The 10 Best Wide-Moat Stocks of 2020

Do any of 2020’s top performers have gas left in the tank for 2021?

A really good book. That long-dreamed-of vacation. Sundays.

Add the 2020 bear market to the list of things that end quickly. (But unlike books, vacations, and Sundays, we welcomed the end of the stock market crisis.) In fact, the 2020 bear was the shortest in stock market history. As we approach year's end, the Morningstar US Market Index is up nearly 16% for the year to date as of this writing.

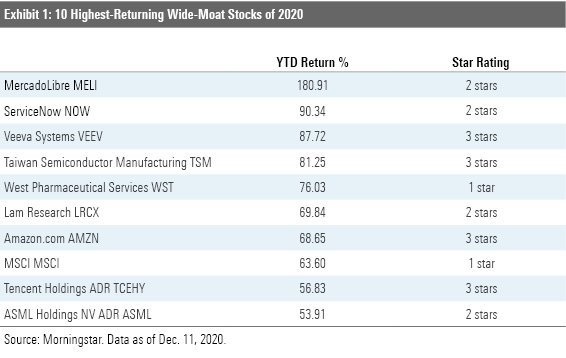

Given the stunning market reversal, it’s not surprising that the 10 best-performing wide-moat stocks of 2020 that our analysts currently cover have posted eye-popping returns--all in excess of 50%. As a refresher, we assign wide Morningstar economic moat ratings to only the highest-quality companies, those we think can outearn their costs of capital over the next two decades.

Also not surprisingly, none of these stocks are screaming buys today. However, four stocks on the list currently trade at the 3-star level, suggesting that they’re fairly valued. As such, they make particularly good watchlist candidates on a market pullback. Here’s a little bit about each. All data and ratings are as of Dec. 11.

Veeva Systems VEEV "Veeva Systems has grown to become a leading vertical software provider supporting mission-critical operations of the life sciences industry. The company's effective technology and dominant position enables it to generate excess returns commensurate with a wide-moat company. The company's strong retention, continued development of new applications, increasing penetration within existing customers, addition of new customers, and expansion into industries outside of life sciences should allow the company to extend its market leadership, in our view.

The company operates in two categories: Veeva Commercial Cloud, which entails vertically integrated customer relationship management, or CRM, services; and Veeva Vault, a horizontally integrated content and data manager. Veeva’s CRM application supports real-time collaboration and regulatory oversight, and enables incremental add-on solutions. The incremental functionality is critical to improving marketing programs while remaining in compliance with mandated anti-kickback laws and statutes. This service has been well received by the life sciences industry and has propelled Veeva to become the leading solution with the lion’s share of this niche market (based on seats). As a follow-on to the initial introduction of CRM, management introduced the Veeva Vault platform to broaden the portfolio that addresses the largely unmet needs of the life sciences industry outside of CRM. Each module offers features and functionality targeting four key areas within life sciences: clinical (R&D); regulatory (compliance); quality of manufacturing; and safety.

Veeva has earned a strong reputation within life sciences and continues to develop new adjacencies to further entrench itself into the core operations of its customers. Strong execution and co-development partnerships with early-adopter customers have enabled the company to introduce robust solutions that leverage the company's vault network, modules, and regulatory domain expertise. In parallel, the company has created incremental use cases, allowing it to expand into industries outside of life sciences that have regulatory interplay, such as cosmetics, chemicals, and consumer goods." Soo Romanoff, analyst

Taiwan Semiconductor Manufacturing TSM "Taiwan Semiconductor Manufacturing, or TSMC, is the world's largest dedicated contract chip manufacturer, or foundry. It makes integrated circuits, or ICs, for customers based on their proprietary IC designs. The firm has long benefited from U.S. and increasingly Asian semiconductor firms transitioning from integrated device manufacturers to fabless designers. TSMC, like all foundries, assumes the costs and capital expenditures of running factories amid a highly cyclical market for its customers. Such cyclicality stems from the fact that foundries tend to add excessive capacity during times of burgeoning demand that can result in underutilization during downturns that hampers profitability.

The rise of fabless semiconductor firms has been sustaining the growth of foundries, which has in turn encouraged increased competition. However, most of these newer competitors are confined to low-end manufacturing due to prohibitive costs and engineering know-how associated with the leading-edge technology. To prolong the excess returns enabled by leading-edge process technology, or nodes, TSMC initially focuses on logic products, mostly used on central processing units, or CPUs, and mobile chips, then focuses on more cost-conscious applications. The firm's strategy is successful, illustrated by the fact it's one of the two foundries still possessing leading-edge nodes when dozens of peers lagged.

We note two long-term growth factors for TSMC. First, the recent consolidation of semiconductor firms is expected to create demand for integrated systems made with the most advanced nodes. For example, major customer Nvidia NVDA is acquiring Arm to consolidate intellectual property and bolster high-end offerings in data centers, artificial intelligence, or AI, and the "Internet of Things," or IoT. Second, organic growth of AI, IoT and high-performance computing, or HPC, applications may last for decades. AI and HPC play a central role in quickly processing human and machine inputs to solve complex problems like autonomous driving and language processing. Cheaper semiconductors have made integrating sensors, controllers and motors to improve home, office and factory efficiency possible." Phelix Lee, analyst

Amazon.com AMZN "Amazon's disruption of the retail industry is well documented, but it continues to find ways to evolve. Its operational efficiency, network effect, and a brand-intangible asset give its marketplaces sustainable competitive advantages that few, if any, traditional retailers can match. The combination of competitive pricing, unparalleled logistics capabilities and speed, and high-level customer service makes Amazon an increasingly vital distribution channel for consumer brands (especially in light of COVID-19 operating restrictions hindering physical retailers). Even with more retailers looking to expand online, we believe Amazon will maintain its consumer proposition through expedited Prime shipping, an expanding digital content library, and new customer services. Aided by more than 540 million estimated global active users, more than 175 million global Prime members, and an unrivaled fulfillment infrastructure, Amazon owns one of the wider economic moats in the consumer sector and is likely to reshape retail, digital media, enterprise software, and other categories for years to come.

Key top-line metrics--including gross merchandise volume growth (a 17% compound annual growth rate the past five years), total physical and digital units sold (22% CAGR), and third-party units sold (28% CAGR)--continue to outpace global e-commerce trends, suggesting that Amazon is gaining share while fortifying its network effect. On top of its impressive growth, Amazon's COVID-19-related buyer and seller acquisition is helping to build a more visible margin expansion story, despite ongoing investment for Prime one-day shipping (including fulfillment infrastructure/capacity), content deals, AmazonFresh, hardware such as the Echo/Alexa-enabled products, AWS, and physical store expansion. While some capital decisions haven't always yielded strong returns, we're optimistic that Amazon can approach 10% operating margins by 2024 based on Prime member adoption/engagement, new subscription services across multiple categories, AWS segment margins around 30%, fulfillment scale, new third-party seller services, expanded advertising offerings, and technology licensing arrangements." Zain Akbari, analyst

Tencent Holdings ADR TCEHY "We think Tencent has put more of the focus on cloud and advertising businesses following its reorganization. The cloud and smart industries group has been created as a stand-alone segment for the cloud business and enterprise-facing services such as smart retail. The advertising and sales department and the social and performance advertising department were merged to form the advertising and marketing services business under the corporate and development group. This business can provide advertisers with integrated advertising solutions and more unified insights into users across Tencent's social and media products. The platform and content group is a new group to connect traffic from platforms such as QQ and YingYongBao to content services such as Tencent news and video.

Tencent is transforming from consumer Internet to industrial Internet. CEO Pony Ma believes the future of the Internet is using artificial intelligence to process Big Data in the cloud, allowing industries to aggregate and unlock value in their data. Tencent aims to help industries to connect to consumers through its platforms such as WeChat, which has over 1 billion users. Miniprograms, official accounts, and Weixin Pay can facilitate communications between consumers and industries and transactions. For example, in the smart healthcare vertical, patients can find the right medical professionals, register for appointments, conduct video appointments with specialists through WeChat, and settle medical fees using WeChat Pay. Tencent can provide AI diagnostic capabilities, for example, helping doctors in screening and diagnosing polyps. Tencent’s cloud, security, and AI capabilities can help hospitals manage their businesses more efficiently. Tencent has a strong position in social networking and entertainment (such as gaming, online video, and online music) and is advancing into finance, government, smart retail, and industrial verticals. This transformation will take time, particularly since Tencent has been more of a consumer-facing company in the past.” Dan Baker, senior equity analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)