Year-End 2020 Tax-Planning Strategies

There likely will be tax changes next year under the new administration, but for now, we need to focus on what's already in front of us.

When it comes to tax planning, much of the attention is on Washington and its changes for 2021, but there's still much to be done when it comes to year-end 2020.

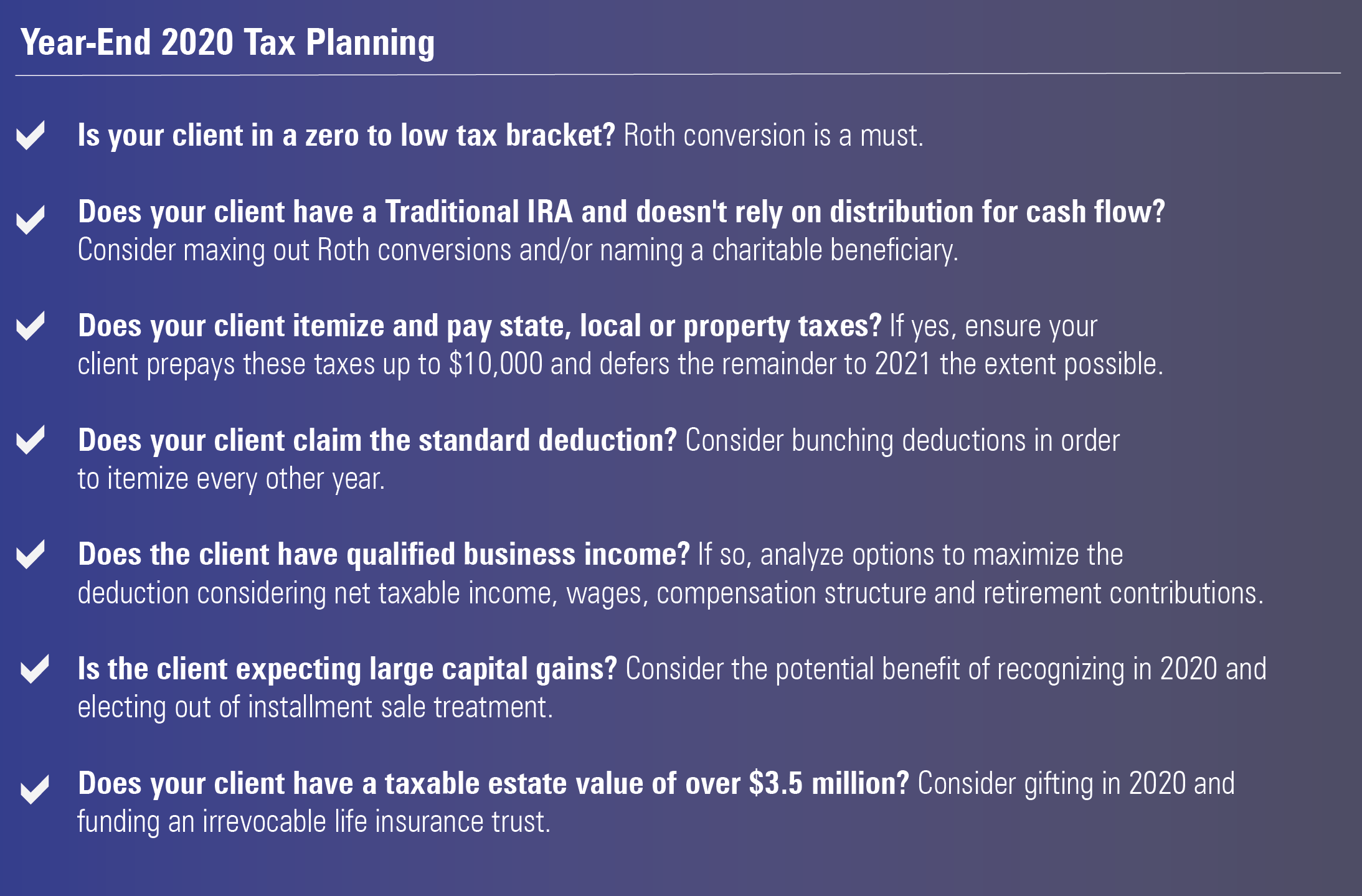

In a future column, I'll be taking a look at what may be on the table for taxes under the Biden administration, but here I'll walk through some tried-and-true tax strategies. These include Roth conversions, itemized deduction moves, qualified business income deduction maximization, and capital gains planning.

The Roth conversion is the holy grail of tax planning. It is a rare opportunity to pay taxes at a discount. By recognizing taxable income on the amount converted, future tax on principal and earnings is eliminated. Further, Roth IRAs are not subject to required minimum distribution rules, and heirs can essentially inherit the accounts with the same tax-free benefits.

IRAs At a minimum, IRA owners should convert to the extent of zero to low tax brackets. But should they convert more? The general recommendation is probably yes. We know that tax rates likely will not decline but increase in the future. It's a big benefit to pay taxes on IRA balances at low rates now to avoid paying taxes at higher rates on both principal and interest in the future. This strategy would likely not be worthwhile for clients without outside cash to pay taxes, or those who rely on RMDs to pay monthly expenses or plan to bequeath IRAs to charity.

Itemized Deductions For clients who typically claim the standard deduction, it might be possible to bunch deductions to allow itemizing deductions in excess of the standard deduction every other year. This can mean accelerating or deferring payments for mortgage interest, state and local taxes, medical expenses, and charitable contributions, depending on the year. Payments of state, local, or property taxes should be deferred to 2021 to the extent in excess of $10,000. Amounts paid above that amount would be disallowed in 2020, whereas in 2021, they might be deductible. It could also be a good year in 2020 to maximize charitable contributions (especially if using appreciated securities and/or a donor-advised fund). The higher itemized deductions could be used to offset additional Roth conversions.

QBI Deduction The qualified business income, or QBI, deduction bestows a permanent tax reduction, meaning there is no deferred tax to be paid in the future. Thus, it is important to maximize this deduction. There are several ways to do this, including deferring income, optimizing salary, properly structuring compensation, and weighing the benefits of pension contributions. For those with service businesses, the QBI deduction is phased out to zero for taxable income between $326,600 and $426,600 for married couples filing jointly and $163,300 and $213,300 for single filers. If taxable income prevents the QBI deduction in part or full, the client should try to accelerate deductions, defer income, and contribute to a retirement plan to bring income down to a qualifying amount.

S-Corporation owner-employees must solve an algebraic problem to determine the optimal amount of salary to pay themselves. Paying salary reduces qualified business income that produces the credit, while higher salaries increase the amount of deduction allowable. The answer has been determined to be two sevenths. For example, say that a high-income taxpayer is the sole employee (owner) of an S-Corporation with income of $70,000 before wages paid. Without paying wages (assuming no material real property), there would be no QBI deduction because the 50% of wages limitation would be zero. If all of the income is paid out as wages there would be no QBI deduction because 20% of QBI would be zero. The maximum QBI deduction is the intersection of the maximum limitations. In this example, the optimal amount of wages would be $20,000 (two sevenths of $70,000). The "intersection" is proved as follows: The deduction would be limited by the 20% of wages maximum of $10,000 (50% of $20,000) subject to the income limitation of $10,000 (20% of $50,000).

Properly structuring salary is critical. Corporations should pay wages to their owner-employees and/or employees. Doing so creates the cap for determining the QBI deduction. In general, companies would rather pay wages than compensation to independent contractors because although both reduce QBI, the former counts toward the wage limitation while the latter does not. For partnerships and LLCs, partners will prefer to allocate profit rather than guaranteeing a payment. Profit allocations do not reduce QBI while guaranteed payments do. For example, a partnership earning $100,000 that pays out $40,000 to one partner and then proportionately allocates the net profit of $60,000 to all of its partners will have QBI of $60,000 and, thus, a maximum QBI deduction of $12,000. On the other hand, if that same partner got a priority profit distribution of $40,000 and then the remaining profit was proportionately allocated to all of the partners, the partnership would have QBI of $100,000 and, thus, a maximum QBI deduction of $20,000.

Finally, the amount of pension contribution should be carefully considered. Pension contributions are tax-deferred (that is, taxes will be due as withdrawn in the future), whereas the QBI deduction is never recaptured. Since pension expense reduces QBI, is it worth it? The answer is not the same for every client. For example, assume that your client has a sole proprietorship with net income of $100,000. Assuming the other limitations are not a factor, the QBI deduction would be $20,000 (20% of $100,000). If a $40,000 pension (defined-benefit) contribution is made, the QBI deduction is reduced to $12,000 (20% of $60,000). At a 28% rate, the pension contribution plus QBI deduction saves $8,960 in taxes. Without a pension deduction, the QBI deduction saves $5,600. So, the savings attributable to the pension is $3,360, or 8.4%. In this case, I would argue that contributing to the pension would be ill-advised. Saving 8.4% now would likely not make up for paying taxes down the road at significantly higher rates.

'Reactionary' Planning With the potential for significant tax law changes on the horizon under the Biden administration, it's important think ahead. This is especially appropriate for capital gains, estate planning, and first-time homebuyers.

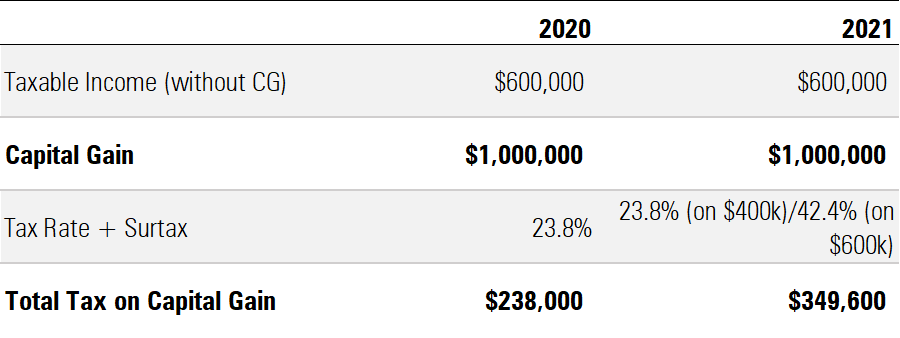

Because future capital gains could be taxed at 39.6% (plus surtax and state income taxes) to the extent income is greater than $1 million, planning now has the potential to cut that tax bite in half. For large capital gains, it might make sense to recognize the income in 2020 rather than take a chance on 2021. For example, let's say your client expects taxable income before capital gains of $600,000 for both 2020 and 2021. The client is selling stock that will produce a $1 million long-term capital gain and has the flexibility to close the transaction in either 2020 or 2021. Based on current tax laws, the gain would result in a federal tax of $238,000. Should Biden's proposals take effect in 2021, a sale in that year would result in a federal tax of $349,600.

Thus, large capital gains should be accelerate into 2020, to the extent possible. At worst case, the client will accelerate tax by as much as a year. But, should the new laws become effective in 2021, this acceleration could save a significant amount of money (in this example, over $111,000).

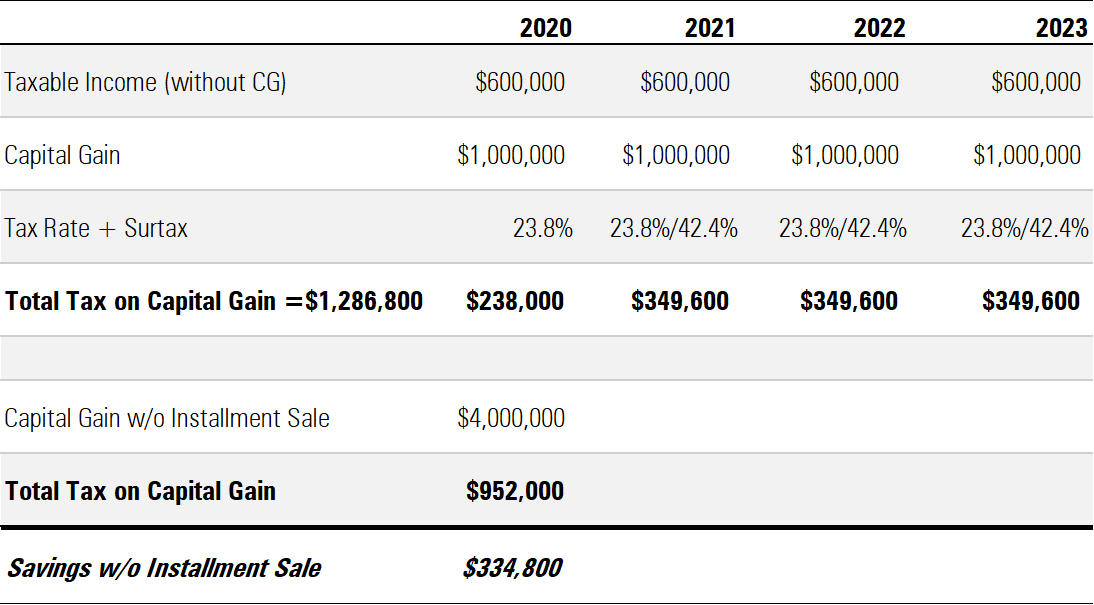

An installment sale situation could expose your client to an even greater tax liability. Let's say your client earns $600,000 per year in taxable income without capital gains. The client sells a business for $4 million, receiving $1 million per year beginning in 2020. Should Biden's new capital gains provisions take effect in 2021, the total tax payable would be $1,286,800 rather than the previous law's total of $952,000. For a savings of over $334,000, it would be worth it for the client to elect out of installment sale treatment in 2020. In other words, it would be better to bite the bullet and pay all the tax up front then to spread a much higher tax amount over the future three years.

Clearly, a client is not going to be anxious to spend virtually all of the first year's proceeds on tax when the tax increase might not happen next year. Since the election must be made by the due date of the tax return (including extensions), by extending the tax return, the decision could be postponed until Oct. 15, 2021. At that point, presumably more would be known about whether or not the capital gains increase would be implemented.

Estate plans will certainly require updating should Biden's proposals become law. At a minimum, we can expect estate and gift exemption amounts to decrease as early as 2021 and not later than 2026. Thus, unless your client is planning to die in 2020, there is a need for proactive planning. Gifts in excess of the future exemption amount will not be subject to tax to the extent within the current exempt amount for 2020. Thus, if you have a client that is planning to make large gifts in the future, it might make sense to do so in 2020. Additionally clients should consider more charitable bequests to help reduce estate values and look into more advanced estate-planning techniques such as qualifying personal residence trusts, family limited partnerships or LLCs, charitable remainder trusts, and so on. Finally, life insurance can be an effective tool for payment of estate taxes. Proceeds from a life insurance policy (or second-to-die policy) can be received outside the estate (that is, not subject to estate tax) if held within an irrevocable life insurance trust.

Last, since there is a possibility of a first-time homebuyer credit of $15,000 in the future, it might pay off the delay purchasing a home for those qualifying buyers.

In my next column, I'll take a closer look at Biden's proposals. But for now, we need to focus on what's already in front of us.

Here's a year-end planning checklist:

Sheryl Rowling, CPA, is head of rebalancing solutions for Morningstar and principal of Rowling & Associates, an investment advisory firm. She is a part-time columnist and consultant on advisor-focused products for Morningstar, and she continues to actively run her advisory business, from which Morningstar acquired the Total Rebalance Expert software platform in 2015. The views expressed in this article do not necessarily reflect the views of Morningstar.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)