Small-Cap Value Comes Back--But Not All the Way

It's too soon to tell whether small-value's November resurgence will endure.

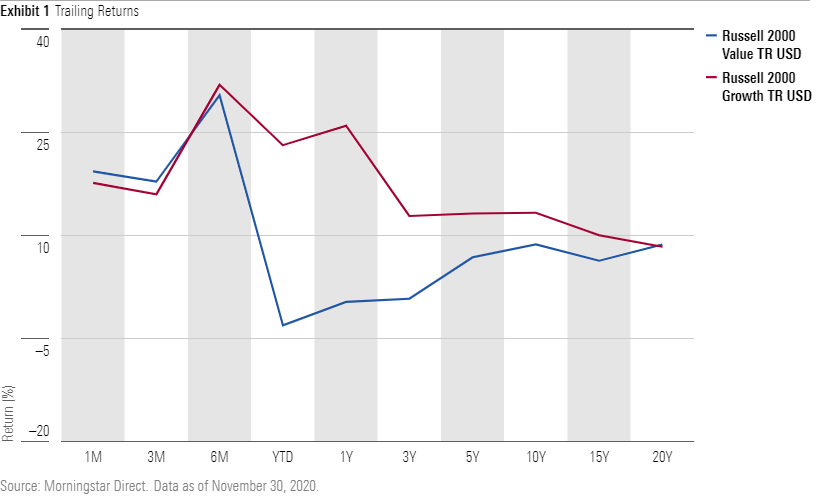

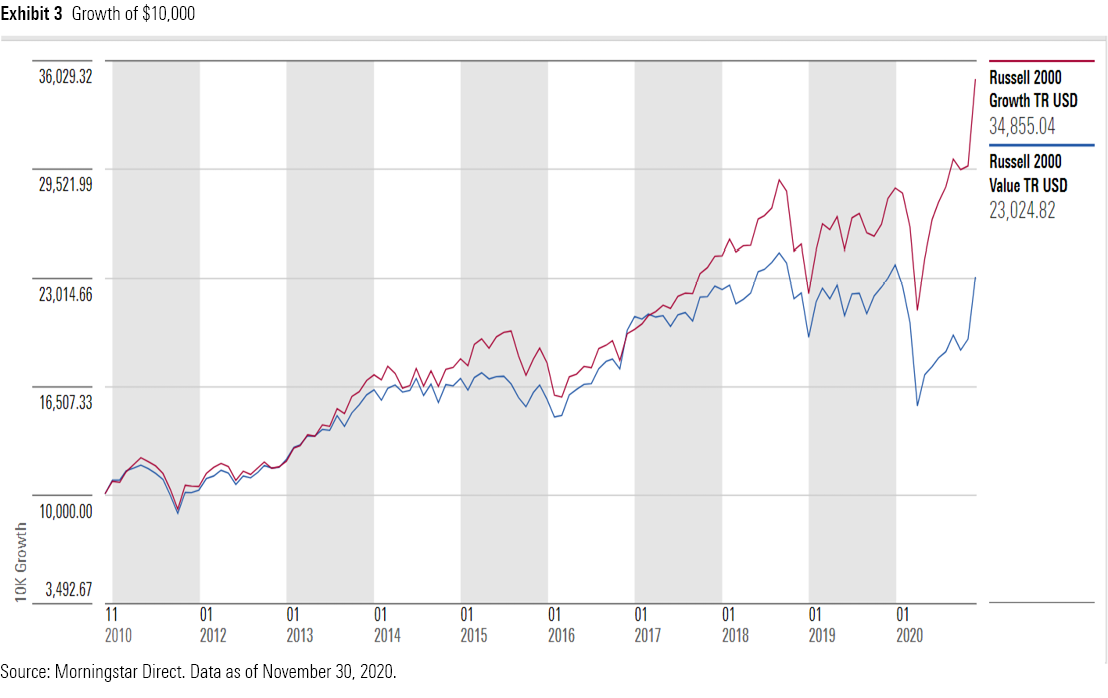

Small-cap value has surged back in the fourth quarter, but it still has a long way to go to recoup years of relative underperformance. The Russell 2000 and Russell 2000 Value indexes rose 18.4% and 19.3%, respectively in November, their best absolute gains since their December 1978 inceptions. The Russell 2000 Growth Index, however, posted a strong 17.6% rise itself and remained far ahead of both its sibling benchmarks for the year and over longer trailing periods through November. The Russell 2000 Value’s paltry 0.8% annualized trailing three-year gain through month's end, for instance, trailed the Russell 2000 Growth Index’s advance by 12 percentage points.

Still, many investors wonder whether November’s sharp value rally signals a sea change. The answer is maybe. It’s too soon to tell.

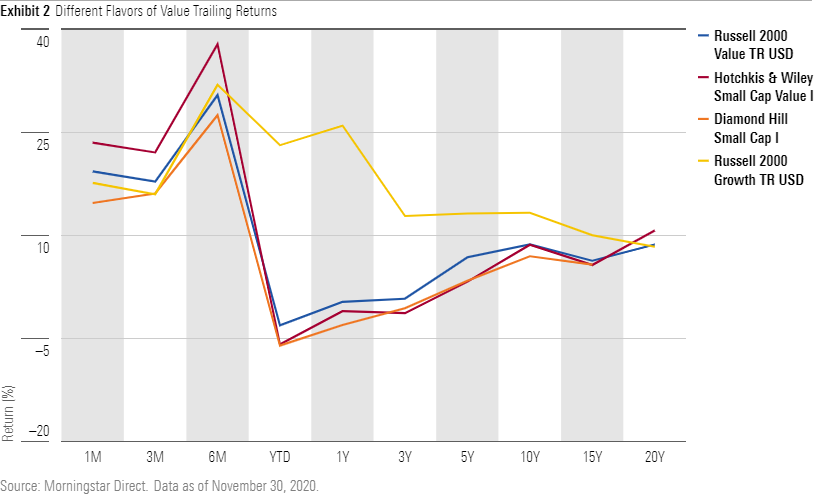

The November rally lifted all small-value Morningstar Category managers. Every fund in the peer group rose for the month, something that has happened 28 times in the past 10 years or 120 months. Deep-value managers thrived. Hotchkis & Wiley Small Cap Value HWSIX, for example, gained 23.5% in November as the downtrodden stocks it favors like Euronet Worldwide EEFT and Seritage Growth Properties SRG propelled results. Relative value managers posted absolute gains but did not fare as well as their deep-value counterparts. Diamond Hill Small Cap DHSIX, a value fund that tends to avoid the most challenged businesses that rebounded the most in November, gained 14.7% in the month.

Like the indexes, however, value managers have a long way to go before catching up with growth or recouping losses incurred this year. Both Hotchkis & Wiley Small Cap Value and Diamond Hill Small Cap were still down about 6% for the year through November and are also down for the trailing three years through November. Only 32 of 118 small-value funds overall (based on oldest share class) had posted positive returns for the year through November. Nevertheless, a few positive trends contributed to the strong month. According to portfolio manager Bill Hench of Royce Opportunity RYPNX, few companies announced earnings disappointments; those who had been selling value stocks abated a bit; fundamental news was pretty good, especially from companies supplying auto, food, housing, and capital goods companies, where there had been little capital investment and inventories were tight; and the risk/reward proposition was pretty good. Other managers point out a still-large valuation difference between value and growth, but it’s hard to say when that will close.

History is not much of a guide. In fact, relative to past value-dominant months, November 2020 isn’t that impressive. While the Russell 2000 Value Index set an absolute record, its performance relative to the Russell 2000 Growth Index did not stand out compared with history. Small-value outpaced small-growth by just 1.7 percentage points. In November 2000, as small-value stocks were emerging from the shadow of the then-deflating Internet stock bubble, the value index beat the growth index by 16.1 percentage points after lagging it by 17.2 percentage points nine months earlier. That year proved to be an inflection point for small-value stocks, but we haven’t seen that dramatic a relative performance swing in 2020. Indeed, the growth index nearly doubled the value index's December gain through Dec. 22, helping the former index more than catch up to the latter for the fourth quarter.

A style reversal doesn’t have to start with a huge relative performance U-turn to be enduring, but there are other reasons for caution. Interest and tax rates are at post-World War II lows, making it easier to justify higher valuations for growth stocks whose peak earnings may be years in the future. Furthermore, many of the soaring growth stocks of this era are different than those of the dot-com boom and bust. They are generating, rather than burning, cash and have solid fundamentals. Ligand Pharmaceuticals LGND, for example, had a price/sales ratio of 10.2 in November--not cheap, but less than half its 29.2 price/sales ratio in early 2000.

There have been some signs of froth, such as the unraveling private office leasing firm WeWork’s lofty valuation before its aborted IPO and Tesla’s TSLA phenomenal rise. But the markets, while exuberant, are arguably not irrational. Many value-oriented managers like Hench acknowledge that while they aren’t willing to pay higher prices for high-flying growth stocks, they can understand why others might, given the franchises’ cash flow and disruptive business models. Their recent reprieve was a long time coming, but few if any value managers are preparing to take victory laps--and they probably shouldn’t.

/s3.amazonaws.com/arc-authors/morningstar/c5cfeb1b-84bd-4fc2-9ea1-ed94bbd92e9f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c5cfeb1b-84bd-4fc2-9ea1-ed94bbd92e9f.jpg)