Top 10 Holdings of Our Ultimate Stock-Pickers' Index

Large-cap strategies continue to underperform the market through 2020.

Fund investors would like to see the manager of the actively managed funds they own beat the market every year, but they've been left wanting for well over a decade. The lack of consistent outperformance by large-cap active managers (the main contributors to the Ultimate Stock-Pickers concept) has been well documented by the S&P Indices Versus Active Funds (SPIVA) U.S. Scorecard. For the five years ending June 2020, the index group noted that 77.97% of large-cap managers had lagged the S&P 500. The results over this five-year period have been similar across all investing styles. A measly 6.9% of large-cap core managers have outperformed their index over the past five years versus 19% of large-cap value managers and 38.5% of large-cap growth managers. (We'll note this analysis is performed on an after-fees basis.)

Although five-year results have been lacking for active management, about 38.5% of large-cap growth funds have still managed to outperform the S&P 500 benchmark. We saw a marked improvement in managers' results in the large-cap value category, which overperformed compared with 2019. Despite the improvement, the value strategy does not remain close to its strong performance posted in 2017 and 2018. Morningstar's large-cap index (MLCP) has posted year-to-date returns of 16.48%.

The fund managers represented in our Ultimate Stock-Pickers concept have had their own issues with relative long-term performance. Only two of our 21 top fund managers were beating the S&P 500 on a 10-year basis at the end of last week. Our fund managers' performance in 2020 isn't looking much better, as only five of our 21 fund managers beat the S&P 500 year to date. Morgan Stanley Institutional Growth MSEGX is the only fund that has managed to beat the S&P 500 for both periods measured.

As a reminder, we devised the Ultimate Stock-Pickers concept as a stock-picking screen, not as a guide for finding fund managers to add to an investment portfolio. Our primary goal has been to identify a sufficiently broad collection of Stock-Pickers who have shown an ability to beat the markets over multiple periods (with an emphasis on longer-term periods). We then cross-reference these managers' top holdings, purchases, and sales against our own stock analysts' recommendations regularly, allowing us to uncover securities that investors might want to investigate further. There will always be limitations to our process. We try to focus on managers that our fund analysts cover and on companies that our stock analysts cover, which reduces the universe of potential ideas that we can ultimately address in any given period. This emphasis is also the main reason why we focus so much attention on large-cap fund managers, as they tend to be covered more broadly on the fund side of our operations, and their stock holdings overlap more heavily with our active stock coverage. That said, by limiting themselves to the largest and most widely followed companies, our top managers may miss out on some big ideas on small companies that have the potential to generate greater outperformance in the long run.

Overall, 2019 was a challenging year for stocks, and 2020 has shaped up to be even harsher given the COVID-19 pandemic. After a volatile December 2018, the market attempted to rally during the first quarter of 2019. There was a brief period of respite in July with performance ticking up, though that soon sharply reversed toward the end of August. Since then, stocks continued to struggle until the end of October. There was a rally in November through the end of the year as some uncertainty concerning economic policies such as those governed by the Fed abated and investors became less cautious. After COVID-19 spread across the world, the markets responded strongly and dipped into bear territory, ending a long bull run. High levels of uncertainty and volatility have characterized 2020. With the recent recovery in markets, stocks now trade on par with our analysts' fair value estimates after a period of undervaluation after the COVID-19 pandemic began to set in.

Taking a look at the cyclically adjusted price/earnings, or CAPE, ratio, which divides the current market price by the average of 10 years of earnings (adjusted for inflation), it currently stands at around 33.46, above where it was when we wrote the last article (28.02). This ratio is compared with a historical mean of 16.76 and median of 15.81, with Shiller relying on market data from both estimated (1881-1956) and actual (1957 onward) earnings reports from companies represented in the S&P 500 Index. Today's levels are higher than levels seen before the Great Financial Crisis and Black Tuesday. The CAPE ratio is generally used to assess potential returns from equities over longer time frames, with higher-than-average CAPE values implying lower-than-average long-term annual returns going forward, which is what we're gleaning from the current ratio. While not intended to indicate impending market crashes, it has provided warning signs for investors in the past.

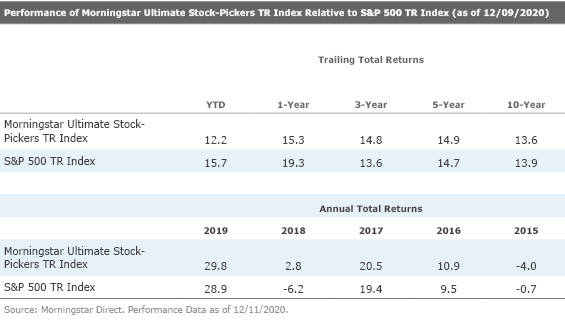

Our own Morningstar Ultimate Stock-Pickers index has not been immune to the trend of underperformance of active management, as it still trails the S&P 500 index year to date. However, 3-year and 5-year returns are still outperforming the S&P 500.

Aside from tracking the holdings, purchases, and sales and the ongoing investment performance of our Ultimate Stock-Pickers, we also follow the makeup and results of the Morningstar Ultimate Stock-Pickers TR Index. For those who may not recall, the Ultimate Stock-Pickers index was set up to track the highest-conviction holdings of 25 different managers, a list that includes our 21 top fund managers as well as the investment managers of four insurance companies—Berkshire Hathaway BRK.A/BRK.B, Markel MKL, Alleghany Y, and Fairfax Financial FRFHF. It is constructed by taking all the stock holdings of our Ultimate Stock-Pickers that are not only covered by Morningstar stock analysts but have either a low or medium uncertainty rating and ranking them by their Morningstar Conviction Score. The Morningstar Conviction Score is made up of three factors:

- The overall conviction (number and weighting of holdings).

- The relative current optimism (holdings being purchased).

- The relative current pessimism (holdings being sold).

The index is composed of three sub-portfolios—each containing 20 securities—that are reconstituted quarterly on a staggered schedule. As such, one third of the index is reset every month, with the 20 securities with the highest conviction scores making up each sub-portfolio when they are reconstituted. This structure means that the overall index can hold anywhere between 20 and 60 stocks at any given time (because some stocks may remain as the highest-conviction score holders in any given period, meaning there can be overlaps in the holdings, reducing the total number of different stocks held). In reality, the index is usually composed of 35 to 45 securities, holding 39 stocks in all at the end of May. These stocks should represent some of the best investment opportunities that have been identified by our Ultimate Stock-Pickers in any given period. It can also have more concentrated positions than one might find in a typical mutual fund, with the top 10 (25) holdings in the index accounting for 48.2% (85.8%) of the total invested portfolio at the end of last month. The size and concentration of the portfolio do change, though, as this is an actively managed index that tries to tap into our top managers' movements and conviction levels over time.

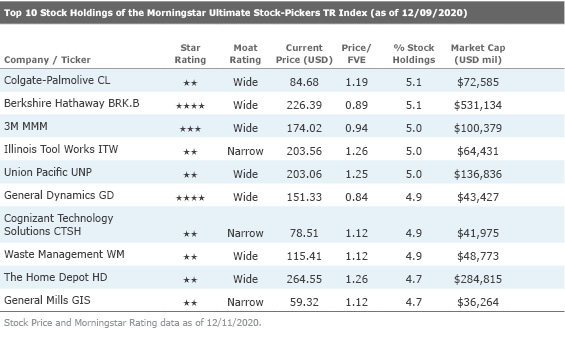

Looking at the top 10 stock holdings of the Morningstar Ultimate Stock-Pickers index at the end of November, there is currently only one name trading at approximately a 10% or more discount to our analysts' fair value estimates. This company is wide-moat rated General Dynamics GD, which currently trades at a 16% discount to Morningstar analyst Burkett Huey's fair value estimate of $181 per share. As this company is both undervalued and a top stock holding on our index, we believe it merits further discussion.

General Dynamics is a long-cycle defense contractor and business jet manufacturer. The firm's segments include aerospace, combat systems, marine, information technology, and mission systems. The company's aerospace segment creates Gulfstream business jets. The combat systems segment mostly produces land-based combat vehicles, such as the M1 Abrams tank. The marine subsegment builds nuclear-powered submarines among other things. The information technology business primarily serves the government market. The mission systems segment focuses on products that provide command, control, computers, intelligence, surveillance, and reconnaissance capabilities to the military. According to Huey, General Dynamics benefits from long-cycle contracts that are fulfilled over decades. General Dynamics’ crown jewel of long-cycle contracts, the Columbia-class submarine, exemplifies this with planned procurement through 2042.

Huey believes that General Dynamics’ exposure to defense primes is implicitly a play on the defense budget, which we think is ultimately a function of both a nation's wealth and a nation's perception of danger. As the U.S. budget is looking increasingly bloated with pandemic relief, we're expecting a near-term slowdown in defense spending to flat or even negative growth. Still, we think that contractors will continue growing due to sizable backlogs and believe that defense budget growth is likely to return. We recognize there is substantial political uncertainty in the budget. Still, we think it will be difficult to materially decrease the defense budget without sweeping political change.

Huey points out that General Dynamics’ business jet segment mostly produces long-range wide-cabin business jets. This market is low volume, at roughly 200 global deliveries each year and many repeat customers. New, quality product drives deliveries in this segment, so the company must continuously convince customers that it has built a better aircraft. Gulfstream dominates volume in this segment, with roughly 50% market share, which leads to superior margins due to progression along the learning curve. We anticipate that the introduction of the G700 in 2022 will be a significant sales driver.

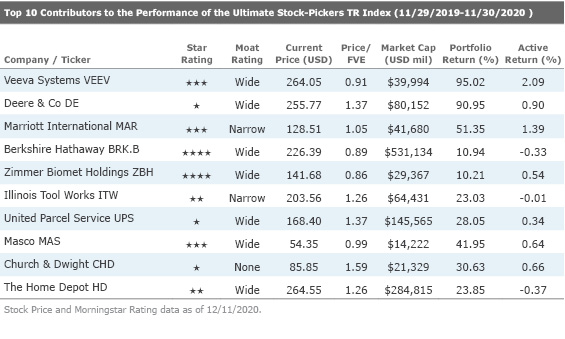

Looking at the Morningstar Ultimate Stock-Pickers index's year-over-year performance, many of the highest-performing standouts came from the industrials sector, which supplied four names to the Top 10 Contributors list, and the healthcare sector, which contributed two names to the list. We note that Berkshire Hathaway, Illinois Tool Works ITW, and The Home Depot HD appeared on both the top 10 holdings and top 10 contributors list this quarter. Two of the names on the list are trading at a discount to our Morningstar fair value estimates. These include wide-moat rated Berkshire Hathaway and Zimmer Biomet Holdings ZBH.

Morningstar analyst Debbie Wang sees value in Zimmer Biomet, which currently trades at a 14% discount to its $164 per share fair value estimate. Zimmer Biomet designs, manufactures, and markets orthopedic reconstructive implants and supplies and surgical equipment for orthopedic surgery. With the acquisitions of Centerpulse in 2003 and Biomet in 2015, Zimmer holds the leading share of the reconstructive market in the United States, Europe, and Japan. Roughly 60% of total revenue is derived from sales of large joints, another 22% comes from extremities and trauma, and the remaining portion is primarily related to spine and dental products.

According to Wang, Zimmer has benefited from close relationships with orthopedic surgeons who make the brand choice. High switching costs and high-touch service keep the surgeons closely tied to their primary vendor. Surgeons bring in enough profitable procedures to keep hospital administrators at bay. This close relationship and vendor loyalty also explain why market share shifts in orthopedic implants are glacial, at best. As long as Zimmer can launch comparable technology within a few years of its rivals, it can remain in a strong competitive position. Nevertheless, Wang believes that surgeon influence will inevitably erode as the practice of medicine changes in response to healthcare reform. Over the long term, it will be more difficult for surgeons to run private practices profitably, and more of them will be open to employment at hospitals.

We think the growing emphasis by payers and hospitals on comparative effectiveness and cost-effectiveness will make conditions more challenging for Zimmer and its rivals. By its nature, orthopedic innovation tends to be evolutionary rather than revolutionary. It is also less common for orthopedic innovation to tap into untreated patient pools with unmet needs, a strategy that cardiac device makers have pursued successfully. The difficulty and ethical issues surrounding randomized controlled trials for orthopedics also weaken Zimmer's position when pressing for premium pricing. We think achieving meaningful innovation in orthopedic implants will be challenging.

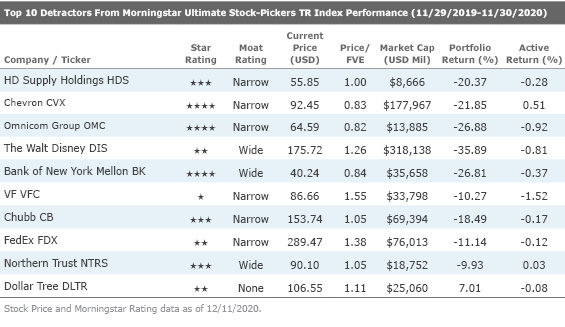

While lists of top-performing stocks are often composed of stocks that have already run up, our top detractors' list can sometimes be a good area to pick through the wreckage. Even though these names might not be performing well, it is possible that there could be some value plays in the long run. From our current list, we will highlight narrow-moat rated Omnicom Group OMC, which is trading at an 18% discount to Morningstar analyst Ali Mogharabi's fair value estimate of $79.

Omnicom is the second-largest player (based on annual revenue) within the advertising space. Compared with its peers, the firm has attained that position less through acquisitions and more through organic growth. While the coronavirus pandemic will force Omnicom to curb its share buybacks and possibly limit the growth of dividends per share, with very well-recognized creative agencies and sub-holding companies such as BBDO and DDB, we expect Omnicom to maintain its market position as it generates competitive organic growth, continues to make acquisitions, and increases focus on the faster-growing emerging markets and the overall digital ad markets.

Mogharabi believes that through various acquisitions, the firm has transitioned from traditional advertising toward becoming a complete solution provider with digital (including online video, social media, and mobile) and other services such as public relations. Compared with its peers, Omnicom has been relatively quiet on the acquisition front since its merger talks with Publicis in 2014. However, top-line growth has been in line with or above the other ad-holding firms.

We look to Omnicom to pick up the pace of its acquisition growth strategy to gain further traction in other faster-growing international markets, as the globalization of businesses in various verticals has increased demand not only for vertical-specific advertising expertise but also for experience, knowledge, and a clearer understanding of different cultures and regulations. Mogharabi also expects Omnicom to continue acquiring and to invest in the growing digital advertising space, which is seeing an increase in dollars dedicated to it by Omnicom's peers and clients.

Disclosure: Malik Ahmed Khan and Eric Compton have no ownership interests in any of the securities mentioned. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)