When Bad Taxes Happen to Good Funds

Learning from past misfortunes can help investors avoid future tax woes.

For mutual fund investors, taxes can be an unpleasant surprise, partly because they're largely out of the individual’s control. Mutual funds build up unrealized gains and are required to distribute those gains to shareholders on a pro-rata basis after they’re realized. As a result, shareholders can end up getting hit by unexpected tax bills, even if they didn’t benefit from previous appreciation.

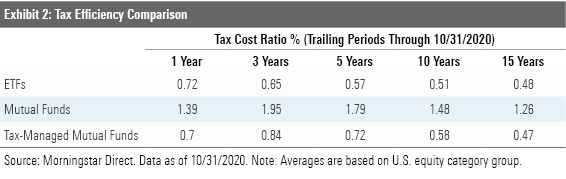

For investors in taxable accounts, the impact can be significant. Over the past five years, Morningstar’s Tax Cost Ratio--a measure of the reduction in returns from taxes on fund distributions--has averaged about 1.8% for U.S. equity funds. Like fund expenses, taxes directly reduce an investor’s take-home pay--the amount of money you end up with after paying taxes and fees. But the return hit from taxes is nearly twice as large [1] as that from annual expenses, which average 0.98% for diversified U.S. equity funds.

In this article, I’ll look at a few examples of otherwise successful funds that have had bad results for investors in taxable accounts and give some suggestions for how to avoid similar problems going forward.

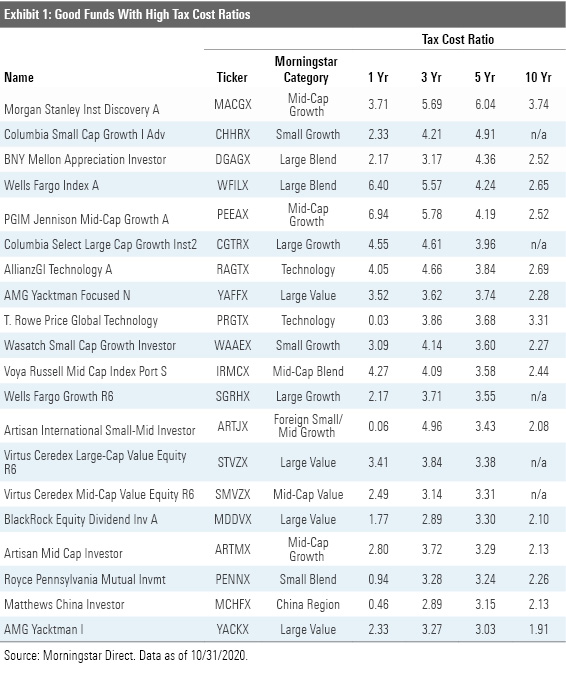

When Things Fall Apart I started by screening on diversified U.S. equity funds with Morningstar Analyst Ratings of Bronze or higher. Our analysts assign these forward-looking, qualitative ratings based on their in-depth analysis of a fund's People, Process, and Parent, as well as its underlying fees. (Note: our rating process doesn't incorporate tax considerations because many shareholders hold funds in tax-advantaged accounts, such as 401(k) plans.)

Despite their overall merits, there are a few funds with above-average Analyst Ratings that haven’t been great holdings for investors in taxable accounts, as shown in the table below. Morgan Stanley Institutional Discovery MACGX, for example, has a five-year Tax Cost Ratio of 6.04%, making it a tough pill to swallow for investors holding it in a taxable account. The fund has racked up impressive long-term returns--enough to land it in the top 4% of all mid-cap growth funds over the 10 years ended Oct. 31, 2020--but performance lagged from 2014 to 2016. As a result, assets dropped from a peak of $2.2 billion in 2013 to just $327 billion by the end of 2016. Management was forced to sell appreciated securities to meet redemptions, and the fund distributed $11.58 per share in capital gains during 2016--equivalent to 73.6% of its net asset value at the time.

There are a few common themes behind funds with above-average Tax Cost Ratios.

Net outflows. This is by far the most frequent reason for above-average distributions. Even portfolio managers who actively try to minimize taxable capital gains can be forced to liquidate securities to meet redemptions in the face of large net outflows. This is one of the less-friendly quirks of mutual funds. Because shareholders buy and sell shares of mutual funds in cash, fund managers are forced to sell securities to meet redemptions and pay departing shareholders the value of their shares. (Exchange-traded funds, on the other hand, have an in-kind creation and redemption structure, making them far more tax-friendly, on average.)

The second fund on the list, BNY Mellon Appreciation DGAGX, is a good example of the negative tax consequences that often follow net outflows. The fund saw its assets decline from about $5.6 billion to $1.6 billion between 2015 and 2017 and paid out capital gains ranging between about 15% and 27% of NAV in each of those years. PGIM Jennison Mid-Cap Growth PEEAX is another prime example. The fund saw its asset base decline from a peak of $3.8 billion at the end of 2013 to less than $1 billion by October 2020; as a result, it has paid out significant capital gains for the past several years. In fact, asset flows are such a significant factor behind distributed gains that most of the funds shown in the table above experienced some net outflows that likely contributed to their above-average distributions.

Manager change. A change in management can sometimes lead to larger distribution if the new manager has a significantly different management style and ends up clearing out portfolio holdings to make room for those that better fit his or her criteria. Columbia Small Cap Growth CHHRX is one example. When Dan Cole came aboard as the lead manager in 2015, he implemented a new approach and sold many of the previous manager's longer-term holdings, resulting in a large capital gains distribution that year. Manager changes at Wasatch Small Cap Growth WAAEX and Artisan International Small-Mid Investor ARTJX were also followed by hefty distributions.

High turnover. Funds that buy and sell holdings at a rapid pace often end up realizing more capital gains. For example, AllianzGI Technology RAGTX has had an average turnover rate of about 145% over the past five years and has consistently made large capital gains distributions. Similarly, T. Rowe Price Global Technology PRGTX had annual turnover rates averaging about 200% until it slowed down the pace of trading in 2019; the fund has made distributions ranging between 9% and 28% of NAV over the past few years. Asset outflows in 2018 also likely contributed to its larger distribution that year.

Active management. Not surprisingly, actively managed funds tend to be far less tax-efficient than their passively managed peers; nearly all of the funds with the highest five-year Tax Cost Ratios are actively managed. Active management is inherently less tax-efficient because it involves buying and selling in an attempt to outperform a market benchmark.

Index funds, on the other hand, generally only need to change their underlying holdings if a security gets added or dropped from the benchmark, which is relatively rare. However, they can still be subject to tax woes if they experience net outflows after building up unrealized gains. Once portfolio managers use up deferred tax losses to offset gains, there’s little they can do to shield investors from capital gains distributions if they’re forced to sell holdings to meet redemptions. That’s exactly what happened with Voya Russell Mid Cap Index IRMCX. The fund has suffered consistent annual outflows over the past several years; as a result, it distributed capital gains equivalent to about 14% of NAV over the past few years, on average.

Avoiding Tax Woes There are a few steps investors can take to avoid getting hit with an unexpected tax bill. Looking at asset location is a good first step; this refers to keeping less tax-efficient funds in tax-deferred accounts, where distributions won't cause any damage. This advice obviously applies to taxable-bond funds, as well as funds that focus on dividend-paying stocks and hybrid funds that combine equities and taxable fixed-income securities. But in many cases, actively managed equity funds aren't a good fit for taxable accounts, either. If you're investing in a taxable account, it makes sense to stick with passively managed index funds or exchange-traded funds, which tend to be significantly more tax-efficient than open-end mutual funds.

For taxable accounts, tax-managed funds, such as Vanguard Tax-Managed Balanced VTMFX and USAA Growth and Tax Strategy USBLX, can help minimize the tax hit. But funds with tax-managed mandates can still end up distributing capital gains if they experience redemptions. For example, JPMorgan Tax Aware Equity JPEAX is estimating a 9% distribution for 2020, on the heels of a roughly 6% distribution last year.

Looking at a fund’s potential capital gain exposure can also shed some light on potential future tax issues. This data point--which investors can track using our Portfolio Manager tool--measures the embedded capital gains that haven’t yet been distributed to shareholders. It’s important to note that funds with high potential capital gains may or may not make taxable distributions. It all depends on when they sell the underlying securities and pay out those gains to shareholders. However, it’s worth keeping an eye on to get an idea of how much a fund has built up in unrealized gains. Because of the U.S. market's overall strength over the past 10 years, most U.S. equity funds have built up unrealized gains. Many international equity funds, on the other hand, currently have accumulated losses that could help them offset future gains.

Finally, most fund companies provide information about estimated annual distributions starting in November. If you’re thinking about adding a fund to a taxable account--especially later in the year---it’s a good idea to double-check the fund’s website or Morningstar’s annual capital gains roundup to avoid “buying the dividend,” or getting hit with a taxable distribution even when you didn’t benefit from the underlying appreciation.

Conclusion Taxes can often be an unwelcome--and unexpected--side effect of mutual fund investing. However, being aware of the underlying factors that can lead to taxable distributions can also improve your long-term results. Being aware of potential tax issues can help you take steps to minimize adverse tax effects from otherwise good funds.

[1] Our calculation is based on the highest tax rates in effect at the time of the distribution--currently 37% for income and 20% for capital gains--so the damage isn’t quite as severe for investors in lower brackets.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)