Gender Diversity on Corporate Boards Is Good for Investors

We screened our coverage universe for standout companies with diverse boards of directors.

The case for gender diversity in the workplace is clear. If an employer is looking to fill a position, considering women and men equally improves the chances of hiring an exceptional employee.

There are many other reasons to consider gender diversity. Morningstar head of rebalancing solutions Sheryl Rowling, CPA, explains why civic duty is just as important; employers are obliged to create diverse teams because it’s the right thing to do. Different perspectives can also lead to more innovative thinking and help teams avoid group-think.

The same idea applies for a company’s board of directors. Gender diversity on a corporate board shows a commitment to civic duty, and in recent years, U.S. companies and their shareholders have improved on this issue. Morningstar’s Gabrielle DiBenedetto and Amrutha Alladi found that women made up just over 20% of board of director seats in 2018, which is nearly double the percentage comprised by women in 2010. But there’s plenty of more work to do here. DiBenedetto and Alladi expect shareholders, with the help of state legislation, to elect more women to their companies’ boards.

Why Should Investors Care about Gender Diversity? Investors may wonder why diversity matters. After all, they may argue, if everyone on the board is qualified and experienced, why does it matter what gender or race they are?

Companies that follow best practices regarding gender equality mitigate their exposure to negative events like potential lawsuits and reputational damage. And a true commitment to gender diversity means ensuring diversity is considered not only during the hiring process but also for promotions, especially while considering leadership positions.

A more diverse board also encourages diversity of thought. Employees with similar backgrounds tend to think similarly. Those with different backgrounds can bring new ideas that can stimulate a team’s creativity.

Addressing a company’s long-term risk, especially gender diversity, begins at the top. Effective company leadership can develop a plan to solve a problem and executive the plan accordingly.

Lack of gender diversity is a long-term risk, and profitable companies tend to mitigate long-term risks.

Large-Cap U.S. Stocks With Gender-Diverse Boards We screened our stock coverage universe and ranked by companies that had the highest Sustainalytics' board diversity scores. Companies that scored best had women represent at least one third of the board and disclosed a board diversity policy (here's an example policy from Bank of Montreal BMO).

We found 146 U.S. stocks of all sizes that met these requirements, so to narrow the list further, we looked for only household names. We cross-referenced the results with the Morningstar US Large Cap TR USD Index, which includes the largest 191 U.S. stocks. These 45 companies remained.

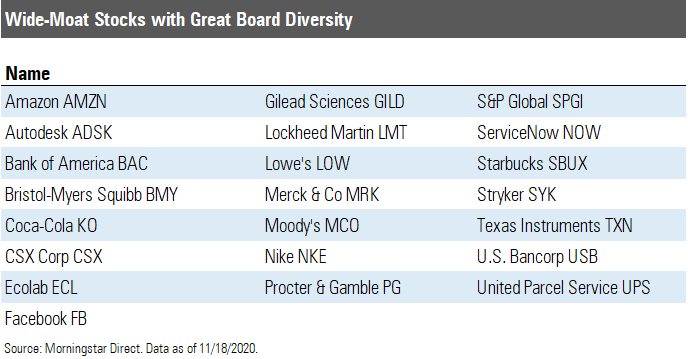

From there, we drilled down to see which ones had wide moats, attractive valuations, and great leadership.

Wide-Moat Stocks With Gender-Diverse Boards Twenty-three stocks have gender-diverse boards and wide economic moats. An economic moat is a sustainable competitive advantage that helps it outperform its peers for years or even decades.

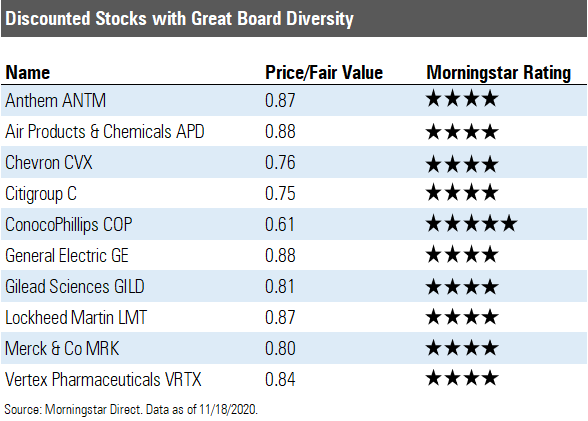

Undervalued Stocks With Gender-Diverse Boards Fourteen stocks have diverse boards and attractive valuations. Price/fair value takes the stock's current price and divides it by Morningstar's Fair Value Estimate. Ratios less than 1.0 mean the stock is trading at a discount, while ratios greater than 1.0 imply the stock is trading at a premium.

The price/fair value is also considered in the Morningstar Rating for stocks, where 4 or 5 stars indicate a stock is trading at a discount relative to its fair value.

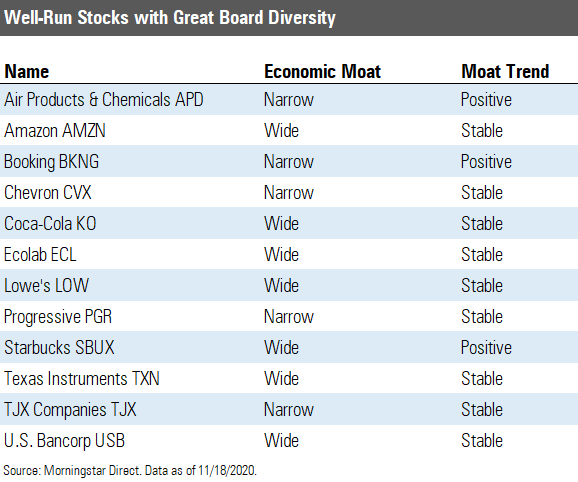

Well-Run Stocks With Gender-Diverse Boards Eleven stocks have women representing at least one third of their board and receive an "exemplary" Stock Stewardship rating. This data point measures how well-run companies are. These organizations make cost-friendly business investments that increase their competitive advantages, execute policies effectively, and have leaders with appropriate management backgrounds.

These well-led companies all have economic moats with stable or positive moat trends, which measures whether the company’s competitive advantage is strengthening, weakening, or remaining stable.

The Most Attractive Stocks Lockheed Martin LMT, the world's largest defense contractor, has a gender-diverse board of directors, a Morningstar Economic Moat Rating of wide, and a discount market price. It remains relatively unaffected by the pandemic as government demand for military products hasn't changed.

Next is Merck MRK, a drug manufacturer, with women representing one third of its board of directors. It’s the most discounted wide-moat stock in the gender-diverse list. Strong fundamentals and easing of concerns around U.S. drug policies will help its stock price.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CQP5OBZT3NBS7M76RDJCKLIFVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)