Building a Niche Advisory Firm From the Ground Up

Knowing your customer is critical.

When I first considered venturing out on my own to build an independent advisory firm, I was a young MBA grad with a few years of experience in the wealth management industry. Today I have my own shop that is focused on millennials in technology industries. But at that time, as I looked around, I quickly saw that most firms were by and large pretty much the same.

The most well-known advisor practices had essentially the same culture, were built on the same old business models, and were not a good match for my generation. I remember interviewing at firms and being asked to write down 50 names of those who would make ideal clients for the firm--read: those who had $250,000 of investable assets. Now tell me, as the first college grad in my family, where was I, a 23-year-old Black kid, supposed to find people with that kind of money? And more importantly, how would I get them to trust me with managing their life savings?

For most of its history, the financial advisor profession has primarily been generalist-centric. As long as there were retirees with a decent-sized nest egg, there were financial advisors cold-calling and selling the next hot stock. Early on in my journey, I found the fundamental issue with this wide-net approach is that you are not uniquely differentiated as being the best at anything for anyone by doing everything for everyone. Having a niche is not only a growth hack, it also allows me to produce at higher levels of excellence and efficiency, simply because I’ve seen the same issues time and time again. And for most clients, expertise is more valuable than size or brand name.

Imagine a world with five financial advisors: the first specializes in equity compensation, the second specializes in entrepreneurs and small business owners, the third specializes in physicians, and the fourth and fifth are generalists who will do just about anything for anyone.

Now imagine what happens when a tech startup employee who needs a financial advisor begins their search. The tech employee will likely interview three of the advisors--the one that specializes in equity compensation, and the two generalists.

Once they're finished shopping around, which of the advisors will have the most credibility for solving the tech employees' problems? Which advisor is most likely to have worked with other startup employees the prospect knows and trusts? The advisor who specializes in equity compensation will win the overwhelming majority of tech folks as clients, compared with the alternatives.

I'll admit, as a startup advisory firm, it was very difficult to limit myself to working with a specific market because, as most advisors will tell you, you should take any business you can get.

And as I went along, I discovered that finding a niche isn't a one-and-done process. Instead, it is iterated upon in a cycle. As I explored my potential target clientele, I refined the expertise necessary to serve them. In turn, the services I offered and the business model I used to deliver it were also refined.

Here’s some of what I’ve learned as I’ve begun to grow my niche-focused firm.

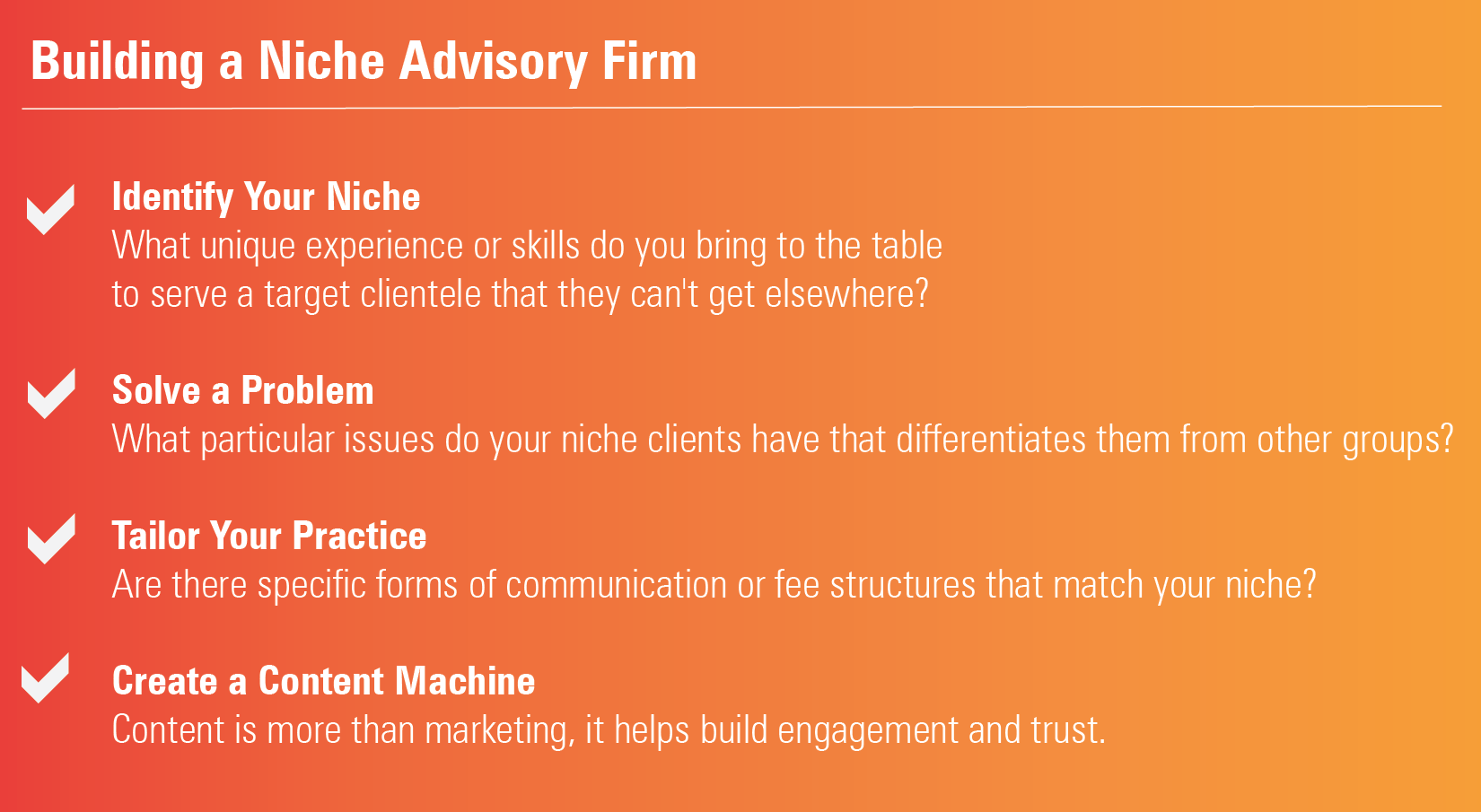

Pick a lane and stay in it. The starting point, of course, is finding that niche.

I began by selecting a general segment in the market where my age--late 20s--would be viewed as an advantage. What unique knowledge or skills could I bring to the table to serve my target clientele that they can't get elsewhere?

As a millennial advisor, I chose to build a firm that addresses my generation's needs. After getting some insight into the tech and startup world from a personal finance perspective, I set to work building more specialized knowledge in equity compensation and related tax planning.

Build it, and they will come. Don't just build a financial advisory business--solve a problem. If I were to successfully pull this off, it was imperative to put the client's best interest first in all decision-making processes. After all, people want to work with businesses that have the most knowledge and expertise in their areas of concern. In a like manner, the main purpose of building a niche-focused firm is to service a particular client like no other advisor can.

This was the number one focus during the early days of building my firm. I spent countless hours analyzing my target clientele and identifying gaps in the marketplace.

After attending a few tech conferences, I knew that my "secret sauce" could be applying UX design methodologies as a strategic business tool; creating personas, facilitating user interviews, user journey mapping, and storyboarding were all critical in helping me craft the ideal business model and client experience for my niche.

I researched my niche through user interviews and made the best effort to deeply understand their needs, goals, motivations, frustrations, and expectations around money. I began asking myself, what essential services will I provide to deliver my unique expertise? Should I offer high-level financial planning along with investment management? Or should I build a financial planning-centric firm that also manages investments? I chose the latter because it matched the kind of high-touch planning for a particular audience that I was aiming for.

Additionally, I considered what would make the most sense in terms of compensation.

Was the traditional assets under management model the best fit for my ideal clientele? Perhaps an annual retainer based on complexity or monthly subscription would be more suitable. After all, it didn’t take much research to conclude that most millennials didn’t have enough investable assets to build a sustainable business on.

By implementing a subscription model, I knew I could lower barriers to access for fiduciary financial advice as well as promote the growth of monthly recurring revenue. Not to mention, it was also apparent that most millennials even preferred subscription-based pricing, since it’s a business model we’re familiar with. All in all, I learned there is no right or wrong way. The best decisions usually start and end with what is best for your niche.

I also found that as a one-man think tank, it was important to not isolate myself along the journey. This was a mistake I made early on in building my shop. I was so focused on my goal of building a niche-focused firm, I underestimated the value of community. The life of an entrepreneur can be somewhat lonely, so it helps to have supportive and like-minded advisors in your corner--especially when it pertains to creating content and brainstorming creative ways to reach your audience.

Create a content machine. Of course, I still had to figure out how to reach my target audience and explain how I would meet their particular needs. It's no secret that in a digital world, there are many more avenues for getting the word out. Having a particular niche can help set an advisor apart from the competition in the cluttered social media space but you need a way to get the attention of potential clients.

One of my mentors has been Justin Castelli, CEO of RLS Wealth Management. I’ve learned a lot from him about the importance of creating differentiated content. “There are many ways content creation helps firms grow--SEO, aiding the development of a strong brand, and becoming a trusted resource for followers,” Castelli says. “Not to mention, an overlooked benefit of creating content is ensuring you will be on your followers' minds when they realize they need to hire a financial advisor.”

To put my plan into action, I created a blog and dedicated the content strictly to equity compensation. Not only was I building an SEO workhorse to increase brand awareness, I was also creating additional resources for prospective and current clients for educational purposes. In short, I’m looking to build brand loyalty.

I’ll have more to say about content creation, how to get the word out, and technology more broadly in future columns.

For me at least, I’ve found differentiation is free marketing, especially in the digital age. Not only this, but you'll also be well positioned to become an expert in the areas where your group of clients need the most help.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)