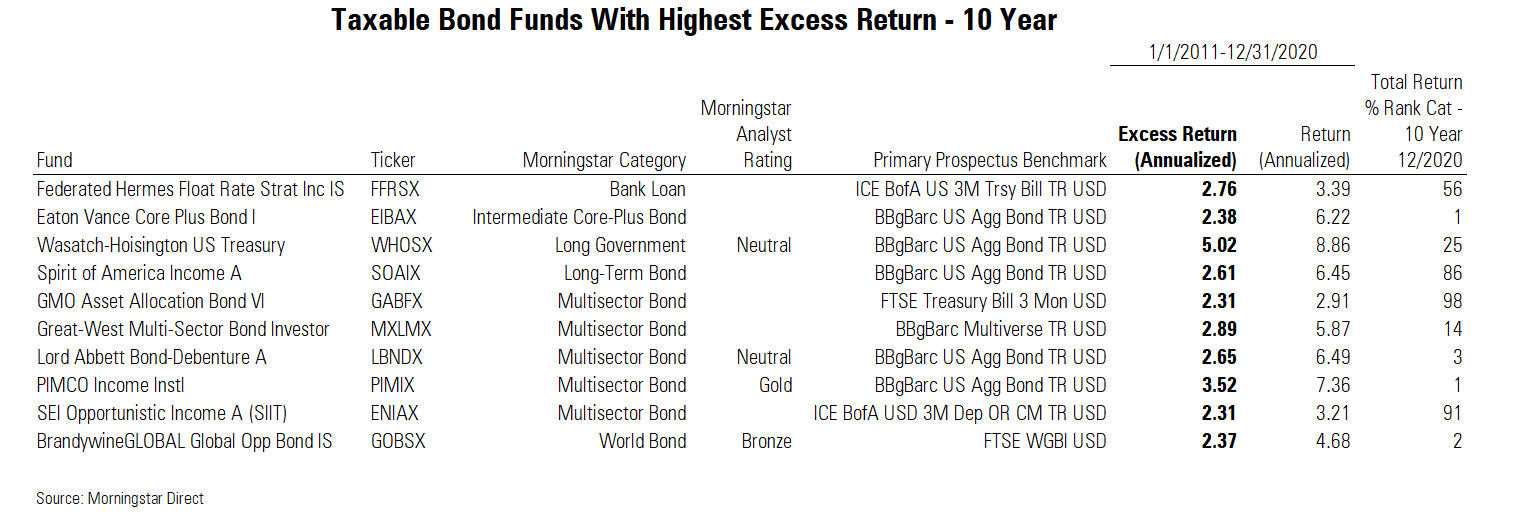

The result was a list of 668 funds for the 10-year period. From there we compared the performance of each fund's oldest share class to that of the primary prospectus benchmark and calculated excess returns. For the past decade, 363 of those funds beat their benchmark.

However, beating a benchmark, even over the span of a decade, may only provide a small window into a fund's performance. As can be seen in the following table, some funds that have far outperformed their benchmark nevertheless land at the bottom of their category.

When we dig deeper, among the 10 funds with the highest excess returns over the past 10-year period, four are under Morningstar coverage.

For Pimco Income PIMIX, which has a Morningstar Analyst Rating of Gold, "the strategy's nonagency residential mortgages have been a consistent contributor to its success," writes senior analyst Eric Jacobson in his report. Pimco leans on the sector for its return potential and modest volatility, Jacobson adds. The fund had a 37% exposure to the sector as of April 30, 2020.

In terms of long-term performance, Jacobson says, "between the early 2020 coronavirus sell-off and the nascent recovery that followed, the strategy placed around the middle of the multisector-bond category for the year through April. Even with that baked in, the strategy has posted long-term returns among the category's best, with modest volatility. It has been as or more resilient in other times of stress, too, such as late 2011 and the summer of 2013."

Bronze-rated BrandywineGLOBAL Global Opportunities Bond GOBSX has outperformed, but with a track record that also displays higher volatility, notes director of fixed-income strategies Karin Anderson. "This strategy has always been among the most volatile in the world-bond category given the team's contrarian calls and willingness to load up on beaten-down bonds and currencies," she says. However, Anderson adds that "this approach has rewarded the patient."

Wasatch-Hoisington U.S. Treasury WHOSX has put together an impressive stretch, beating its benchmark by an annualized rate of 5%. "Wasatch-Hoisington U.S. Treasury has outperformed so well because longer-date U.S. Treasury rates have declined significantly over the past decade," says analyst Mike Mulach. "The fund doesn't take on much credit risk but sports extreme interest-rate risk." Morningstar awards the fund only a Neutral rating.

The other Morningstar-rated multisector-bond fund to make the list is Lord Abbett Bond-Debenture LBNDX. "The strategy's success is closely tied to the health of the high-yield and equity markets--both sectors have had bouts of volatility during the 10-year-plus bull market, but that additional risk has generally led to stronger rallies than peers," says analyst Zachary Patzik. Patzik warns that the Neutral-rated fund is susceptible to bouts of volatility, and the strategy has been among the worst performers when credit markets sell off.

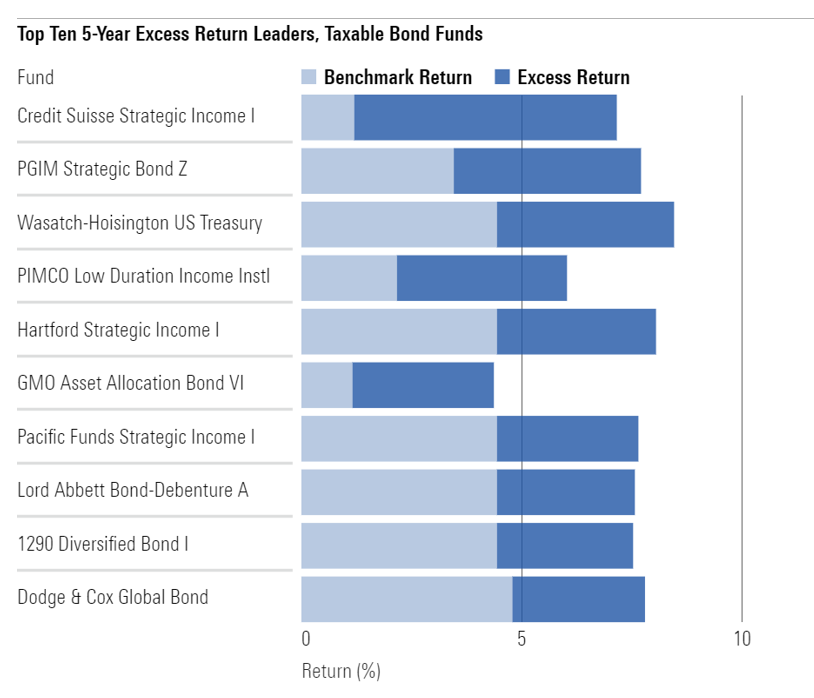

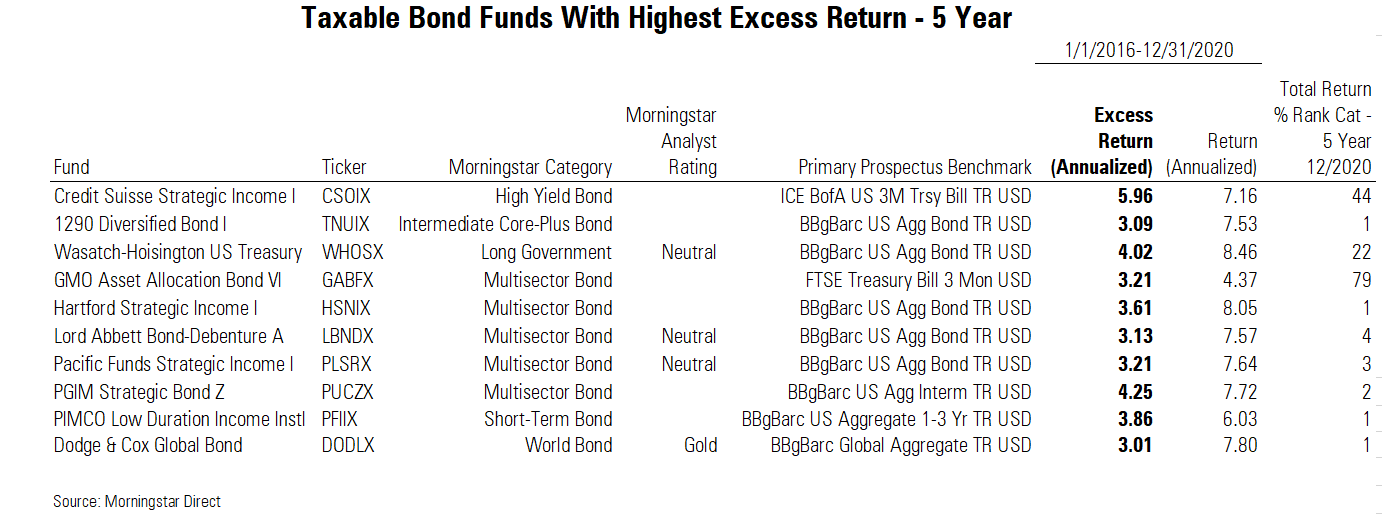

Five-Year Outperformers In a second screen, we looked for funds that have beaten their benchmark for the past five years.

We started with a list of 864 funds. From there, we compared the performance on each fund's oldest share class to that of the primary prospectus benchmark and calculated excess returns. For the past five years, 480 of those funds beat their benchmark.

Source: Morningstar Direct.

Wasatch-Hoisington U.S. Treasury claimed the third spot for overall excess returns over the five-year period. Lord Abbett Bond-Debenture, which also made the 10-year list, landed among the five-year top outperformers as well.

Rounding out the list of funds under our coverage are Gold-rated Dodge & Cox Global Bond DODLX and Neutral-rated Pacific Funds Strategic Income PLSRX.

Senior analyst Benjamin Joseph calls the strategy behind Dodge & Cox Global Bond "patient and disciplined." Launched in 2014, the fund utilizes the deep, bottom-up research that is a hallmark of the firm.

"Consistent with other Dodge & Cox's offerings, this strategy's process is built on deep fundamental analysis with a long-term outlook," Joseph says. "The team leverages the firm's broad research capabilities to pinpoint high-conviction opportunities and isn't afraid to invest heavily in them."

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)