Did ESG Pay Off for Fund Investors Last Year? Yes and No.

Funds courting less ESG risk topped their indexes more often than funds courting more ESG risk in a topsy-turvy 2020.

Executive Summary

- Funds courting less environmental, social, and governance risk beat their benchmark indexes more often, and by larger average margins, than funds courting more ESG risk in 2020.

- The relationship between ESG risk and fund success was weaker when it came to "intentional" funds that explicitly aim to advance ESG goals than it was among funds not seeking to advance such goals.

- International stock funds courting low ESG risk beat their indexes about twice as often as those courting high ESG risk, but the relationship was weaker for U.S. stock funds.

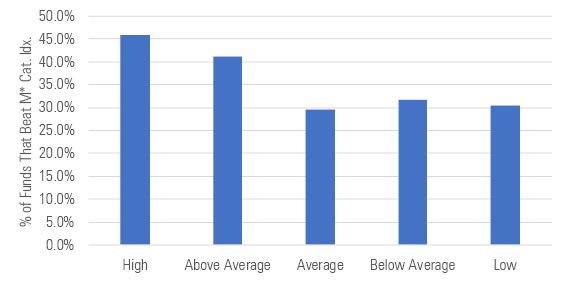

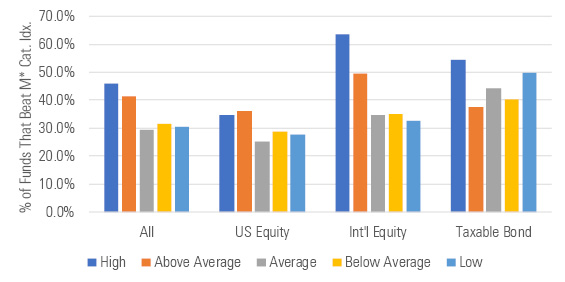

Exhibit 1: Percentage of ESG-Rated Funds That Beat Their Index in 2020, by Rating (as of Dec. 31, 2020; vs. M* Category index; includes dead funds; oldest share class only)

- source: Morningstar Analysts

Introduction Investors might consider an ESG fund for various reasons, such as a desire to advance nonfinancial goals like combating climate change, or pursuing racial and gender equity. Whatever the goals, there's been a lot of debate about the relationship between ESG and investment performance. Some argue it hurts returns while others say the opposite. Given this, we thought we'd examine how ESG-rated funds performed in 2020.

To briefly review, we assign Morningstar Sustainability Ratings, also known as “globe” ratings, to funds based on how much material unmanaged ESG risk their holdings court. Funds whose holdings court less ESG risk receive higher ratings (that is, 4 or 5 globes) while those whose holdings court more risk get lower ratings (that is, 1 or 2 globes).

To conduct our study of ESG-rated funds’ performance, we compiled the 2020 net returns of all stock and bond funds that had a Sustainability Rating as of Dec. 31, 2019. We compared each fund’s returns against those of the style-specific benchmark index assigned to it. For example, we compared the returns of ESG-rated large-growth funds to the Russell 1000 Growth Index, which is the index that corresponds to the large-growth Morningstar Category, and so forth.

Findings As shown in Exhibit 1, we found that funds with higher ESG ratings--that is, those that courted less ESG risk--beat their style-specific index more often than funds with lower ESG ratings. For instance, around 46% of funds rated "High" (meaning low ESG risk) generated higher returns than their benchmark while only 30% of funds rated "Low" (that is, high ESG risk) did the same.

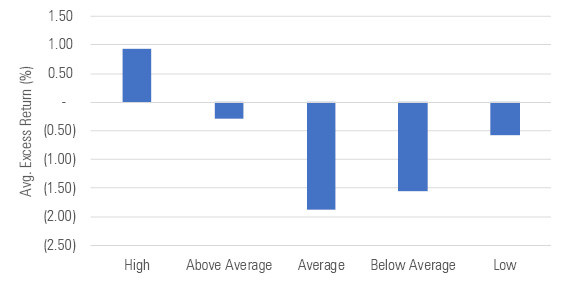

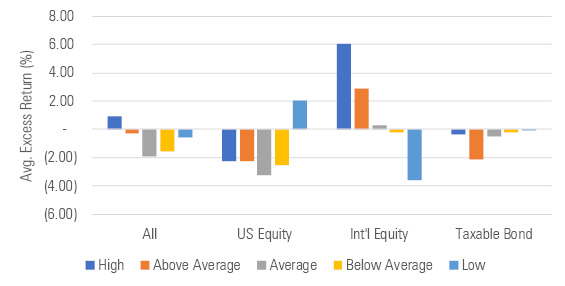

Funds with higher ESG ratings also bested their benchmarks by larger average margins than funds with lower ESG ratings. In other words, there was a better average payoff to investing in funds that courted less ESG risk.

Exhibit 2: 2020 Average Excess Returns of ESG-Rated Funds, by ESG Rating (as of Dec. 31, 2020; vs. M* Category index; includes dead funds; oldest share class only)

- source: Morningstar Analysts

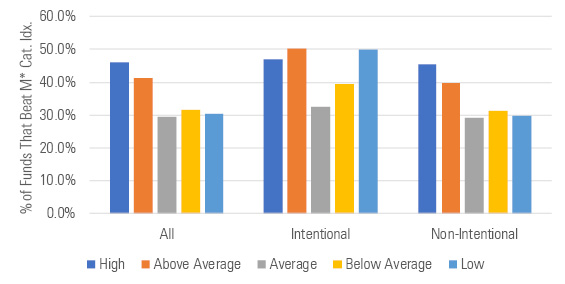

That said, some caveats apply. For one, when we look at success rates of ESG-rated funds by “intentionality” (that is, is the fund intentionally aiming to incorporate ESG, have an impact, and so on), we find success rates don't vary much by ESG rating. Put another way, success didn't depend as much on the level of ESG risk when the fund was explicitly trying to minimize ESG risk, though it’s worth noting that as a whole intentional funds succeeded more often than non-intentional funds.

Exhibit 3: Percentage of ESG-rated Funds That Beat Their Index in 2020, by Intentionality (as of Dec. 31, 2020; vs. M* Category index; includes dead funds; oldest share class only)

- source: Morningstar Analysts

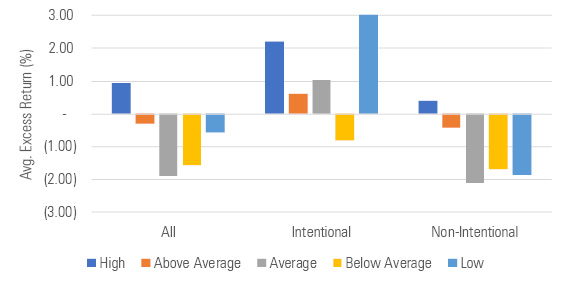

By contrast, there seemed to be a stronger relationship between ESG risk and the average payoff of investing in non-intentional funds. As shown below, there was a wider spread in the average excess returns of higher- and lower-ESG rated non-intentional funds than of intentional funds.

Exhibit 4: 2020 Average Excess Returns of ESG-Rated Funds, by Intentionality (as of Dec. 31, 2020; vs. M* Category index; includes dead funds; oldest share class only)

- source: Morningstar Analysts

(It’s worth noting here that there are relatively few "intentional" ESG funds. Of the 4,300-plus funds we examined, less than 500 had been tagged "Sustainable Investment--ESG Overall" as of Dec. 31, 2019, the starting point for the study. As such, non-intentional funds drive the overall results.)

Another caveat is that the relationship between ESG risk and fund success varied quite a bit by asset class. Nearly all ESG-rated funds invest in stocks, with U.S. stock funds accounting for nearly 60% of all ESG-rated funds. But the relationship between ESG risk and fund success wasn’t especially strong among U.S. stock funds. Rather, it was international stock funds where the higher ESG-rated (that is, lower ESG risk) succeeded nearly twice as often as the lower ESG-rated.

Exhibit 5: Percentage of ESG-Rated Funds That Beat Their Index in 2020, by Rating (as of Dec. 31, 2020; vs. M* Category index; includes dead funds; oldest share class only)

- source: Morningstar Analysts

This is even more apparent when we examine average excess returns by ESG risk and asset class. There's not a clear relationship between ESG risk and average payoff among U.S. stock funds and bond funds, whereas it's clearer among international stock funds.

Exhibit 6: 2020 Average Excess Returns of ESG-Rated Funds, by ESG Rating (as of Dec. 31, 2020; vs. M* Category index; includes dead funds; oldest share class only)

- source: Morningstar Analysts

Conclusion There's a lot of debate about whether incorporating ESG helps or hurts returns and the above--which covers a single year and looks at it based on a few relatively simple measures--is unlikely to settle it.

We’ll provide further analysis on the relationship between ESG risk and performance, including studies that control for other variable and risk factors, before long. Nonetheless, this study reveals some patterns that shed light on broader performance trends in 2020, trends that bear watching as more ESG funds launch in the future and other funds consider incorporating ESG into their investment process.

For Further Reference For further research on the relationship between ESG risk and investment performance, consider checking out these other pieces that my colleagues have published recently:

- Jon Hale's recurring series on ESG-fund performance

- "Sustainalytics: How Combining ESG Risk and Moat Ratings Can Benefit Portfolios"

- "ESG as a Factor"

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)