Which Fund Companies Supported Climate Via Proxy Votes?

Support may be rising but not for all firms.

Investors are more focused than ever before on the long-term risks that climate change poses--to the financial system as a whole, to individual portfolios and to personal livelihoods. One of the key ways that investors have a voice on climate change in the corporate world is through shareholder resolutions that can shape company behaviors and disclosures. For many investors, this raises the importance of understanding how the mutual funds they own cast votes on their behalf.

Which fund companies have shown investors that they are the strongest supporters of resolutions--known as proxy voting--aimed at fighting climate change?

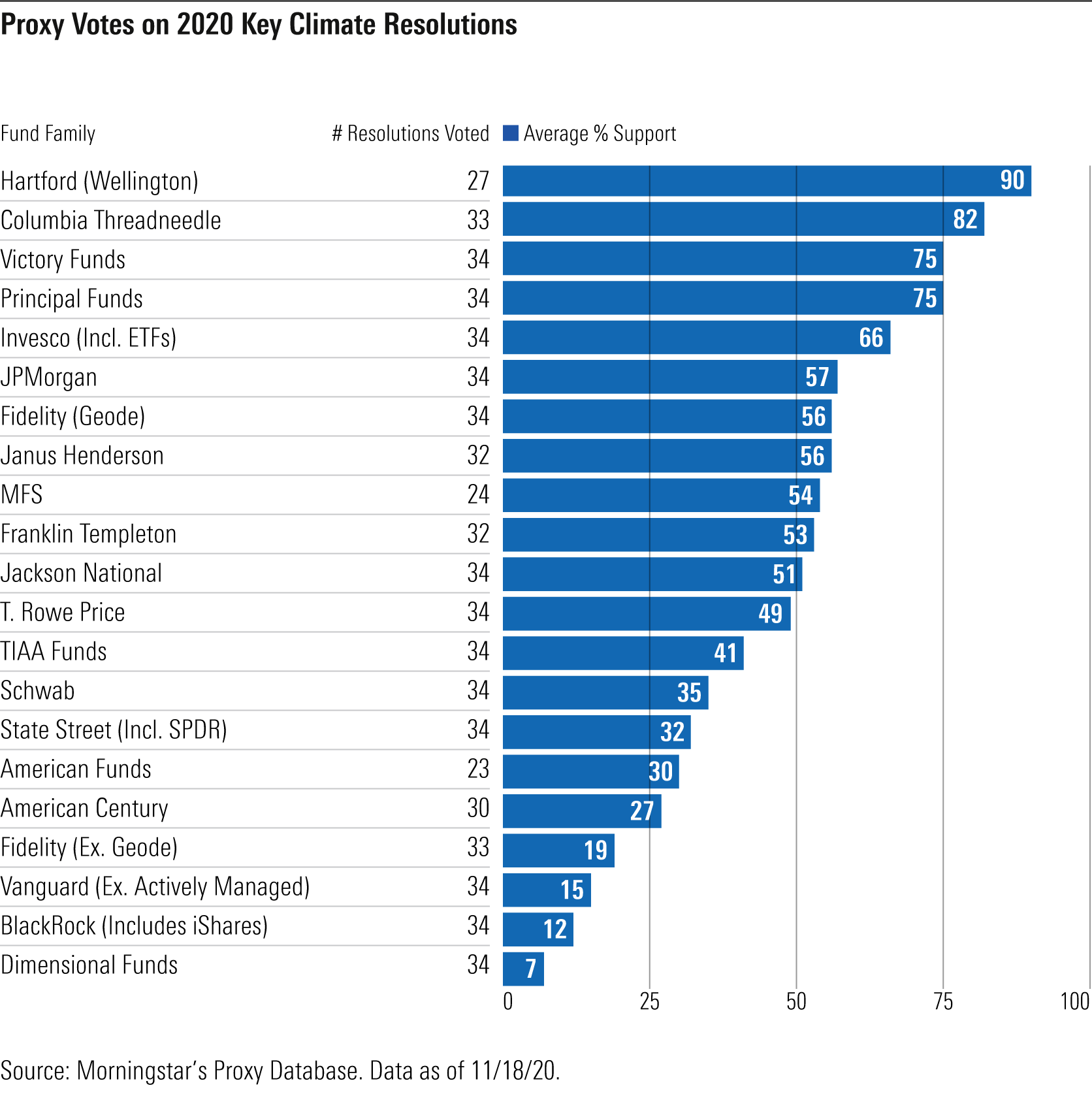

Using Morningstar’s data on fund-level proxy voting, we computed voting profiles for the 20 largest U.S stock fund managers across a select list of 34 key resolutions relevant to climate action. Overall, we found rising support for stronger climate governance and improved transparency around risks and emissions goals. However, the level of support ranged widely among fund companies.

Here’s a look at how the top 20 looked overall on their 2020 votes for climate transparency and climate governance. The greatest level of support came from Hartford Funds, where the equity strategies are mostly run by Wellington Capital Management. (Wellington also manages and casts votes for several of Vanguard’s actively managed funds.) Filling out the top five were Columbia Threadneedle, Victory Funds, Principal Funds, and Invesco.

A more detailed study of voting on climate change issues for 2020 is available to Morningstar Direct and Office clients here.

JPMorgan funds, the ninth-largest U.S. fund company, ranked sixth overall by its climate voting record--supporting 23 of the 34 key resolutions, with one mixed vote. In 2019 the firm had only supported 7% of a comparable set of key resolutions. Close behind in 2020, was Fidelity Investments’ Geode group, which manages the firm’s index funds.

At the bottom were Dimensional Funds, eighth largest, and the two largest stock fund managers--Vanguard and BlackRock--where support for key climate change resolutions barely made double-digit percentages.

The votes in question include 14 resolutions requesting climate risk disclosures, as well as 20 others filed out of concern for high-emitting companies’ broader climate governance. Climate governance is the idea that a firm’s overall risk exposure and contribution to climate action should be elevated to board level and that boards should be held accountable. This includes how firms act to influence climate policy. The “asks”--or specific requests made in the resolutions--therefore cover lobbying disclosures and independent board leadership arrangements at fossil-fuel companies and large emitters.

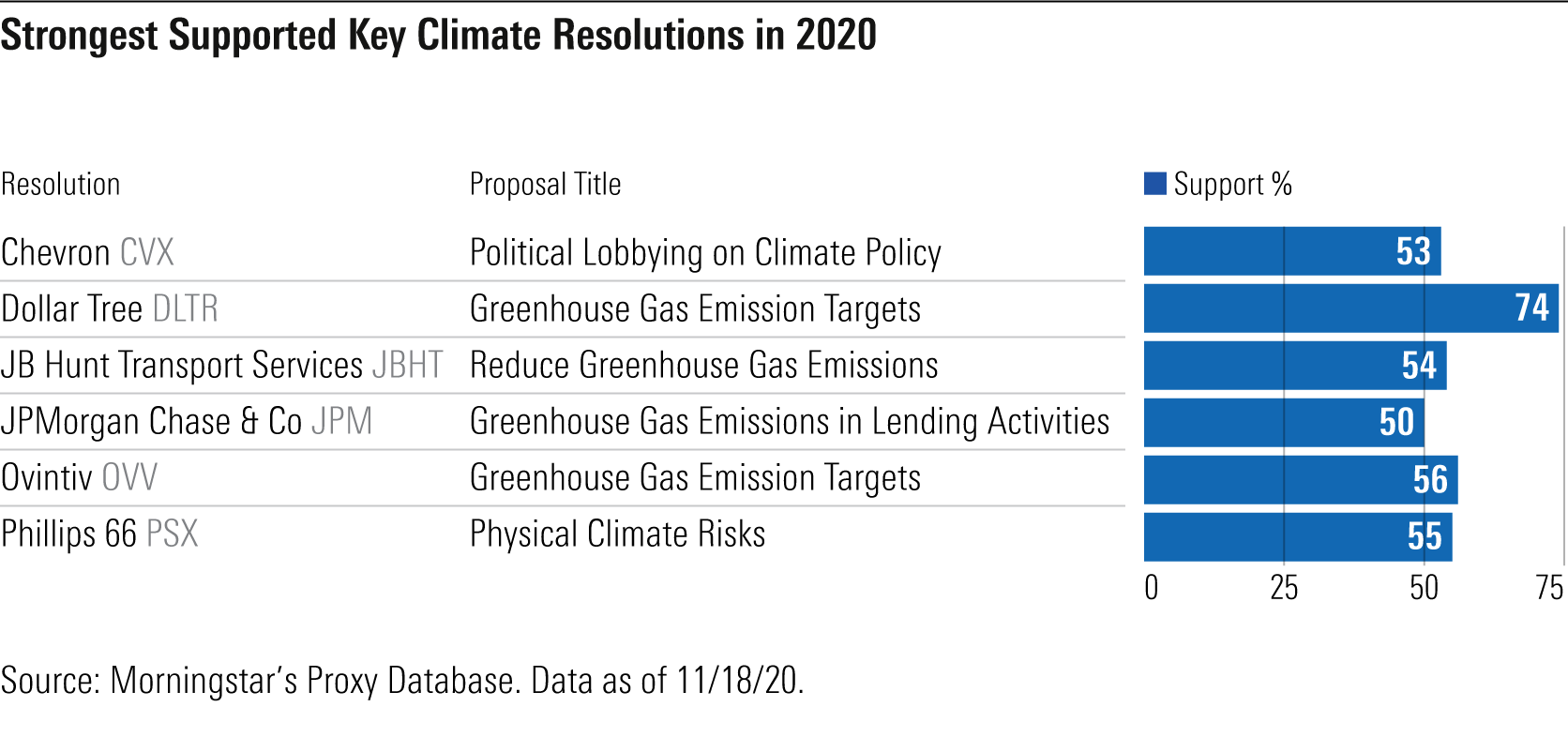

To understand what’s at stake with these resolutions, the following are five measures that received majority support and one that fell just shy of the 50% mark.

The measure at JP Morgan Chase & Co, parent of JPMorgan Asset Management, received 49.6% support and called on the investment bank to examine the global warming contribution of its lending activities and report on efforts to align lending with the Paris Agreement's goal of maintaining global temperature rise below 1.5 degrees Celsius.

A resolution at Phillips 66, meanwhile, asked the firm to disclose risks that climate-induced hurricanes and sea level rise could damage its petrochemical plants in Texas, releasing toxic chemicals and endangering life and shareholder value. The climate lobbying resolution at Chevron was filed by European bank BNP Paribas and asks for a report into how the company’s lobbying activities align with the goal of limiting average global warming to well below 2 degrees Celsius, noting that “…of particular concern are the trade associations and other politically active organizations that speak for business but, unfortunately, too often present forceful obstacles to progress in addressing the climate crisis.”

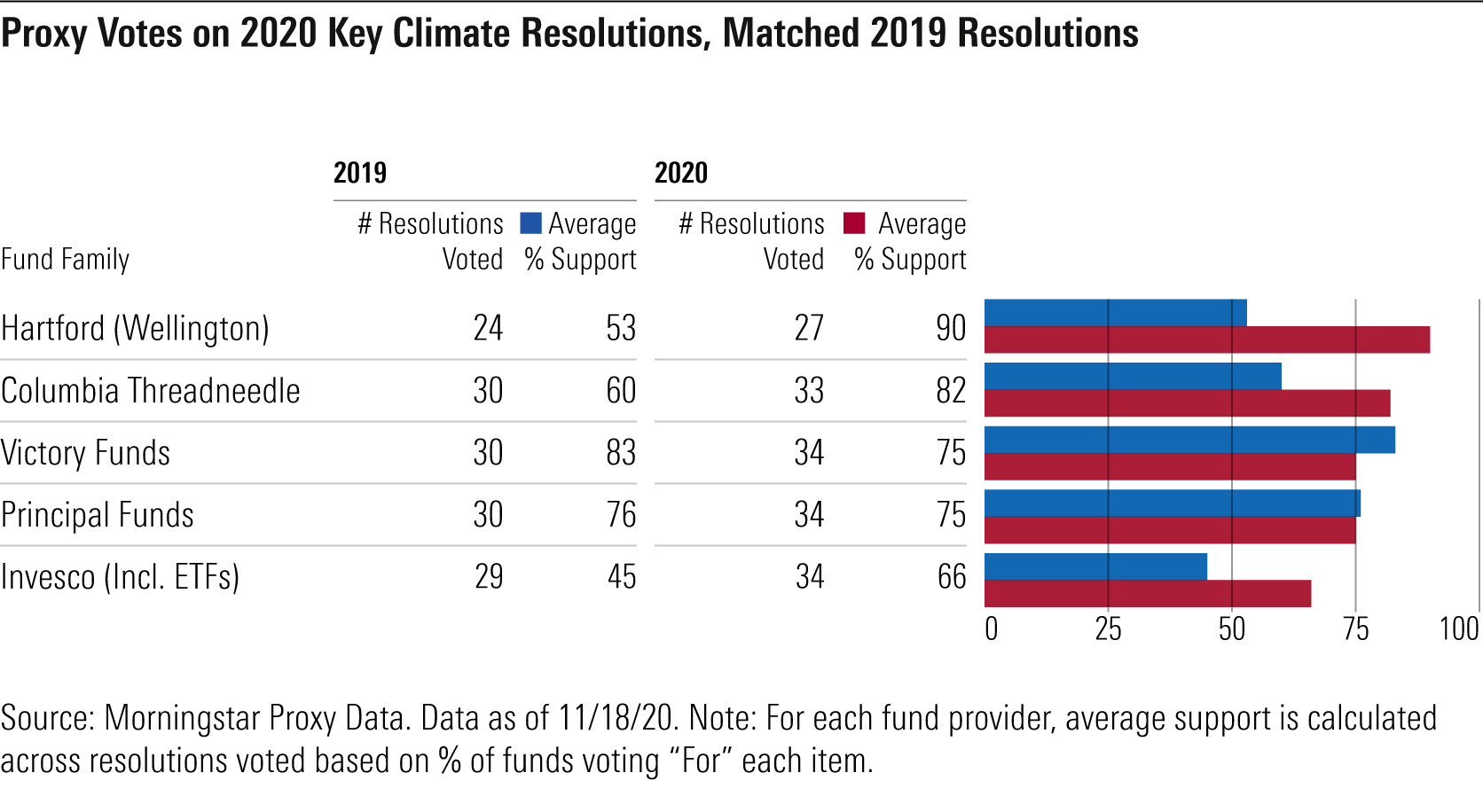

Here’s a closer look at the fund companies showing the greatest support for proposals related to climate change in 2020, compared with votes on a matched set of proposals voted in 2019.

Wellington Management, which is a member of the global collective of investors committed to collaborative engagement on climate action--called Climate Action 100+--topped the ranking of the 20 largest U.S. fund providers--supporting 90%, or 24 of the 27 key climate resolutions it voted.

In 2017 Wellington signed the Statement of Support for the Task Force on Climate-Related Financial Disclosures, or TCFD, recommendations and is listed among the TCFD supporters. It reports undertaking climate-focused engagements and advocates for TCFD adoption by investee companies. In 2018 the asset manager formed an alliance with Woods Hole Research Center to examine how climate change may impact global capital markets and how to integrate climate science into asset management.

Proxy-voting guidelines are supposed to explain an institution’s voting stance across a broad range of governance issues.

Investors can look to Wellington's 2020 proxy-voting guidelines, which affirm its support across the areas covered by the key resolutions set:

"…we generally support shareholder proposals asking for improved disclosure on climate risk management and we expect to support those that request alignment of business strategies with the Paris Agreement or similar language. We also generally support proposals asking for board oversight of political contributions and lobbying activities or those asking for improved disclosures where material inconsistencies in reporting and strategy may exist, especially as it relates to climate strategy."

Columbia Threadneedle supported 27 of the 33 resolutions voted across its family of funds. Columbia Threadneedle's proxy-voting guidelines affirm the asset manager's endorsement of the TCFD recommendations as well as the CDP disclosures. Elsewhere in the guidance they note that "we regard the separation of the roles of the Board Chair and the CEO to be a matter of good practice and governance," explaining the unanimous support for the eight resolutions calling for an independent board chair.

While supporting most of the key resolutions, Victory and Principal Funds each opposed five of the eight resolutions calling for independent board leadership. Principal's proxy-voting decisions generally rely on those from outside research company, Institutional Shareholder Services, Inc. ISS' Benchmark Proxy-Voting Guidelines offer a default voting strategy based on annually revised guidance.

According to Invesco's proxy-voting guidelines, its position on political lobbying disclosure and transparency as well as action on climate change, is to review all resolutions on a case-by-case basis, but generally to support these requests. Invesco has been a member of the Climate Action 100+ investor coalition since its inception and launched its first TCFD report in August this year.

Looking Ahead Shareholder resolutions are a distinctive feature of the U.S. proxy process, but they also are being filed in greater numbers at companies around the world.

Internationally, climate risk resolutions at Australian petroleum producer Woodside Energy, South African financial-services provider FirstRand Group, and Canadian asset manager iA Financial Group earned majority support in late 2019 and in the first half of 2020. Resolutions at Royal Dutch Shell, Equinor, Rio Tinto, Santos, Barclays, Mizuho, and others caught media headlines in 2020. These call on boards to publish policies and targets and to align business plans, portfolios, and incentive structures with a 1.5 degrees Celsius global-warming limit.

Our research points to a 2021 proxy season in which shareholders tackle climate governance more concertedly through the proxy process.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q27ZB7KFPZBMHFKY6IURRWJQHM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)