Why Dividend-Stock Funds Are Still Worthwhile

They won't excel in every down market, but the long-term investment case remains solid.

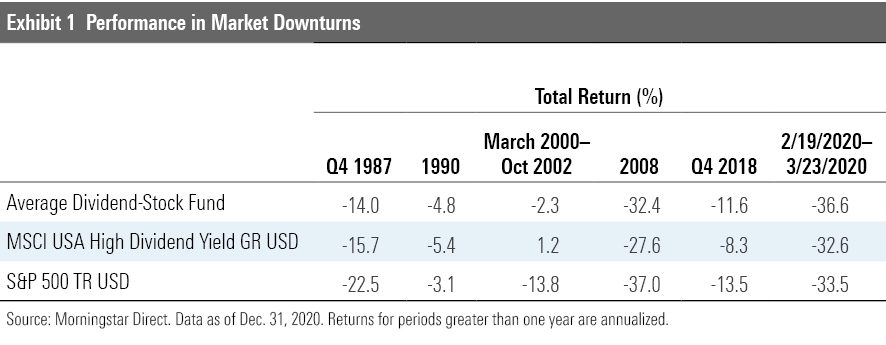

Dividend stocks are often thought of as dull but reliable, lagging in bull markets but holding up better in tough times. But in 2020, they lived up to only part of the bargain. As the novel coronavirus roiled the market in February and March, the MSCI USA High Dividend Yield GR Index dropped 32.6%, nearly matching the S&P 500’s loss. (The average dividend-stock fund lost closer to 37% over the same period.) When the market bounced back starting in the second quarter, dividend stocks failed to keep pace with the broader market's surprisingly strong gains.

Dividend stocks suffered in early 2020 partly because scores of companies (including major firms like Disney DIS, Royal Dutch Shell RDS.A, and General Motors GM) either reduced or suspended their dividends as the sudden economic decline from the coronavirus dented profitability and cash flow. Sector exposure was another factor that weighed down returns, as dividend stock benchmarks are light on the technology issues that have led the market. Investment style is a closely related reason for dividend stocks’ underperformance, as they lean heavily toward value instead of the high-growth, momentum-oriented stocks that led the market during most of 2020.

Taking a Longer-Term View Despite dividend stocks' lackluster showing in 2020, I'd argue they still have a solid investment case. Dividends have historically made up a significant percentage of equity-market returns, as companies that start paying dividends typically have enough excess cash flow to continue making payments year after year. Dividend programs are often thought of as a way of encouraging discipline and sound financial management, as they make it more difficult for management teams to throw money at products and strategies that may or may not pay off.

Stocks with above-average dividends have generally held up relatively well in previous market downturns. In the fourth quarter of 1987, for example, the MSCI USA High Dividend Yield GR Index lost nearly 7 percentage points less than the S&P 500. They also emerged with far lighter losses during the tech correction that started in spring 2000, as well as the brief downturn in the fourth quarter of 2018. The recession-driven decline in 1990 was an exception, however. Economically sensitive stocks suffered the worst losses as investors fled to defensive names, hurting dividend-focused market benchmarks.

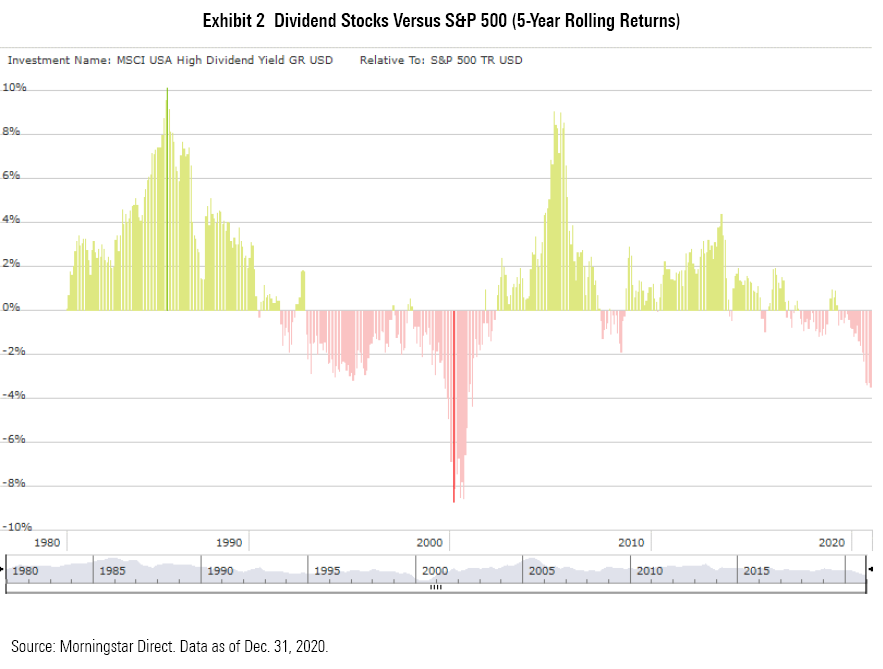

Looking at returns over rolling time periods also supports the case for dividend-stock funds. As the chart below illustrates, dividend-paying stocks tend to fare worst during more ebullient markets, such as 1995-99 and the generally strong five-year period from 2016 through 2020. Stocks paying higher dividends also tend to underperform during periods of rising interest rates. Even so, dividend stocks have outpaced the broader market during 25 of the 41 rolling five-year periods from 1976 through 2020. They’ve typically fared best during periods of slow economic growth and sluggish market returns, such as the early part of the decade in the 1980s, when stagflation dragged down market returns, as well as the 2000s, when the market struggled to win back previous gains following the technology-driven downdraft.

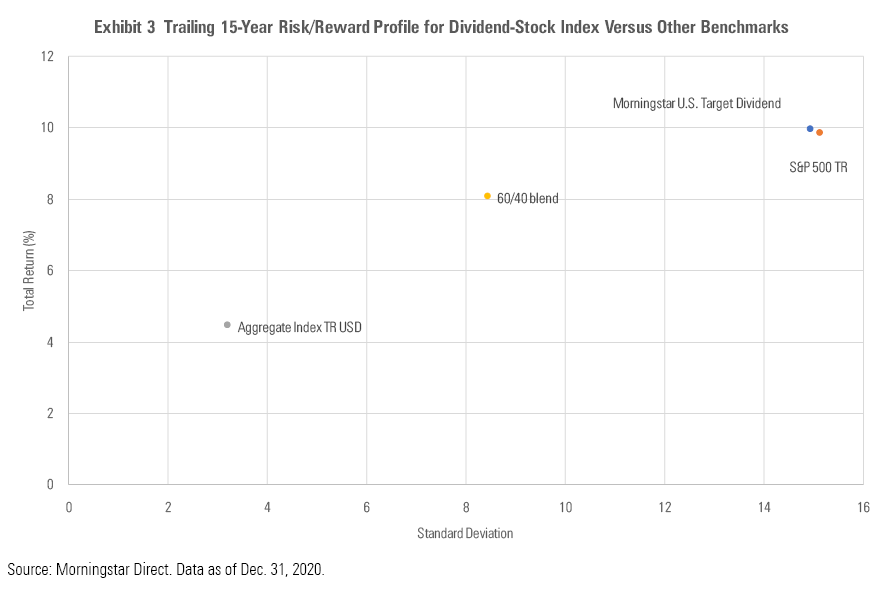

These showings have helped dividend stocks pull ahead of the broader market for the trailing 20-year period ended in 2020, with an annualized return of 7.9% versus 7.5% for the S&P 500. Over the trailing 20-year period, dividend stocks have also shown less volatility (as measured by standard deviation), leading to attractive risk-adjusted returns.

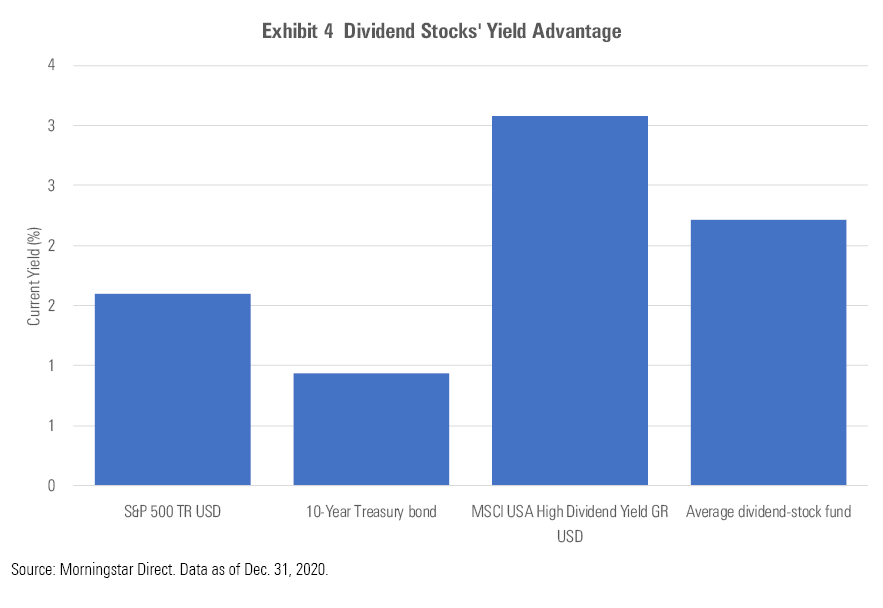

Other Advantages Yield is another obvious advantage for dividend stocks, particularly now that fixed-income interest rates are at a multidecade low. While the yield on the 10-year Treasury bond recently edged above 1%, fixed-income yields remain low across the board. Investors can capture some additional yield by dipping into lower credit-quality tiers, but yield spreads on corporate, high-yield, and municipal bonds have all compressed significantly after widening during the market turmoil in early 2020. As a result, dividend-stock yields compare favorably with those on fixed-income securities. As with bonds, though, more yield isn't necessarily better, as stocks with the highest dividend yields in percentage terms tend to have weaker financial health and can be especially vulnerable to economic distress. Most dividend-yield indexes and funds incorporate quality screens to avoid this problem.

Dividend stocks also carry tax advantages. Most stock dividends (as long as they're considered "qualified") are taxed at capital-gains rates. That means most investors will pay a rate of 15% or 20% on dividends paid out from mutual funds or individual stocks, compared with ordinary income tax rates of as much as 37% on fixed-income securities.

Dividend stocks look relatively attractive from a valuation perspective, as well. As of Dec. 31, 2020, the average stock in the MSCI USA High Dividend Yield Index (weighted by position size) was trading at a 2% premium to Morningstar’s fair value estimate, compared with a weighted average premium of 13% for the stocks included in the S&P 500. Investors can therefore use dividend-stock funds as a more value-oriented counterweight to the tech-heavy, growth dominated S&P 500.

Conclusion The bottom line is that every down market is different, and dividend-oriented stocks won't excel in every one. Overall, though, they tend to hold up a bit better than average during times of market turbulence and have generated attractive risk-adjusted returns over longer periods.

A previous version of this article displayed incorrect Exhibits 2 and 4.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)