Gold Is a Dull Investment

Gold may offer some insurance against a market meltdown, but there is a cost to own it.

A version of this article previously appeared in the October issue of Morningstar ETFInvestor. Click here to download a complementary copy.

I’ve never been a big fan of gold. It’s not a productive asset, so it doesn’t generate any cash flows, and it’s only worth what someone else is willing to pay for it. Yet there’s evidence that gold can serve as a hedge against a market meltdown and inflation, so it may serve a purpose as a small position in a diversified portfolio. The opportunity cost of holding gold is currently low, as real interest rates are negative.

Yet insurance doesn’t boost expected returns. Rather, it tends to reduce them. There is no compelling economic reason to expect gold to provide strong real (inflation-adjusted) returns over the long term. Gold is far from a perfect hedge against inflation and market tail risk. But then again, nothing is.

Investors willing to accept the cost of this imperfect insurance might consider a low-cost physical gold exchange-traded fund like SPDR Gold MiniShares GLDM. It owns gold bars in a vault in London, so it should closely hew to gold spot prices.

An Imperfect Hedge Gold is a strange metal. It is a commodity that behaves as a safe-haven asset, largely because of its universal role as a store of value for thousands of years. Sam Lee, a former editor of this newsletter, articulated it well when he said, "The best way to think of gold is as a nonyielding currency with a special trait: The only way to 'print' it is to pull it out of the earth at great cost." Like any foreign currency, the price of gold tends to move in the opposite direction of the strength of the U.S. dollar.

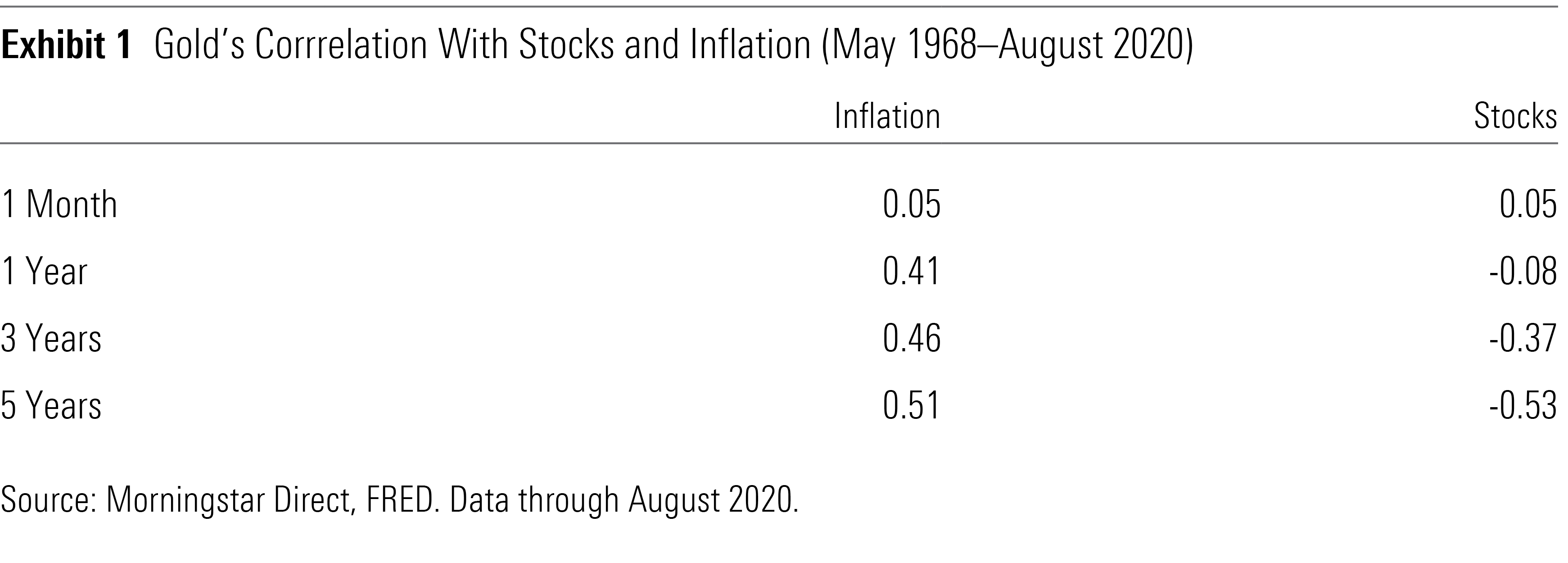

Predicting the movement of any currency or commodity is very difficult, and gold is no different. The best reason to own it is as a hedge against a market meltdown and inflation, rather than as a speculative bet that gold prices will be higher in the future. Over short periods, gold has been uncorrelated with stocks, but over longer holding periods the two assets have been negatively correlated, as Exhibit 1 shows. In other words, gold has tended to do well in stretches when stocks have fared poorly, and vice versa. For example, during the global financial crisis from Oct. 9, 2007, through March 9, 2009, gold cumulatively gained 25.9%, while the S&P 500 lost 54.9%.

There is no law that this relationship must always hold, and there are no economic drivers to enforce it. It exists because investors perceive gold as a safe-haven asset and use it accordingly. While there isn’t a compelling reason to expect that perception to change, the hedge is only as strong as that perception.

In this way, gold is similar to fiat currencies like the U.S. dollar. Its value depends on others’ faith in it, as there are limited practical applications for it aside from jewelry. The difference is the supply of gold is fairly stable, while central banks can change their money supply at will. This underpins the second reason for owning gold: to hedge against inflation.

Like most commodities, gold prices have been positively correlated with inflation, as Exhibit 1 shows. But they don’t move in lockstep with inflation. Gold can and has lost purchasing power over decade-long spans, as it did between August 1993 and December 2005. Investors who bought gold at its record high real price in January 1980 are still waiting to be made whole on an inflation-adjusted basis. Gold is clearly not a perfect inflation hedge, though it can help boost returns in inflationary periods.

Cryptocurrency has emerged as a competing asset with gold for investors who don't trust government-issued currency. While this could reduce investment demand for gold, it still has a couple of things in its favor: 1 | It has proven staying power and is more likely to be around 50 years from now than any cryptocurrency; and 2 | gold still behaves like a safe-haven asset, while most cryptocurrencies are highly speculative.

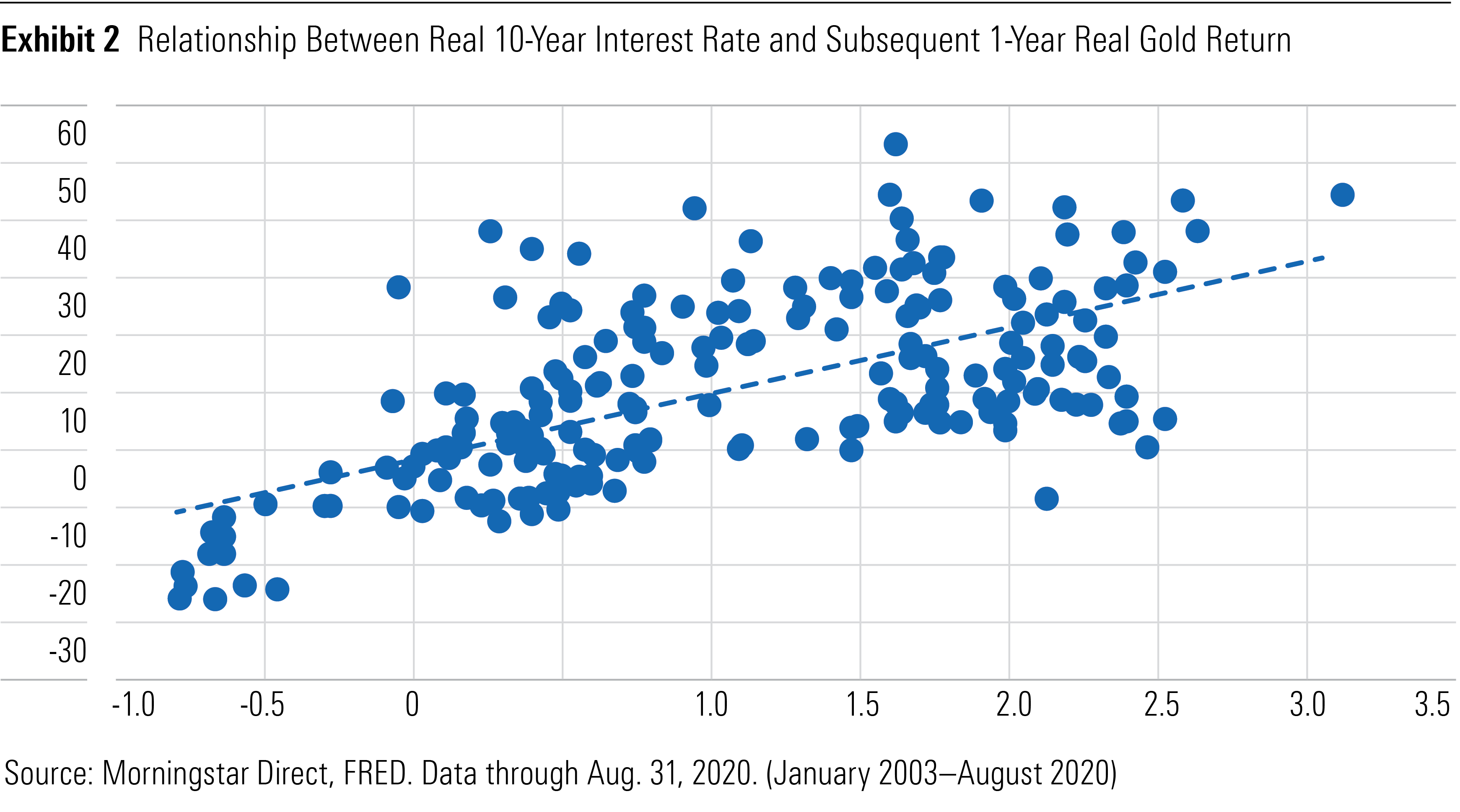

Opportunity Cost Gold doesn't yield anything, so there's an opportunity cost to own it. The lower interest rates are, the lower that opportunity cost is. Consequently, there has been a strong inverse relationship between real (inflation-adjusted) interest rates and the real price of gold, like most bonds. Because current prices and future returns move in opposite directions, the expected returns on gold are positively correlated with real interest rates, even though gold yields nothing. Exhibit 2 shows this relationship. Low interest rates inflate gold prices but depress future returns.

Rising interest rates hurt gold prices by increasing the opportunity cost of holding it. So a bet on gold is also a bet that real interest rates will remain low.

Because real interest rates are near record lows, it’s not surprising that real gold prices in U.S. dollars are near record highs, as shown in Exhibit 3. Viewed in this light, gold is far from a screaming buy. Although its long-term real returns will likely be lower going forward, gold may still be worth considering. It’s not perfect, but it can still serve as a hedge against tail risk and inflation.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)