Contrarian Tilts for Your Portfolio

These areas stand to benefit from a global economic recovery.

Contrarian investing is easier said than done. In theory, it sounds easy: If conventional wisdom is often wrong, there should be room to outperform by taking the opposite position. In practice, though, areas that are out of favor often stay out of favor, while market darlings can stay in the spotlight longer than you might expect.

In this article, I'll discuss a few ideas for tilting your portfolio toward out-of-favor areas without taking on excessive risk. Some of these areas have already shown glimmers of brighter returns but have still lagged the broader market by fairly wide margins in recent years.

What Works With Contrarian Investing Having the right time horizon is one key to successful contrarian investing. Academic research has generally found that in the short term, stocks with strong recent performance tend to continue doing well. This momentum effect seems to hold over time periods of about a year, but performance trends can persist over multiyear periods.

That means a basic contrarian strategy of simply choosing stocks, sectors, or asset classes that have been out of favor doesn't always work. Indeed, the worst-performing sector or asset class in one calendar year often goes on to lag the following year, and sometimes for the following several years. However, reversion to the mean is a powerful force. Morningstar's Alex Bryan studied contrarian strategies over various time periods and found favoring sectors and asset classes that had lagged over the previous four- to five-year period generally led to better results.

Patience is also key. For example, our annual Buy the Unloved study focuses on fund categories with net outflows over the past year but assumes a three-year holding period. If you suspect you might be tempted to bail out if an area continues to lag, going against the grain probably isn't the best approach. Even if you're willing to hold on through potential underperformance, it makes sense to limit the percentage of your portfolio devoted to contrarian plays. While your risk tolerance may vary, capping contrarian bets at 5% to 10% of assets is a reasonable limit.

Ideas for Contrarian Tilts With those caveats in place, here are some ideas to consider adding to your portfolio.

International stocks: Stocks outside of the United States have shown a hint of promise in recent months but have still trailed domestic market benchmarks by a huge margin over longer periods. Over the 10-year period ended in December 2020, the MSCI EAFE Index posted annualized returns of just 5.5% per year, compared with 13.4% for the S&P 500. This dismal performance owes to a few different factors, including lower earnings-growth rates for non-U.S. companies, lighter exposure to the technology sector, and the U.S. dollar's generally strong upward trend since mid-2011.

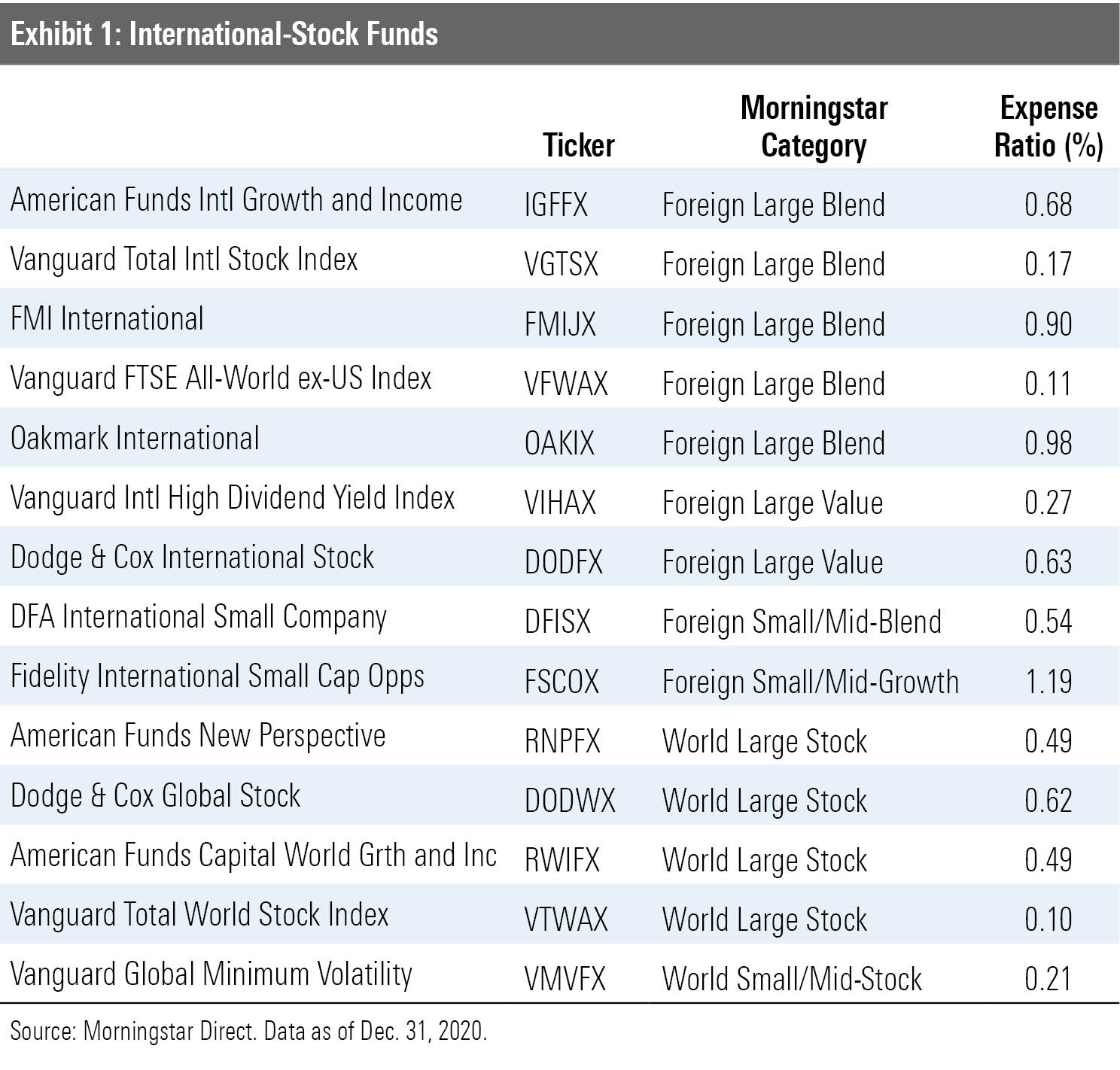

Recently, the dollar's strength has shown some signs of reversing, contributing to a stronger showing from international stocks. A global post-coronavirus economic recovery combined with continued weakness in the U.S. dollar would be positive for non-U.S. markets. The table below shows selected international mutual funds that garner Morningstar Analyst Ratings of Gold and have relatively low expense ratios. Most of these are broadly diversified, but a few target more-specific areas that have been out of favor, including smaller-cap stocks and value-oriented issues (which have lagged globally).

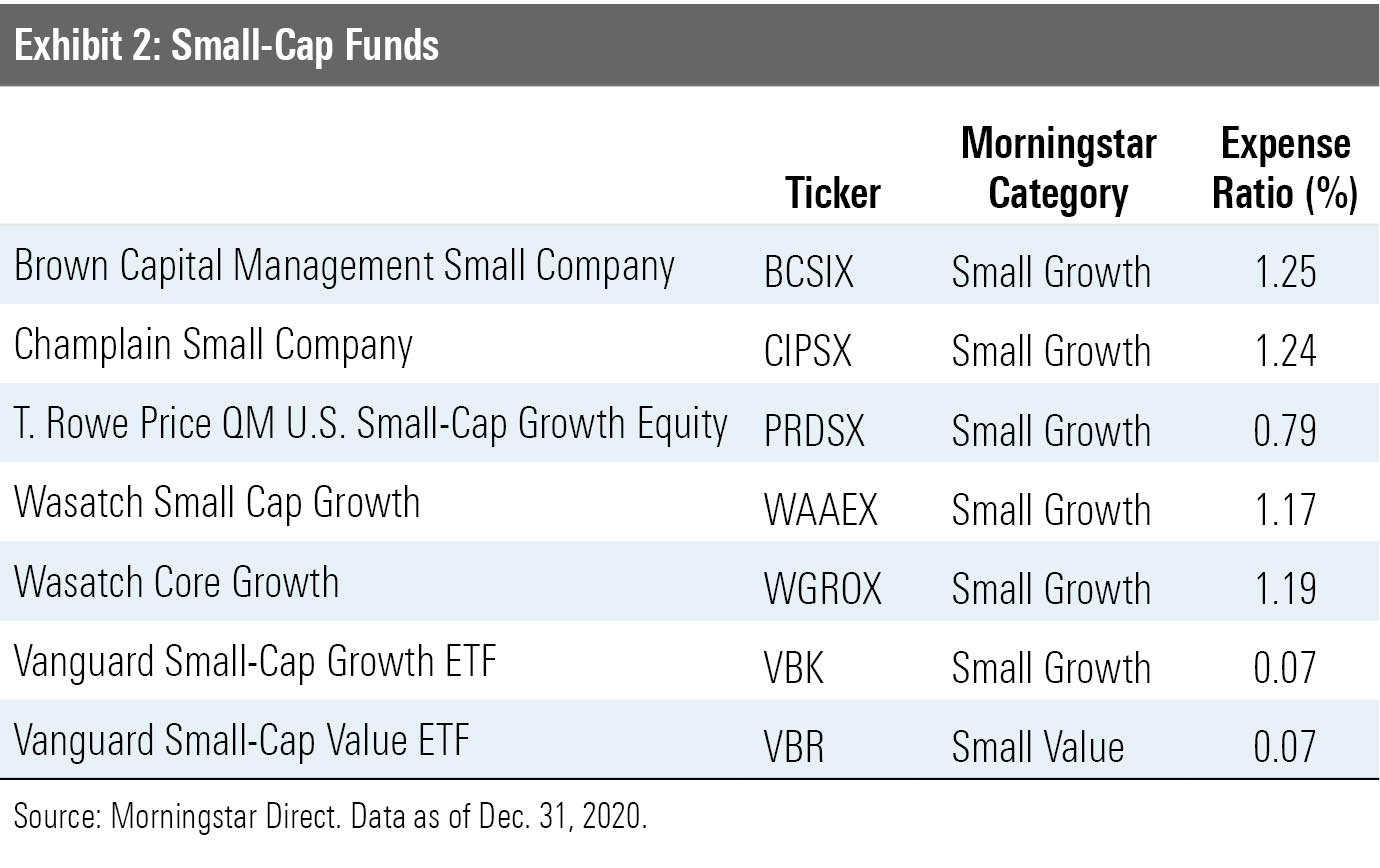

Smaller-cap stocks: Academic research has found that smaller-cap stocks tend to outperform over longer time periods even after adjusting for higher levels of market-related risk. However, this small-cap effect has been harder to find in recent years, as larger stocks have taken a strong lead over the past decade. Part of this likely reflects differences in profitability; while the market's biggest firms have continued widening their profit margins, smaller-cap issues have lagged. That relative weakness also means that smaller firms have more room to improve during periods of economic recovery. If history is any guide, small-cap stocks could fare better as the economy regains strength over the next couple of years.

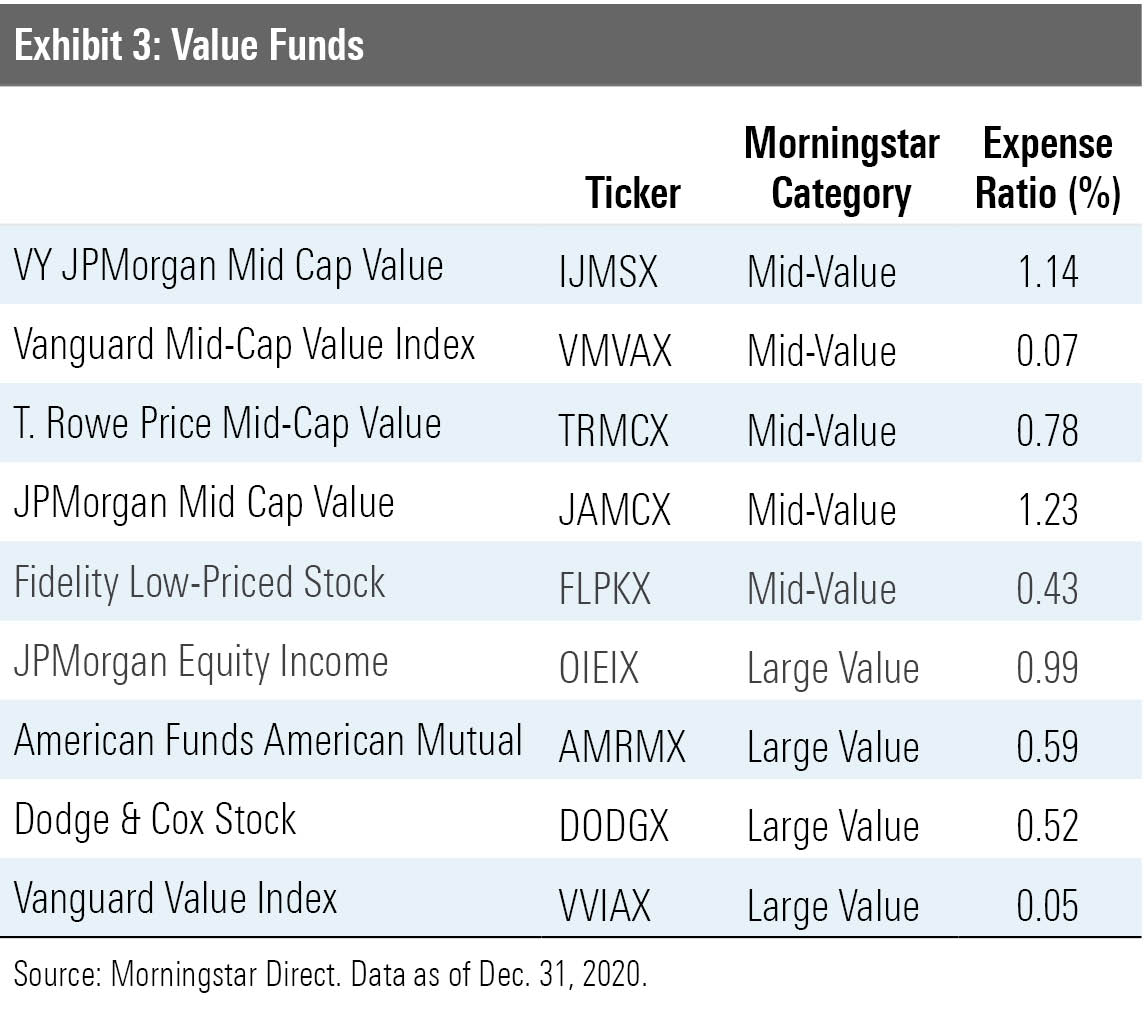

Value: This is another case where academic theory has been jarringly out of tune with market returns in recent years. Value stocks, the theory goes, perform well over longer periods partly because their low prices give them more room to rise. Why that hasn't worked recently is unclear; it could partly reflect limitations inherent in traditional value metrics, such as price/book value, which don't capture the value of intangible assets.

Value's underperformance is also partly a sector story. On average, value indexes have far less exposure to technology stocks, which have led the market, and more exposure to financials and energy stocks, which have fallen far behind. In addition, companies trading at lower valuations tend to have weaker financial health, which has also held back performance. However, these stocks generally fare better during periods of economic recovery. Broad-based value indexes such as the Russell 1000 Value started showing more signs of life thanks to positive COVID-19 vaccine news in November and December 2020.

Sector-Focused Contrarian Tilts For the next three areas, I focused on sectors that have not only been out of favor for the past five years but are also trading at a discount to our analysts' estimates of their underlying fair value. That should improve the odds that performance will eventually reverse course. Again, patience is paramount, especially in more specialized areas.

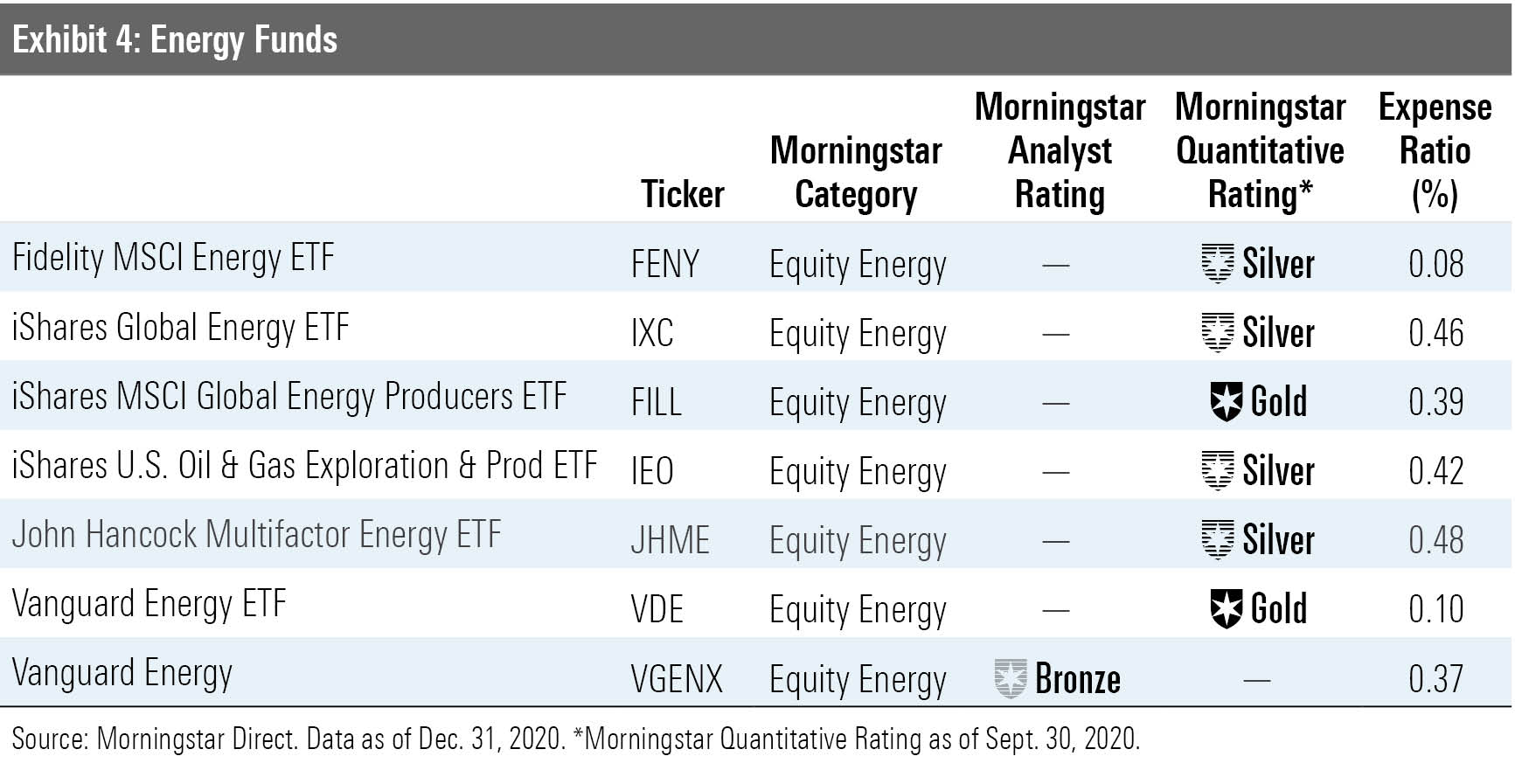

Energy: The energy sector has been sorely out of favor for several years running. As a result, energy investors have lost money over the trailing five- and 10-year periods. Even after energy stocks rallied in December 2020, the S&P 1500 Energy Index still lost an average of 3.4% per year over the trailing 10-year period ended in 2020. The sector has been hit by a glut of supply and a sudden drop in demand as the pandemic put a sudden halt on travel and daily commuting.

As global economies recover, increased commuting and travel activity should help bolster demand. There are still long-term risks, such as growing social and political opposition to traditional hydrocarbon energy companies, as well as excess capacity. However, the average energy stock in our coverage universe now trades at a 21% discount to estimated fair value, giving them a generous margin of safety to mitigate potential risks.

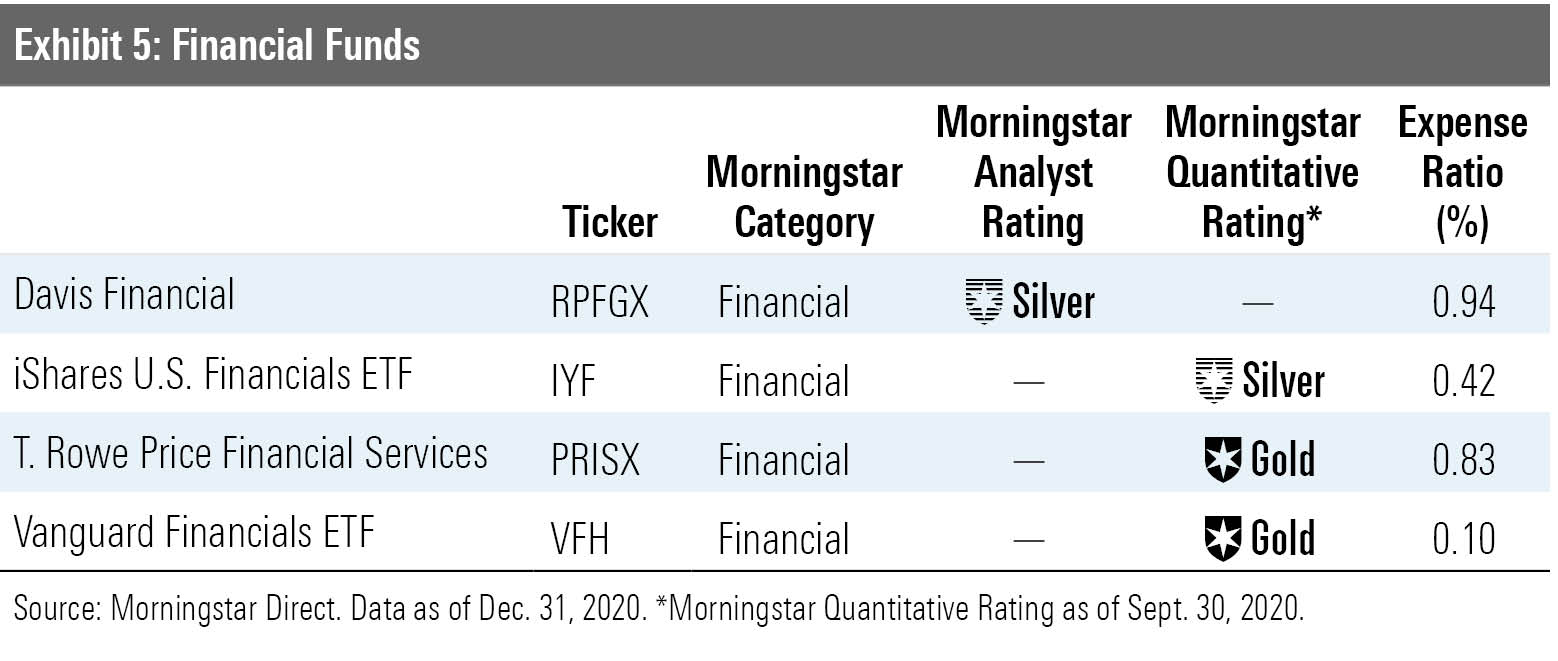

Financials: Financial stocks haven't underperformed as much as the energy sector but have still lagged the broader market by about 4 percentage points per year over the past five years. While declining interest rates generally boost valuations for stocks in general, they often compress profit margins for financial firms as the gap narrows between what banks can earn and what they charge for customer loans.

But now that interest rates are at a multidecade low, there's not much room for them to fall farther. If stronger economic growth leads to higher interest rates, profit margins should expand. In addition, most financial firms have significantly better financial positions than they did during the global financial crisis in 2008 and 2009. Banks have tightened lending standards and increased loan-loss reserves. On average, financial stocks in Morningstar's coverage universe are trading at a discount of 1% to estimated fair value.

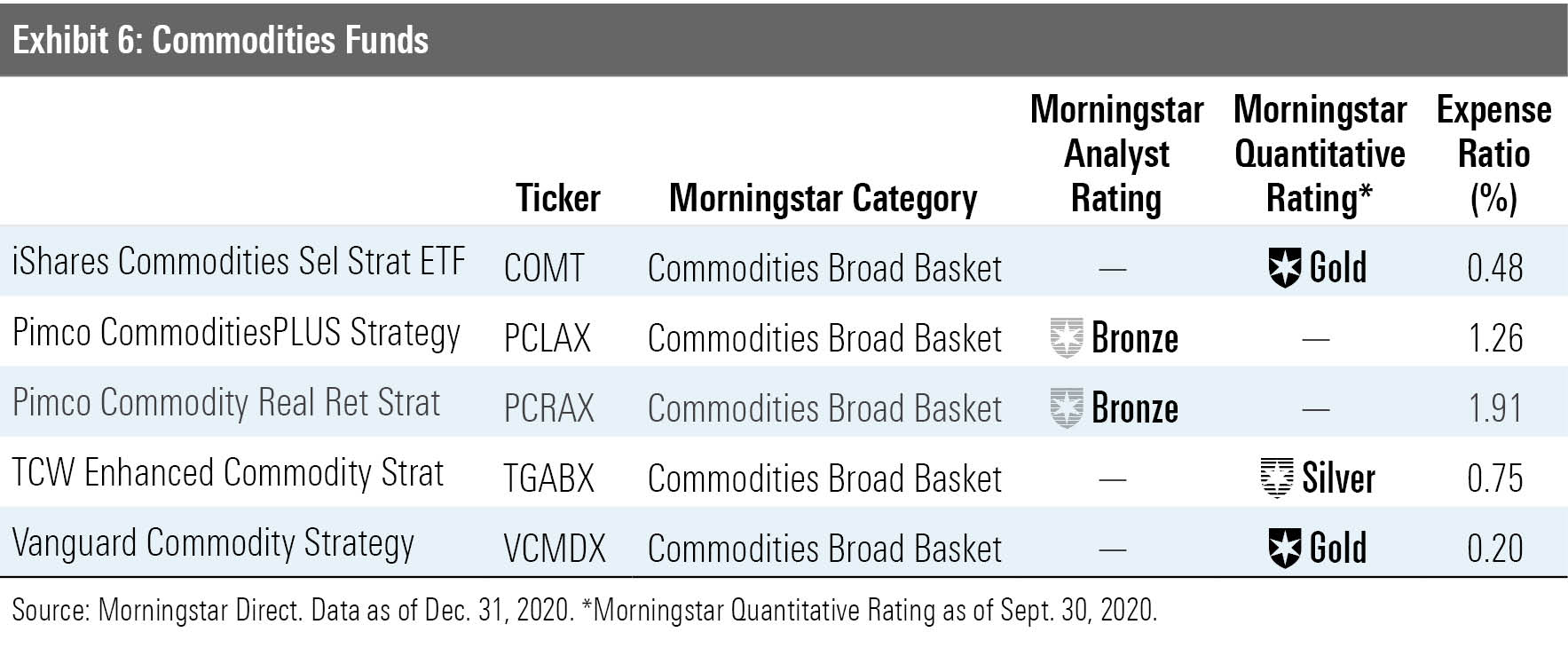

Commodities: Strictly speaking, commodities are a distinct asset class and not a separate sector. They consist of raw materials used to manufacture other things, such as steel, crude oil, aluminum, lithium, and chemicals used in agriculture and industrial production. After some strong showings earlier in the decade, the Bloomberg Commodity TR Index posted negative total returns in each year from 2011 through 2015, followed by additional losses in 2018 and 2020. Commodity performance is tightly linked to global economic growth, and performance suffered partly because of a falloff in demand from China and other major commodity markets.

However, the inherently cyclical nature of commodities means the asset class should also benefit as global economies improve. An increase in infrastructure investment would also boost demand for commodities. Finally, commodities have historically had low correlations with both stocks and bonds, making them an excellent portfolio diversifier when used in small doses, as well as a potential hedge against higher inflation.

Conclusion Given the market's surprisingly strong showing for most of 2020, overall valuations are relatively steep. But it's still possible to find pockets of value by zeroing in on areas that have not only been out of favor but also stand to benefit from shifting trends as global economies recover from the pandemic.

Correction: An earlier version of this article incorrectly stated the Morningstar Quantitative Ratings for four funds. In Exhibit 4, the ratings for iShares Global Energy ETF, iShares U.S. Oil & Gas Exploration & Production ETF, and John Hancock Multifactor Energy ETF were changed to Silver from Gold. In Exhibit 6, TCW Enhanced Commodity Strategy's rating was corrected to Silver from Gold (Jan. 6, 2021).

An earlier version of the article displayed data and ratings for iShares Global Financials ETF in Exhibit 5. The fund was replaced with iShares U.S. Financials ETF (Jan. 6, 2021).

Exhibits 4, 5, and 6 were updated to indicate that the Morningstar Quantitative Ratings were as of Sept. 30, 2020 (Jan. 6, 2021).

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)