November Analyst Ratings Upgrades, Downgrades, and More

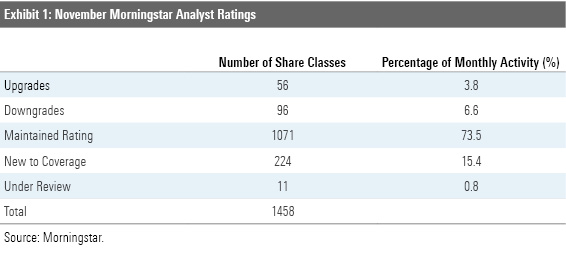

Morningstar analysts rated 1,458 share classes and vehicles and 271 unique strategies in November 2020.

Morningstar updated Analyst Ratings for 1,458 fund share classes, exchange-traded funds, and separately managed accounts/collective investment trusts in November 2020. Of these, 1,071 maintained their previous rating; 96 were downgrades; 56 were upgrades; 224 were new to coverage; and 11 came Under Review due to material changes, such as manager departures.

Sifting out multiple share classes and vehicles, Morningstar rated 271 unique strategies in November 2020. Of these, 10 received a rating for the first time, with the rest having at least one investment vehicle type that a Morningstar analyst previously covered. Below are some highlights of the upgrades, downgrades, and funds new to coverage.

Upgrades Fidelity OTC's FOCPX new manager has settled in well, earning a People Pillar rating upgrade to Above Average from Average, and a Morningstar Analyst Rating upgrade to Bronze from Neutral across all share classes. Manager Chris Lin has been calling the shots at this technology and healthcare heavy fund since October 2018, but his prior experience as the firm's tech sector leader and as a healthcare analyst helps, as does the strength of Fidelity's large equity research team in those areas. Lin looks for 150-300 stocks with competitive advantages and pricing power, which don't need to invest much to fuel future growth. He still has something to prove in other sectors, but he has shown tech stock-picking skill.

Enhancements to Aberdeen Emerging Markets’ ABEMX approach earned it a Process Pillar rating upgrade to Above Average from Average, bringing its Morningstar Analyst Rating to Bronze from Neutral for its cheapest share classes. Its more-expensive shares stayed Neutral. Devan Kaloo, a 20-year firm veteran, leads the tenured seven-member global emerging-markets team. The squad applies a patient, bottom-up approach focused on value and quality factors like franchise power, balance-sheet strength, and corporate governance. The portfolio historically had maintained double-digit sector/country deviations from the MSCI Emerging Markets Index, but the team has reined these in, refocusing on stock selection rather than allocation. Since January 2019, China stock selection had helped strong performance.

American Beacon AHL Managed Futures’ AHLIX deep, experienced subadvisor earned its People Pillar rating an upgrade to High from Above Average, and brought its Morningstar Analyst Rating to Silver from Bronze for its cheapest share classes. Its more-expensive classes earn Bronze and Neutral ratings. Man AHL, this strategy’s subadvisor, has 120-plus employees devoted to research, technology, and implementation. The comanagers of this strategy, Matthew Sargaison and Russell Korgaonkar, have a long history of implementing systematic strategies. Man AHL mainly uses a systematic momentum-based approach that aims to profit from trends in prices across various markets and provide uncorrelated returns. The approach looks for trends over a two-month time frame on average, which is shorter than the typical peer and improves responsiveness.

New to Coverage Brown Advisory Sustainable Growth BAFWX debuted with a Morningstar Analyst Rating of Silver for its cheaper share classes while pricier ones came in at Bronze. Karina Funk and David Powell have led this strategy for more than a decade with solid results and have a deep central analyst team backing them. The managers focus on companies with historically higher earnings-per-share growth rates than the Russell 1000 Growth Index and then look for ESG-driven (environmental, social, and governance) competitive advantages that ultimately lead to cost reduction, increased revenue, or enhanced franchise values. The manager also subjects potential names to a thorough ESG risk assessment before building the approximately 35-name portfolio. It has shown some reliance in downturns and has lower volatility than the index, which has contributed to attractive risk-adjusted returns.

Downgrades Delaware Small Cap Value's DEVLX Process Pillar rating dropped to Average, bringing its Morningstar Analyst Rating to Bronze from Silver, while the more-expensive ones remained at Neutral. Lead manager Christopher Beck will retire at the end of July 2022, but that's not the issue. His team, including co-successors Kelly Carabasi and Kent Madden, has the depth and experience to make a smooth transition. The issue is that the fund's approach, while sensible, is not particularly differentiated. Beck, over his 23-year tenure, has consistently looked for companies that can grow free cash flow over the long term and return it to shareholders, but whose shares trade at compelling valuations. It hasn't translated into superior results, though.

IShares Core MSCI EAFE ETF’s IEFA approach doesn’t capture the full non-U.S. equity opportunity set, so its Process Pillar rating drops to Above Average from High and its Morningstar Analyst Rating to Silver from Gold. The fund tracks the MSCI EAFE Investable Market Index, which holds large-, mid-, and small-cap stocks from 21 overseas developed markets but it excludes stocks listed in emerging markets. In the foreign large-blend Morningstar Category, the typical competitor has a 10% emerging-markets allocation. The fund is still diversified and cheap, though.

/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)