7 Stocks for Quality Seekers

These names were recently added to the Morningstar Wide Moat Focus Index.

The Morningstar Wide Moat Focus Index tracks companies that earn Morningstar Economic Moat Ratings of wide and that are trading at the lowest current market price to fair value. How has this cluster of high-quality names performed over time? Pretty well: The index has beaten the S&P 500 during the trailing three-, five-, and 10-year periods as of this writing.

With those performance numbers on the index's side, its constituents are a fertile hunting ground for investors looking for high-quality stocks trading at reasonable prices.

In an effort to keep the index focused on the least-expensive high-quality stocks, Morningstar reconstitutes the index regularly. The index consists of two subportfolios containing 40 stocks each, many of which are overlapping positions. The subportfolios are reconstituted semiannually in alternating quarters, on a "staggered" schedule. We re-evaluate the index's holdings and add and remove stocks based on a preset methodology. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves rightsizing positions.

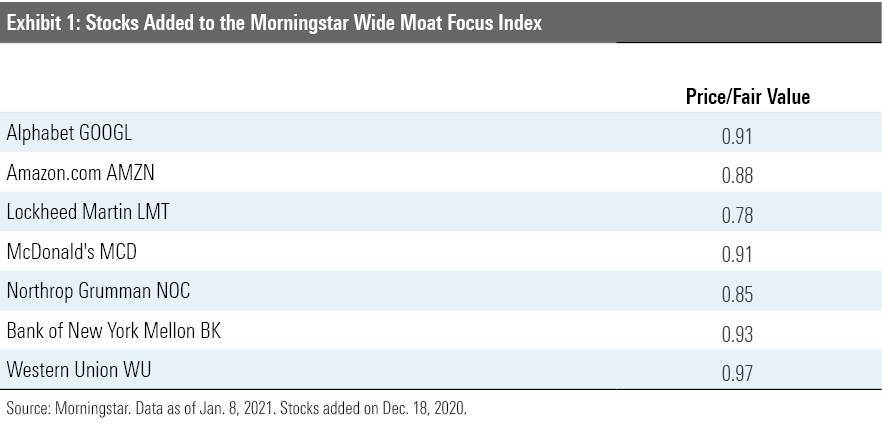

After the most recent reconstitution on Dec. 18, 2020, half of the portfolio added seven positions and eliminated seven. The index now holds 50 positions.

Additions Notably, two of the new names added to the index are members of the FAANG set: Alphabet GOOGL and Amazon.com AMZN. Both stocks are undervalued according to our metrics.

Google dominates the online search market, which has led to a pickup in antitrust cases against Alphabet. We nevertheless continue to rate the market leader as a wide-moat stock, thanks to its network effect and intangible asset moat sources, and we maintain our $1,980 fair value estimate, confirms senior analyst Ali Mogharabi.

Dig Deeper: States Target Alphabet's Search and Digital Advertising

Amazon, meanwhile, continues to find ways to evolve, remarks analyst Zain Akbari. "Its operational efficiency, network effect, and a brand intangible asset give its marketplaces sustainable competitive advantages that few, if any, traditional retailers can match," he explains. "The combination of competitive pricing, unparalleled logistics capabilities and speed, and high-level customer service makes Amazon an increasingly vital distribution channel for consumer brands."

Watch: A Quick Look at Amazon

Two defense contractors--Lockheed Martin LMT and Northrop Grumman NOC--also joined the index. We believe wide moats are common in the industry, argues analyst Burkett Huey. "They exist because of intangible assets: product complexity that thwarts new entrants, contract structures that reduce risk for the contractor, decades-long product cycles, a lack of alternative suppliers, and the switching costs of a risk-averse customer facing a significant time investment to switch over products," he explains.

The index added two names from the financial services sector--Bank of New York Mellon BK and Western Union WU--in December.

BNY Mellon is the largest custodian in the world. "While core custody can be an undifferentiated offering, scale and the stickiness of clients have helped the firm generate double-digit returns on tangible equity," explains senior analyst Eric Compton. We tag a $48 fair value estimate on shares.

"Western Union is the clear leader in an industry where size confers significant advantages," notes senior analyst Brett Horn. An industry shift toward electronic methods of money transfer will likely limit growth, warns Horn. But the company's cost advantage nevertheless remains significant.

McDonald's MCD rounds out the list of additions to the index. We think the fast food chain is well-positioned to compete both during the ongoing pandemic and longer term, says analyst Rebecca Scheuneman. "While it must contend with pandemic-related guest traffic pressures, aggressive industry promotional activity (limiting near-term pricing opportunities), and wage increases across many global markets, we believe McDonald's technology, value, marketing, and franchisee advantages will allow it to sustain normalized low- to mid-single-digit system sales growth and high-single-digit operating income growth over a longer horizon, implying operating margins improving to the mid-40s over the next five years," she notes.

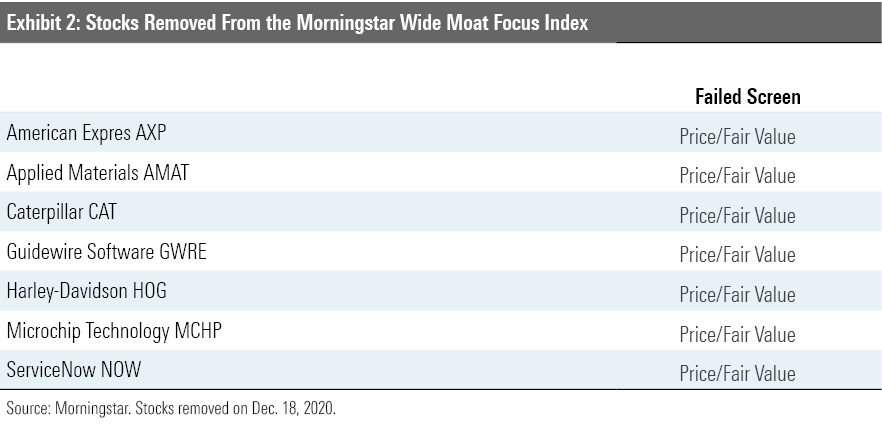

Removals Stocks can be removed from the index for a few reasons: If we downgrade their economic moats or if their price/fair value ratios rise significantly. All of the removals in the latest reconstitution were pushed out by stocks that were trading at more attractive price/fair value ratios at the time of reconstitution.

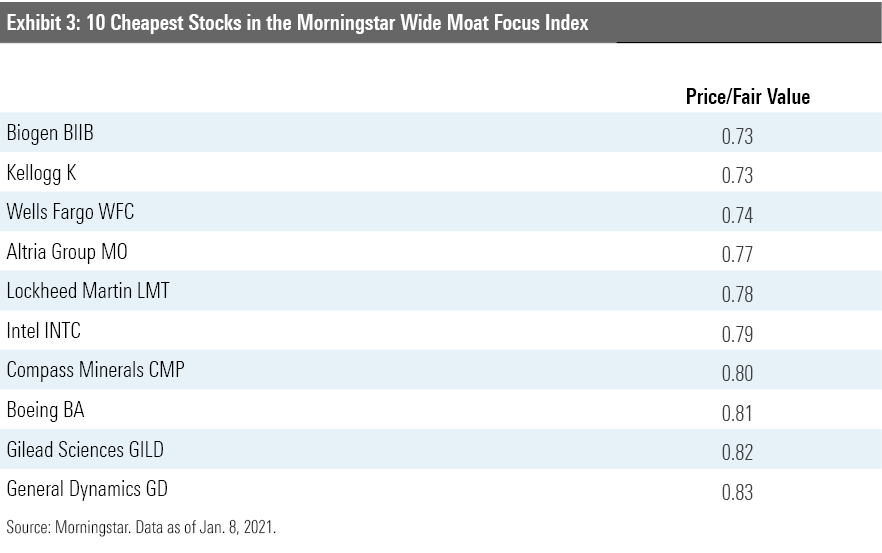

High-Quality Stocks in the Bargain Bin Here are the 10 cheapest stocks in the Morningstar Wide Moat Focus Index as of Jan. 8.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)