Lagging Funds Get a Bounce

Some funds’ fortunes shift as value revives and momentum fades.

It’s only been a span of six weeks, but trends in the stock market since the start of the fourth quarter are leading to a change in fortunes for some underperforming groups of funds.

During October, the small-value Morningstar Category led among U.S. diversified stock funds with a 3.3% gain, the first month the category was the strongest performer since the end of 2019. Meanwhile, in October, the large-growth category lost 2.6%, trailing all other eight Morningstar Style Box categories, the first month since March 2018.

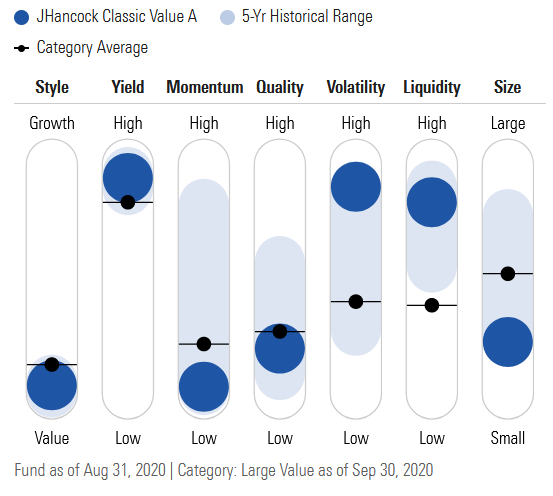

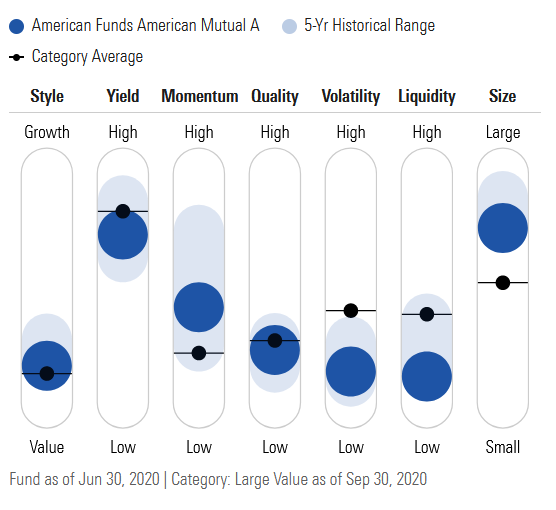

Underlying these results are shifts in some of the factors driving returns. Using Morningstar’s Factor Profile data, we’re able to look farther past their category grouping to analyze a fund’s portfolio on seven metrics: style, yield, momentum, quality, volatility, liquidity, and size exposure.

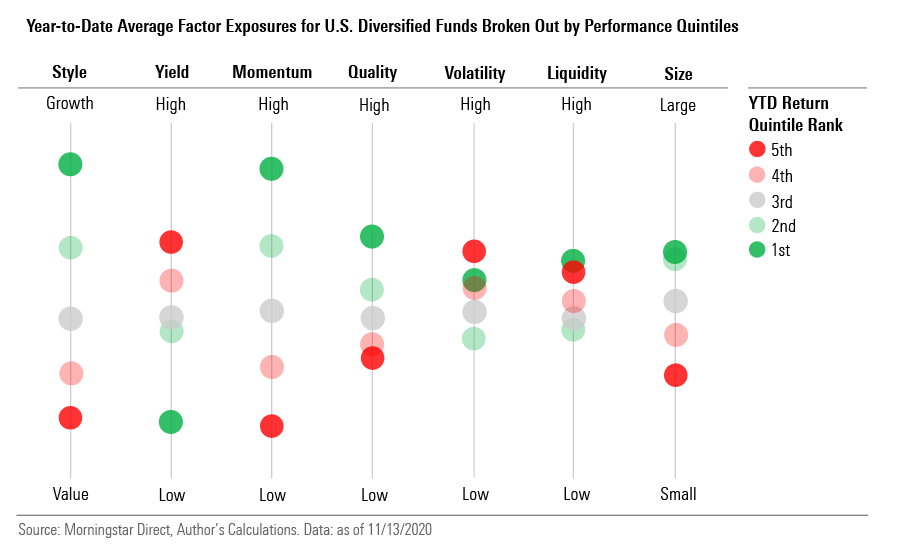

Here’s what the landscape looked like over the first nine months of the year:

The story during the first nine months of 2020 continued a long-term trend where strategies focused on fast-growing companies (high style exposure), large company stocks (low size exposure), and momentum exposure left their counterparts in the dust. Momentum exposure is loosely defined as stocks that are on a continuous winning streak, where low momentum stocks are laggards that continue to underperform and are viewed as undervalued.

This pattern was essentially the one that has been in place for the past two years, where there was a high degree of correlation between momentum, growth exposure, and strong performance. This led to an unprecedented winning streak of a handful of funds heavily exposed to large technology firms including Apple AAPL, Amazon.com AMZN, Facebook FB, and Microsoft MSFT. (See our recent article on this topic.)

Meanwhile, the laggards were funds that had portfolios consisting of higher-yielding stocks or lower-quality companies. (Quality reflects profitability and balance sheet trends.)

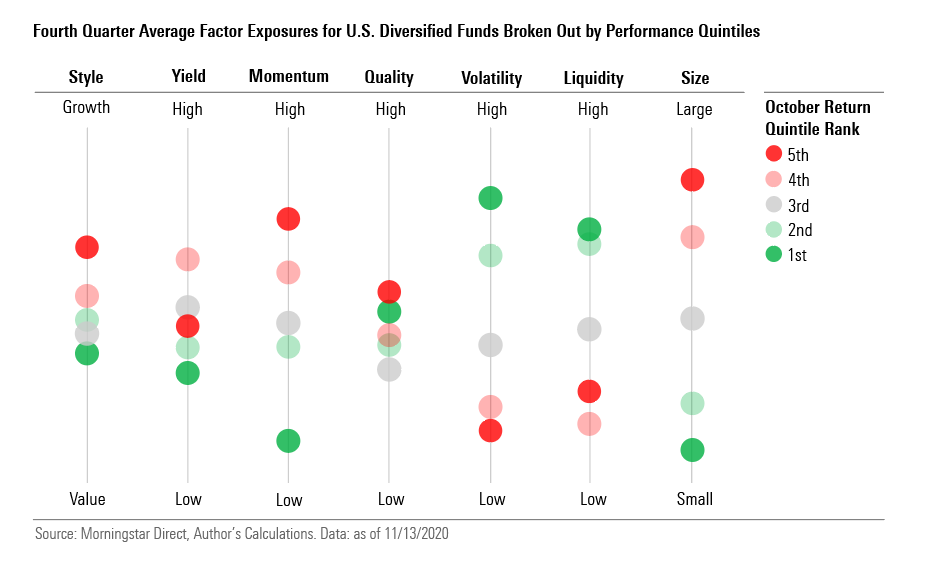

Then came October.

It’s often joked that momentum stocks “take the escalator up and the elevator down.” And that’s exactly what happened in the start of the fourth quarter, where the highest momentum funds on a winning streak fell to the bottom of the heap.

The fourth quarter’s winners consisted of funds holding the most undervalued, lowest momentum stocks.

Drilling down to individual funds, we can see how these trends played out among large-growth and large-value funds.

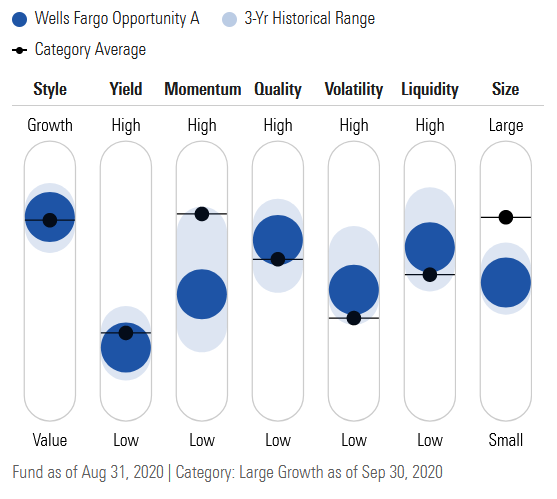

Large-Growth Strategies Wells Fargo Opportunity SOPVX was ranked fourth among its category for the first half of the fourth quarter, although looking back to the first three, it was 92nd.

Wells Fargo Opportunity is a large-cap fund, but it’s more exposed to smaller stocks than the average fund in its category. It’s ranked within the 43rd percentile for small-cap exposure, which is near the line of large- and mid-cap funds. Additionally, it was in the 73rd percentile exposure for growth exposure, similar to its peers, and 53rd percentile for momentum exposure. Besides growth, these were all headwinds in previous quarters but helped fuel the fund’s fourth-quarter outperformance.

Additionally, healthcare is the second-largest sector among holdings. And although the sector as a whole didn’t produce stellar returns, with the Morningstar US Healthcare Index returning 6.8% compared with Morningstar US Energy Index's 13.2% gain, a handful of Wells Fargo Opportunity’s top holdings like Ametek AME, UnitedHealth Group UNH, and Medtronic MDT proved resilient in the fourth quarter, gaining 18.0%, 14.1%, and 8.3%, respectively.

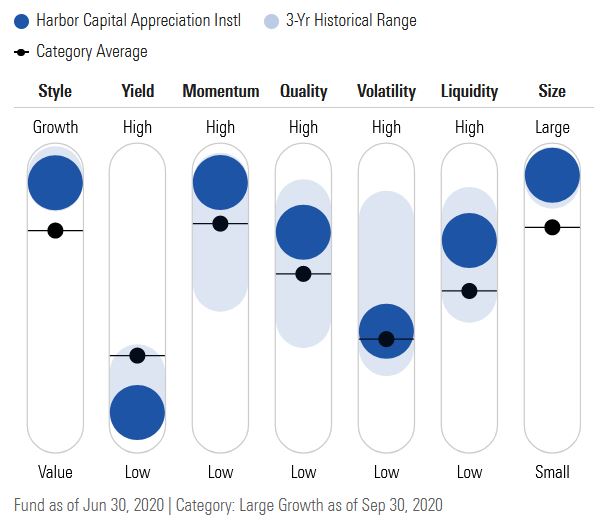

Harbor Capital Appreciation HACAX was on the flip side of the trend reversal. For the first nine months of 2020, HACAX ranked 10th in category. Among U.S. stock funds, Harbor Capital Appreciation has some of the highest exposure to growth, momentum, and large caps and has relatively low exposure to volatility.

Among Harbor Capital Appreciation's top five holdings were Amazon.com, Tesla TSLA, Apple, and Nvidia NVDA, which returned 70.4%, 412.8%, 58.8%, and 130.3% for the first nine months, respectively.

But these same stocks have more recently weighed down the fund. Each of its top 15 holdings have underperformed the Morningstar US Market Index since the start of October. When the tables turned at the beginning of the quarter, it found itself at the bottom, the fund is currently ranked 97th in its category.

Large-Value Strategies Looking across the aisle to funds in the large-value category, it was a similar chain of events.

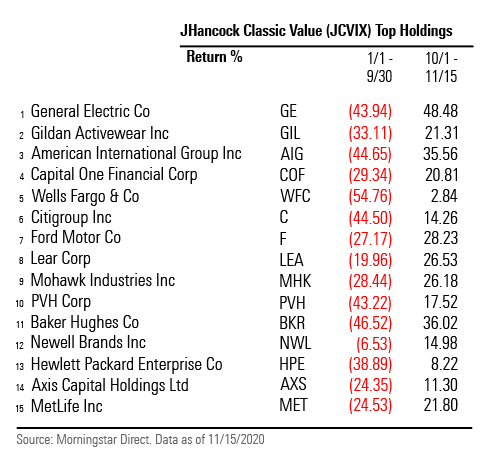

JHancock Classic Value JCVIX ranked 99th among large-value funds for the first three quarters but shot up to first for the first half of the fourth. The fund’s portfolio has a relatively smaller market capitalization compared with other large-value funds, lower momentum, deeper value, and much higher volatility and liquidity exposure. Each of these were positives for the fund starting in October.

Strong holdings in the fourth quarter include General Electric GE, which returned a 48.5% gain to the Morningstar US Market Index’s 7.4% and which has low momentum, high volatility exposure, and relatively high liquidity exposure. Additionally, in the top 10 were insurance firm American International Group AIG and Ford Motor F, both deep-value stocks, which returned 35.6% and 28.2% in the fourth quarter, respectively. Looking at JHancock Classic Value’s top holdings tells a polarized story of the stock market's fortunes during the first three quarters versus the start of the fourth.

Gold-rated American Funds American Mutual AMRMX ranked 10th among the large-value category for the first three quarters but ranked 92nd for the first half of the fourth. It had a 5.7% gain to the Morningstar US Market Index’s 7.4% for the month and a half. Even though American Funds American Mutual is in the large-value category, three of its largest holdings Microsoft, The Home Depot HD, and Apple have significant growth exposure, returning 34.4%, 29.5%, and 58.8% for the first three quarters, respectively, buoying the fund’s top performance. These three holdings returned 2.9%, -0.2%, and 3.2% respectively for the fourth quarter.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)