High Burnout Rate for Thematic Funds

These trend followers don’t make great investments.

A version of this article previously appeared in the November 2020 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

Thematic funds--investment strategies that try to profit from trends in the economy--have exploded in popularity over the past several years. Since January 2014, asset managers have brought more than 140 thematic funds to market, chasing a range of themes from artificial intelligence to disruptive healthcare technologies. Thematic investing isn't anything new. It has been a part of past market cycles, with funds popping up in the late stages of a bull market. But latching on to these trendy investments has some downsides.

On the surface, many thematic funds have undesirable traits. On average, thematic portfolios are far more concentrated than the global market portfolio (a proxy for the investment opportunity set), and they often levy considerable fees. The average thematic fund has almost half of its assets allocated to its 10 largest holdings, while that figure is about 12% for the MSCI ACWI Investable Market Index. A typical thematic fund charges more than 60 basis points, while funds tracking a basket of global stocks are available for less than a fourth of that price.

A closer examination of a typical thematic fund's life cycle helps further illustrate why thematic funds don't make great investments. These funds are typically launched late in bull markets, when asset prices are high and investors are more likely to feel adventurous. Subsequently, they often perform poorly. And the trends that they focus on tend to wane over time, making them less relevant in the future. As a result, they typically have short lives, so they are poor strategies for compounding wealth over the long run.

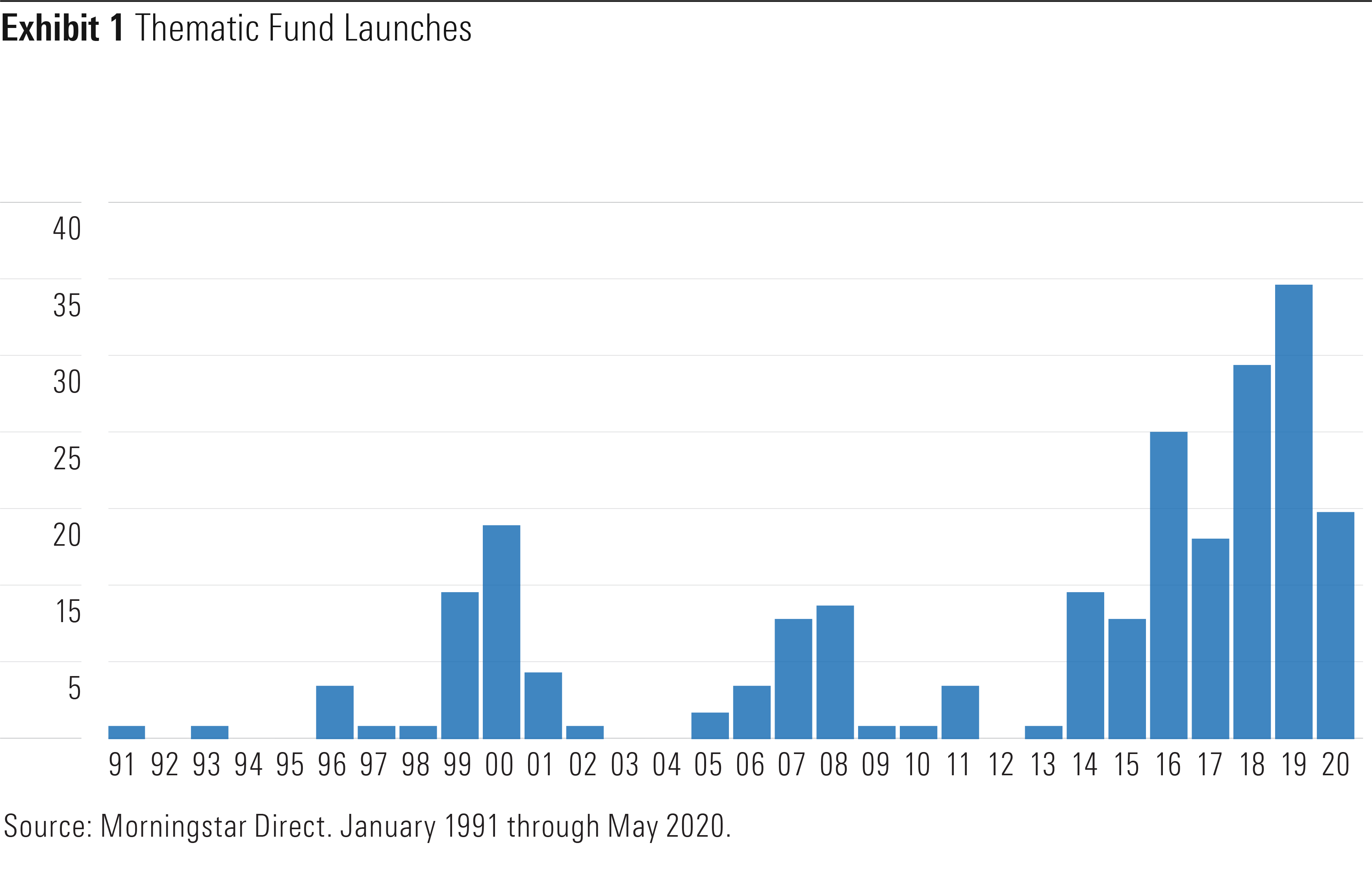

Challenged From the Start Historically, asset managers have shown a tendency to launch thematic funds in the late stages of a bull market, after trends have taken hold. That pattern emerges in Exhibit 1, which shows the number of thematic fund launches in each year over the past 25 years.

The number of funds launched from 2014 through the present stands out. Backed by one of the longest bull markets in U.S. history, asset managers took advantage of the exchange-traded fund wrapper to deliver many thematic strategies to investors. Thematic funds are attractive to asset managers because there is often less competition among these products than there is for broad market index funds and strategic-beta portfolios, making it easier to launch a differentiated product that can support high fees. Not all of these funds will last, but those that do can be profitable.

Launching thematic funds in the final years of a bull market sets them up for poor performance. Tapping into popular trends means these strategies likely hold stocks with strong recent performance--those that are more likely to be trading at prices above their intrinsic values. Thematic strategies are not immune to the relationship between price and expected performance, with sky-high prices translating into low expected returns. Even if a thematic fund isn't holding the hottest stocks, it is still exposed to market risk. So, these funds can head south when the market turns.

The initial performance of thematic funds illustrates that point. On average, thematic funds launched between January 1996 and July 2018 underperformed the MSCI ACWI Investable Market Index by 3.3 percentage points annually over their first two years of life.

In the context of good long-term investments, short-term underperformance might be something to shrug off. But that's different with thematic funds because the trends that these funds chase often don't remain popular for very long. Themes come and go, along with the funds that attempt to profit from them.

One reason lies with the durability of certain themes. Over the past 25 years, funds have attempted to profit from a wide range of themes that proved unsuccessful. Portfolios tracking trends in homeland security, 3D printing, and the recent U.S.-China trade war litter the thematic fund graveyard.

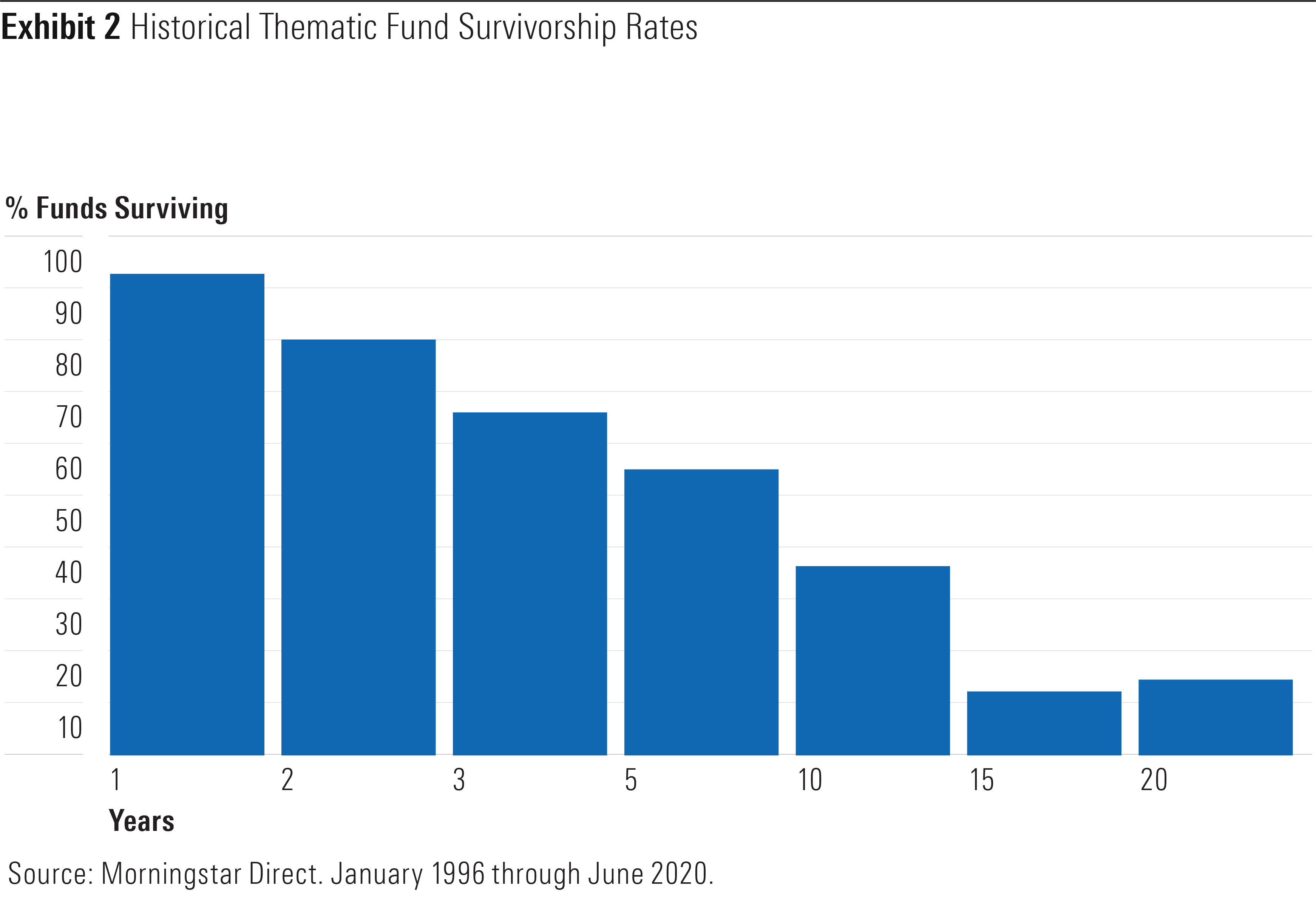

Even successful themes may not stick around for long. Historically, the chance that a thematic fund will shut down increases with age. The historical survivorship rates in Exhibit 2 show that roughly 94% of thematic funds made it through their first year, but less than 15% managed to endure for 15 years or longer. Short life spans are problematic as they prevent thematic funds from capturing the benefits of long-term compounding.

Changing With the Times Thematic funds launched in each period reflect the trends of their time. Internet funds dominated the landscape between 1996 and 2000, while water conservation and alternative/clean energy investments were popular between 2005 and 2008. The latest round of thematic funds started coming to the market in 2014. But this cohort lacks the consistency of the previous two epochs. Instead, asset managers launched funds spanning a wide range of topics, including online retail, cannabis, and artificial intelligence, among others.

The popularity of a theme changes over time. Those that resonate in one period may not last to the next, making it difficult for a thematic fund to continue attracting money after interest has waned. And low assets under management mean that fee-based revenue may not be sufficient to offset the costs of managing the portfolio. For that reason, a fund's AUM can indicate whether a fund is likely to stick around.

Of those thematic funds that have liquidated or merged in the past 25 years, the average fund had only $25 million 12 months before it was shut down. That figure is biased upward by a few large portfolios in the sample, with median AUM at only $5 million.

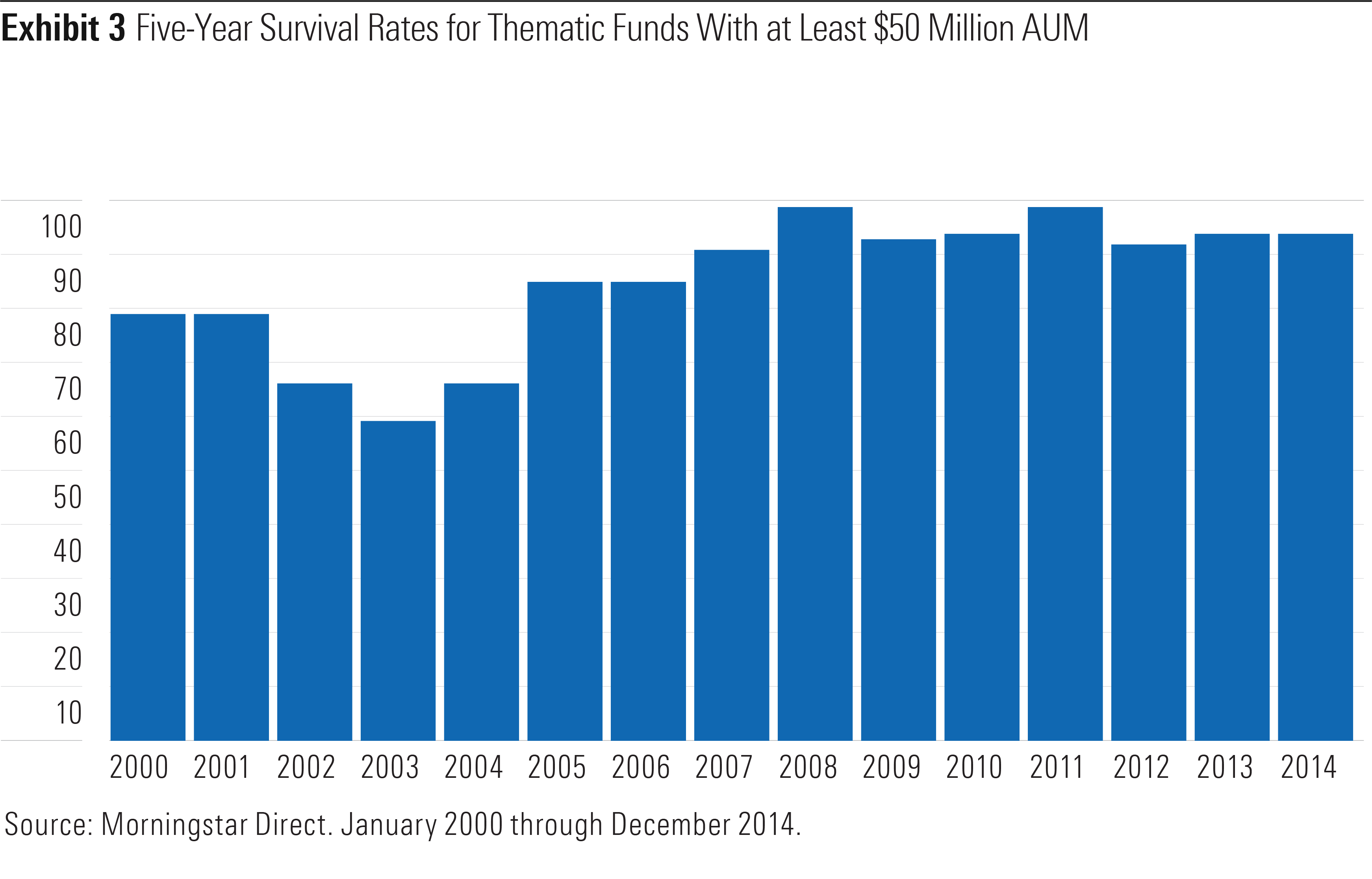

AUM also works in the other way, helping predict which thematic funds will survive, at least over the medium term. Historically, thematic funds with at least $50 million in AUM have high five-year survival rates. Exhibit 3 shows the five-year survival rates for funds that had $50 million in AUM as of the date on the x-axis. Beyond five years, the mortality figures in Exhibit 2 take hold, so a large portion of these funds eventually die off.

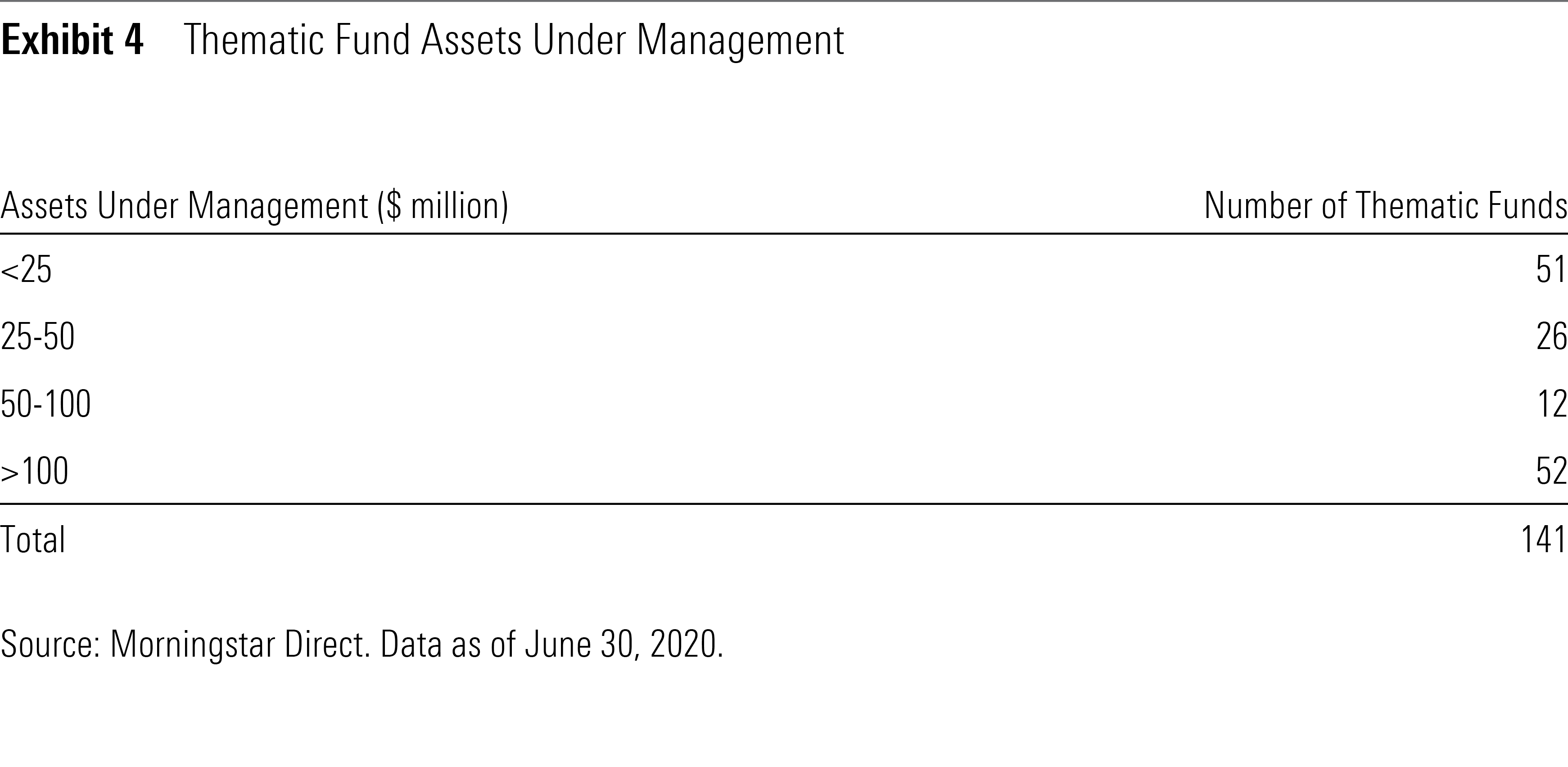

That $50 million threshold doesn't imply a great future for many of today's thematic funds. Exhibit 4 breaks down the AUM of funds currently available to investors. As of June 30, 2020, there were 141 thematic funds across all U.S. Morningstar Categories. But only 64 (45%) had more than $50 million to their name.

Buyer Beware Thematic funds are a high-risk/high-reward bet on niche segments of the market. They come into existence during the late stages of bull markets, when high prices often set them up for poor future performance.

Given their concentrated portfolios, high fees, and low survivorship rates, thematic funds should be used as satellite holdings. Investors can avoid selecting funds that are at high risk of closing by sticking to those with at least $50 million in AUM. But even those funds may not last long. The odds of picking a long-term survivor, let alone an outperformer, are small.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)