50-Year-Old Asks: Is It Time for More Bonds?

An equity-heavy portfolio and an index-centric approach have served this couple well so far, but is it time to take some risk off the table?

Christopher and Kate have always invested in stocks.

Christopher's first job in customer support for a financial-services firm exposed him to the basics of investing and the importance of getting started while he was young. "Being an English major, I knew nothing about personal finance, business, or investing," he wrote. "But I learned about compound interest, starting early, and making retirement a part of my plan--even in my early 20s."

Nearly 30 years, two kids, and several career and locational changes later, Christopher and his wife Kate still have most of their $900,000 retirement portfolio in stocks. But now that they're 50, they're wondering if it's time to take some chips off the table, especially because they're aiming to retire in 12 years.

"I've been modeling retirement since 2005," Christopher wrote, "but I might need some help moving into bonds."

Following that first job, Christopher went on to receive his MBA and has since held positions in software, manufacturing, and healthcare technology companies. Kate's an attorney. Their daughter has started college, and their son is still in high school.

In addition to their disciplined retirement savings program, Christopher and Kate have done a lot right with other aspects of their financial lives. They've been dollar-cost averaging into 529 college savings plans since their children were born and now have $117,000 in the 529s. They have no debt, apart from the mortgage on their home and a small balance remaining on a car loan. They have an emergency fund in place and don't go in for extravagant spending. Christopher notes that their major annual expenses, in addition to their basic living expenses, are Catholic school tuition for their son and two family vacations per year.

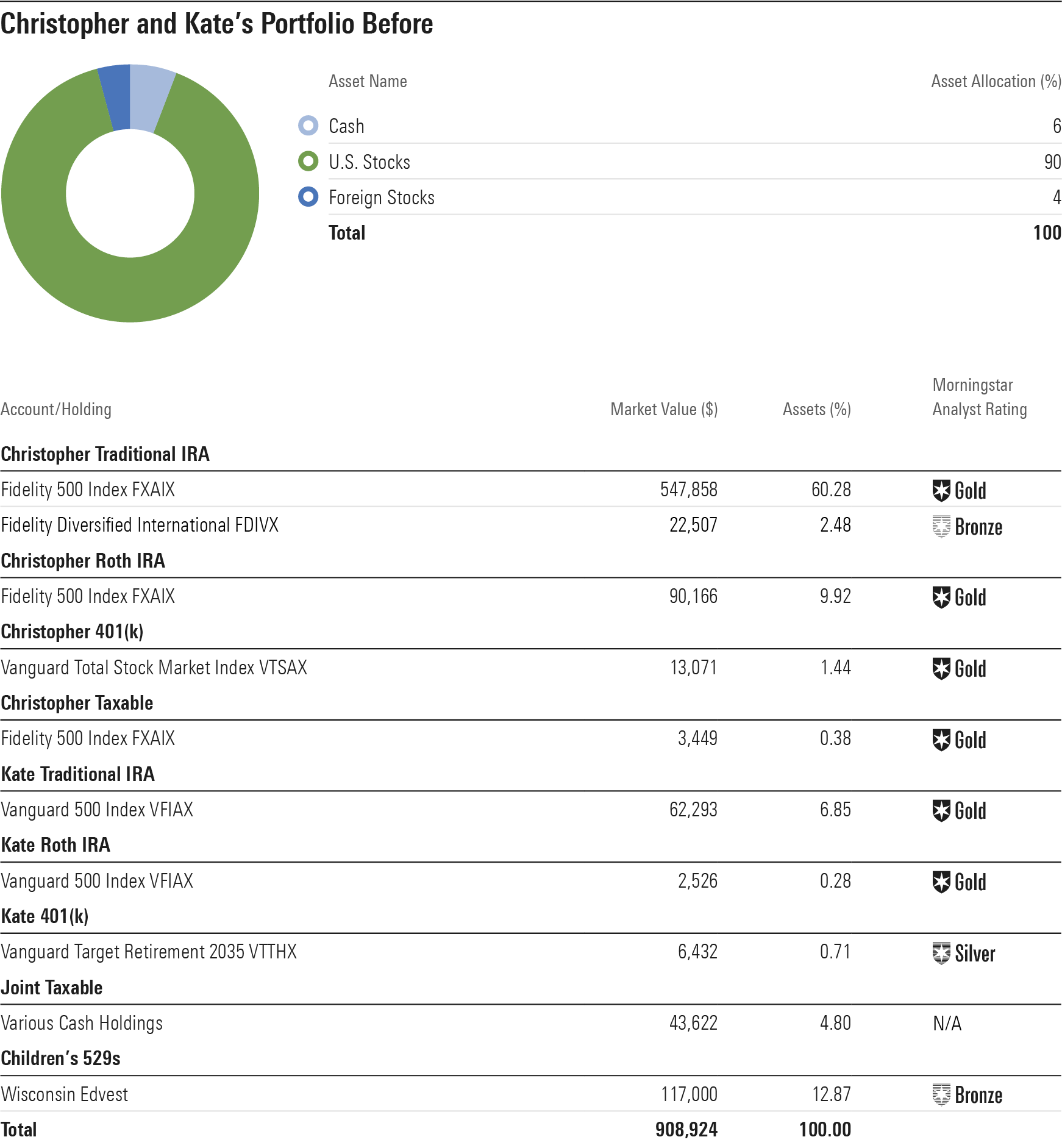

The Before Portfolio In addition to recognizing the importance of getting started on an investing program early on, Christopher also became a true believer in index funds in that first job. As a result, his and Kate's portfolio is almost entirely index-tracking funds. In fact, the bulk of their portfolio resides in S&P 500 index funds, siloed in multiple accounts. The couple has just a small amount of assets in bonds and foreign stocks. And thanks to their portfolio's heavy emphasis on the large-cap S&P 500, they have almost nothing in smaller stocks.

The bulk of their portfolio is in Christopher's traditional IRA, which consists of assets rolled over from former employers' plans. That portfolio includes Fidelity 500 Index FXAIX, which has a Morningstar Analyst Rating of Gold, as well as Bronze-rated Fidelity Diversified International FDIVX, which is the only active fund in their whole portfolio. Christopher also has a smaller Roth IRA, a 401(k), and a taxable account. Not surprisingly, he has populated all three with index funds.

Kate's holdings are smaller than Christopher's but similarly stripped down. Her traditional and Roth IRAs include S&P 500 index funds, while her 401(k) consists of Vanguard Target Retirement 2035 VTTHX.

In addition, the couple has cash holdings, CDs, and a money market fund in their joint taxable account.

Source: Morningstar.

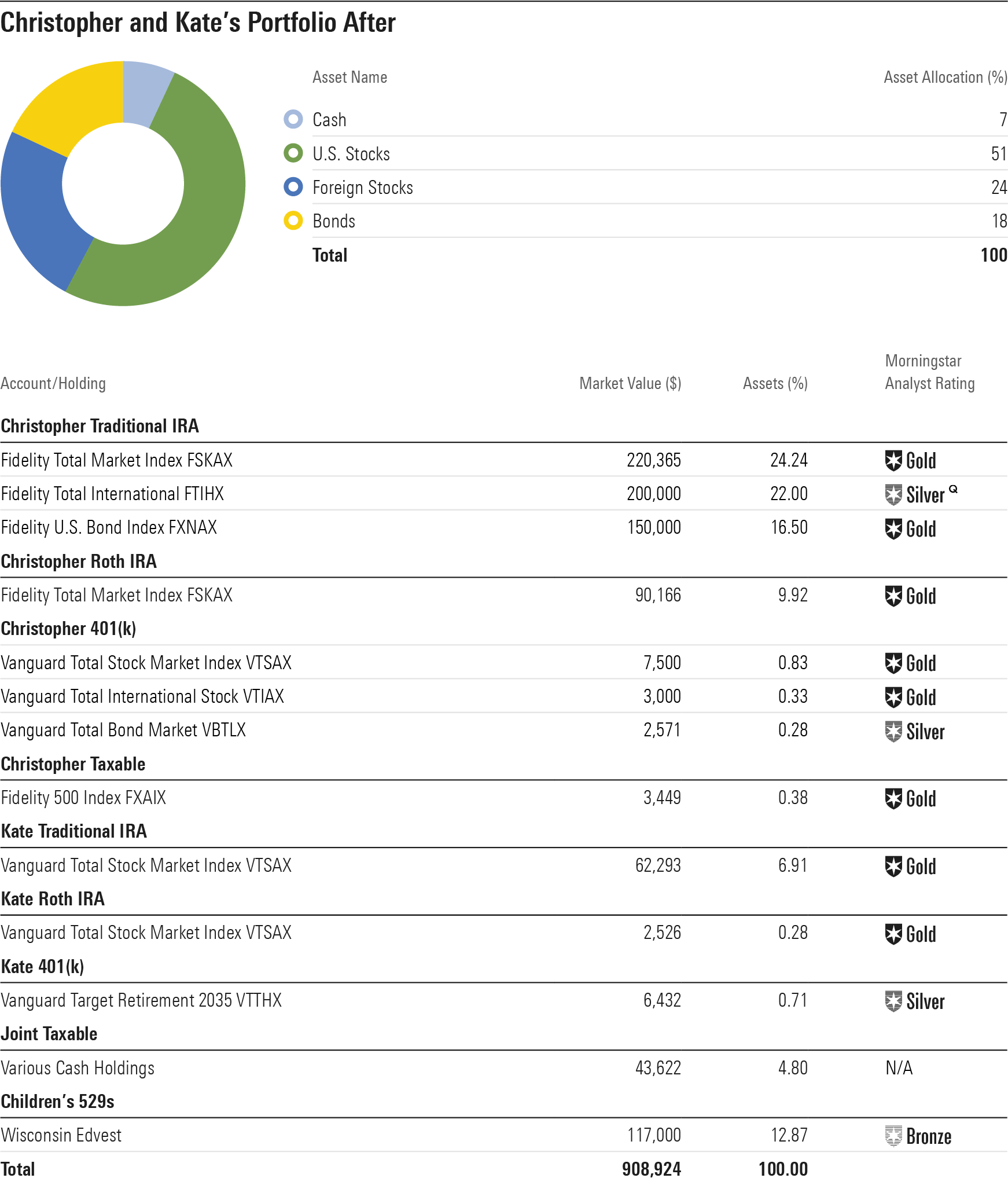

The After Portfolio Given that Christopher and Kate still have more than 10 years until retirement and that the return potential for bonds is so low, maintaining an equity-heavy portfolio makes sense. I also like how streamlined Christopher and Kate's portfolio is, as well as the fact that they haven't hesitated to use index funds throughout their portfolio. Index trackers like S&P 500 index funds are so well diversified that there's no good reason not to duplicate the same exposure across accounts.

However, I agree with Christopher that it's a good time to start thinking about adding a bit of bond exposure to their portfolio, to help reduce risk and preserve what they've managed to save. The U.S. stocks that dominate their portfolio aren't cheap today. Morningstar's bottom-up research indicates that stocks are roughly 5% overvalued, with much of that overvaluation driven by the names at the top of the S&P 500. Losses of 50% or even more haven't been unprecedented.

Thus, my After portfolio has a roughly 20% weighting in bonds, largely in Christopher's traditional IRA and 401(k). (There's no reason that each account needs to be well diversified unto itself, and it makes sense that their Roth IRAs would remain heavily tilted toward stocks.) That bond allocation lands between the Aggressive and Moderate versions of the 2035 vintage of the Morningstar Lifetime Allocation Index.

Because Christopher likes index funds, I used a simple Bloomberg Barclays U.S. Aggregate Bond Index tracker for fixed-income exposure. Fidelity U.S. Bond Index FXNAX is low-cost and Gold-rated. Bond index funds have very low yields today--barely better than cash. But the big positive is that they've historically been excellent ballast for equities, largely because high-quality bonds are often in demand when stocks are in the dumps and/or investors are concerned about the economy.

My After portfolio also makes some adjustments to the equity portfolio to improve its diversification and return potential. Again, I concentrated those changes largely in Christopher's traditional IRA and 401(k).

For starters, my After portfolio bumps up the weighting in foreign stocks to bring their geographic diversification more in line with professional asset-allocation guidance like target-date funds and the Morningstar Lifetime Allocation Indexes. Moreover, foreign stocks appear to have better valuations and return prospects than U.S. stocks today.

In addition, I prefer total market index funds over S&P 500 index products for equity index exposure, so I made that switch in each of the tax-deferred accounts. I left the S&P 500 index fund intact in the taxable account, however, as switching could trigger tax costs.

Source: Morningstar.

Editor's note: Names and other potentially identifying details in portfolio makeovers have been changed to protect the investors' privacy. Makeovers are not intended to be individualized investment advice, but rather to illustrate possible portfolio strategies for investors to consider in the full context of their own financial situations.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)