Advisors, These Hiring Biases Are Damaging Your Firm’s Future

Prepare for 2030's demographics.

The landscape for financial advice is changing rapidly. It’s not just technology or even the markets. It’s demographics as well.

By the end of this decade our industry's dominant client cohort will change from baby boomers to gen X and millennials … and yet our industry is almost exclusively structured to serve boomers. In other words, if you have a practice based on boomers--and especially if it is white, male baby boomers--you have a decade before becoming a dinosaur.

Then consider this: What long-term goal do most advisors and advisory firm leaders have for their organizations? In my conversations with them over the years, it’s for their firms to continue on after their retirement, which means that they want their firms to be both intergenerational and sustainable.

But let's face it, our profession is stunningly lacking in the diversity that underlies those demographic trends. As the CFP Board's research highlights, we're overwhelmingly male: less than one fourth of CFPs are women. Also, it is overwhelmingly white: less than 10% of CFPs are People of Color. Add to this that there are more CFPs over the age of 70 than under 30 and it becomes crystal-clear how homogenous the advisor community has become.

None of this bodes well in the decade ahead as wealth becomes more diverse--and especially more female and younger.

In my professional career, now in its fourth decade, there’s been one constant: change. My very first opportunity as a rookie stock trader was to figure out the potential of a new sector that had just developed in the past year. Nobody else at the firm quite understood it, so they threw it to the new guy. I was able to make it work.

So while there are plenty of tweaks that advisors can make to their practices in an attempt to stay ahead of these demographic changes, small changes aren’t enough.

In particular, many advisors fall short in a critical area: hiring and succession planning. And the reason is a difficult one for many advisors to acknowledge and maybe even recognize: biases in their hiring.

What can be done?

Among the most effective strategic responses is the full and proactive embrace of holistic human capital management, and, within this domain, making a commitment to the successful practice of diversity, equity, inclusion, and belonging, or DEIB.

The more proficient advisors become at DEIB, the more they can be open to deep wells of both talent and prospective clients.

However, doing so requires advisors to be aware of conscious, unconscious, and systemic biases in their hiring, which, unfortunately, are prevalent.

Let’s start with conscious bias, a habit that we exhibit routinely by seeking to perpetuate the current profile of a firm into the future rather than evolving them strategically and purposefully. One primary way we do this is to prioritize "cultural fit" in our hiring, which results in adding colleagues who are "just like us."

Contrast that with seeking "cultural add"--that is, attracting colleagues who'll help a firm evolve into something more capable of serving a diverse client base. Further, as the business case for Diversity & Inclusion demonstrates ever more conclusively, this'll also lead to higher organizational performance, a veritable "diversity dividend."

To seek more-diverse talent requires being beware of natural and prevalent unconscious biases, too. When we encounter the unfamiliar, we tend to raise our metaphorical guard, and this perceived difference becomes a source of separation. Further, because we tend to value the familiar over the new or novel, we also tend to assume that the latter is somehow lesser, which is not usually the case.

Some years ago, in my work with a not-for-profit organization that placed interns of color with major financial-services firms, a human resources professional from one company called to complain about the educational provenance of a student from Hampton University. Essentially, her argument was that because she hadn’t heard of Hampton, it couldn’t be a good school and therefore the intern couldn’t be a good candidate.

After a brief conversation during which I highlighted that university’s history--especially its standing among Historically Black Colleges and Universities--as well as its long list of distinguished alumni, she relented and promised to give the intern a fair shot.

Suffice it to say that this intern found another company’s culture more welcoming when it came to taking a full-time job.

Another common form of hiring bias is systemic, as illustrated by my experience with another firm that our organization served. One summer, one of its groups hired five summer associates: two white males, two white females and one African-American male. All were rock stars and performed well, but the department could only make two offers for full-time employment. During the hiring decision meeting at summer’s end, an all-too-familiar pattern emerged:

The white male professionals ranked the two white male associates most highly, sharing that they reminded them of a young "Dan" (the partner in charge of that department who was also a legend in the business). By contrast, the white female professionals ranked the two white female associates most highly, sharing that they reminded them of a young "Robin" (the newly minted female partner who was among a handful in the entire firm). Intriguingly, though all acknowledged that he was indeed a future superstar, the lone African-American male didn’t remind them of anyone in the group--because, of course, there were no senior People of Color there--so he never made it to the top of anyone’s list and was excluded.

The "systemic bias" here was that the way in which the partnership structured its hiring processes led to inclusionary outcomes; there simply was no way for the Black prospect to be chosen.

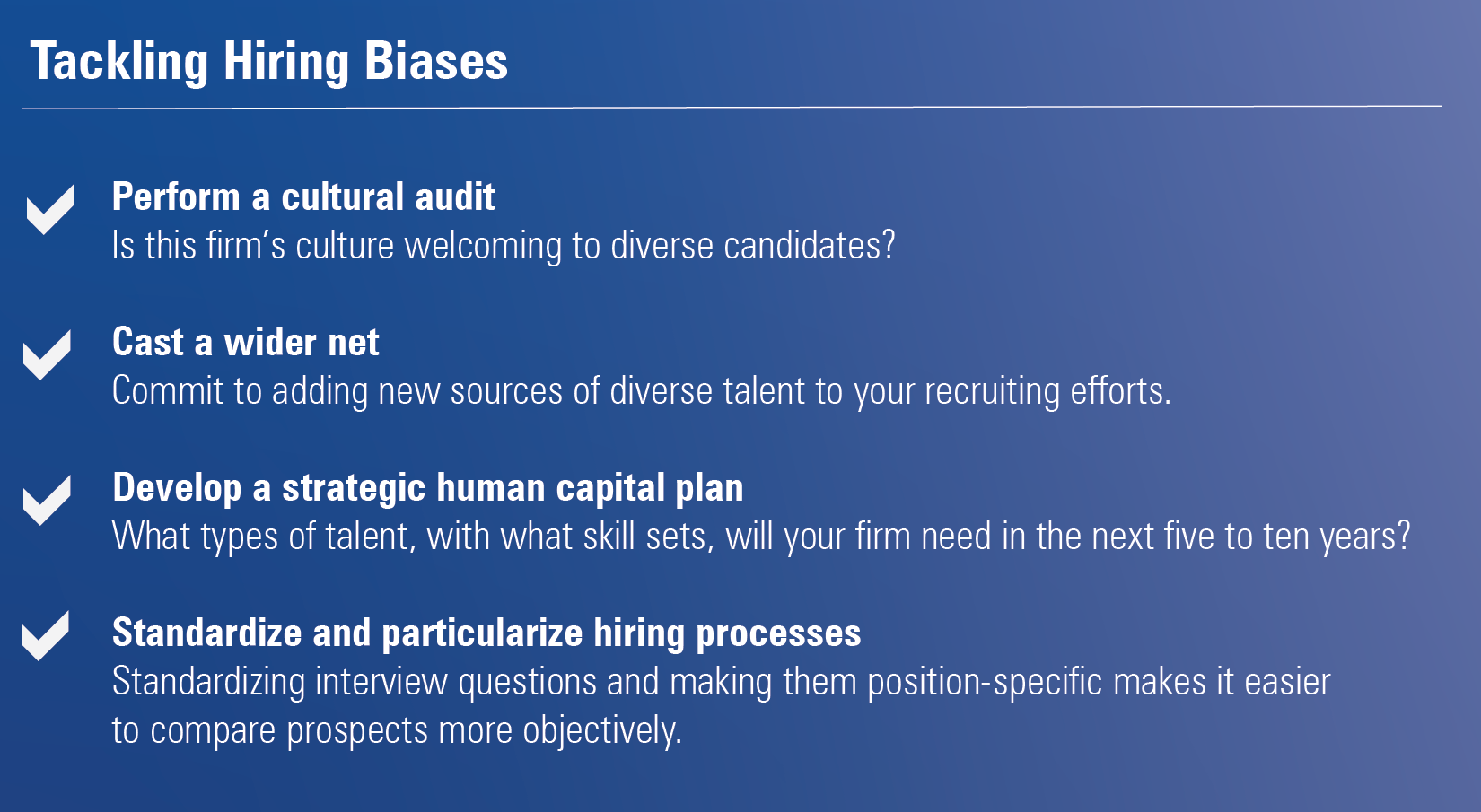

Here are some concrete steps to address these problems:

- Perform a cultural audit.--How would someone who didn't know you see your firm's culture? What would be their answer to the question: Is this firm's culture welcoming to diverse candidates? Hold yourself accountable to answering honestly by offering concrete examples for your responses. Chances are that these will reveal whether your firm is truly open to future colleagues who may be different, yet can help your culture evolve into a better one.

- Cast a wider net.--Commit to adding new sources of diverse talent to your recruiting efforts. This could include recruiting from schools with significant diversity in their student body, as well as partnering with industry groups--like the Financial Planning Association, the CFP Board's Center for Financial Planning, and the Association of African-American Financial Advisors and its Foundation (where I'm a board member)--to identify both entry-level diverse talent as well as lateral/experienced hires.

- Standardize and particularize hiring processes.--Another way in which we can be unfair to diverse candidates is by asking different questions to different candidates from different backgrounds. For example, if our last three junior advisor hires have come from a local state university, our perceived familiarity will likely lead us to ask them a different (and likely easier) set of questions than we might with the candidate from an institution with which we're not familiar. Accordingly, standardizing interview questions and making them position-specific makes it easier to compare answers more objectively.

- Develop a strategic human capital plan.--Off the top of your head, what types of talent, with what skill sets, will your firm need in the next five to 10 years? Now compare your intuitive answer with your strategic business plan. (If you don't yet have a plan for how much and how you expect your business to grow in the next decade, then this should be your first priority.) When there is clarity about the type of talent needed and why, you can be more thoughtful about recruitment, development, and retention efforts. That in turn greatly increases the ability to attract diverse talent, cultivate it thoughtfully over time, and maximize its contribution to an organization's cultural evolution.

Embracing the dual opportunities of human capital management and DEIB requires meaningful work, both to evolve firms to be more welcoming to diverse talent as well as to eradicate internal biases.

The great news is that, successfully pursued, our profession will avoid the inevitable reckoning as well as greatly increase the likelihood of being able to thrive in the new world of the 2030s, which, as we all know, will be here sooner than we think.

Walter K. Booker is the chief operating officer of MarketCounsel, a business and regulatory consulting firm for registered investment advisors. Prior to joining MarketCounsel, Walter was a senior operating executive in both the institutional and individual investor sectors of the financial-services industry. Walter is chairman emeritus and a board member of Sponsors for Educational Opportunity and a board member of the AAAA Foundation. The views expressed in this article do not necessarily reflect the views of Morningstar.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)