Finally Time for Value Stocks to Shine?

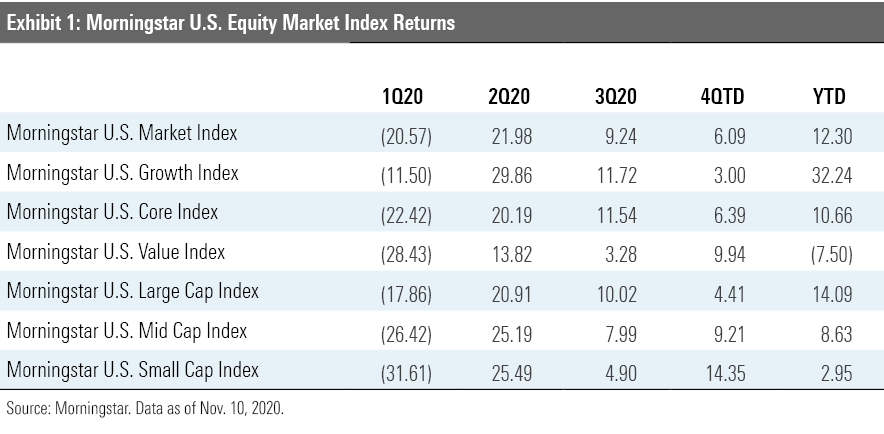

As the pathway to economic normalization in 2021 becomes clear, the market has begun to favor value stocks over growth stocks.

With the U.S. elections behind us, the economic recovery on solid footing, and new positive data from Pfizer regarding the efficacy and safety of its vaccine, the stock market has rallied off its recent lows at the end of October.

However, the market performance over the past few weeks has shifted from favoring the high-growth, large-cap stocks that propelled the markets higher earlier this year to small- and mid-cap value stocks.

Value stocks have consistently lagged behind growth stocks over the past five years and especially during the pandemic, with growth stocks overperforming value stocks by more than 44%. However, that trend appears to have changed course over the past few weeks. The market rotation thus far in the fourth quarter is indicative of investors seeing a path toward economic normalization in 2021.

During the second and third quarter, investors flocked to stocks of firms that would benefit from the changes that the novel coronavirus introduced to society. Thus far this quarter, stocks of those companies that had been harmed the most by the pandemic, and will rebound strongly as activity normalizes, have surged higher. Industries such as energy, financial services, and industrials have risen the most thus far in the quarter, while highfliers like the technology sector have lagged since the end of the third quarter.

Economy to Normalize in 2021 While the pandemic continues to pressure sectors that are adversely affected by social distancing practices, the U.S. economy has bounced off its lows.

In the third quarter, U.S. gross domestic product rose at an annualized 33% rate, and we expect fourth-quarter GDP to expand at a 4.3% annualized rate. Based on our expectation that a vaccine will be approved and distributed over the first half of 2021, we expect economic activity to rebound by another 4.7% in 2021 and unemployment to fall to 4.9% by the end of next year. In fact, we expect that the nominal level of GDP will return to prepandemic levels by the end of the third quarter.

As the vaccine is broadly distributed over the first half of 2021, in our economic outlook we incorporate our expectation that the consumer services sectors that have been hard-hit will recover meaningfully and normalize in the second half of the year.

A Welcome Vaccine Update On Monday, Pfizer PFE and partner BioNTech BNTX reported favorable phase 3 data on vaccine BNT162b2, with an efficacy rate of over 90% and no major safety issues observed at an interim analysis. As such, we have increased the vaccine's probability of approval to 90% from 60% in our model.

With the vaccine’s efficacy over 90% and no major safety issues observed, we believe the regulatory agencies are likely to authorize it for emergency use in late 2020, followed by full approval in 2021 pending supportive final data.

As the vaccine becomes broadly available over the first half of 2021, we expect that many of the industries that have been adversely affected by the pandemic will quickly rebound as pent-up demand drives utilization higher.

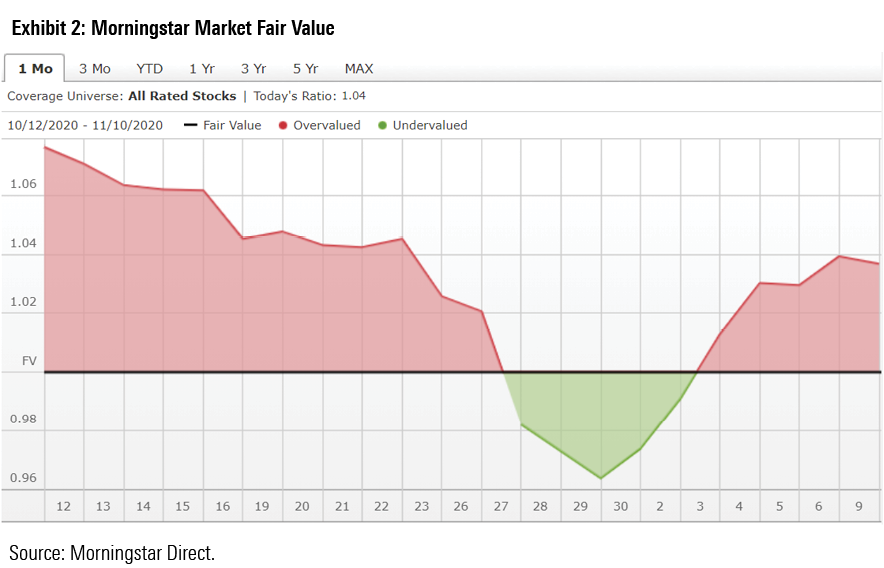

Detailing Morningstar's Equity Valuation From a broad market perspective, we see the market as slightly overvalued. According to the Morningstar Market Fair Value, stocks are generally about 4% overvalued. This metric measures the ratio of the price/fair value for the median stock over time.

A ratio above 1.00 indicates that the stock’s price is higher than Morningstar’s estimate of its fair value. The further the price/fair value ratio rises above 1.00, the more the median stock is overvalued. A ratio below 1.00 indicates that the stock’s price is lower than our estimate of its fair value.

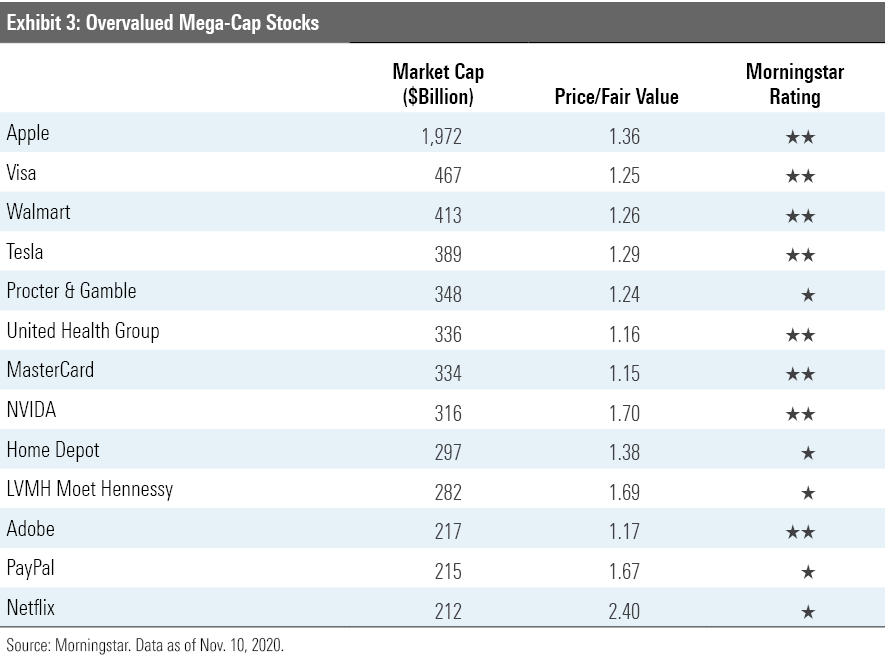

While the overall market is slightly overvalued, we note that the valuation is skewed higher by a number of mega-cap stocks (companies with market caps of more than $200 billion) that we consider significantly overvalued. For example, there are a dozen companies which we rate as 1- or 2-stars in the mega-cap cohort. The Morningstar Rating for funds is based on a 5-point scale in which 5-star stocks are the most undervalued and 1-star stocks are the most overvalued.

If you were to remove these stocks from the calculation, our market valuation metric would drop by 4%. Based on its outsize $2 trillion market cap, the broad market valuation would drop by 1.5% by just removing Apple AAPL.

In addition to the mega-cap stocks skewing valuation higher, we have also found that the dispersion of our fair value estimates as compared with market prices is wider now than last year. In fact, the standard deviation of the price/fair value metric has doubled from a year ago. The result is that we are seeing both a greater number of stocks that are significantly overvalued and greater number of stocks that are significantly undervalued.

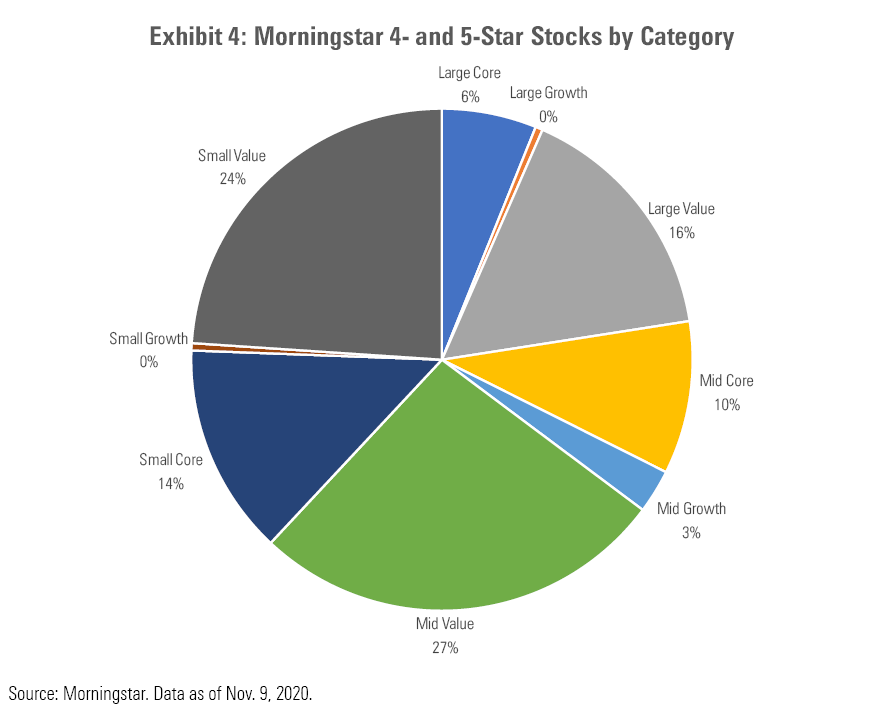

Based on our fundamental, bottom-up approach to valuing the broad stock market, we highlight our view that small- and mid-cap stocks in the value Morningstar Categories offered the most opportunities to investors in our fourth-quarter outlook. Across those stocks that we rate 4- or 5-stars, we still see a significant amount of undervaluation within these categories.

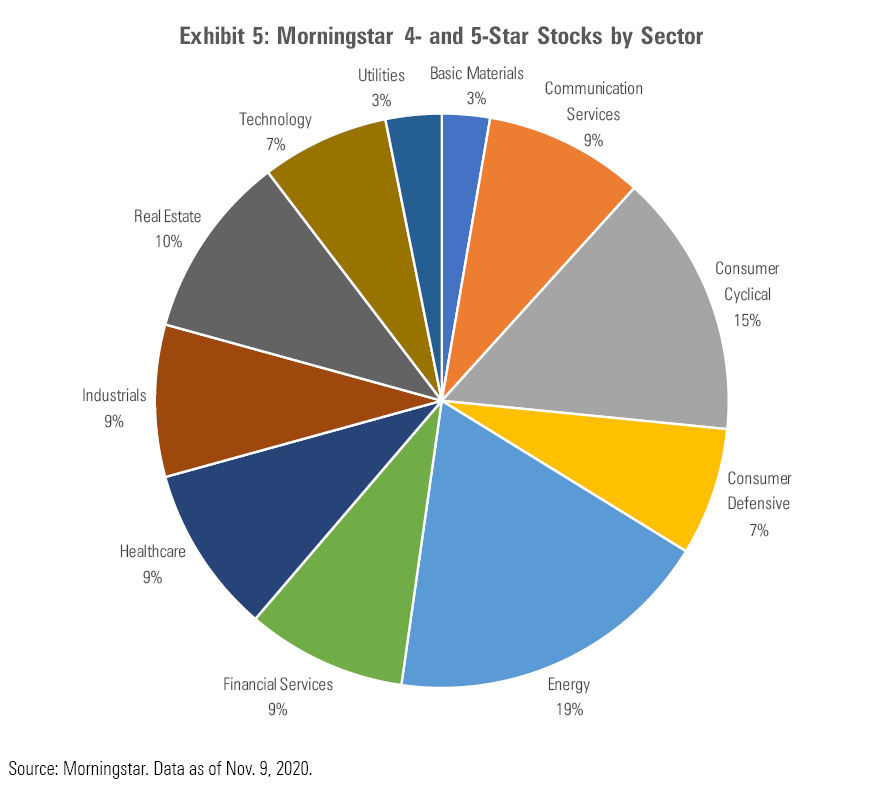

Across our sector coverage, we continue to see the highest percentage of our 4- and 5-star stocks in the energy, consumer cyclical, and real estate sectors.

The combination of reduced political risk and the expectation for a safe and effective vaccine to be rolled out in the first half of 2021 will hasten economic normalization next year. In this scenario, we expect small- and mid-cap stocks in the value category will outperform as their earnings rebound.

Investors who want exposure to the small-cap stock category, but don’t want the risk of picking individual stocks, can utilize Morningstar’s fund research and tools to identify the appropriate funds for their portfolios.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)