December Analyst Ratings Upgrades, Downgrades, and More

Morningstar analysts rated 777 share classes and vehicles and 221 unique strategies in December 2020.

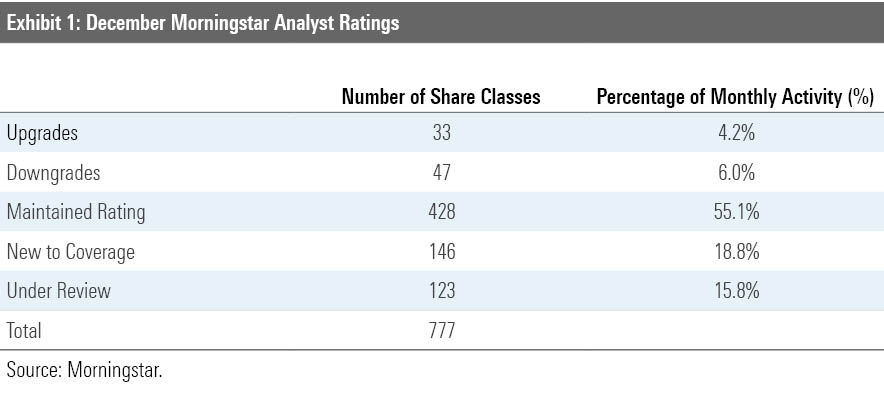

Morningstar updated Analyst Ratings for 777 fund share classes, exchange-traded funds, and separately managed accounts/collective investment trusts in December 2020. Of these, 428 maintained their previous rating, 47 were downgrades, 33 were upgrades, 146 were new to coverage, and 123 came Under Review because of material changes such as manager departures.

Sifting out multiple share classes and vehicles, Morningstar rated 221 unique strategies in December 2020. Of these, 52 received a rating for the first time, with the rest having at least one investment vehicle type that a Morningstar analyst previously covered. Below are some highlights of the upgrades, downgrades, and ratings for newly covered strategies.

Upgrades A lengthy stretch of team stability and the ongoing support of Pimco's redoubtable expertise across global bond sectors lead to a Morningstar Analyst Rating upgrade for the cheapest share classes of Pimco Dynamic Bond PFIUX to Silver. Its more expensive share classes stayed Bronze and Neutral, but lead manager Marc Seidner has impressed in recent years with a circumspect approach that has proved effective in a variety of market conditions. He has improved the strategy's process since struggling in 2015. He's kept it versatile but risk-aware by focusing more on getting position sizes right and employing more stress-testing and quantitative analysis. That helped Seidner earn a People Pillar rating upgrade to High from Above Average, which lifted the overall ratings for the strategy's cheaper share classes.

Strong implementation of a solid process earned WCM Focused International Growth WCMIX an upgrade to Silver from Bronze. The 16-member investment team focuses not only on companies’ competitive advantages, but whether they are strengthening or deteriorating, which helps this strategy avoid stocks that are milking decent but stagnant businesses and find those branching into new opportunities or fortifying their positions. Asset and team growth present some challenges to extending the fund’s remarkable string of six top-quartile finishes in its foreign large-growth Morningstar Category in the past nine years. This firm’s intense focus on its circle of competence and its own competitive advantages, however, supported Process and Parent rating upgrades to High and Above Average that drove the overall rating boost.

Downgrades Transamerica Large Cap Value's TWQIX Analyst Rating for its cheapest share class dropped to Neutral from Bronze after it replaced subadvisor Levin Easterly Partners after little more than eight years with Rothschild & Co. Asset Management. The downgrade is less about Rothschild than about Transamerica dumping an old-school value manager when value has been out of favor. Levin's Jack Murphy was a bottom-up contrarian investor who ran a focused portfolio of about 35 out-of-favor stocks he and his team thought were poised for rebounds. The fund initially put up strong numbers after he took over in July 2012, but it struggled recently, including in 2019's market rally and 2020's novel coronavirus-driven sell-off. Rothschild lead manager Paul Roukis has been in the industry since 1992 and subadvises three other large-value strategies. He and comanager Jeff Agne, who has 19 years of experience, run a more diversified portfolio of 65-80 stocks assembled in part with quantitative screens; they also are more willing to hang on to stocks with higher valuations. It's not clear whether they'll be better than Levin, but they will be different.

Vanguard Market Neutral’s VMNFX dropped to Neutral from Bronze owing to a longer-than-expected slump. The market environment has not favored this systematic market-neutral strategy. The family’s quantitative equity group uses computer programs to sort for stocks by their growth, valuation, quality momentum, and management. It goes long the high-ranking stocks and short the low-ranking ones and optimizes the portfolio to zero out market exposure across 24 GICS industry subgroups. Being valuation-conscious on the long side while shorting highfliers has not been a good combination for the strategy since about 2016. That and the mixed performance of Vanguard’s other quant funds raise questions concerning quantitative equity group’s ability to keep pace with peers that have invested significantly in their systematic approaches in recent years. Thus, the People Pillar rating is downgraded to Average.

New Ratings Former Morningstar Prospect Tributary Small Company FOSCX graduated to full analyst coverage with a Bronze rating. Mark Wynegar, lead manager since 1999, runs the fund with Michael Johnson and five analysts; they look for companies with durable competitive advantages trading at modest prices. The team's experience--and average of 20 years in the industry and 10 at the firm--and focus on its simple but solid process underpin the strategy's rating.

One of the funds swept up in Morningstar’s expanding ESG coverage, Pax Global Environmental Markets PGINX, earned an Analyst Rating of Bronze for its strong investment team, thoughtful stock-picking process, and disciplined execution. A large, seasoned, and stable team from Impax Asset Management runs this global strategy with a bottom-up process targeting growth companies that derive 20% or more of their revenue from activities across four broad categories of environmental markets: clean energy; water; waste or resource recovery; and sustainable food, agriculture, and forestry. The team follows a 10-step process that considers management quality, regulation, and risks, among other things, and pays close attention to valuation when building its 40- to 60-stock portfolio.

Analysts Stephen Welch and Gabriel Denis contributed to this report.

/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)