33 Undervalued Stocks for 2021

Here are our analysts’ top ideas in each sector for the new year.

For the new list of Morningstar’s top analyst picks, read our latest edition of ”33 Undervalued Stocks.”

Despite a dramatic selloff in February and March, U.S. stocks finished 2020 with a remarkable 16% return, as measured by the S&P 500. Not surprisingly, we think stocks are overvalued today: The median stock in our North American coverage universe traded at a 6% premium to our fair value estimate at year’s end.

Only 18% of the stocks we cover have Morningstar Ratings of 4 or 5 stars, observes Dave Sekera, Morningstar's chief U.S. market strategist, in his latest stock market outlook. In aggregate, energy and real estate stocks look undervalued; the technology sector, meanwhile, is the most overvalued.

Here are some specific undervalued stocks across sectors that are among our analysts' best ideas.

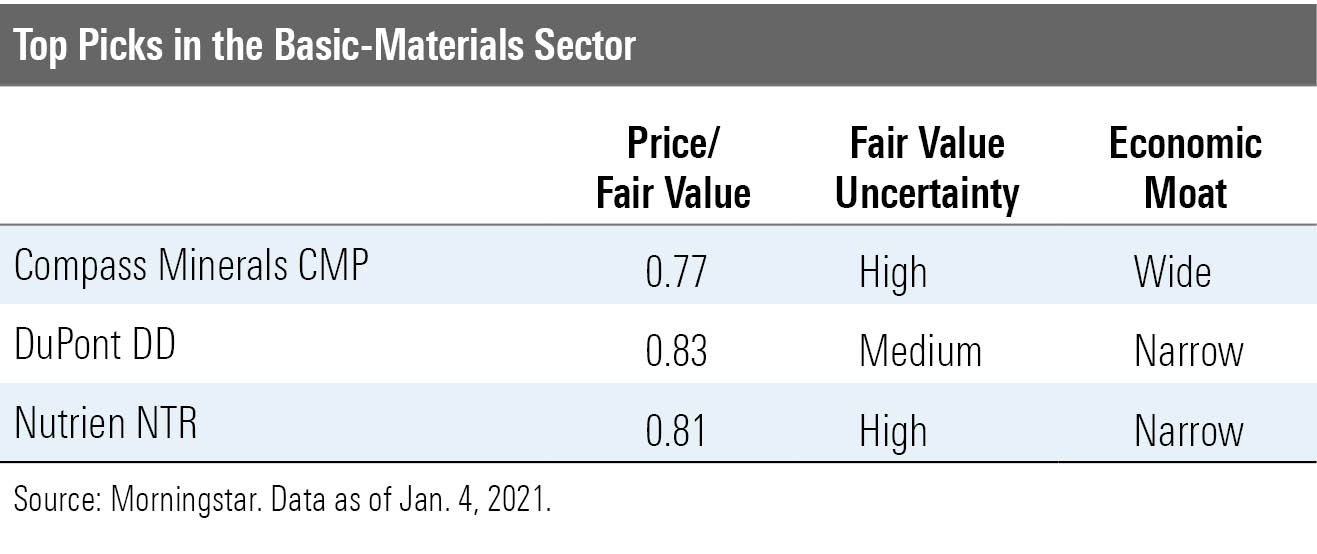

Basic Materials After underperforming the broader market in 2020, about 20% of the basic-materials stocks we cover are undervalued, reports senior analyst Seth Goldstein. He notes that the most-attractive opportunities in the sector can be found in the agriculture and chemicals industries.

In agriculture, we project potash demand to grow over the next several years; further, we expect chemicals producers to continue to see a recovery in demand in 2021. “This should bode well for specialty chemicals producers, whose differentiated products command premium pricing, driving profit recovery as volumes return,” concludes Goldstein.

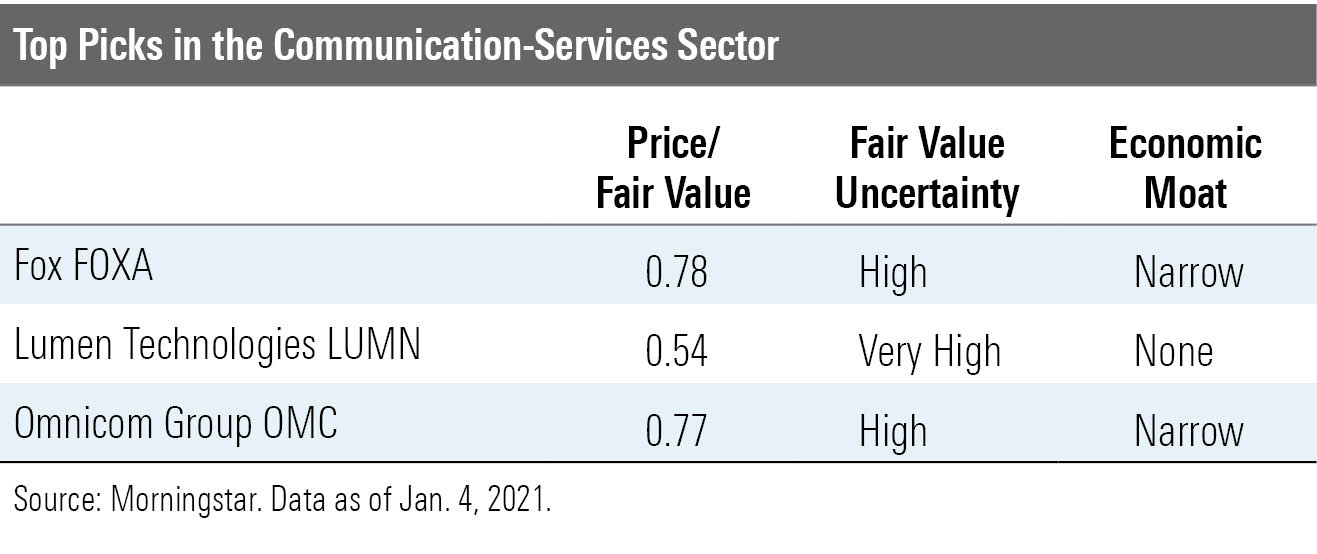

Communication Services The communication-services sector outperformed the broader market last year, despite the U.S. government’s suits filed against Alphabet GOOGL and Facebook FB--which account for a combined 45% of the sector’s market capitalization, remarks director Mike Hodel. “We suspect both cases will end up in the U.S. Supreme Court and ultimately be decided in the firms’ favor,” he argues.

A sharp uptick in online advertising demand near 2020's end drove up valuations for online platforms such as Pinterest PINS, Snap SNAP, and Twitter TWTR. As a result, traditional media and telecom stocks look the most attractive from a valuation perspective, maintains Hodel.

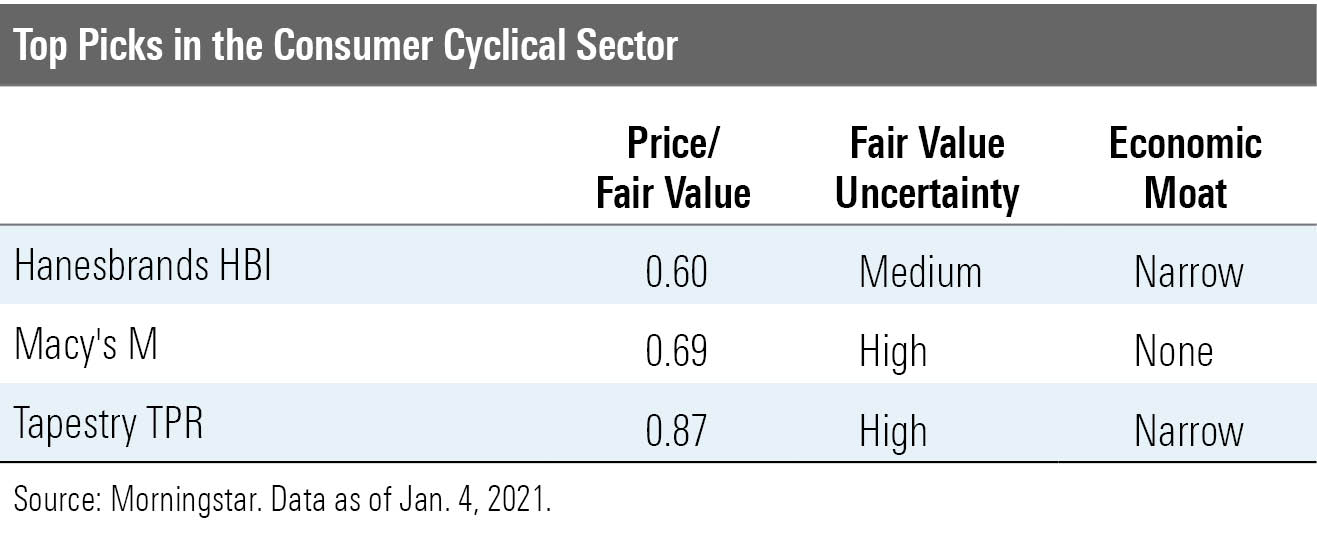

Consumer Cyclical Consumer cyclical stocks enjoyed a robust 2020, more than doubling the performance of the broader market. The median consumer stock in our coverage universe is trading at a 4% premium to our fair value estimate, suggesting that the sector is fairly valued, points out director Erin Lash. “While the sector was plagued by shelter-in-place mandates at the onset of the pandemic, extra disposable income and a rise in e-commerce have since advanced consumer cyclical gains,” she explains.

Even as COVID-19 vaccines become more widely available, we expect the erosion of the department store channel to persist. We also expect a preference for local travel to continue into 2021, which may continue to hurt airline travel, suggests Lash. Investors can find modest values in the auto and restaurant industries.

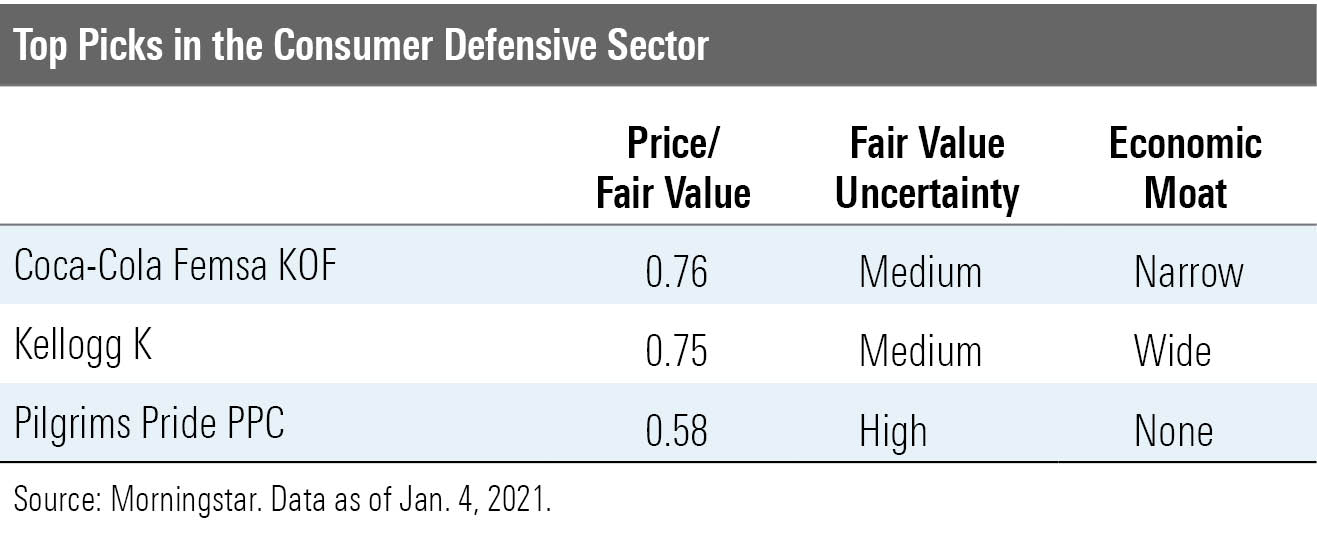

Consumer Defensive Consumer defensive stocks trailed the broader market's gains in 2020. Nevertheless, we think the sector looks overvalued, with the median stock in our coverage universe trading 7% above our fair value estimate, observes Lash. However, 20% of the combined retail defensive and consumer packaged goods names are trading in 4- and 5-star range, suggesting that they're undervalued.

"One byproduct of the pandemic has been an increased shift toward e-commerce for consumer packaged goods, where penetration has languished for some time," says Lash. This recent uptick reinforces our expectation that e-commerce will rise to a mid-single-digit level of consumer-packaged-goods sales in the next few years.

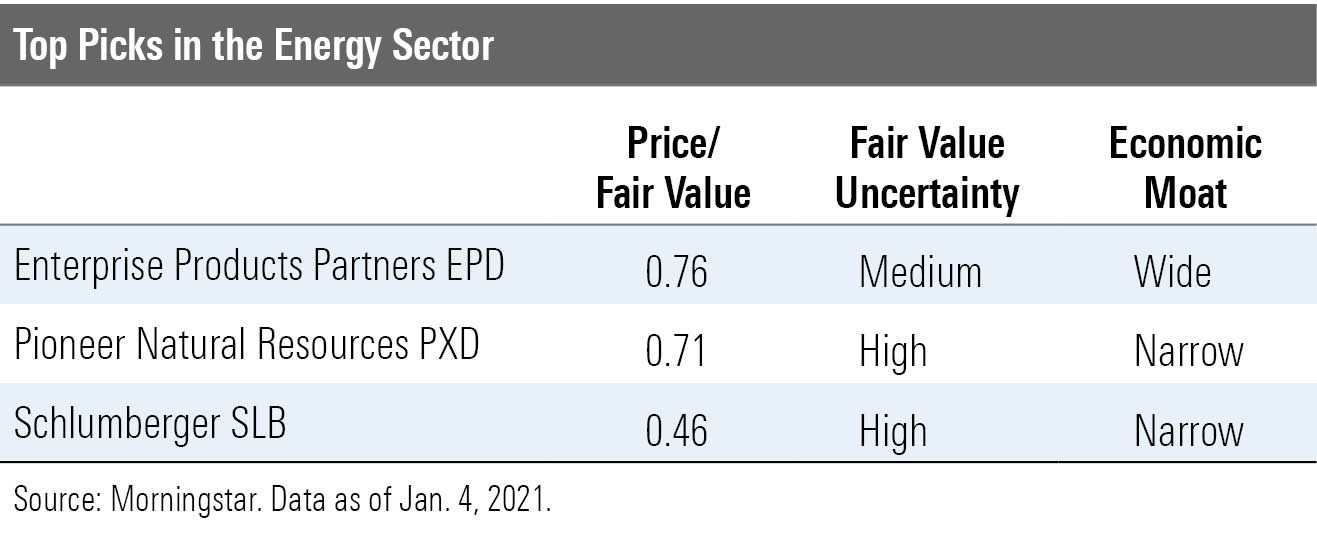

Energy Although energy stocks outpaced the broader market in the fourth quarter of 2020, they finished the year well in the red. Not surprisingly, the energy sector is the most undervalued by our metrics, trading at a 22% discount to our fair value estimate, reports director Dave Meats. "We still anticipate a near-complete recovery in crude demand when the pandemic recedes in 2021," he adds.

Meats acknowledges that uncertainty remains in the timing of the recovery, as a resurgence in COVID-19 cases has forced governments to again extend lockdowns and travel restrictions, suppressing consumption. That being said, we expect consumption to be near prepandemic projections by 2023.

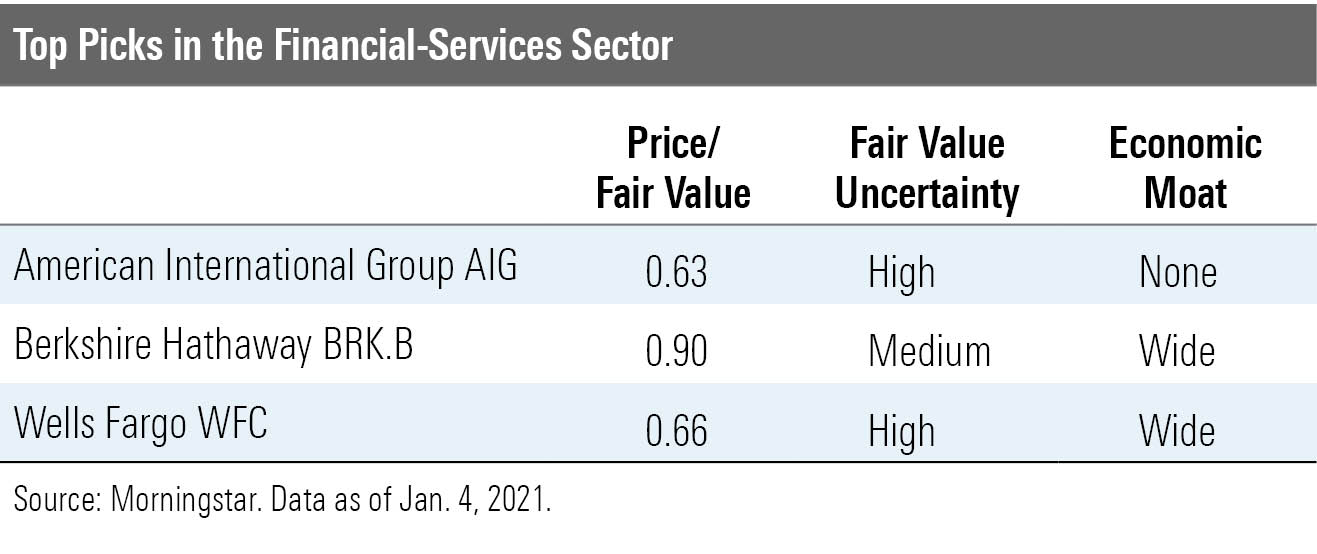

Financial Services Though they outperformed in the fourth quarter, financial-services stocks trailed the broader market by a significant margin last year. Nevertheless, the median financial sector stock is trading at a 6% premium to its fair value estimate, indicating that the sector is overvalued, explains director Michael Wong.

"The outlook for two of the primary drivers of banking profitability, interest rates and loan charge-offs, has recently improved," he continues. Meanwhile, nonbank industries in the sector are in various stages of earnings recovery. We expect earnings to grow this year for nearly all financial industries. The exception may be capital markets, as trading and investment banking revenue remained strong in 2020, Wong concludes.

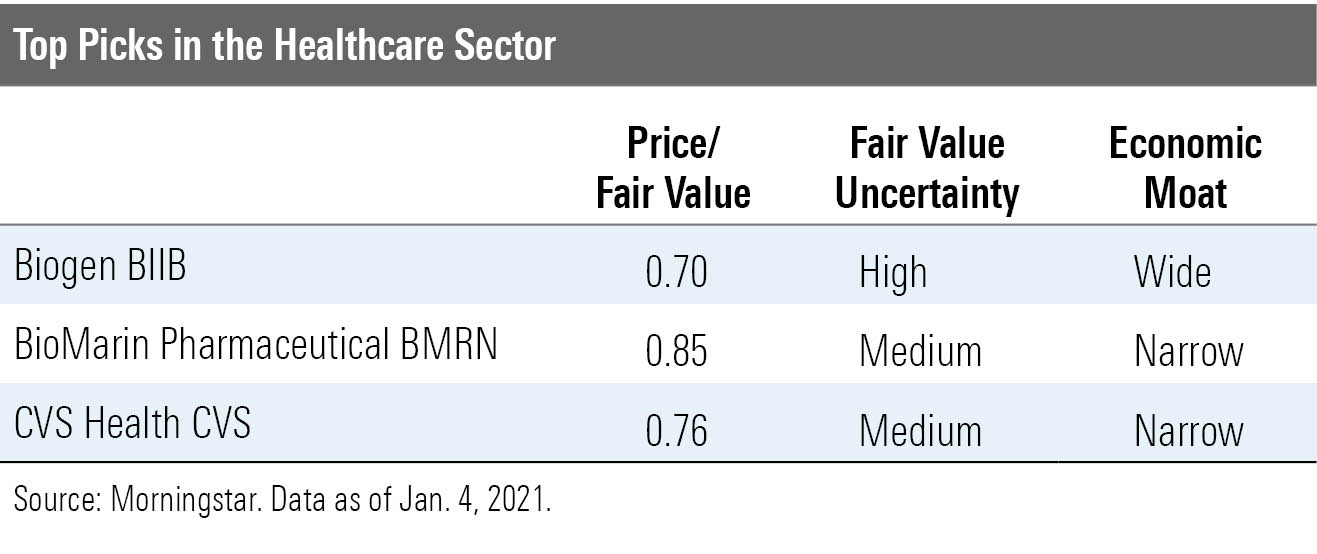

Healthcare Healthcare stocks slightly lagged the broader market last year, despite largely solid underlying fundamentals in the sector, says sector director Damien Conover. Why? We believe some concerns remain about changes to U.S. healthcare policy. "Overall, we don't expect any major changes regarding healthcare reform, but rather more moderate changes that target insuring more people and easing some of the patent costs around specialty drugs," he notes.

The median healthcare stock we cover is trading at a 9% premium to its fair value estimate, suggesting the sector is overvalued. We continue to see the most undervalued firms in the drug manufacturer and managed-care industries, reports Conover. We believe the drug firms may end the pandemic with vaccines, thereby generating goodwill that the firms can potentially use to support overall drug pricing.

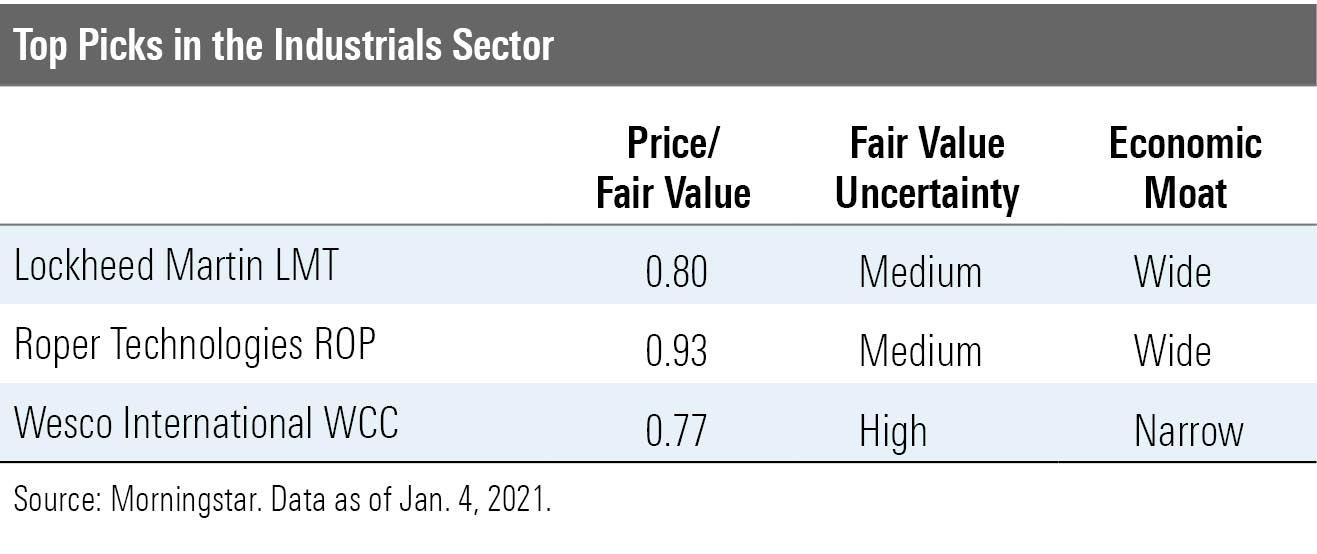

Industrials Despite a sharp fourth-quarter rebound in construction, industrial distribution, and farm and heavy construction machinery stocks, the industrials sector lagged the broader market in 2020. Yet few industrials stocks are undervalued today, maintains sector director Brian Bernard.

There are pockets of opportunity among aerospace and defense firms. "While a new U.S. administration introduces defense budget uncertainty, we still expect elevated spending on missiles, missile defense, and space militarization as the U.S. defends against great powers conflict," he adds. Moreover, President-elect Joe Biden's promised infrastructure plan would be a boon for construction-oriented industrials.

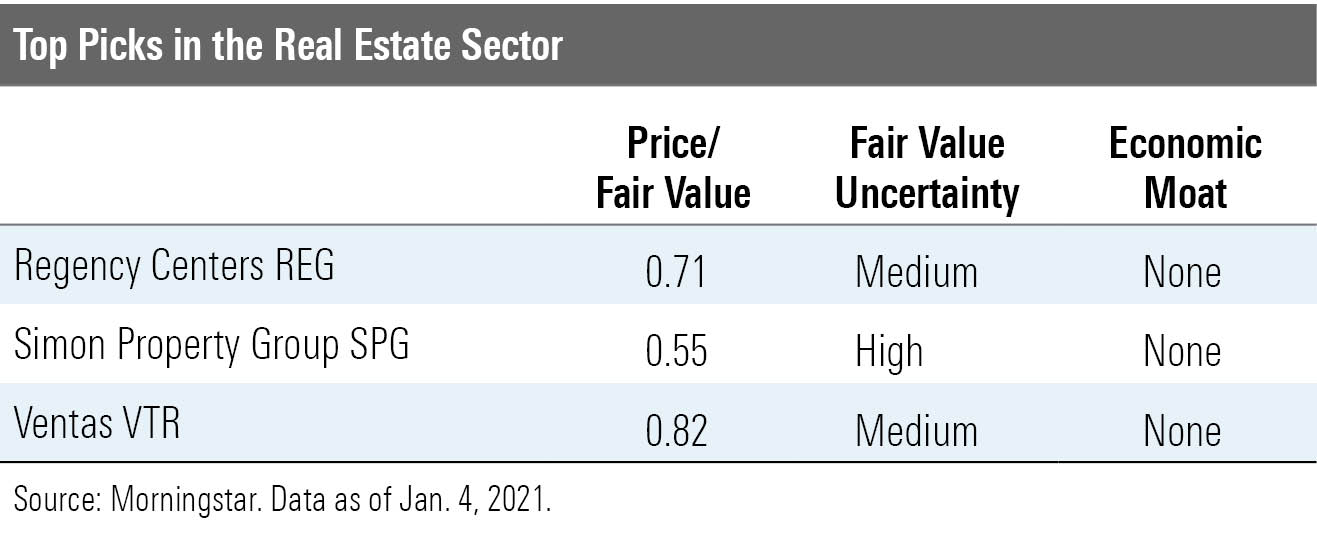

Real Estate The real estate sector fell in 2020, lagging the broader market by a significant margin. We've seen a significant bifurcation in the performance of various subsectors, reports analyst Kevin Brown. Sectors that are more sensitive to the impacts of the coronavirus--including hotels and malls--have struggled most, while those in the industrial and self-storage industries have fared far better.

Not surprisingly, the median stock in our real estate coverage universe is trading at a sizable 9% discount to fair value, says Brown--with the most appealing values resting in the hardest-hit subsectors. "Given our long-term outlook, we believe that the hotel and mall sectors will rebound and see years of strong growth once the global crisis is over," he concludes.

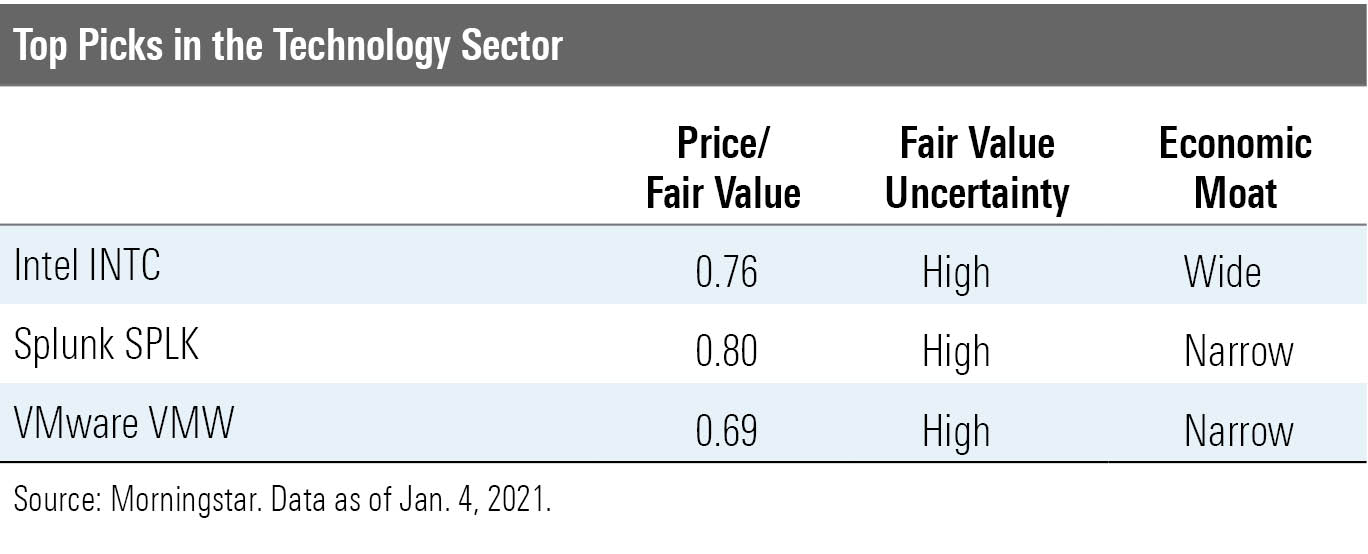

Technology The technology sector enjoyed stunning outperformance in 2020, more than doubling the return of the broader market. "We still wouldn't characterize this rise as a bubble across the higher-quality, larger-cap tech names we cover, as we see robust fundamental tailwinds supporting future growth for most of our coverage," reports director Brian Colello. That being said, we think the sector overall is significantly overvalued, with the median stock in our coverage universe trading at a 20% premium to intrinsic value at year's end.

Indeed, buying opportunities are rare. Hardware is the cheapest subsector--but it's still about 12% overvalued. And the best-positioned names for the remote-work trend are rich. "Independent of valuation, we remain especially fond of moaty software businesses, as these firms generate revenue on a subscription basis with little risk of cancellations," says Colello.

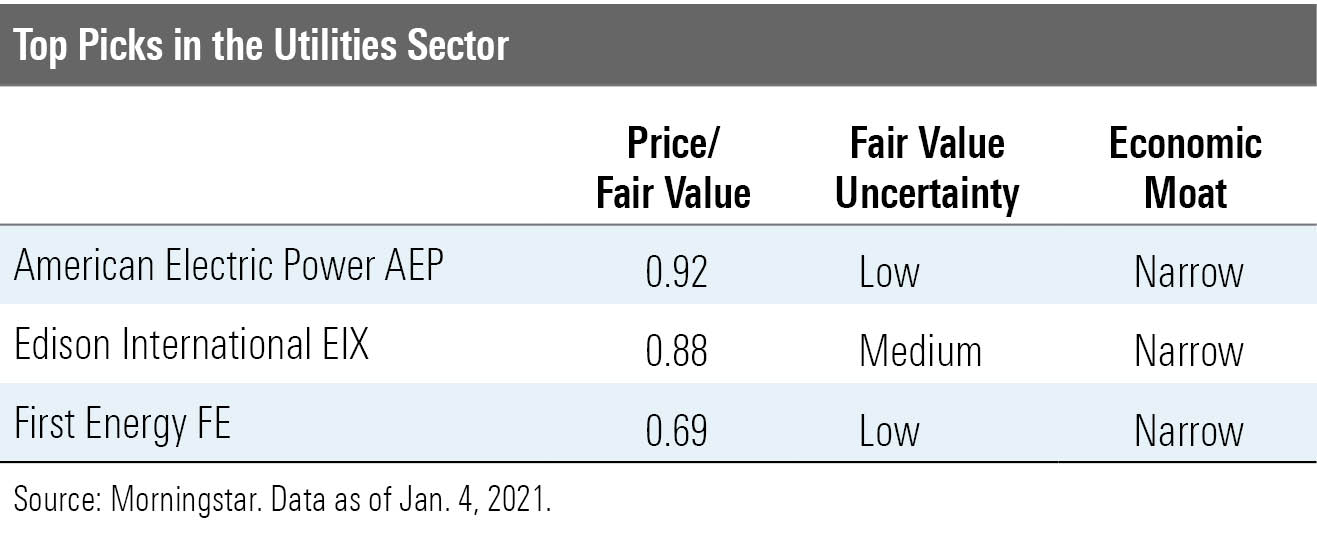

Utilities The sector closed 2020 well behind the broader market, and as a result, utilities enter 2021 as fairly valued and far more appealing investments than a year ago, suggests strategist Travis Miller. "The sector's 3.3% average dividend yield remains exceptionally attractive relative to ultralow interest rates," he adds.

We expect renewable energy to be the theme for 2021 and beyond, with the winners being those that can execute by completing projects on time and on budget and maintain steady earnings growth, says Miller. However, valuations remain rich for the highest-quality utilities with the best earnings and dividend growth; the best opportunities can be found among less obvious beneficiaries of the renewable energy movement with strong balance sheets and solid dividends.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)