Set Realistic Expectations for Multifactor Funds

There is a strong case for multifactor funds, but even the best can underperform for a decade.

A version of this article previously appeared in the November 2020 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

Multifactor funds are sound in theory. They target stocks with characteristics that have historically been associated with market-beating performance, also known as factors. Just as it's prudent to diversify across asset classes, sectors, regions, and securities, it's a good idea to spread bets across factors that have a good chance of long-term success. Doing so can reduce risk and make it easier to stick with these factors through their inevitable rough patches.

Yet most of these funds have disappointed in recent years, illustrating that diversification across factors with strong theoretical support doesn't guarantee strong performance. Even the best funds aren't immune to lengthy stretches of underperformance. It's important to be selective and have realistic expectations.

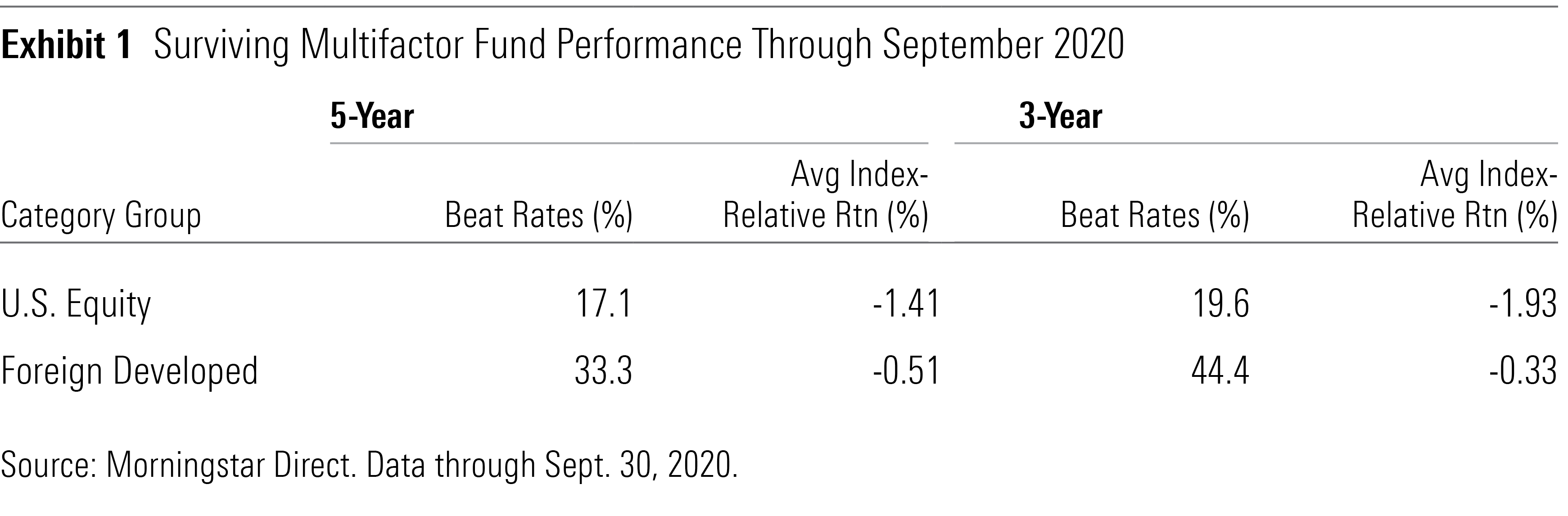

Disappointing Performance Most multifactor funds have underperformed their respective Morningstar Category indexes in recent years, as Exhibit 1 illustrates. Of the 35 surviving U.S.-listed multifactor equity exchange-traded funds in the nine Morningstar Style Box categories, only six posted higher returns than their category indexes over the trailing five years through September 2020. The results weren't much better after adjusting for risk (based on alpha) or over the most recent three-year period, where more funds were included. Multifactor funds in the foreign developed categories had better success rates, but those were still shy of 50%.

These results may be disappointing, but they aren't that surprising. Much of this underperformance is attributable to the poor performance of the value and small-size factors, which many of these funds lean into more heavily than their benchmarks. While these funds' inclusion of other factors tended to partially offset this performance drag, it often wasn't enough to overcome it.

Factor diversification helps, but it doesn't eliminate the risk of underperformance, even over long periods. That's because there are only a handful of robust factors to diversify across. Just as underperformance in one stock can sink a five-stock portfolio, significant underperformance in one or two factors can cause a multifactor fund to underperform. However, diversification is still prudent because it's hard to know which factors will do well in the short term.

Set Realistic Expectations It may be tempting to interpret multifactor funds' recent underperformance as a sign they lack merit, but that conclusion isn't warranted. While the factors that many of these funds target have tended to pay off over the long term, the volatility of their returns relative to the market far exceeds their average return edges. So there is a nontrivial probability that they will underperform over five-year and even 10-year periods, just on account of bad luck.

Academic researchers Eugene Fama and Kenneth French, who serve as consultants to Dimensional Fund Advisors, illustrate this effect in their paper, "Volatility Lessons" (1). They simulated the return distributions over several horizons for a few well-known premiums (market-risk, value, and small size) by randomly drawing monthly returns from each premium's historical distribution from 1963 through 2016.

They found U.S. stocks underperformed Treasuries in 15.6% of the 10-year simulations. When that happens, it's not evidence that stocks are broken. Sometimes, returns in solid strategies are just disappointing. Similarly, large-value stocks underperformed the market in 20.5% of the 10-year simulations, while small stocks underperformed in 22.5%.

Fama and French say it best: "Our general message is universal; because of the high volatility of stock returns, investors cannot draw strong inferences about expected returns from three, five, or even 10 years of realized returns."

We replicated this analysis for the MSCI USA Diversified Multifactor Index, tracked by iShares MSCI USA Multifactor ETF LRGF, which has a Morningstar Analyst Rating of Silver. On average, that index beat the market by 0.15% per month (1.82% annually) from December 1998 through September 2020. Yet even with that expected edge, it underperformed in 14.5% of our 10-year simulations.

Focus on Portfolio Construction Because performance is an unreliable indicator of investment merit, it's more important to focus on portfolio construction methodology. We recently published "A Framework for Evaluating Multifactor Funds," which provides a guide for assessing these funds' approaches to portfolio construction (2). Here are a few key questions from that framework worth asking before buying any multifactor fund.

1) Which factors does the fund target? There are only a handful of factors that truly matter for stock investors. These include value, momentum, quality, low volatility, and small size. While there are many other factors, they either are not widely accepted, not investable at scale (like illiquidity), or just repackage one or more of these core factors. It is best to stick to funds that target a combination of the core factors.

It's also prudent to look for complementary factor pairings. For example, value tends to work well when momentum doesn't, and vice versa. Similarly, quality's returns relative to the market are negatively correlated with small size.

2) How does the fund combine its targeted factors? There are two main approaches to combining multiple factors in a portfolio: considering factors separately (mixing) or considering them jointly (integration).

Funds that follow the mixing approach split their portfolios into individual sleeves, each targeting a distinct factor. This approach is simple and makes it easy to gauge the impact of each factor on the fund's performance. The drawback is it tends to dilute the fund's overall factor exposures because there is usually little overlap between the holdings in the different sleeves.

Funds that use the integration approach can achieve stronger factor exposures. They pursue stocks with the best overall combination of factor characteristics. This allows them to allocate the entire portfolio to stocks with exposure to the targeted factors.

The downside of the integration approach is that it can lead to greater active risk, which increases the potential for both outperformance and underperformance. It is also more complex than the mixing approach, making it harder to attribute portfolio performance to distinct factors.

3) How strong are the factor tilts? Funds with greater exposure to their targeted factors have greater potential to outperform the market than their less aggressive counterparts when those factors are in favor and greater risk of underperformance when they are not. Portfolios with higher thresholds for stock selection and more-frequent rebalancing should have higher factor exposures than those with less demanding criteria and less-frequent updates.

The Morningstar Factor Profile, which is available for all equity funds, makes it easy to view how each fund's factor exposures compare against its peers, based on the most recent holdings data.

Top Picks for the Timid and Intrepid Factor strength is a matter of personal preference, as stronger factor tilts tend to come with greater risk of underperformance. So, Morningstar Analyst Ratings don't directly penalize funds for high or low factor exposures. There are highly rated funds in each group.

Investors looking to dip their toes into factors might consider Silver-rated Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF GSLC. This fund explicitly limits its expected active risk relative to the broad, large-cap market, which gives it a low active share and mitigates potential underperformance. It uses the mixing approach to bring together value, momentum, quality (measured by profitability), and low volatility. While the fund's factor tilts are modest, it has a low 0.09% expense ratio to match, giving it a good shot to beat the market over the long term.

LRGF is more appropriate for those comfortable with taking greater active risk to boost returns. This fund targets stocks with the best overall combination of attractive value, momentum, small size, and quality characteristics. This allows the entire portfolio to work together, mitigating exposure to stocks with offsetting factor characteristics and strengthening its factor tilts.

Multifactor Versus Individual Factor Funds Given multifactor funds' complexity, it's fair to ask whether it might be better to buy a few individual factor funds instead. That might be appropriate for investors who aren't satisfied with the factor combinations available in multifactor funds. However, it isn't prudent to use single-factor funds to time factor exposures, as that's very difficult to do successfully.

Multifactor funds offer a few advantages over combining individual factor funds. They rebalance for you and tend to have lower turnover, as some changing factor exposures offset. And funds that use an integrated approach to portfolio construction can achieve stronger factor tilts than a portfolio of individual factor funds.

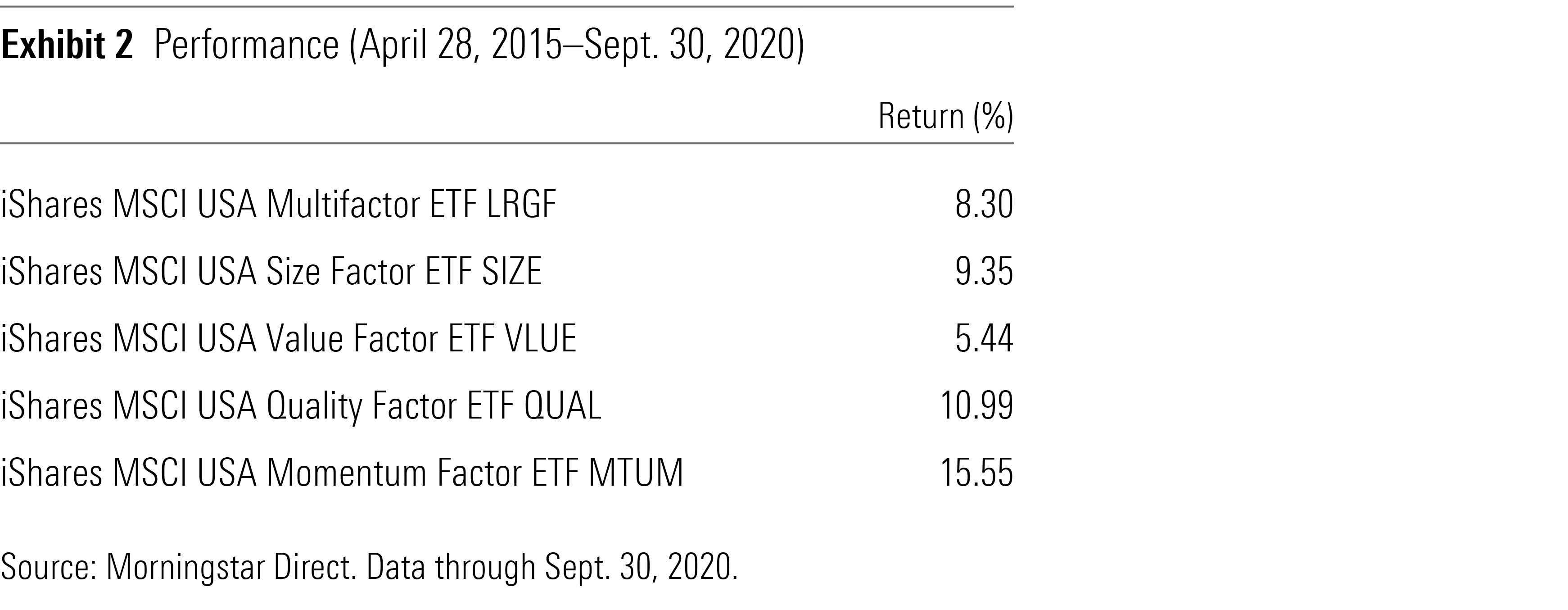

Consider LRGF: From May 2015 (the first full month after its inception) through September 2020, it underperformed an equally weighted portfolio (rebalanced annually) of four individual factor funds drawn from the same universe (shown in Exhibit 2) by 2.59% annualized. This doesn't undercut the case for this multifactor fund. Rather, it largely reflects LRGF's stronger value and small-size tilts than the equally weighted individual factor portfolio. This should give it greater upside potential when those factors are in favor.

Patience Is the Most Important Factor Investors who aren't comfortable with the possibility of underperforming for five or even 10 years shouldn't own multifactor funds--or any active investment for that matter. It often takes a long time for factors to pay off. That's a feature, not a bug: If they paid off consistently, investors would likely crowd into these strategies, which could reduce their efficacy. That doesn't mean you should ignore performance or give all multifactor funds a pass.

What matters is which factors a fund is targeting and how efficiently it captures them. Well-constructed funds, like LRGF and GSLC, won't always beat the market, but they have a good shot over the very long term.

References 1) Fama, E., & French, K. 2018. "Volatility Lessons." Fama/French Forum. https://famafrench.dimensional.com/media/467644/paper-volatility-lessons-may-2018.pdf

2) Bryan, A., Boyadzhiev, D., Choy, J., Sanzgiri, Z., & Sotiroff, D. 2020. "A Framework for Evaluating Multifactor Funds." https://www.morningstar.com/content/dam/marketing/emea/pan_emea/Multifactor_Funds_Framework.pdf

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)