What Delisting Chinese Stocks from NYSE Means for Passive Funds

Though the situation is still fluid, recent developments have clarified the implications for investors.

Editor's Note: Morningstar Direct users can access the full research report here.

On Monday, Jan. 11, 2021, the "Executive Order on Addressing the Threat from Securities Investments That Finance Communist Chinese Military Companies" signed by President Trump will become effective. In the past month, regulators have added more companies to the sanctioned list and issued some clarifications on the matter. Major international index providers completed their consultation processes and announced their plans. The major benchmark providers will exclude the securities listed by the Office of Foreign Assets Control, or OFAC, from their equity and fixed-income indexes. Any index funds and exchange-traded funds whose benchmarks will be excluding the affected securities will follow suit.

However, the interpretation of the executive order remains fluid. On Dec. 31, 2020, the New York Stock Exchange announced plans to delist the ADRs of three Chinese telecom companies. It put this on hold Jan. 4, 2021 but reverted to its original plan on Jan. 6. The latest guidance from the OFAC, issued on Jan. 6, explicitly stated three NYSE-listed ADRs and subsidiaries of the military companies were subject to the executive order. As such, we expect that international index providers will make further announcements in the days to come.

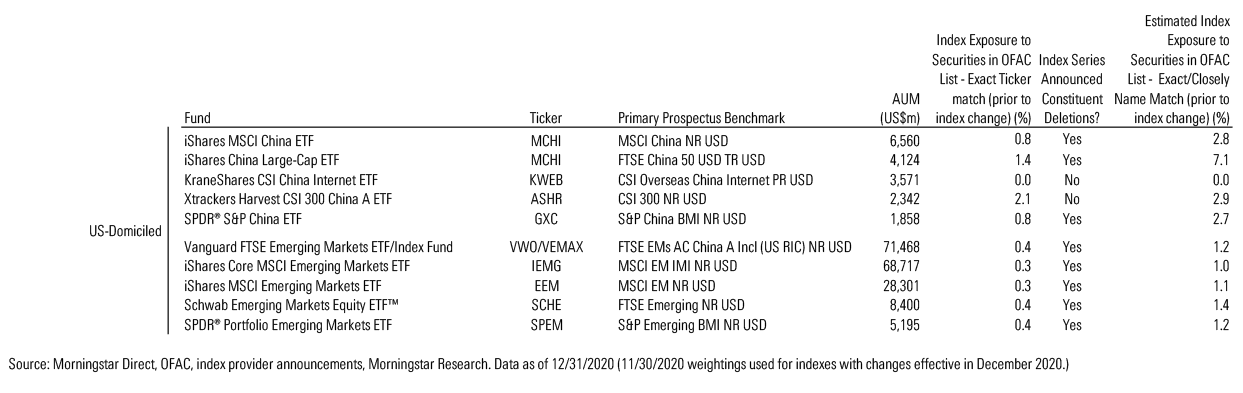

As it pertains to index-tracking products, irrespective of domicile (US and non-US), many funds tracking the affected indexes either have or are expected to follow the indexes' adjustments, depending on the effective dates of the changes for the relevant index. To comply with the latest OFAC guidance, US index funds and ETFs would likely have to sell their holdings in subsidiaries and ADRs not excluded by the relevant indexes. For index funds and ETFs domiciled in the US tracking an index that may not remove the securities listed in the OFAC list, we believe the managers will have to remove those securities, including the subsidiaries, before Jan. 11, 2021. In both cases, US index funds and ETFs will likely incur some additional tracking error to accommodate these exclusions.

Depending on their Chinese equity exposure, these stocks' weightings range from 0.04% in the case of the MSCI ACWI to 2.21% in the MSCI China A Index. To comply with the latest OFAC guidance, US index funds and ETFs would likely have to sell their holdings in other subsidiaries not excluded by the relevant indexes.

The situation remains fluid, and we estimate that the sanctioned companies aren't likely a significant portion of most investors' portfolios. Thus, the investment implications for many are likely immaterial. That said, it's important for investors to understand the potential impact and to incorporate new information as it comes to light.

/s3.amazonaws.com/arc-authors/morningstar/4350bbc4-9f7e-4cd7-ab9d-ff0490158cb6.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4350bbc4-9f7e-4cd7-ab9d-ff0490158cb6.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)