Morningstar's Take on the Fourth Quarter

Our analysis of the fourth quarter in stocks and funds.

As 2020 comes to a close, Morningstar's analysts have provided in-depth reviews and outlooks across equity sectors and fund categories.

Equities Quarterly Market Outlook: Opportunities in Value and Energy Stocks The broad equity market is trading at a 6% premium to our fair value estimates. 2020 Market Performance in 7 Charts We take a closer look at the stock and bond markets in Q4 and more. Economic Outlook: We Remain Optimistic for a Rapid Recovery A lot is riding on the coronavirus vaccine. 33 Undervalued Stocks for 2021 Here are our analysts' top ideas in each sector for the new year. Healthcare: In Healthcare, Drugmakers and Managed-Care Firms Look Attractive We don't expect major policy reforms now that the dust has settled on the elections. Utilities: Clean Energy Provides Growth in Utilities Sector We expect the incoming Biden administration to speed up investment in renewable energy. Basic Materials: Agriculture, Chemicals Appeal in Basic Materials We expect potash demand to grow over the next several years in basic materials. Communication Services: Even Regulators Can't Slow the Momentum of Online Media Giants Market seems focused on the rebound in online advertising demand. Energy: Energy Remains the Most Undervalued Sector We expect a nearly complete recovery in crude demand as the pandemic subsides in 2021. Consumer Defensive: Bargains Scant in Consumer Defensive Sector Alcohol and tobacco still present the biggest opportunities. Technology: 3 Undervalued Tech Stocks Look beyond the tech giants for hidden opportunities. Financial Services: Outlook Improved but Still Overpriced Most financial stocks are trading above our fair value estimates. Industrials: Outside of Aerospace and Defense, Few Undervalued Industrials Stocks Incoming administration could be a boon for infrastructure spending. Real Estate: We Expect Malls and Hotels to Rebound We believe most REITs will continue to pay dividends, making their increased yields attractive to investors. Consumer Cyclical: Limited Opportunities in Consumer Cyclical Aside from auto and restaurant subindustries, the sector looks fully valued. Consumer Defensive: How Has the Consumer Equity Sector Handled the Pandemic? And one stock we like. Technology: The Tech Sector Soars in 2020 But there are still a few bargains to be had. Healthcare: Coronavirus at Center Stage And some undervalued stocks that capture our attention. Energy: What We Expect From Oil Prices How the vaccine affects this sector, and two of our top picks. The Outlook for Dividends Dividend investors had a hard time in 2020, but Morningstar analyst Dan Lefkovitz think the outlook is brighter for the year ahead. Dividend Picks for 2021 We spot opportunities in consumer staples, utilities, and energy. Funds

2020: The Year in ETFs We've reached a tipping point in the balance between mutual funds and ETFs. 2020: The Year in Bond Funds Bond markets overcome a turbulent year.

2020: The Year in Funds Growth funds dominate, investors embrace bonds, and a terrific manager struggles. 2020 Year-End Wrap-Up: U.S. Equity Funds U.S equity markets rebound off first-quarter lows. Sustainable Equity Funds Outperform Traditional Peers in 2020 A strong year for ESG equity index funds. Wild Ride for International Equities in 2020 Investors looked past the pandemic's near-term impact.

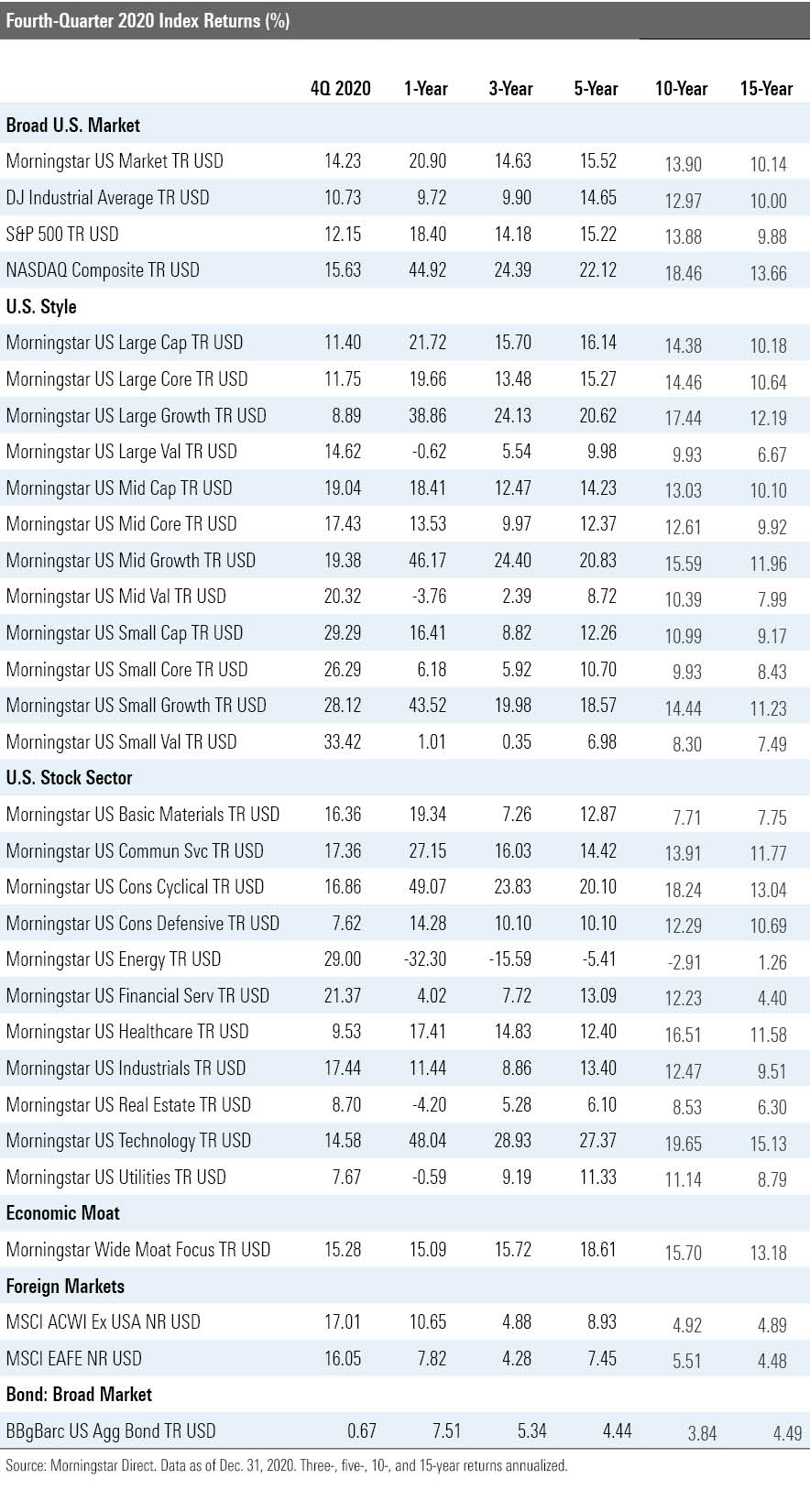

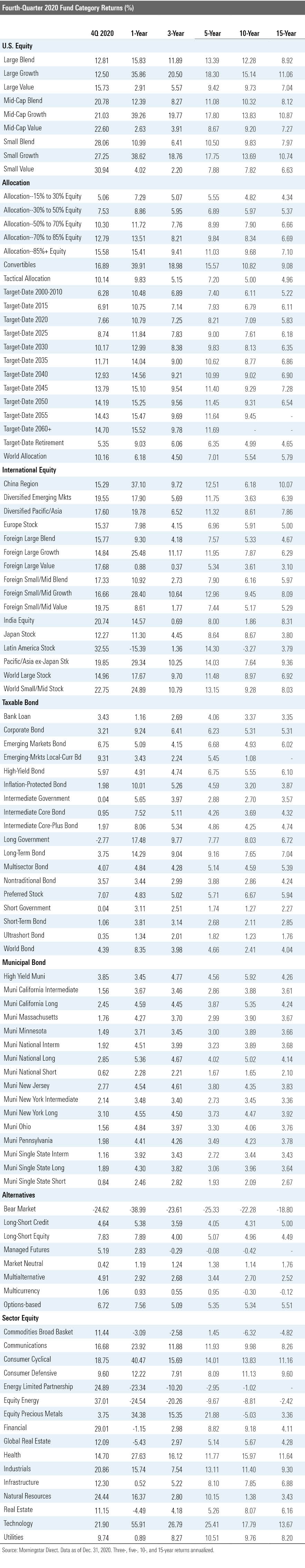

Download the quarter-end data.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)