What the Next Generation of Clients Is Looking for From Advisors

This new column covers how advisors can appeal to and help millennials and others.

Millennials have grown up facing very different financial needs from previous generations. This requires financial advisors to learn how to solve a new set of problems.

I consider myself an elder millennial. The oldest of us are in our late 30s and, like any age group, fall across the range of financial stability--from earning high salaries or experiencing underemployment or unemployment. Millennials are saving to buy homes even as prices seem increasingly out of reach, struggling to save for a down payment while paying high rent costs. A large number are putting aside the dream of homeownership and focusing instead on making student loan payments.

Millennials' attitudes toward wealth can be very different from that of their parents and grandparents. Some millennials are starting to inherit wealth and property and are finding it comes with mixed feelings. Many are taking a close look at what makes up this wealth and realizing that growing financial assets at any cost is not their goal. The majority of us care about the social and environmental impacts of our investments and actions.

For advisors who embrace these clients, it can be a big opportunity to grow their firms and make a positive impact. However, I’ve spoken with hundreds of millennial clients across the country who feel like traditional financial advisors do not understand these issues.

My goal in this column is to share what I’ve learned working with clients in their 20s and 30s, and clients of all ages who want to invest with their values, so more professionals across the financial industry can help.

Why I Became a Financial Planner Before becoming a financial planner, I was a public school teacher in communities with stark income and wealth disparities. Then I worked in the nonprofit world as a trainer for financial coaches working with people living in subsidized housing before shifting gears to educate financial planners working with wealthy clients. Now, I run my solo RIA providing virtual, hourly, or retainer-based financial planning, often with folks in the middle class who are building savings for the first time in their lives. Separately, I also work for a wealth management firm, making investment decisions based on social-justice criteria.

My career has always cut across income and wealth spectrums. My mission, which began as a personal one, is to demystify personal finance and financial systems, with a focus on closing racial wealth divides. As a result, education runs through everything I do.

So, what are the most pressing financial-planning challenges that my clients across the wealth spectrum face today? Here are some examples based on recent experiences I’ve had with clients:

- A 27-year-old single person who works at a tech company and earns $140,000 per year. He is the first college graduate in his family. He has $100,000 in retirement savings and company stock and $80,000 in student loans. The client wants to invest in a socially responsible way, but his retirement accounts don't have the investment options he is looking for. The client is considering graduate school and also wants to buy a house in one of the most expensive cities in the United States. He may need to financially support both parents within the next 10 years.

- A 32-year old who works for a grassroots publishing company and earns $70,000 per year. Her partner has $50,000 in student loans and works for a nonprofit. One has inherited $300,000 and will inherit more in the coming years but is unsure of how much. They want help creating a giving plan with a focus on reparations to Black and Indigenous communities. The client wants any investments they make to be completely outside of public markets, in alternative impact investments and local businesses.

- A couple in their late 30s who are both educators. One has inherited $2 million dollars and farm land, all managed by the parents' wealth advisor. The other grew up experiencing financial insecurity in the U.S. and often sends money to a family member. They both want to align their money with their values but are unsure how. They don't want to hold any investments funding incarceration or immigrant detention, companies extracting fossil fuels, or other practices that go against their values.

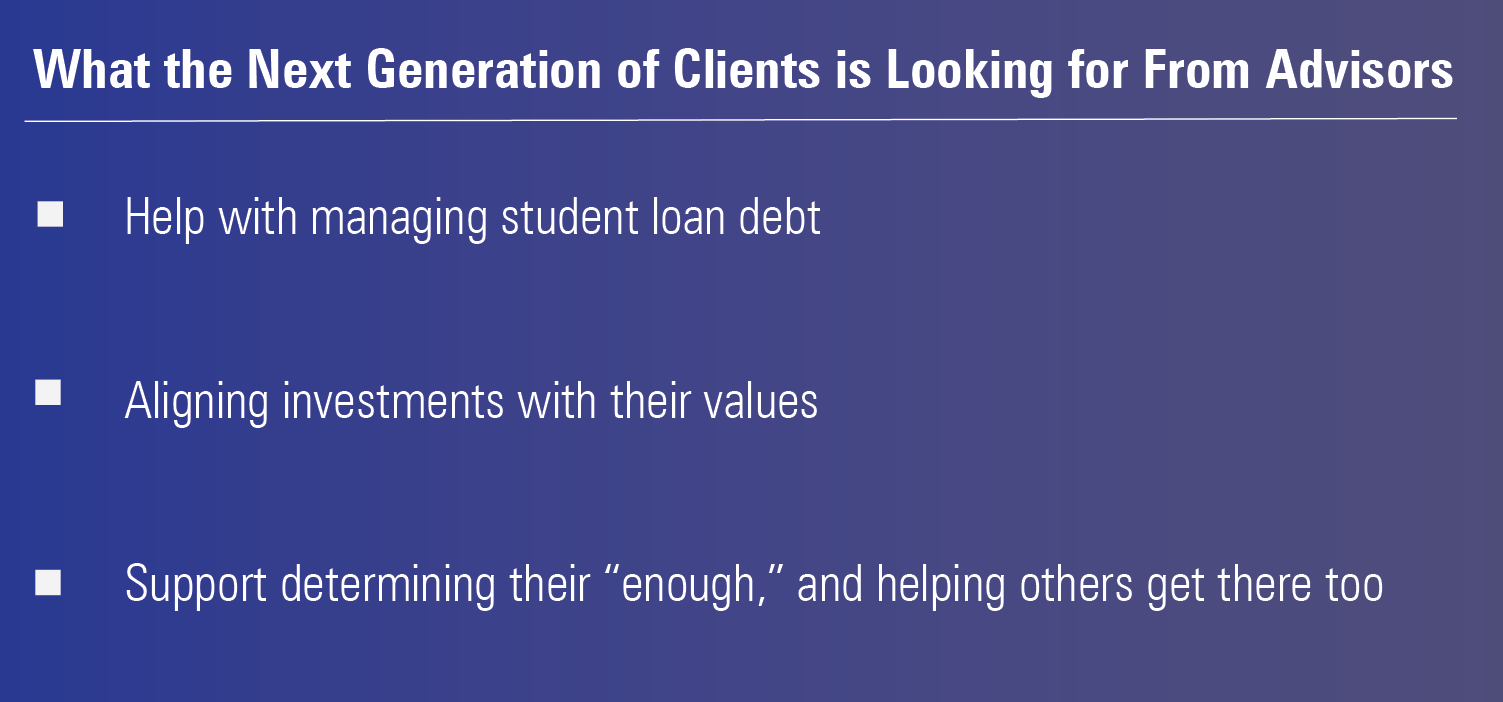

What Clients Are Asking These client composites point to three common themes:

1) Student loans are an issue for clients across the income and wealth spectrum.

Education costs have outpaced the rate of inflation and income growth over the last three decades. I often work with couples where at least one partner has student debt. This has implications for taxes, homeownership, retirement savings, and starting a family. I have also worked with six-figure income earners who are first in their families to attend college--and have federal student loans in default or in collections. It's important that advisors working with millennial clients understand loan forgiveness programs and strategies for managing student debt in light of competing priorities and overlapping life goals.

2) Clients want to align their investments with their values--and are having difficulty making that happen.

Many clients with this intention have already done some initial research and know that the only investment options available in their employer-sponsored retirement accounts include index funds that hold companies in problematic business lines, such as driving climate change or mass incarceration.

For clients with taxable investments or inherited wealth, all too often their financial advisors trivialize their goals of investing in nonextractive industries or are unable to help them because they do not know how to compare sustainable investment options. There are also young people who stay out of the stock market completely for the reasons discussed above. These clients want help evaluating alternative, direct impact investments like loans to Community Development Financial Institutions, community land trusts, and worker-owned cooperatives. Many of these young people want to invest in the burgeoning "solidarity economy" to make wealth distribution and ownership more equitable.

3) Clients want support to determine their “enough” and to help others have enough.

Traditionally, financial advisors have had one goal: maximizing their clients’ wealth. But many young people are deciding that accumulating wealth is not a meaningful goal in itself.

When the goal isn’t maximizing personal wealth, the conversations are very different from the traditional financial-planning meeting we’ve been trained to conduct. They want to know: How much can I redistribute now while ensuring financial security for myself and my family?

Some of my clients are giving at least 10% of their income every year while saving for their retirement. They reinvest family inheritances to be more aligned with their values or pledge to give it away during their lifetimes. They are also funding political movement building or emergency housing and medical needs for others. Importantly, rather than calling their actions "donating" or "charity," they are intentionally "moving" money or "returning" it to economically oppressed Black, brown, and Indigenous communities that have for generations experienced barriers to wealth and financial security because of government policies like redlining.

An Opportunity for the Financial Advice Industry In future columns, a primary focus will be to drill down into topics like these that advisors can use to grow and improve their practices. To do that, we can't ignore broader social, environmental, and political issues that our clients face. I believe that the young people I speak with are just the beginning of a much bigger trend.

Phuong Luong, CFP, is an educator, financial planner, and investment strategist focused on economic justice and closing racial wealth divides. She is currently the Investment Strategist for Adasina Social Capital and the founder of Just Wealth, a virtual, solo, fee-only RIA. She is also the online facilitator for the Boston University Financial Planning Program. Phuong is a subject matter expert in ESG and regenerative investing. The views expressed in this article do not necessarily reflect the views of Morningstar.

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_1997613e43634249b59dd28db9b24893_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)