Has the Coronavirus Affected Correlation?

In a globalized world, many stock markets move in sync. Is that still true during the pandemic?

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Diversification is a key concept for any investor and means spreading your money not only across different asset classes but across different regions. The breakdown by country or region is among the key factors when examining a financial portfolio.

In a globalized world, it is essential to have an idea of how the various countries to which one is exposed influence each other. Otherwise, we risk investing in regions that are subject to very similar movements--that is, they are strongly correlated.

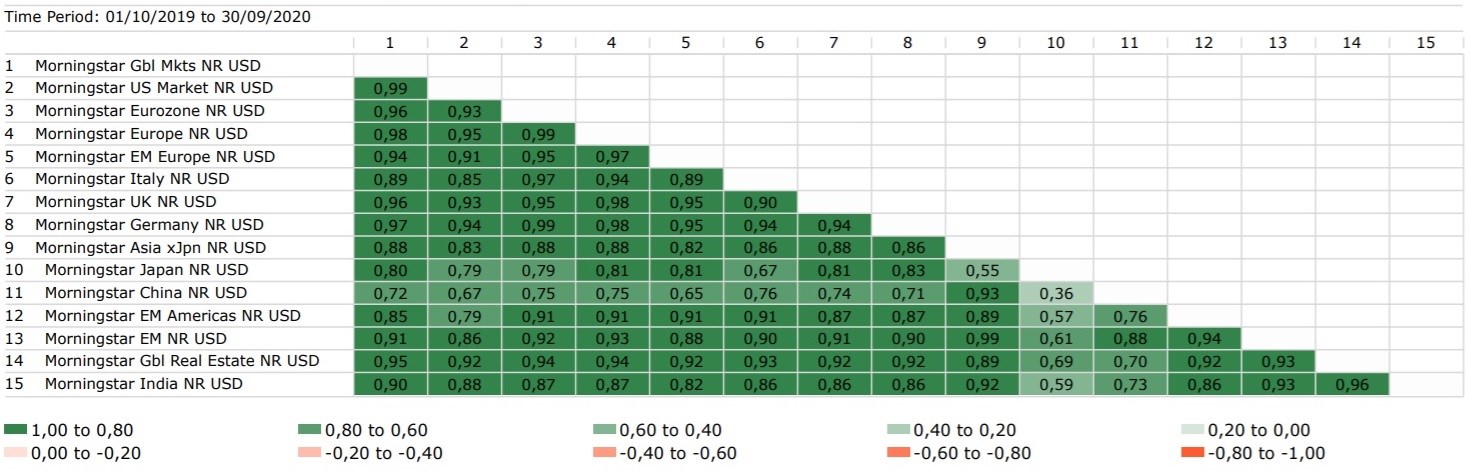

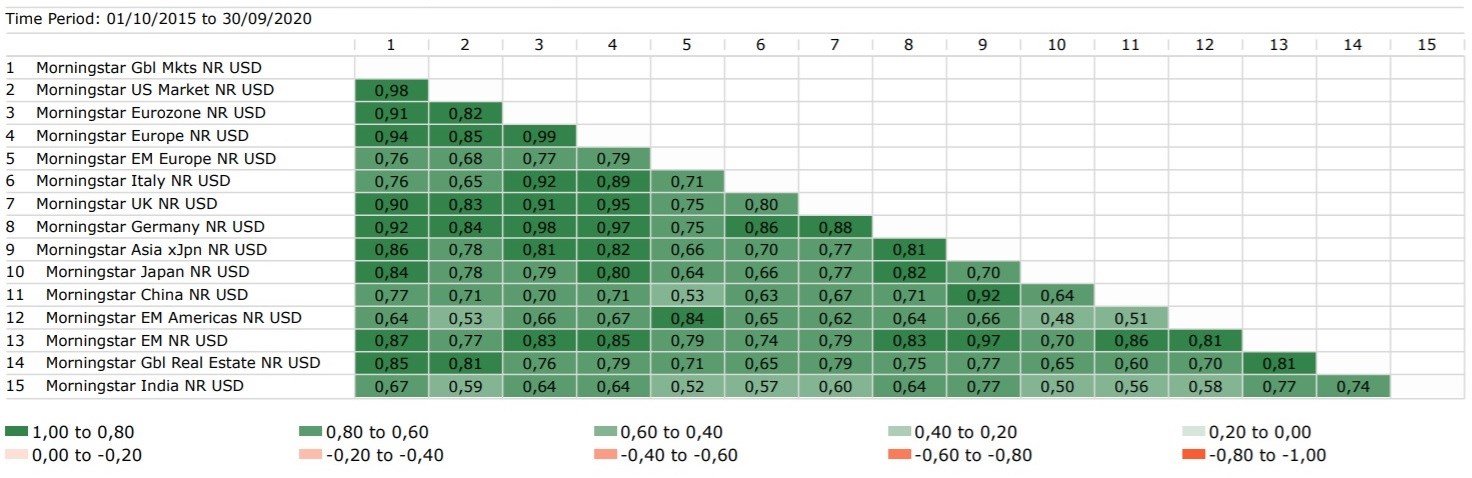

The tables below show just how strongly international markets have been correlated over the past year. The only region that saw a decrease in its correlation with other stock markets was China. The correlation between China and Japan, for example, went down from 0.64 over five years to 0.36 over the past 12 months. The Chinese stock market has recovered more vigorously than the others since the COVID-related sell-off in March 2020. Indeed, the Morningstar China Index gained 11.6% year to date, compared with negative 6.0% for the Morningstar Emerging Markets Index, negative 11.7% for the Morningstar Eurozone Index, and 1.3% for the Morningstar US Market Index. (Data in euros as of Sept. 30, 2020.)

One-Year Correlation of International Markets

On the other hand, emerging markets such as India, Latin America, and emerging Europe have all seen their correlation rates increase on average over the past 12 months.

Developed financial markets, then, are increasingly connected: Europe and the United States show a correlation of 0.95 over the past year (a ratio of 1.00 would indicate two markets moving exactly in tandem). The eurozone and the global stock indexes' mark is 0.96. The real estate sector, for its part, has seen all its correlation coefficients grow.

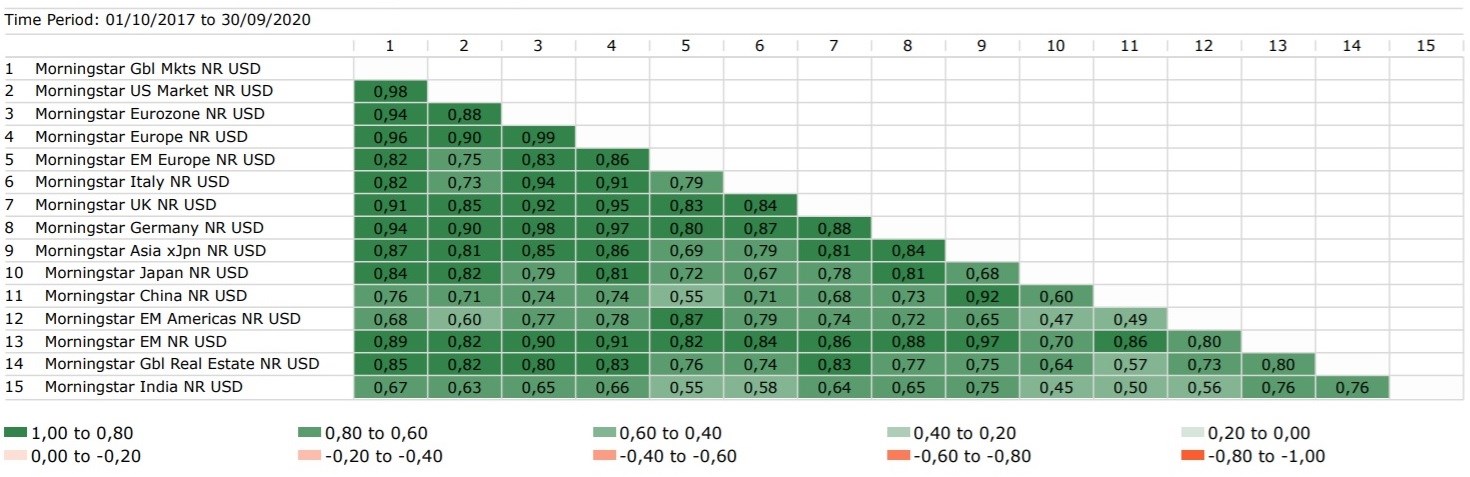

Across the three tables we notice a darker green trend over the past year, compared with three and five years, except for China. (The greener the box, the higher the correlation.)

Three-Year Correlation of International Markets

The correlation coefficient measures how the performance of one instrument affects the performance of another: It varies between negative 1 and positive 1. A coefficient of 0 indicates that there is no correlation between the two funds. A coefficient of 1 indicates that there is a perfect positive correlation, which means that the two instruments move together: If one rises by 10%, so does the other, and vice versa. Obviously, in the case of perfect negative correlation (equal to negative 1), the ratio is inverse: If the first rises by 10%, the second loses 10%.

Five-Year Correlation of International Markets

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)